How Useful Is It to Close Funds?

No one likes a bloated fund.

The article was published in the October 2021 issue of Morningstar FundInvestor. Download a complimentary copy of FundInvestor by visiting the website.

When Scott Brayman left Sentinel to found Champlain Investment Partners, he had capacity on his mind. His Sentinel fund had grown larger than he thought was ideal, so he started his own firm with plans to close the fund before asset growth forced him to change his strategy. He closed Champlain Small Company CIPSX in 2007 with assets under $1.5 billion and Champlain Mid Cap CIPMX a decade later at just under $5.0 billion.

When Artisan co-founder Carlene Murphy Ziegler left Strong Capital to set up her own firm, she announced right away that her fund, Artisan Small Cap ARTSX, would close to new investors at a low preset asset level. Since that time, many funds at Artisan, which gives managers control over when they close, have closed to new investors. For example, Artisan International Value ARTKX and Artisan International Small-Mid ARTJX have closed this year. Artisan International Small-Mid manager Rezo Kanovich closed his fund at around $6.5 billion, whereas his previous charge, Invesco International Small-Mid Company OSMAX, closed at around $9.7 billion and grew to $11.0 billion by the time he left.

Clearly, closing at the right level is important to some managers. It should be important to investors, too. Closing to new investors is a sign of good stewardship because it requires fund companies to forgo some profits in the short term in favor of serving investors and upholding their fiduciary duty to them. In many ways, incentives are aligned between fund companies and fund investors, but this is one spot where they diverge. As the above examples illustrate, fund companies handle these situations very differently.

There are three reasons for closing. The most common is that the fund invests in a liquidity-constrained way and is approaching a level at which asset growth might cause it to change its approach. We see this most often with small-cap strategies. The options for managing asset bloat are to buy more stocks, move up in market cap, hold more cash or exchange-traded funds, or change nothing and just accept higher trading costs and longer times to buy and sell. All these things can diminish outperformance. We have seen focused large-cap funds, emerging-markets funds, high-yield bond funds, and bank-loan funds close, too, because asset size can affect their strategies.

The second reason to close is an overwhelming amount of inflows. In this case, the problem isn't the overall assets under management but that money is coming in too fast to invest prudently. A cousin to this is if the inflows are so-called hot money that follows strong fund performance, it could leave as rapidly as it arrived once performance slows. Vanguard has restricted flows temporarily for this reason. I bet Bruce Berkowitz wishes he realized this at Fairholme FAIRX as money that poured into the fund from 2005 to 2010 quickly reversed course after 2011 when returns slowed.

The final reason to close a fund is if its manager can't find anything to buy. Longleaf Partners and Warren Buffett have famously done this, but it's rare. More often managers simply add to their favorite portfolio holdings or build a little cash in extreme cases. As it's difficult to pinpoint a market top, that's probably prudent.

Even if you don't own a fund that's closing, it's still a noteworthy event because it shows the fund company is acting in an investor-friendly way and it might close other funds. In addition, it's common to see closed funds reopen when a bear market hits or the fund is in a slump. For example, Wasatch Small Cap Growth WAAEX reopened in March 2020 and closed again in July 2020.

Closing in Perspective

Closing is a useful tool for fund managers, but it's just one of many things going on. Generally, exceeding the optimal asset size for a fund is a hindrance--not a disaster. With hindsight I often hear investors say that a big underperforming fund is lagging because it got too big. Usually that's only partly true because the impact can be subtle.

The impact of asset bloat can be hidden by other factors. In any single calendar year, the fund's style, favored sectors, and top securities are likely to have a much greater impact. Over time, you can say the loss of small-cap exposure was affecting returns, but it's just one of many factors and not easy to isolate.

In fact, some big funds continue to do well. Does Fidelity Contrafund's FCNTX success prove asset size doesn't matter? I'd argue that Contrafund's Will Danoff is an exceptional investor who has handled assets with aplomb, while Fidelity Magellan FMAGX has shown just how hard it can be to run a lot of money. Both funds have closed in the past, albeit after they were already massive, so it's not comparable to, say, Champlain Small Company closing short of $1.5 billion.

It's also worth considering the context in which funds close. Typically, it's because their strategies just had a great stretch of performance that brings money flying in the door. Thus, the fund's portfolio might be a little overpriced when it closes. As a result, a fund might start to cool off around the time it closes.

Did It Work?

I was curious to see how FundInvestor's Morningstar 500 funds had fared since closing. Had they beaten their benchmarks? Did closing effectively slow down inflows?

There are 35 Morningstar 500 funds currently closed to new investors across all share classes. I focused on the 28 that have been closed for more than a year and therefore can give us some meaningful data. Of those, 16 continued to outperform their benchmarks. I think that's better than it sounds because, as I mentioned, funds tend to close after a strong run of outperformance. While I'm interested in the results, I would note that 28 funds do not make for a very large sample size.

