First-Time Parents Balance College, Retirement Savings

With a lot in flux in their lives, how much cash is too much?

Editor’s Note: This portfolio makeover is from 2021. Keep in mind that the current market environment may be different than when this makeover was executed.

“First-time parents later in life.”

That was the capsule description that Kate, a 45-year-old freelance educator and artist, gave to describe herself and her husband Mark, a 50-year-old college professor. The couple welcomed their son 18 months ago just as the pandemic was unfolding in the United States.

As with many people during this period, Kate and Mark find themselves taking stock of their life and their goals, including their financial situation. Their long-term financial goals are to save for college for their son while simultaneously saving for retirement. But they have shorter-term financial goals in mind, too. They own an apartment in New York City but have their sights set on a larger place to accommodate their increasingly active son as well as offices for both of them. They'd also like to be able to take advantage of Mark's upcoming sabbatical to live and travel overseas--a longtime dream of theirs. At the same time, they're concerned about the implications of such a break for their finances. The sabbatical would entail a one-third reduction in Mark's income for the year, and Kate worries about the implications for her freelance business. "My work might come to a complete halt for that year or at least a number of months," Kate wrote, "and that's very scary since I'm dependent upon referrals and staying connected to the art community."

Kate and Mark would also like a second set of eyes on their $1.9 million portfolio, which they've been carefully building up during their careers. They've been assiduous savers, but their portfolio is also sprawling, with nearly 60 holdings across seven accounts. They're also concerned about the amount of cash that they're holding. "Because I work mostly freelance, I tend to keep a lot of--probably too much--cash in the bank instead of investing it," Kate wrote. Between her and Mark, their cash holdings total nearly $200,000.

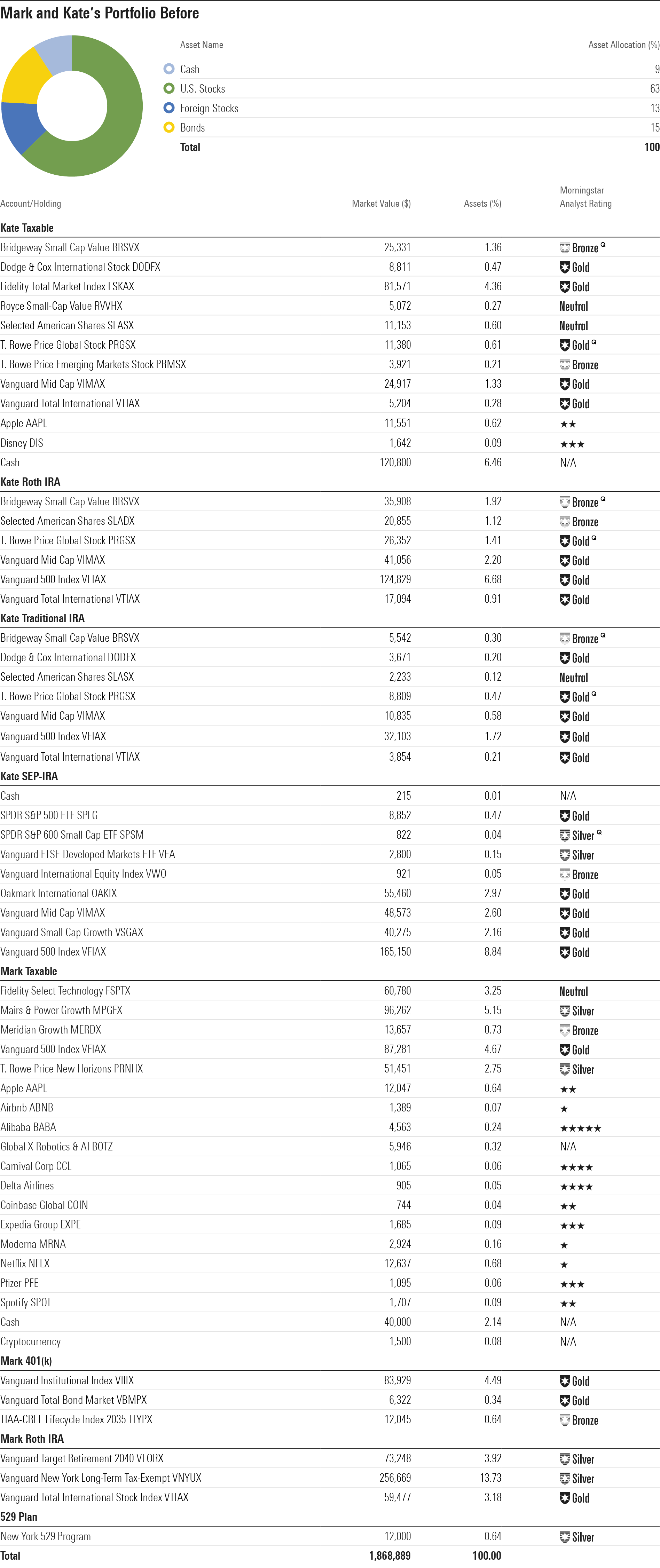

The Before Portfolio

Despite the sizable cash stake, Kate and Mark's portfolio is still quite aggressive, with three fourths of its assets in stocks and the remainder in cash and bonds. Within the sizable equity stake, the majority of holdings are U.S.-focused; just 13% of the portfolio is invested outside the U.S. The portfolio is also heavily growth-focused; nearly a third of assets land in the large-growth square of the Morningstar Style Box, and just 15% in large value.

