Year-End Tax Planning During Uncertain Times

Tax laws are in flux, but investors can take these steps now.

It’s that time of year to think about year-end tax planning. In this article, I’ll show how your clients can save on taxes. I'll walk you through several year-end strategies for minimizing taxes, and will share tips that you can incorporate into your year-end planning as well.

Before I begin, I must give a caveat. Whatever advice or strategies I discuss today could change based on Congress passing new tax laws. Therefore, I’m going to talk about two types of planning: standard tax strategies that likely apply with or without a tax law change, and proactive strategies that might be advantageous depending on what we think might happen.

Let's look at the current tax law environment; 2021 is the last certain year of low tax rates. The current rates are scheduled to expire after 2025, but under Joe Biden’s presidency, tax laws could change dramatically before we get to 2025. Although we have a rough idea of major themes of the Biden tax plan, the details have been constantly changing. And with the great divide between and within the political parties, we can’t be sure of what will pass, what will have an impact on 2021 or 2022, or if even anything will pass at all.

Some might believe that this uncertainty negates the need for tax planning. I believe that uncertainty shouldn’t be used as an excuse for skipping planning. The key to planning is to make the best decisions now, based on the information available and our judgment. My goal is to position clients so that they will benefit if a law changes and not be hurt if it doesn’t. Or they will benefit if there are no changes and won’t be hurt if there are.

“Standard” Planning

Whether tax laws change or not, certain moves always make sense, such as making Roth IRA conversions, bunching itemized deductions, increasing charitable giving, and taking the qualified business income deduction. For example, you should always take advantage of zero to low tax brackets to do Roth conversions--especially because we can safely assume tax rates won’t decrease. Failure to recommend this to clients could border on malpractice. How far you go with Roth conversions depends on the circumstances and goals of each client.

Bunching itemized deductions and making the most of charitable deductions are standard moves that should always be considered. And, of course, the qualified business income deduction is a total freebie.

Minimizing gains is a good strategy for now--as long as your client has income under the limits mentioned in the new proposals. This strategy is a standard planning move, yet for clients anticipating large gains, they could be facing higher rates down the road under new law. So, strategies for these clients will be addressed when we get into proactive planning.

Similarly, for clients with state and local taxes of $10,000 a year or less, you can do standard planning. But for those with more, there’s no benefit to prepaying state income taxes or property taxes. In fact, if we get a loosening of the limitation, waiting until 2022 to pay 2021 state balances due could mean full federal deductibility. We’ll just have to wait and see.

Biden Proposals

Performing detailed tax planning requires full knowledge of upcoming tax changes. Unfortunately, the proposals are changing all the time, and we don’t know if anything will pass. But we do know some things: We can expect tax rates to increase at some point--at least for high-income taxpayers. That one piece of information can help us quite a bit with planning.

In any event, let's review the current changes on the table.

Tax Rates As with prior versions of the proposals, the top tax rates are set to increase. For 2021, the top tax rate is 37%, applying at taxable income more than $523,600 for single taxpayers and $628,300 for married filers. Effective in 2022, the top rate jumps to 39.6%, applying to taxable income more than $452,700 for singles and $509,300 for marrieds. Because the top bracket starts at a lower income level, those with income between $452,700 and $523,600 for singles and $509,300 and $628,300 for marrieds will see their top bracket going from 35% to 39.6%.

Capital Gains Tax Today, long-term capital gains are taxed at a maximum federal rate of 20% plus a possible 3.8% surtax. Prior versions of the tax proposals bumped the long-term capital gain rate to the top federal bracket (proposed at 39.6% plus 3.8% surtax) for those with income over $1 million--and this change was going to be retroactively effective as of March 2021. The good news is that the new proposal caps the top long-term capital gains rate at 25% (plus the surtax). The bad news is it kicks in at taxable income over $400,000 for singles and $450,000 for married filers, rather than only affecting those with income over $1 million. The new rules, if passed, will be effective as of Sept. 13, 2021. Home sale gains more than the exclusion are also included for purposes of the higher capital gains tax.