Two funds really stood out. The first was Fidelity Growth Company FDGRX, which has beaten its benchmark by more than 250 basis points a year since closing in 2006. That means Steve Wymer has outperformed with a large asset base for a very long time--and clearly made a lot of money for a lot of people.

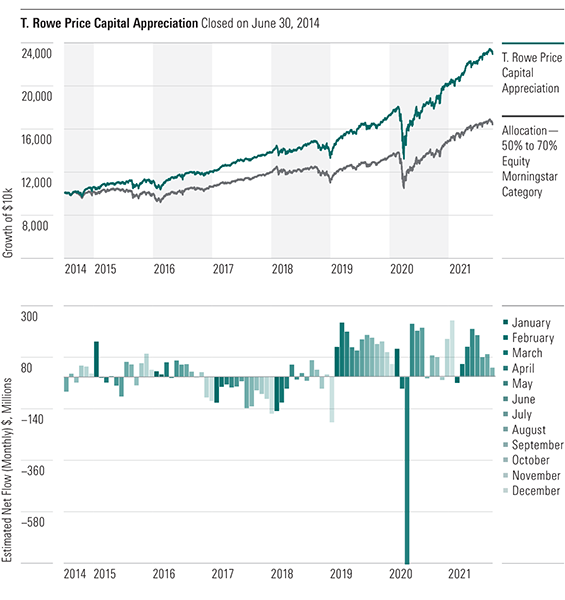

The other was T. Rowe Price Capital Appreciation PRWCX, which closed in 2014 and has outperformed its Morningstar Category benchmark by nearly 500 basis points over the past seven years. Again, a remarkable achievement for David Giroux, and shareholders must be very glad the fund closed.

Both of these funds would seem to have a lot of capacity given their market-cap focus and breadth of reach. Yet, it still helps to keep assets from growing out of control. Wymer was able to focus his bets more and get some meaningful returns from his private equity positions even though they were small relative to the fund's asset base.

Giroux still had enough nimbleness to shift among sectors and asset classes to find the most attractive risk/reward profiles.

On the negative side, Lazard Emerging Markets Equity LZOEX has lagged by almost 200 basis points a year since closing in 2010. However, the fund’s value tilt has held it back relative to a broad emerging-markets index, so it's not nearly as bad as it sounds.

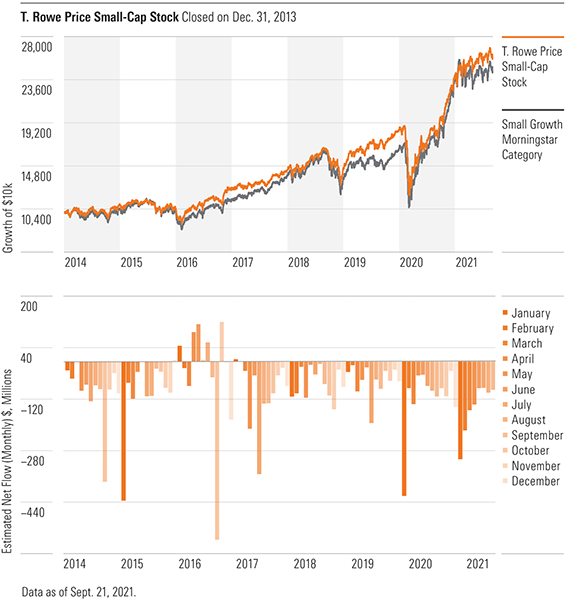

What about the management of flows? For this, we see that closing was quite effective. On average, funds took in less than $50 million a month after closing, and many were close to flat. This suggests that closing really does buy managers some breathing room to maintain the integrity of their strategies and to avoid spending too much time managing flows.

One interesting exception was FPA New Income FPNIX, whose flows ticked up after it closed in August 2020. The fund has taken in $3.5 billion since closing. Existing investors can contribute more money, so this kind of result is certainly possible, though rare.

More often we see flows flatline quickly if the fund company is really shutting down to new investors. Over time, funds just naturally lose some shareholders, so when you stop most inflows, that steady attrition can hold net flows to zero or lower. That's not a bad outcome for fundholders as it can keep assets from getting out of hand.

Take T. Rowe Price Small-Cap Stock OTCFX, which closed in December 2013. Starting in January 2014 and nearly every month thereafter, the fund has been in modest outflows. Yet it has outperformed the Russell 2000 Growth Index by about 170 basis points per year. T. Rowe Price has closed quite a few funds over the years, and I've noticed that it tends to shut off flows pretty firmly, whereas other firms might leave a little more room for others to get through the door.

Conclusion

Fund closings are effective at moderating inflows and giving managers a fighting chance. They also signal good stewardship. That makes funds from firms like T. Rowe Price, Wasatch, and Artisan good bets. Keep an eye out for reopening funds as they've already shown they'll close in order to serve shareholders.

/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)