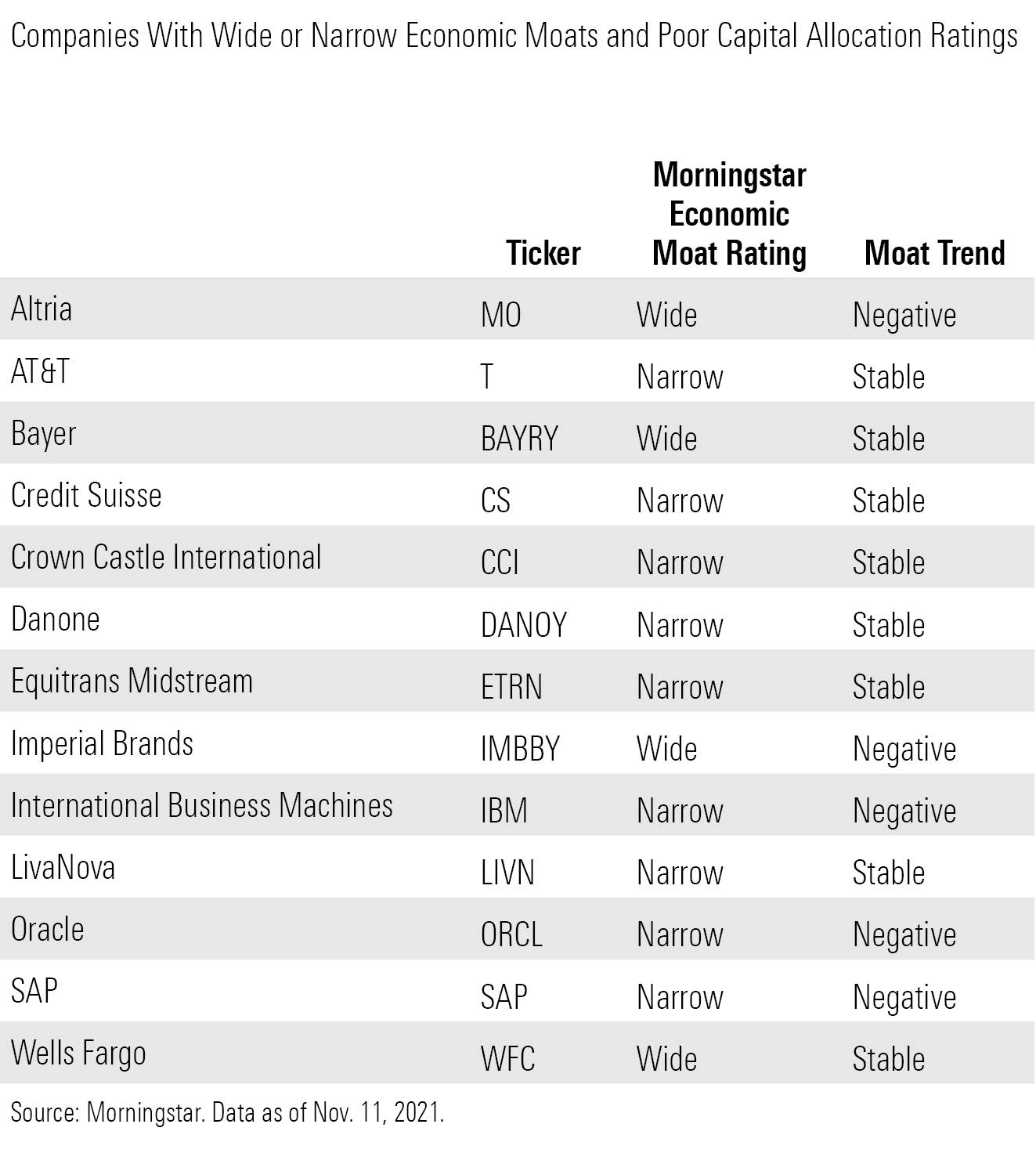

13 Good Companies Run by Poor Capital Allocators

These firms all have wide and narrow economic moats but earn poor capital allocation ratings.

Life is filled with incongruities. We have, for instance, jumbo shrimp. Working vacations. Old news. Friendly takeovers.