Surtax Changes Those selling or conducting an active business would be subject to the 3.8% surtax beginning in 2022, even though they are not currently. This new tax affects singles with taxable income over $400,000 and married couples with taxable income over $500,000. There's also a new 3% surtax that would apply to those with adjusted gross income of $5 million or more.

There are other potential changes as well, including:

- Currently, married couples and singles can transfer by gift or inheritance up to $11.7 million each. The proposals would cut that amount in half, to $5.85 million per person. Especially in California, where houses are worth millions, this means that more people will need to plan for potential estate tax.

- Being able to deduct up to $600 of charitable contributions even if you don't itemize.

- Medical deductions for COVID-19 supplies and personal protective equipment.

- Eliminating the state and local tax, or SALT, deduction limit of $10,000.

- Limiting retirement contributions for those with accounts over $10 million.

- Eliminating backdoor Roth IRAs.

Finally, increasing C-Corp tax rates seems to be off the table--for now.

"Proactive” Strategies

Proactive strategies involve planning for potential tax law changes, while taking care to only make moves that won’t backfire if new tax laws don’t happen.

Capital Gains We know that capital gains rates will not decrease, and there's a decent chance they will increase. For clients with income levels over $400,000 single or $450,000 married, large sales might be better closing in 2021 rather than 2022. Worst case is the client pays the tax sooner, but if new laws do pass, there could be tax savings. The 25% capital gains rate is already effective as of September 2021--if the law passes as written. But we don't know whether the retroactive date would really stick. We do know that the additional surtax won't apply to business sales in 2021, so it's best to close those deals before year-end. If your client is selling a business or large asset on the installment basis (or has already had a sale in 2021), hold off on quickly filing the 2021 return just in case it makes sense to elect out of installment sale treatment. Again, if capital gains rates increase after 2021, your client might want to pay all the tax up front to save the 5% tax hike and the 3.8% surtax.

I previously recommended not prepaying state taxes if the client has already paid in $10,000 or more of state, local, and property taxes. But what if the client has more taxes owed for 2021? In this case, you need to weigh the potential savings against the cost of waiting to pay the tax. For example, if I delay paying my property taxes due in December, I’ll be charged a 10% penalty. That seems like too big a risk on a “maybe” write-off in 2022. But if I delay my state quarterly payment or cut my withholding, the most I risk is a small underpayment penalty, the equivalent of 0.25% per month in California. If I will be in the 39.6% tax bracket, and there’s a chance I can deduct the tax in 2022, I might be willing to pay 0.25% per month. So, it’s basically a risk/reward decision.

Estate Planning If your client has recently drafted or updated estate documents, there might not be much to do unless the laws actually change. For clients who are under the current exemption amount, but could be above the proposed exemption amount, it might be time to revisit estate planning. Consider gifting before the exemption amount decreases, look at charitable giving and bequests, and consider life insurance to pay potential estate taxes.

