Retirees Seek Direction on a ‘Mishmash’

A self-taught individual investor reaches out for a second set of eyes on a portfolio that she fears has become unwieldy.

Editor’s Note: This portfolio makeover is from 2021. Keep in mind that the current market environment may be different than when this makeover was executed.

Retired for nine years, Lauren and Matt, 75 and 76, have established a comfortably sized portfolio and live within their means. They own their own home in a beautiful part of the western United States, and their children and grandchildren live nearby.

But Lauren describes their portfolio as "a mishmash of many trades and conflicting brilliant ideas." Lauren has been a self-taught do-it-yourself investor since receiving poor advice from a financial advisor while she was still working. "[The advisor] steered me into some very questionable investments, and that's when I turned to Morningstar to research some of her choices, and on many buys, I did not do what she wanted, thankfully … That is when the crash of 2007-08 happened and I lost lots of money on investments that were not sound in the first place and would never come back."

Lauren and Matt now hold many top-rated funds, thanks to Lauren's research, but they're not clear on how they fit together and support their spending plan. "I'm afraid my portfolio is just what it has morphed into and not the best choices for me now that I am retired and taking required minimum distributions," she wrote.

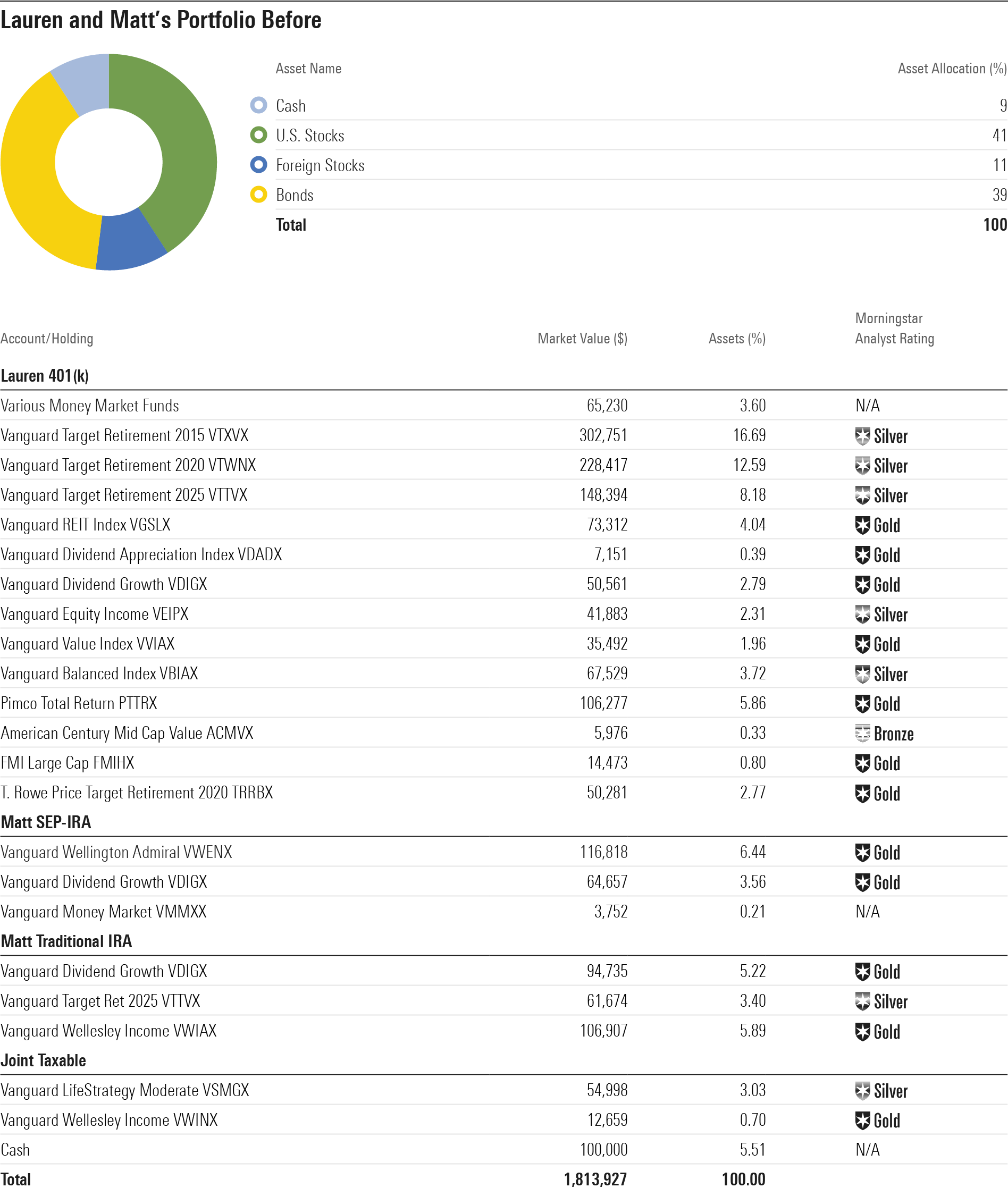

The Before Portfolio

Lauren and Matt have a well balanced asset allocation: 52% of their Before Portfolio is in stocks, with the remainder in cash and bonds. They have also achieved solid diversification within their equity exposure: While they're a bit light on foreign stocks relative to most institutional asset-allocation recommendations, their portfolio is well dispersed across the Morningstar Style Box. And because low-cost Vanguard funds dominate their holdings, their total expense ratio is ultralow--just 0.19% on an asset-weighted basis. That compares very favorably with the 0.81% that an investor would pay for a similarly allocated basket of average mutual funds.

Lauren's 401(k) from her former employer is the largest investment pool. Its largest weightings are in multiple target-date funds geared toward people in or near retirement. That allocation to funds of funds helps explain why their total asset allocation is so well balanced and their portfolio is so well diversified. Additionally, she has allocations to a number of fine active and index funds, including gems with Morningstar Analyst Ratings of Gold such as Vanguard Dividend Growth VDIGX, Pimco Total Return PTTRX, and FMI Large Cap FMIHX.

Matt's SEP-IRA and traditional IRA also include many fine funds, including Vanguard Wellington VWENX, Vanguard Wellesley Income VWIAX, and Vanguard Dividend Growth. Finally, the couple's taxable account holds a large cash stake as well as two Vanguard allocation funds.

