Short-Term Bond Fund Investors Get Active

The trend to passive funds may be reversing here.

The short-term bond Morningstar Category has seen increased inflows in the past couple of years--and in September, it took in more money than any other category. That makes sense given investor worries about future interest rate increases. Perhaps more surprising is that a lot of this money has gone to actively managed funds, reversing a previous trend where short-term bond fund investors favored cheaper passive vehicles. We looked at this shift and dove into some of the more interesting funds receiving net inflows.

Short-Term Bond Funds Gain Share

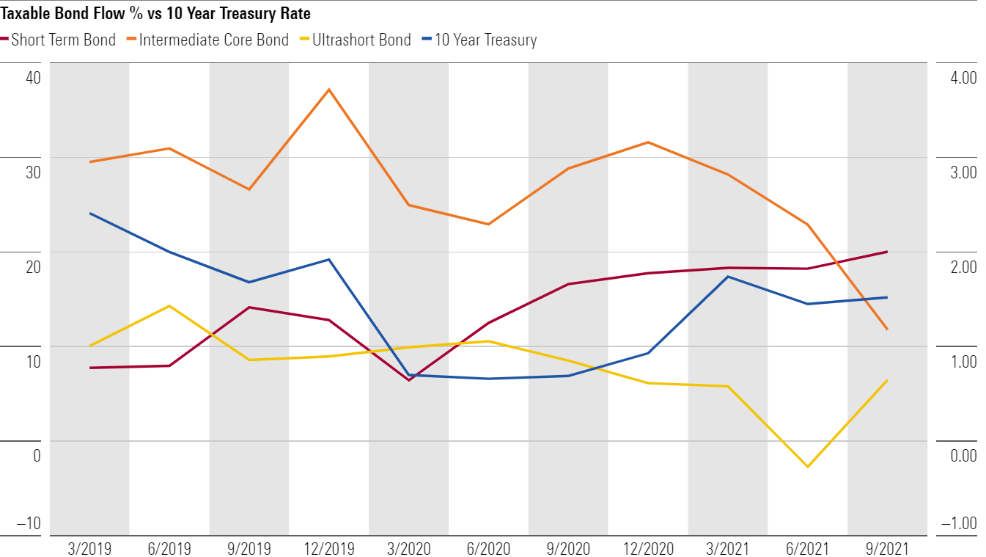

Over the past two years, the short-term bond category has seen an increasing share of flows into taxable-bond funds. Intermediate core bond funds, a mainstay of diversified portfolios, usually get the bulk of flows. However, short-term bond funds have averaged a higher organic growth rate than intermediate core bond funds lately. In 2019, they grew 17.5% versus 13.3%, and this lead has widened so far in 2021: For the year through September, short-term bond funds have an organic growth rate of 15.2% compared with 9% for intermediate core bond funds.

There are two factors largely driving this shift. First, investors are anticipating future hikes in interest rates. Second, because of the current low rates, ultrashort bond funds do not provide a strong enough incentive to attract investors despite their reduced interest-rate risk. In the middle sit short-term bonds.

As the chart below shows, the short-term bond category has captured a higher share of taxable bond flows as the 10-year U.S. Treasury yield has increased since April 2020. In contrast, intermediate core bond, the largest taxable-bond category in terms of total net assets, has seen a decreasing share of flows over that time. Ultrashort bond funds have also had a declining share of flows over this period, though investor interest has ticked up recently.

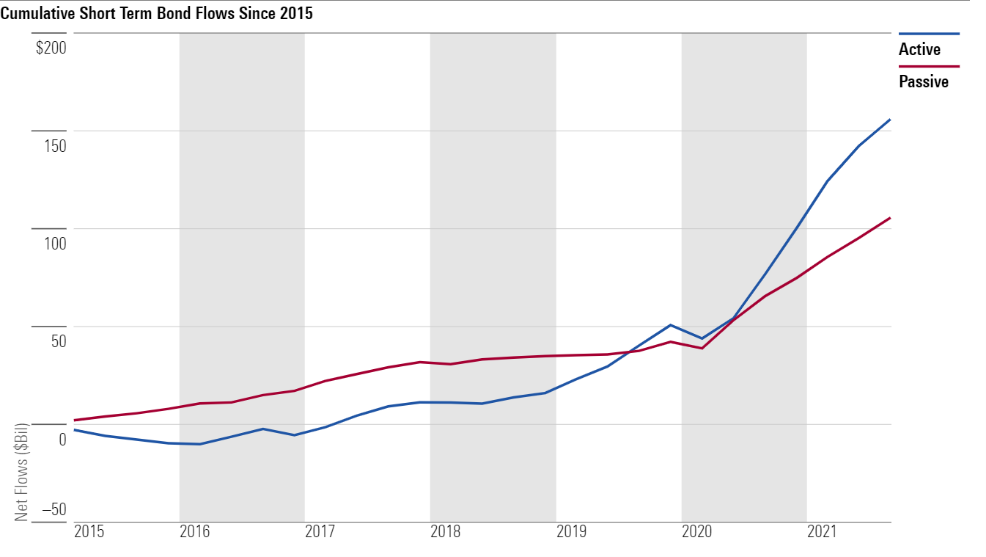

Investors Pay Up for Active

Over the past three years, flows into actively managed short-term bond funds were double the flows into passive funds in the category. That’s a shift: Passive funds had been more popular than active funds for much of the past decade. From 2015 to 2017, passive short-term bond funds pulled in $31 billion, versus only $10.9 billion for their active counterparts.