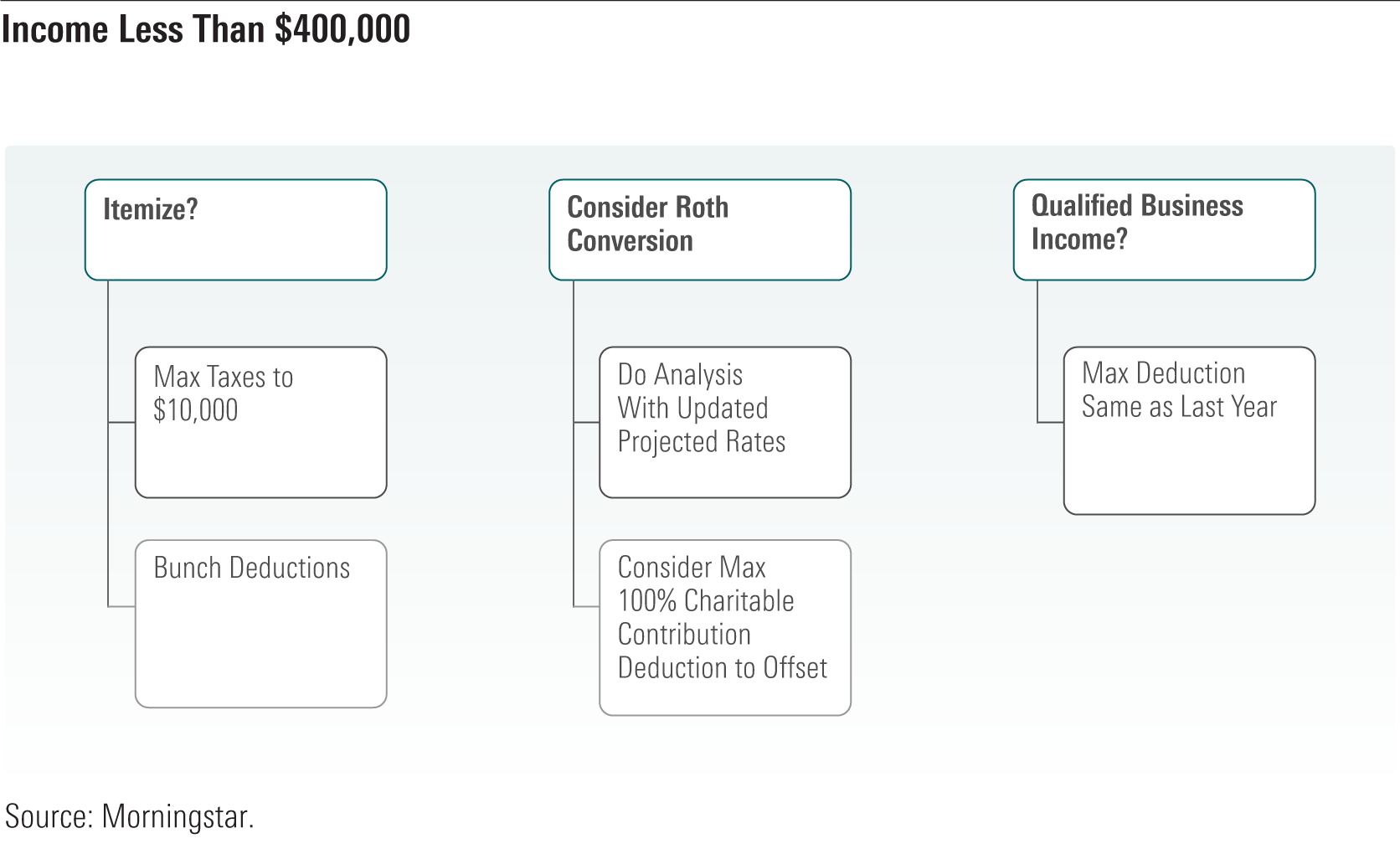

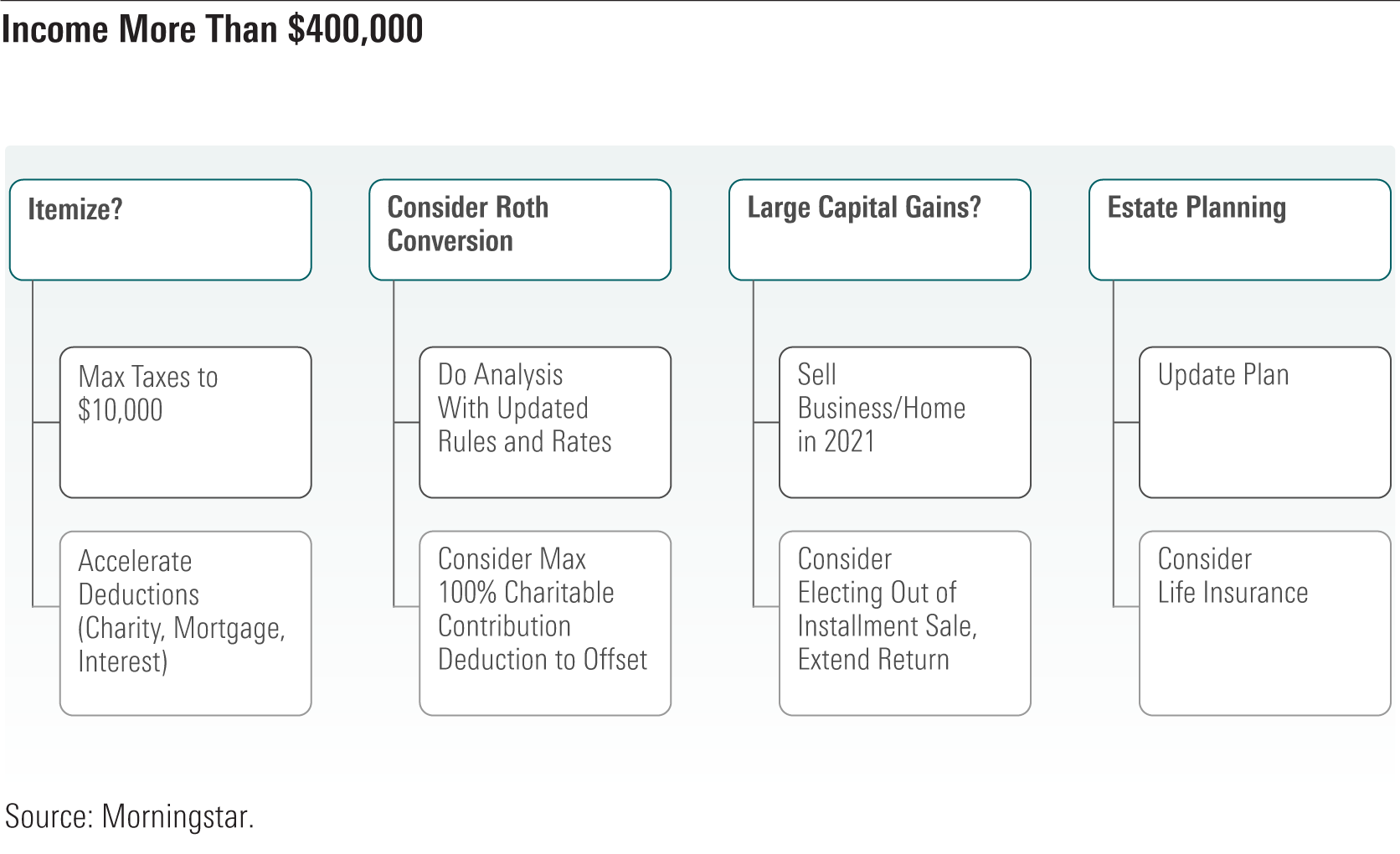

First and foremost, remember that each client is different. We can try to standardize some approaches, but in the end, you’ll likely need to run some numbers. Having said that, I have created two charts spelling out some ways to organize strategies.

This chart is for clients with income (and expected income) of less than $400,000 per year.

In general, these clients should not be materially affected by new tax laws, unless the SALT limitation is eased or eliminated.

This chart is for clients with income over $400,000--generally your higher-income clients.

These clients could be significantly affected by new tax laws. In addition to the standard strategies related to itemized deductions and Roth conversions, attention must be paid to capital gains planning and estate planning.

Rise to the Challenge

Although year-end tax planning might be complicated and uncertain this year, advisors need to rise to the challenge. Remember that planning must be individualized and detailed calculations are likely necessary. Keep the above charts in mind and get the tax planning software ready!

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/256953a9-ba08-4920-baa8-ccdc229ed9f9.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RYIQ2SKRKNCENPDOV5MK5TH5NY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6NPXWNF2RNA7ZGPY5VF7JT4YC4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/256953a9-ba08-4920-baa8-ccdc229ed9f9.jpg)