ESG Ratings Are Now Available for Bond Funds, Allocation Funds

A change to the Morningstar Sustainability Rating methodology means we can rate more funds, in more categories.

We made some changes to the Morningstar Sustainability Rating for funds that will increase the number of funds receiving ratings. Importantly, we will now provide globe ratings, which measure ESG risk relative to category peers, for most fixed-income funds and allocation funds.

To do this, we will now incorporate Sustainalytics' established Country Risk Rating scores for sovereign-issued securities. Previously, our rating incorporated the ESG risk of corporate issuers only using Sustainalytics ESG Risk Ratings. Morningstar's Sustainability Rating methodology is unique in that it takes a modular approach, scoring and ranking the corporate and sovereign portions of the portfolio independently. This allows for a more nuanced look at the portfolio's risk exposures that enables better comparison between similar strategies. That's because often the corporate portion of the portfolio is the area where a fund manager has more opportunities to manage the fund's ESG risk exposure, while it's common for peer funds to have very similar sovereign exposure.

How It Works

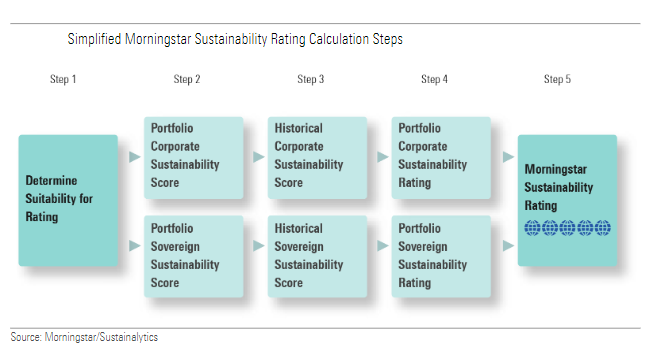

This is a simplified flowchart of the process used to determine the rating.

First, we examine the types of holdings in the fund’s portfolio and whether the securities are eligible for ratings. We require that most of the securities in the portfolio (at least 67%) are rated.

Next, the two portfolio sleeves are scored. To calculate the sustainability score for the corporate sleeve, we take each security’s ESG Risk Rating score, which measures the degree to which a company’s economic value (enterprise value) is at risk driven by ESG factors. It’s applicable to stocks, bonds issued by corporate entities, select securitized debt, and supranational entities. We average the portfolio holdings’ scores on an asset-weighted basis to come up with the portfolio’s corporate sustainability score.

To calculate the sovereign sustainability score, we use Sustainalytics Country Risk Ratings, which assess countries’ prosperity by considering their access to--and management of--natural, human, and institutional wealth, which corresponds to the assessment of environmental, social, and governance factors in the corporate ESG ratings. The sovereign rating is applicable to fixed-income securities issues by government entities and select securitized debt.

The next step is to calculate the historical portfolio sustainability scores for both the corporate and sovereign sleeves. Historical scores are a weighted average of the trailing 12 months of Morningstar Portfolio Corporate and Sovereign Sustainability Scores, respectively. Historical scores are not equal-weighted; rather, more-recent portfolios are weighted more heavily than more-distant portfolios.

The corporate and sovereign historical scores are ranked independently against all other scored funds within a Morningstar global category peer group to derive a rating for the corporate portion and the sovereign portion of the portfolio.

Finally, we combine the Portfolio Corporate Sustainability Rating and the Portfolio Sovereign Sustainability Rating. We weight the corporate and sovereign scores in proportion to the fund’s actual portfolio to get the overall Morningstar Sustainability Rating.

The Rating in Action

Let’s take a look at an example. IShares ESG U.S. Aggregate Bond ETF EAGG is an exchange-traded fund that gives investors exposure to the investment-grade bond market with an ESG tilt. This fund, which earns a Morningstar Analyst Rating of Silver, tracks the Bloomberg Barclays MSCI U.S. Aggregate ESG Focus Index, a market-value-weighted index consisting of U.S. Treasury bonds and investment-grade U.S.-dollar-denominated securitized, corporate, and government-related bonds. It targets the same broad sector weightings as the Bloomberg U.S. Aggregate Bond Index.

The new methodology allows us to give this fund a Morningstar Sustainability Rating for the first time:

- source: Morningstar.com

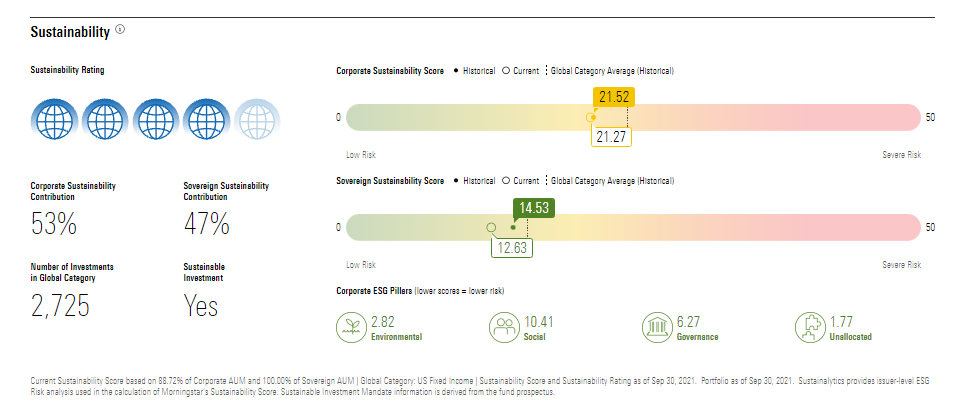

IShares ESG U.S. Aggregate Bond ETF earns an overall rating of 4 globes. That means this fund is exposed to less ESG risk than most peers in the U.S. fixed-income global category.

Here's how it breaks down: The corporate sleeve of the portfolio receives medium ratings (historical and current) for ESG risk exposure. The portfolio's current and historical sovereign sustainability scores are lower but contribute slightly less to the portfolio's overall rating (53% for the Corporate Sustainability contribution versus 47% for the Sovereign Sustainability contribution).

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q7DQFQYMEZD7HIR6KC5R42XEDI.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DJVWK4TWZBCJZJOMX425TEY2KQ.png)