Along those same lines in investing, we have what Morningstar would dub good companies whose managers have made poor capital allocation decisions. These are companies that have carved out significant advantages (or economic moats) and are therefore quite likely to withstand the slings and arrows from competitors, but they've built those moats in spite of what we consider to be poor management practices that haven't delivered shareholder returns.

The Morningstar Capital Allocation Rating represents our assessment of how well a company manages its balance sheet, investments, and shareholder distributions. Analysts assign each company one of three ratings--Exemplary, Standard, or Poor--based on their assessments of how well a management team provides shareholder returns.

Watch: Introducing the Morningstar Capital Allocation Rating

Today we're looking for companies that are competitively sound but not especially adept at capital allocation, according to our standards. Specifically, we screened for companies with wide or narrow Morningstar Economic Moat Ratings and Poor capital allocation ratings. Thirteen made the list.

Here's an in-depth look at the capital allocation ratings of three of the names from the list. Premium Members can research the ratings for the remaining companies on each stock's individual analyst report.

AT&T T

"We believe recent capital allocation decisions have destroyed shareholder value and that the firm will pay the price for these missteps for some time to come. As a result, we rate the firm's capital allocation as Poor. This assessment stems from our view that a relatively weak balance sheet has hindered AT&T's strategic flexibility and wiliness to invest aggressively in the business when needed. Management is moving in the right direction, using the planned WarnerMedia spin off to shift to a dividend policy that better supports needed investment, but AT&T is still playing catch-up. It will need to invest aggressively for the next several years to make its fixed-line network competitive, and it still doesn't expect to get debt leverage below targeted levels until the end of 2023.

"The firm's run of heavy capital deployment began in 2012 with a massive share-repurchase program that, at the time, was billed as a temporary move away from AT&T's 1.5 times net debt/EBITDA leverage target. The firm repurchased $27 billion of its shares through 2014 at prices per share in the mid-$30 range, pushing leverage to 1.8 times. That activity reduced balance sheet flexibility as the firm subsequently pursued the AWS-3 auction, the DirecTV deal, expansion into Mexico, the Time Warner acquisition, and the recent C-band auction. With leverage now around 3.2 times EBITDA, AT&T's capital structure simply didn't line up well with a large dividend payout. Yet management explicitly expressed support for the prior dividend until abruptly changing direction, catching long-suffering investors off guard.

"These capital forays have not only left AT&T with a weaker balance sheet, they also left the firm in a weaker competitive position overall, in our view. With 2015's DirecTV purchase, AT&T acquired a satellite TV business that was, at best, peaking in maturity. The firm also hasn't invested as aggressively as it should have in its business. Until recently, the firm had prioritized margins over maintaining wireless market share, allowing T-Mobile to steadily steal customers. In addition, AT&T has only begrudgingly invested to expand its fiber optic network in the past. New CEO John Stankey has made fiber construction a top priority, but AT&T only plans to upgrade around 3 million locations per year, equal to about 5% of its footprint. Expanding fiber is key to not only stabilizing the consumer broadband business but also providing a network edge in wireless and bringing high-quality service to more business customers as they adopt 5G.

"In 2015, the firm spent $18 billion at the AWS-3 auction, equating to an unprecedented price/MHz-POP (a common measure of spectrum capacity and usefulness). Dish Network DISH was a heavy bidder in that auction, and AT&T may have pushed prices higher to stall this would-be competitor. However, we don't believe AT&T has anything to fear from Dish, and we think this capital would have been better spent elsewhere. While valuations in the C-band auction were more reasonable, with a much larger amount of spectrum up for sale, AT&T likely could have secured spectrum more cheaply prior to the auction if it hadn't been tied up with other initiatives and debt repayment.

"AT&T has placed a priority on debt reduction since the Time Warner merger closed, using asset sales as a part of this effort. Not all these sales have made strategic sense, in our view. For example, the sale of its wireless assets in Puerto Rico seems odd given the territory's strong ties to the United States and AT&T's presence elsewhere in Latin America. Management's continued emphasis on debt reduction could push the firm to make additional questionable asset sales."

--Michael Hodel, sector director

Bayer BAYRY

"Overall, we rate Bayer's capital allocation as Poor. The rating reflects our belief that Bayer possesses a sound balance sheet, a poor track record of investments, and mixed efforts on shareholder distributions.

