China’s Market Risks Are Nothing New

They've always lurked beneath the surface.

A version of this article previously appeared in the October 2021 issue of Morningstar ETFInvestor. Click here to download a complimentary copy.

It wasn’t long ago that China’s market was promoted as a big investment opportunity. The narrative revolved around capturing the country’s astounding growth. A booming economy and rapidly evolving stock market were fertile ground for investment opportunities.

China’s market remains in the spotlight today, but for very different reasons. The central party hasn’t been bashful about meddling with some of the country’s publicly traded companies. Such circumstances aren’t new for emerging markets. Government actions have adversely affected stock performance in other emerging markets over the past decade, such as Russia and Brazil.

China’s stock market isn’t riskier than it was several years ago. Its government was always working behind the scenes to guide the country’s economic growth and spur its market higher. China’s central party was largely responsible for expanding its economy through a series of reforms that began in the late 1970s. Ever since, it has been loosening or tightening restrictions as it saw fit, with implications--both good and bad--for investors.

China’s Invisible Hand

There’s no denying China’s impressive growth over the past two decades. Its gross domestic product grew at slightly more than 13% per year over the two decades through 2020--almost 10 percentage points higher than the rate of U.S. GDP growth over that same span. The Chinese stock market, while not the best-performing emerging market over that period, still ranked near the top.

The foundation for that explosive growth started taking shape in the late 1970s, when China’s central party embarked on a series of reforms to grow its economy and improve the lives of its citizens. It took measured actions over the ensuing decades to become a major player in the global economy, including privatizing some state-owned companies, joining the World Trade Organization, and more recently, expanding foreign investors’ access to China’s locally traded stocks on the Shenzhen and Shanghai exchanges.

Underneath that impressive effort was a rapidly shifting stock market that has come to resemble those of Western countries. Just 10 years ago, oil drillers and major banks dominated China’s market. Today, companies operating in the technology, consumer discretionary, and communications sectors rank among its largest publicly traded firms.

Relatively strong performance and access to a growing pool of publicly traded stocks have pushed China’s market into a precarious position among its emerging-markets peers. It accounts for one third of many emerging-markets indexes and the exchange-traded funds that track them.

China’s looming weight in emerging-markets ETFs is a concern, but deteriorating diversification is only one of the risks it presents. While China’s central party has loosened restrictions to grow its economy, it can also tighten them in ways that harm investors. Several emerging markets, including China, are subject to political risk, or potentially adverse interference from their governments.

Ulterior Motives

Government interference isn’t a new source of risk in emerging markets. Other recent examples include Russia’s mandated dividend payouts from its state-owned companies, or Brazilian politicians that personally profited from bribes at state-owned energy giant Petrobras PBR.

Those cases are directly tied to state-owned companies, where the connection between government actions and company performance is more direct. Politicians who serve in executive roles or on boards of directors at state-owned firms may influence operations in ways that compromise earnings but benefit a country’s economy or its citizens.

In a similar fashion, China’s government has not hesitated to meddle with domestic businesses to achieve its political ambitions. Late last year, the central party halted Ant Group’s IPO. A few months later, it mandated that several publicly traded education companies change their status to nonprofit organizations. Neither event was good for investors, nor did they build confidence in China’s market. Ant Group wasn’t able to raise capital through the public market, and tutoring companies, such as Gaotu Techedu GOTU and TAL Education Group TAL, saw their prices decline by more than 80% over a few months.

While the potential for interference isn’t new, the scope has changed. Unlike the other examples from Russia and Brazil, the recent actions of China’s central party were aimed at private companies. That sends a big message by demonstrating that the government won’t limit its interference to state-owned enterprises. Some of these actions were also bolder than they had been historically. Ant Group’s stalled IPO was expected to be one of the largest on record.

Context Matters

The market appears to have responded to the central party’s actions. Over the 12 months through September 2021, iShares MSCI China ETF MCHI fell 7.5%. Some of that decline was tied to stocks like GOTU and TAL. The rest was likely the market pricing in future actions that may affect other Chinese stocks. Despite China’s large position in the emerging-markets universe, investors were still better off in a broader emerging-markets ETF. IShares Core MSCI Emerging Markets ETF IEMG, which earns a Morningstar Analyst Rating of Bronze, gained almost 20% over the same period.

It also helps to consider China’s position in the global market. Chinese stocks account for just 4% of global market capitalization and have a long way to go to catch up to the U.S. market’s 59% stake. In the context of a globally diversified portfolio, risks specific to Chinese stocks remain relatively small.