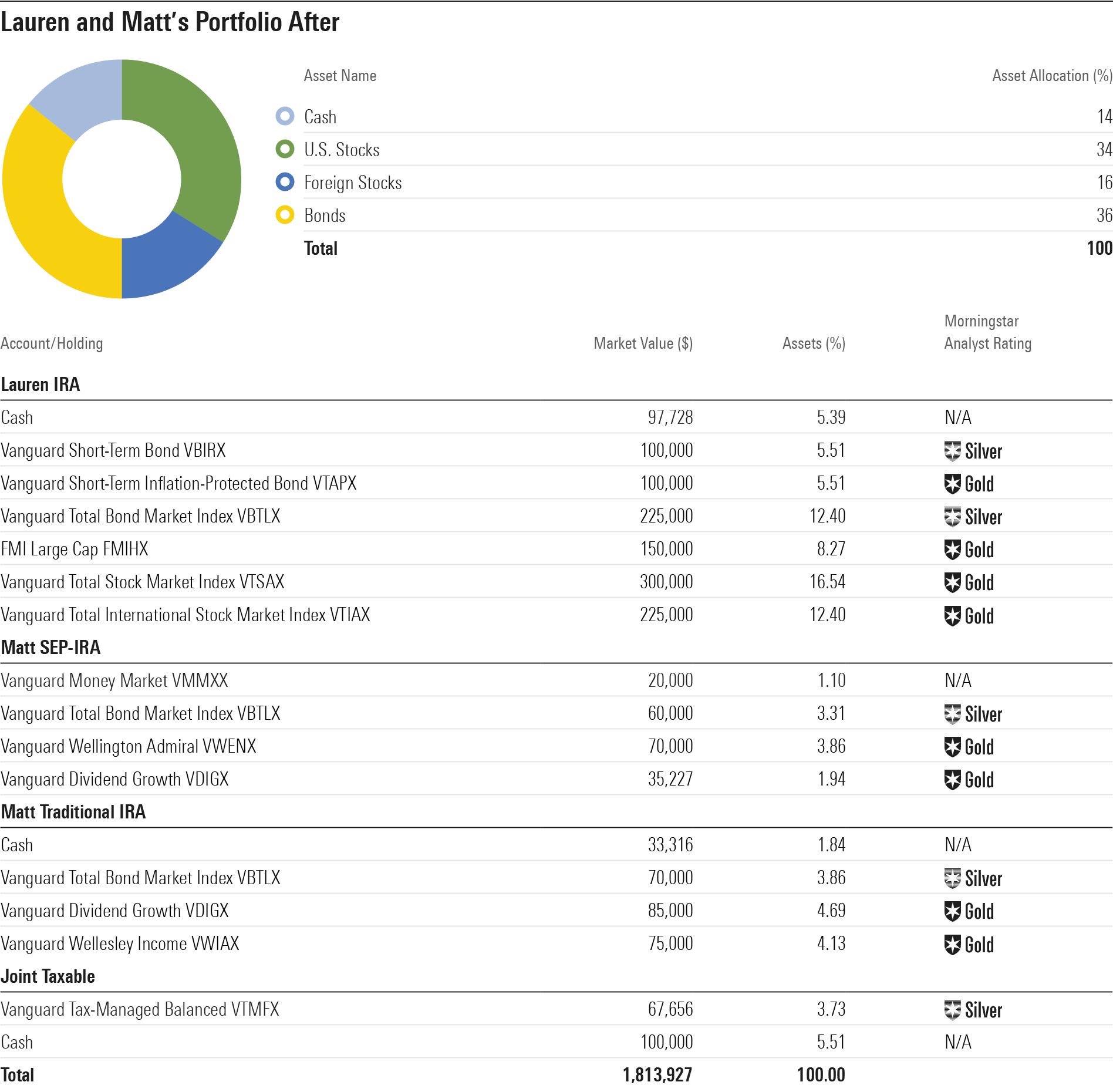

The After Portfolio

Lauren and Matt use their required minimum distributions to supply their cash flow needs on an ongoing basis, noting that the amount is adequate to provide for their income needs and also covers vacations and home repairs. Given that the assumptions that underpin the Uniform Lifetime Table for RMDs are conservative--specifically, they assume a spouse who is 10 years younger--this seems like a fine system, as long as Lauren and Matt don't mind the variability in their cash flows. (They say they don't.) Moreover, the pair has nearly $170,000 in taxable assets that aren't subject to RMDs, which makes their RMD-based withdrawal system more conservative still.

My After Portfolio makes a few adjustments, however. As solid and hands-off as their target-date, balanced, and allocation funds are, I like the idea of employing discrete stock and bond funds to supply their cash flows in retirement. That way, when Lauren and Matt sell to meet their RMDs, they can pull from whichever of their holdings has appreciated the most recently. I used broad-market index funds to provide pure, low-cost U.S. and foreign stock and bond exposure throughout the portfolio.

I used their anticipated withdrawals to help structure all of their accounts that are subject to RMDs, targeting enough in cash and bonds to meet their RMDs for the next 10 years. This isn't a precise science, in that each year's RMDs will depend on how their portfolios have performed in the year prior. But by using a bucket-type system, they can each hold a couple of years' worth of withdrawals in cash, then step into high-quality bond funds with another five to eight years' worth of anticipated withdrawals. That gives them 10 years' worth of withdrawals in cash and bonds