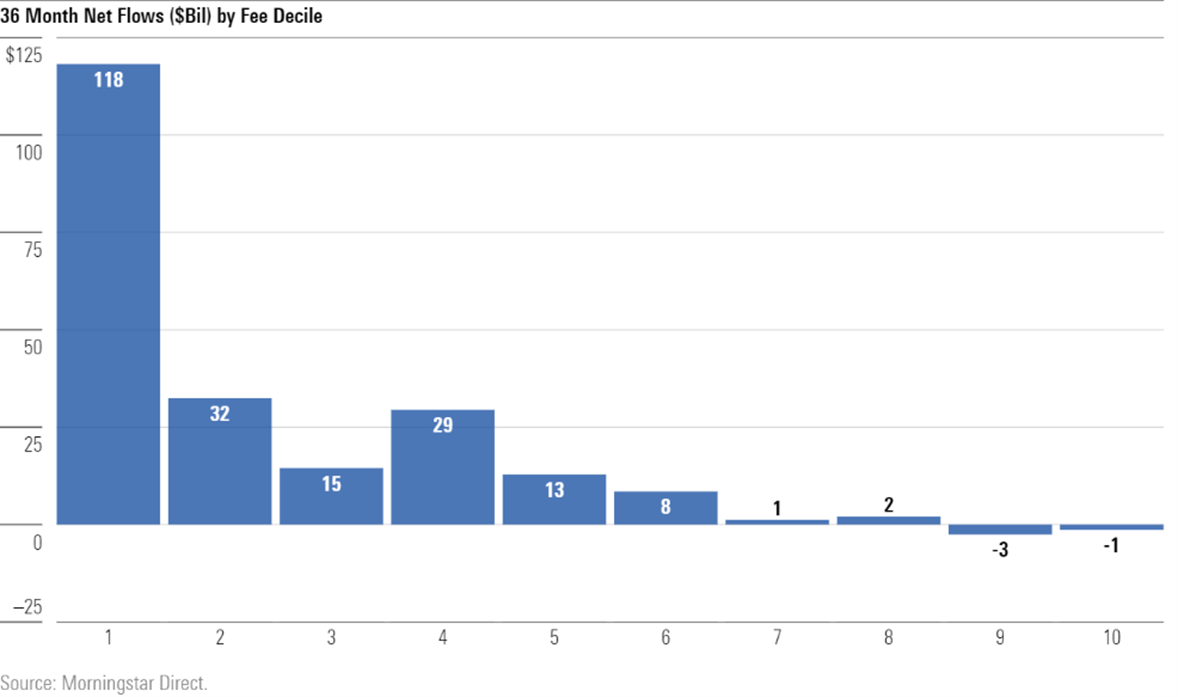

A significant portion of inflows over the current three-year period went to pricier active funds. This bucks the broader trend in the taxable-bond universe: In our midyear fees and flow review, we found that overall the "the least expensive funds took in the most money, with 10% of funds accounting for more than half of the total $344 billion that went into bond funds." Furthermore, only the top five cheapest deciles received net inflows. Looking at just the short-term bond category, however, even funds in the third-most-expensive decile had net inflows.

High-Flow Funds

We took a look at some of the funds and share classes that received significant inflows over the past three years. Inexpensive index funds remain a popular way to get exposure to short-term bonds, but some investors have been willing to pay more for the promise of higher yields even it means taking on more risk.

Two passive Vanguard ETFs, Vanguard Short-Term Corporate Bond ETF VCSH and Vanguard Short-Term Bond ETF BSV, received the most money from investors. Both funds have an expense ratio of 5 basis points, placing them in the lowest fee decile. VCSH, which earns a Morningstar Analyst Rating of Gold, replicates the Bloomberg U.S. 1-5 Year Corporate Bond Index. Silver-rated BSV tracks the Bloomberg U.S. 1–5 Year Government/Credit Float Adjusted Index.

The third-most-popular strategy was the actively managed Lord Abbett Short Duration Income LDLFX, one of the largest in the category. Most of its share classes are rated Neutral, while the most-expensive C share class has a Negative rating. In his analyst report, R.J. D'Ancona describes the fund as one of the more aggressive in the category with a high-yield stake that at times reaches 20%. However, investors did show some price sensitivity here: While most of its share classes had net inflows, the two most-expensive had net outflows over that period.

Most of the funds in the category with double-digit organic growth rates over the past three years are active funds. PGIM Short-Term Corporate Bond PIFZX, for example, has grown from less than $10 billion in total assets under management to nearly $14 billion. Morningstar strategist Eric Jacobson notes in his analyst report that “the strategy is atypical for a short-term bond offering given its laserlike focus on corporate debt.” That focus means the portfolio has been hard-hit at times, such as in March 2020, but the strategy's long-term record remains strong versus its rivals. The least-expensive share classes carry Gold, Silver, and Bronze ratings, while the others are rated Neutral.

Voya Short Term Bond IGZAX has also drawn significant inflows with an approach that differs from the norm. Associate director Brian Moriarty writes that “the portfolio has taken on a more aggressive profile [through 2020] than one might expect for a short-term offering. For example, the managers have drawn down investment-grade credit exposure in favor of securitized credit, particularly in commercial mortgage-backed securities and collateralized loan obligations, as well as high-yield corporate credit.” The strategy’s cheapest share class earns a Silver rating, while its more-expensive ones are rated Bronze or Neutral.

Aptus Defined Risk ETF DRSK, one of the priciest funds in the category, has pulled in more than $700 million since it launched just over three years ago. The actively managed exchange-traded fund stands out in the category by adding a layer of equity exposure. While 90%-95% of its assets are invested in corporate bonds, the remainder is invested in “long-term in-the-money call options on selective large-cap stocks and sectors.” This fund is not covered by Morningstar’s analysts, but its Morningstar Rating indicates that it has had high returns relative to its category, but also a high risk score.

/s3.amazonaws.com/arc-authors/morningstar/d8236d6f-dcec-4d1b-b5ba-e086adefd364.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)