"Despite the heavy debt added by the Monsanto acquisition, we believe Bayer holds a sound balance sheet with low levels of risk regarding the size of the debt carried, the business cyclicality facing the firm, and the debt maturity outlook. While an argument could be made to increase the leverage of the balance sheet to be more active in investing, we believe the company, along with the majority of firms in the large-cap biopharma industry, should hold ample balance sheet strength to support for opportunistic acquisitions as dynamic scientific data emerges. Also, a strong balance sheet helps biopharma firms through most product litigation challenges with minimal concern by the market. However, in Bayer's case, the heavy concerns over the glyphosate litigation have put the firm's sound balance sheet under pressure.

"Turning to investments, we believe Bayer is operating at a poor level. The company only spends on drug research and development at the low-double-digit range as a percentage of sales (below the high-teens industry average). Further, the company has shown low productivity with poor execution in pipeline development. The lower productivity is limiting the returns on invested capital.

On the acquisition side and partnership side, Bayer has executed poorly. The largest recent acquisition of Monsanto for over $65 billion diversified cash flows and looked like a reasonable acquisition at the time, but the mismanagement and misunderstanding of the glyphosate risk has made the deal more problematic and has likely taken capital away from needed R&D investments. However, on the positive side, the decision to divest its no-moat material science business should improve the firm's overall competitive profile as the remaining business lines of healthcare and crop science hold much stronger competitive advantages.

"Regarding distributions, we believe Bayer made the right choice to lower dividends in 2020 given the poor execution of the business performance and the heavy and still uncertain glyphosate litigation overhang.

"On the management side, Werner Baumann took over as chairman of the board in May 2016, bringing strong financial and healthcare management experience from a long tenure at Bayer. Baumann joined Bayer in 1988 and has held several managerial posts in the healthcare group, which should bode well as Bayer moves toward a more focused effort in healthcare, divesting the material science group."

--Damien Conover, sector director

International Business Machines IBM

"We rate IBM's capital allocation as Poor based on our assessment of a sound balance sheet, poor investments, and appropriate shareholder distributions.

"We think IBM's balance sheet is sound based on its healthy cash cushion and manageable debt. IBM, on a pro forma basis, had cash and cash equivalents of $8.2 billion and total long-term debt of $48.5 billion as of June 2021. We think the firm's investments are poor as IBM has had massive resources to put toward innovation, but it has failed to keep up with cloud-only peers, largely owing to execution, in our view. While IBM's acquisition of Red Hat was the largest deal in the company's history, we don't think IBM paid an outrageous amount, as we valued Red Hat at a market capitalization of $26.8 billion prior to the announcement. IBM acquired Red Hat for a deal price of $34.0 billion, giving it a premium of our fair value estimate of close to 30%. However, this is relatively in line with software deal premiums. While we don't think this premium was outrageous, we think that it was unnecessary to own Red Hat, given that the major synergy is solely that IBM has a greater customer base to sell to. If we assume that Red Hat was purely an instigator to change IBM's perception, we don't think the benefits will be to the extent that IBM's brand requires. Finally, we believe IBM's shareholder distributions are appropriate, as dividends and share repurchases are not diverting R&D efforts, in our view. Our poor investment rating hinges more heavily on execution issues.

"Our capital allocation rating is informed by our review of IBM's management. IBM is steered by Arvind Krishna, who has held the CEO position since April 2020, before which he had over 30 years of experience at IBM. We think Krishna's experience as former senior vice president of cloud and cognitive software at IBM is fitting as we consider the business segment to be the driver of IBM's success or failures in the future. However, we think Krishna will need to work hard to deflect IBM's weak brand perception, which we concede is a massive task."

--Julie Bhusal Sharma, analyst

Start your free 14-day trial of Morningstar Premium. Understand the difference between a good company and a great opportunity. Unlock our analysts' fair value estimates and get continuous research and analysis to help you make the best decisions.

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5SLJLNMQRACFMJWTEWY5NEI4Y.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KNTMDTIW3JFWJBYCASLAV3ZIJE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/D2M6HBDLIZD3RLWRUR7IPUIVIU.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)