3 Solid Climate Tech Funds for Investors

These strategies should play only a bit part in a diversified portfolio.

Bill Gates has said that the next generation of FANGs (Facebook [Meta], Amazon.com, Netflix, and Google [Alphabet]) will be climate tech companies. You can bet that a large number of the leaders at last week's headline-grabbing climate summit in Glasgow, COP26, agree with him.

The question for Main Street investors is: How do I get a piece of that action?

Last week, world leaders convened in Glasgow to discuss ways that countries can work together to reduce carbon emissions to forestall further human-caused global warming. One frequently mentioned theme was the need for investment and innovation in climate technology, such as renewable energy like solar and hydropower.

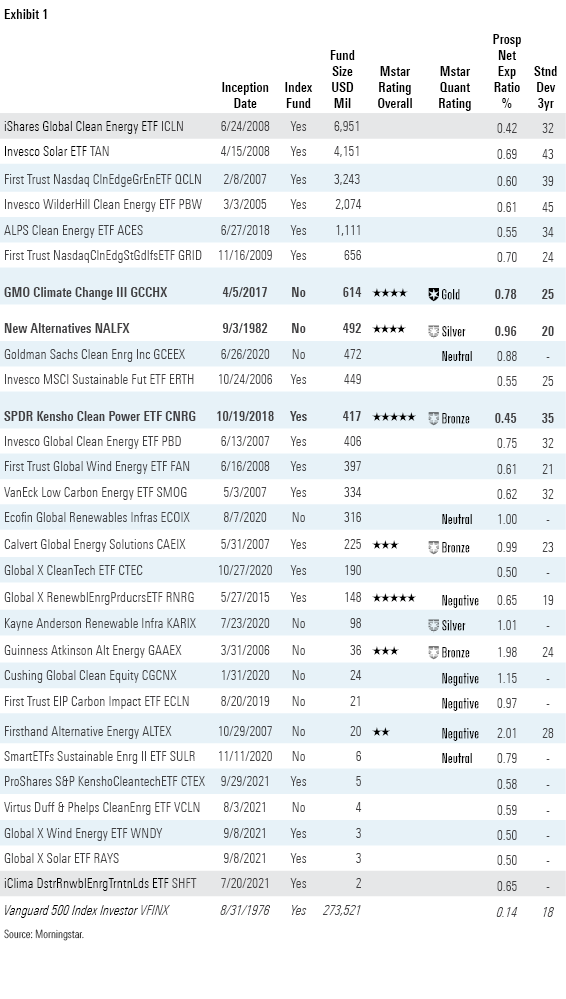

The good news is that if you believe that innovation in climate technology is set to take off, the investment industry has introduced a raft of new funds globally. The bad news is that many are unproven and much more volatile than diversified equity funds. Twelve of the 29 funds exhibited below were introduced in the last three years. Climate tech funds with at least a three-year track record have an average three-year standard deviation of 29.5 versus 18.4 for the Vanguard 500 fund. (Standard deviation is a measure of risk. The higher the number, the riskier the asset has been in the past.)

In addition, investment funds must own publicly traded companies. But there are very few of these, relative to privately held companies, and they are concentrated in competitive industries such as solar-panel manufacturing and mining commodities such as lithium.

Venture capital funds have poured more than $14 billion into privately held climate tech startups so far this year, according to PitchBook data. Global private equity and venture capital investors have already created and fully funded as many climate-focused funds in 2021 as were raised during the previous five years combined.

What's more, climate-tech itself is a diverse subindustry, including categories as wide-ranging as food and mobility systems. Few of the innovative businesses in these subindustries have publicly traded shares, however. PitchBook offers this taxonomy for understanding the landscape to help investors prepare for what's coming.

3 Options Stand Out

To be sure, some options are worth a second look. Two actively managed strategies, GMO Climate Change III GCCHX and New Alternatives NALFX, earned 4-star Morningstar Ratings for funds and moderate standard deviations relative to peers. The GMO offering has a Morningstar Quantitative Rating of Gold, while New Alternatives has a Silver Quantitative Rating. New Alternatives has one of the longest track records among all intentional ESG funds; it is coming up on its 40th anniversary.

The passive option that stands out is SPDR Kensho Clean Power ETF CNRG. It boasts expenses that are about half of the actively managed options, 5 stars, and a Bronze Quantitative Rating. Its standard deviation is significantly higher than the actively managed picks above.

The Vanguard 500 fund is displayed to facilitate comparison to a broadly diversified index.

Diving a Bit Deeper

The composition of the opportunity set holds some surprises:

- Only six of 29 launched in the past year.

- Two thirds (18 out of 29) are indexed, or passively managed.

- 13 have 10-year track records.

While many niche actively managed strategies are expensive relative to passive options, clean tech vehicles are reasonably priced as a group. Fourteen of the options are in the top (best) quartile in terms of Morningstar Fee Level % Rank (not shown in the table).

These climate tech strategies own stocks that are small relative to household names like Tesla TSLA.

For example, Invesco WilderHill Clean Energy ETF PBW holds small-cap companies like solar-panel manufacturers SunPower SPWR ($5.7 billion market cap) and Sunrun RUN ($12 billion); and Standard Lithium SLI ($1.7 billion). Solar-panel manufacturers endured a boom-and-bust cycle before and after the global financial crisis, and the industry is still highly competitive and fraught with risk. For example, Invesco Solar ETF TAN, which focuses on solar power stocks, had a 27% drawdown from February to May 2021, while S&P 500 investors enjoyed a 14% return. Such episodes test the conviction of clean tech investors.

Proceed With Caution

The options for retail climate tech investors will get better as more companies are publicly listed in the future. In the meantime, these strategies should play only a bit part in a diversified portfolio. The adventurous are advised to do more homework than usual before jumping in.

For more on Morningstar’s sustainability research and COP26 coverage, visit our COP26 hub.

/s3.amazonaws.com/arc-authors/morningstar/e3601478-840b-4f9a-ab6f-261f14c3ddd5.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e3601478-840b-4f9a-ab6f-261f14c3ddd5.jpg)