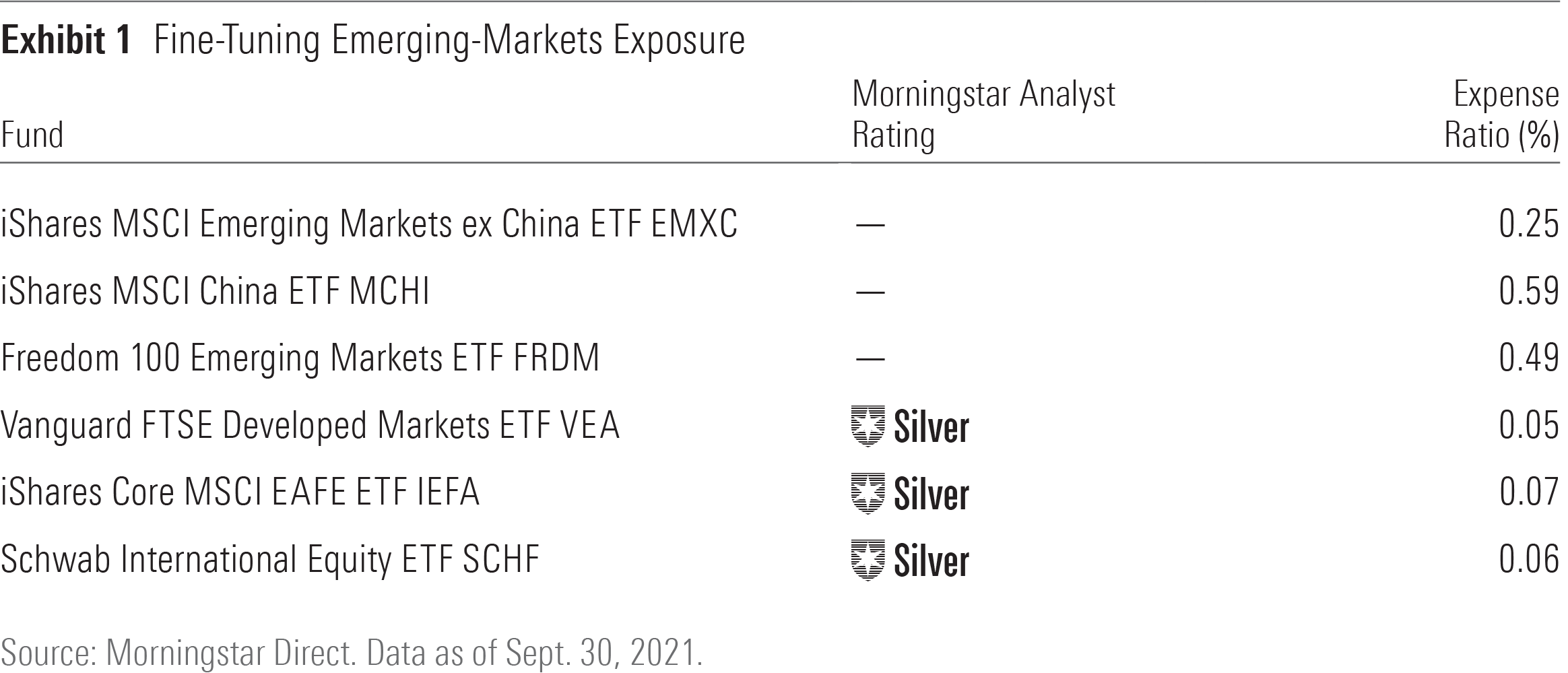

The latest actions by China’s central party and the potential for government interference in other markets shouldn’t change the Analyst Ratings for broad emerging-markets ETFs. These factors are already baked in. As of today, most broad-market index-tracking funds in the U.S. large-blend and foreign large-blend Morningstar Categories typically receive an Above Average or High Process Pillar rating. Broad emerging-markets index funds land one notch lower at Average, partly because of the potential for adverse government interference, a source of risk that’s unlikely to be rewarded. Process Pillar ratings drive most of the Analyst Ratings for index-tracking funds. So, low-cost emerging-markets ETFs are typically rated Bronze, while cheap U.S. and foreign market index-trackers typically earn Silver or Gold ratings in their respective categories.

Investors who want to go one step further and avoid China’s market have a few options. Exposure to China’s market may be fine-tuned by pairing iShares MSCI Emerging Markets ex China ETF EMXC with iShares MSCI China ETF. Freedom 100 Emerging Markets ETF FRDM is another alternative. FRDM doesn’t explicitly exclude Chinese stocks, but it builds its portfolio around markets with greater civil, economic, and political freedoms. As of this writing, Chinese stocks don’t make the cut because the country scores poorly on several freedom-related metrics, including those tied to government interference.

Avoiding emerging markets altogether is a trivial alternative. Foreign developed-markets index funds don’t possess the political risks present in China and other emerging markets. They capture a majority of the available overseas market capitalization, meaning they’re still a reasonable way to invest abroad. Exhibit 1 highlights some of the highest-rated foreign developed-markets index funds in the foreign large-blend category.

Cutting emerging markets altogether eliminates any potential upside these markets offer. However, their advantages are already limited by their relatively smaller share of the global market.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Morningstar, Inc. does not market, sell, or make any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/78665e5a-2da4-4dff-bdfd-3d8248d5ae4d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/78665e5a-2da4-4dff-bdfd-3d8248d5ae4d.jpg)