that could sustain them through an equity pullback without ever needing to touch depreciated equities. They can hold the remainder of their portfolios in equities. They won't necessarily "spend through" their portfolios in that specific sequence--cash, then bonds, then equities. But that setup helps insulate their spending from a sustained equity drawdown should one occur.

While Lauren's 401(k) includes many fine funds, it's somewhat limited on the fixed-income front. Rolling over to an IRA would provide her with more choices, including funds focused on Treasury Inflation-Protected Securities.

Their taxable holdings are but a small slice of their overall portfolio, but that account could be a bit more tax-efficient and streamlined. In addition to the cash they like to hold for emergencies, I employed Vanguard Tax-Managed Balanced VTMFX for one-stop, tax-efficient stock/bond exposure.

One of the only risk factors for Lauren and Matt's plan is long-term-care expenses. Lauren has long-term-care insurance coverage, but Matt had a health condition that disqualified him from coverage. One backup idea if Matt requires long-term care while Lauren is still living would be to tap home equity through a reverse mortgage to cover the cost of care.

Editor’s note: Names and other potentially identifying details in portfolio makeovers have been changed to protect the investors’ privacy. Makeovers are not intended to be individualized investment advice but rather to illustrate possible portfolio strategies for investors to consider in the full context of their own financial situations.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MFL6LHZXFVFYFOAVQBMECBG6RM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EGA35LGTJFBVTDK3OCMQCHW7XQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)