The ESG Advisor: Index Funds Pose Problems for Asset Manager Net-Zero Commitments

Passive managers need to get more active on the ownership side.

The sense of optimism that permeated the first week of the COP26 global climate summit in Glasgow took a sobering turn this week as overall commitments appeared to fall short of the goal of limiting global temperatures from rising more than 1.5 degrees Celsius.

Last week, I discussed the promising news about the net-zero commitments asset managers have been making. The Net Zero Asset Managers initiative now has 220 signatories with $57 trillion in assets under management. That’s promising news because these asset managers appear to understand what is at stake, and they are willing to make a public commitment to get to net zero, meaning that the collective impact of their investments should have net-zero greenhouse gas emissions by 2050. To get to that goal requires interim reduction targets of 50% that must be achieved by 2030.

But in keeping with this week's more sobering news, the commitments made by asset managers may not be enough. That's the conclusion of a study of Net Zero Asset Manager commitments released this week by a group called Universal Owner that is in the business of helping investors evaluate their climate-related impact.

The report notes that, far from being on track to decarbonize their entire portfolios, most asset manager commitments, thus far, cover only a portion of their AUM. Of the 43 asset manager targets analyzed for the study, 30 covered 80% or less of AUM; only 13 covered 100%. The report estimates these commitments would result in decarbonization of only 20% by 2030, far short of the 50% target.

The chief culprits in the failure to hit net-zero targets are index funds. Because these funds passively track stock or bond markets, asset managers aren’t including them in their net-zero commitments. As a result, index funds may be locking asset managers into “auto-financing” fossil fuel companies. The idea that index managers can do nothing about this is not really true, the report argues, because index rules and asset manager decisions on how a fund tracks an index “involve a huge element of discretion that could be used to green index investing.”

Asset managers need to own up to this problem, and fast, if they are going to get to net zero. Index providers could address it by altering their inclusion rules. Asset managers could adjust how they build and optimize index-tracking portfolios. They could also close traditional index funds and steer new money into net-zero index funds. I know that seems unlikely as we sit here today, but if asset managers are serious about stopping climate change, they need to have the courage to step up and make hard choices.

One direction would be to push for regulatory solutions that would limit automatic inclusion of companies that don’t have net-zero commitments in portfolios. Or asset managers could push for the more direct approach of requiring companies to reduce emissions by 50% this decade and to be net zero by 2050.

Another way index managers can address this issue is by pressing the companies they think they have to own in their index funds to make their own net-zero commitments. This can be done via direct engagement and proxy voting, tools asset managers have been using to a much greater extent in the past few years.

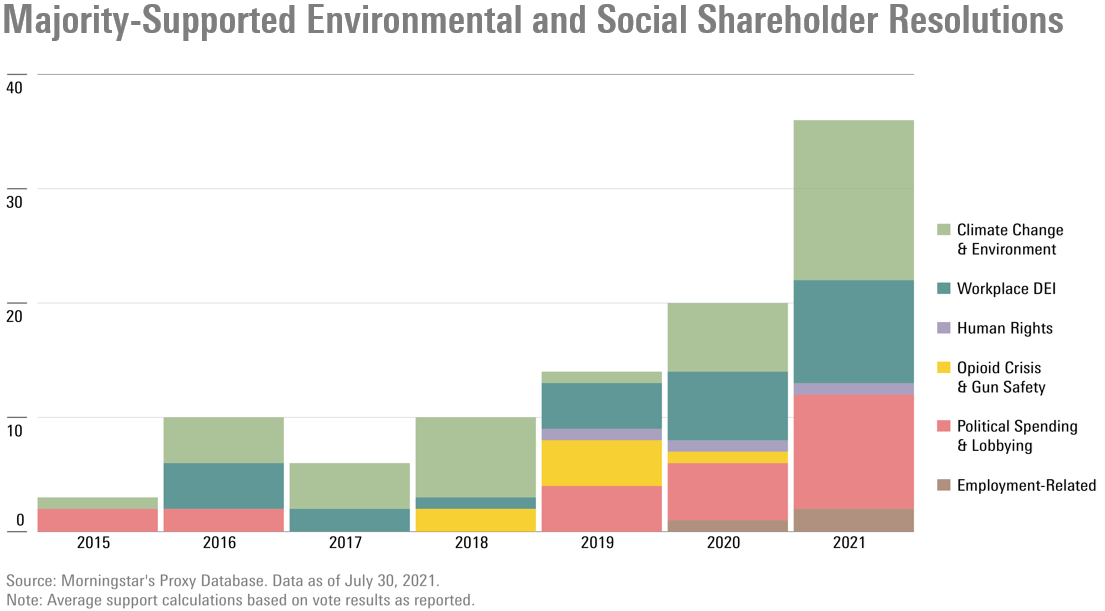

My colleague, Jackie Cook, has run the numbers on how often asset managers running mutual funds and exchange-traded funds available in the United States voted in favor of shareholder resolutions on a variety of environmental and social issues last year, including climate-related resolutions.

Overall, shareholders have been supporting these proposals at record levels. Just six years ago, it was exceedingly rare for a proposal to receive majority support. This year, 36 resolutions did so.

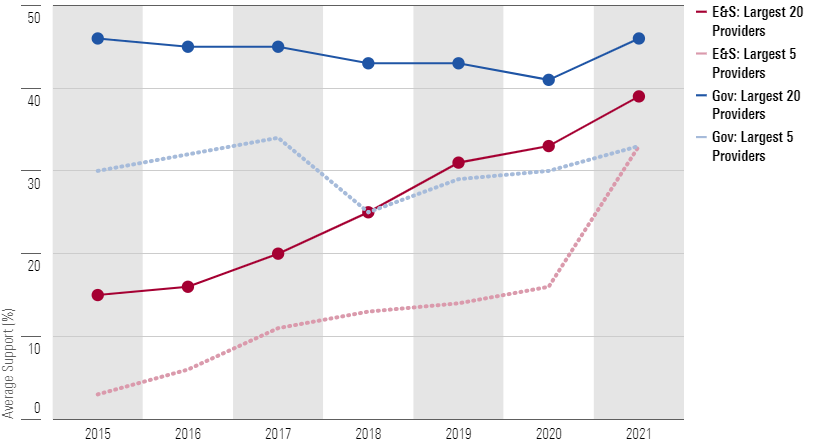

And that increasing support has been driven by large fund companies, as shown in the solid and dotted red lines in the chart below.

Fund Provider Support for Shareholder Resolutions

- source: Morningstar's Proxy Database. Data as of 8 November 2021. Note: Includes votes on all E, S, and G resolutions.

Looking only at key votes, which we have defined as environmental- and social-related shareholder proposals receiving at least 40% support of noninsider shares voted, we found that the large passive fund managers exhibited a wide range of support.

BlackRock/iShares supported 73% of key environmental and social resolutions, State Street/SPDR supported 72%. But Vanguard supported a much lower 53%, and Dimensional Fund Advisors a paltry 16%.

To put this into context, among the largest 50 fund complexes in the U.S. as defined in the Morningstar Fund Family 150, BlackRock/iShares ranked 37th, State Street/SPDR ranked 39th, Vanguard ranked 46th, and Dimensional ranked 49th. They could all do better; Vanguard and Dimensional could do way better.

You can bet that shareholders will propose a bevy of resolutions in 2022 asking companies to report on their path to net zero. Guidance issued last week by the SEC makes it more likely that these resolutions will make it to a shareholder vote. Asset managers should be clarifying their engagement and voting strategies now.

/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)