Kate and Mark's holdings run the gamut: actively managed mutual funds, index funds, individual stocks, the aforementioned slug of cash, and even a little bit of cryptocurrency. While Kate is mainly interested in investing in mutual funds, both active and passive, Mark likes index funds and enjoys overseeing a small component of individual stocks. While they've both saved and invested inside of tax-sheltered vehicles--IRAs and 401(k)s--they also hold nearly $700,000 in taxable assets.

Mark's taxable account is the largest silo and has a heavy growth bias. In addition to large stakes in growth-oriented funds such as Fidelity Select Technology FSPTX and T. Rowe Price New Horizons PRNHX, it also includes a number of individual growth stocks. Kate's taxable portfolio, meanwhile, has more of a value orientation via funds like Royce Small-Cap Value RVVHX and Selected American SLASX. It also includes overseas exposure via four separate funds. Their tax-sheltered accounts are more mainstream, but still feature overlapping holdings. For example, Vanguard Mid-Cap Index VIMAX appears in four separate accounts.

In addition, Kate and Mark hold a 529 for their son. They've amassed $12,000 in the Silver-rated New York 529 program thus far. Mark also has two pensions from previous university jobs. One has a present value of $87,000, and the other will pay about $3,500 per year in retirement.

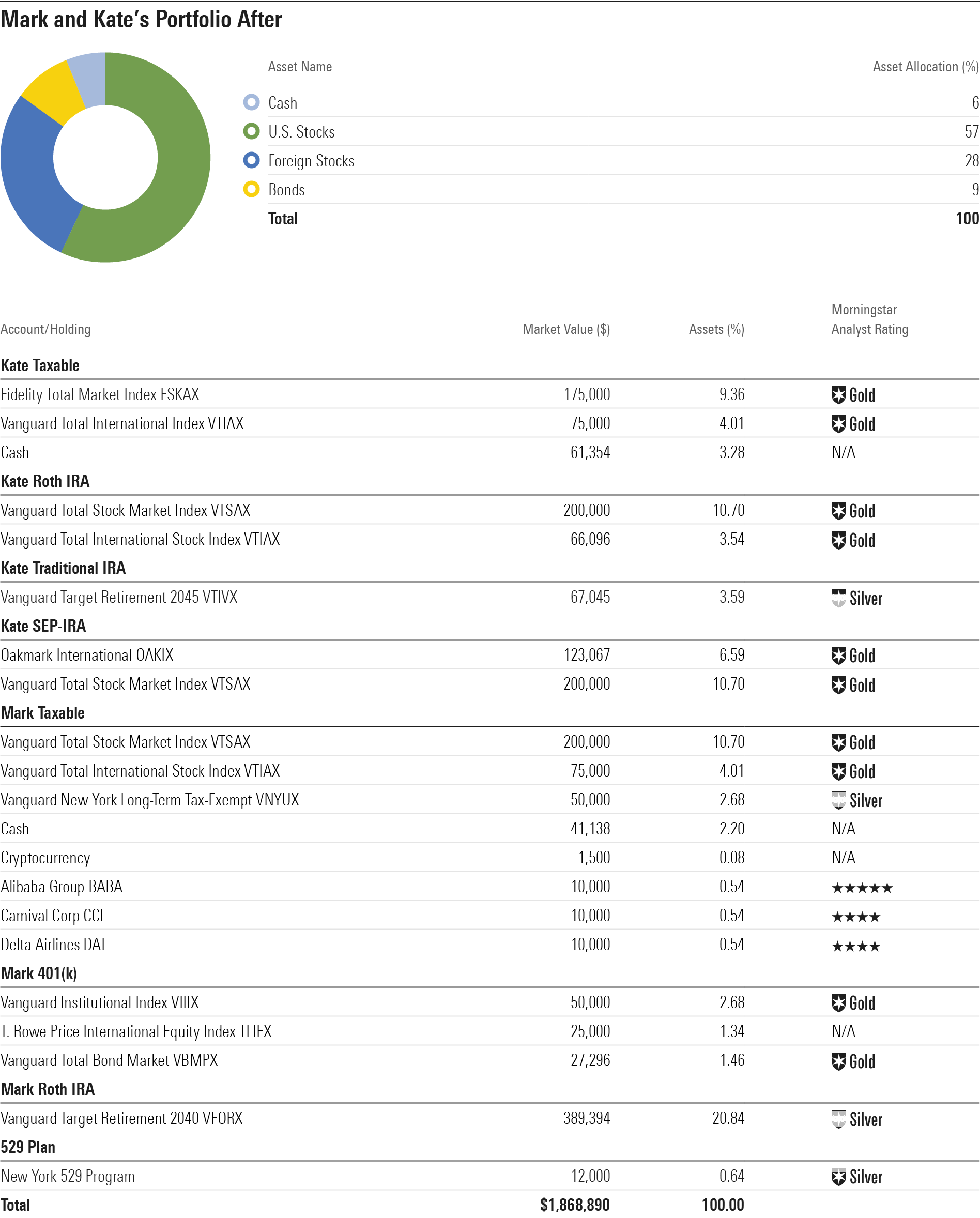

The After Portfolio

Kate and Mark are wise to be concerned about their cash holdings, especially given the combination of ultralow yields and rising inflation. At the same time, it makes sense for them to maintain a healthy cash allocation on an ongoing basis, given that Kate is a contract worker and her earnings can be a bit lumpy. Moreover, the combination of Mark's upcoming sabbatical and a possible home purchase argue for maintaining ample liquidity for the time being. Kate and Mark said that they'd like to hold about $100,000 in cash to help address their emergency-fund needs as well as their sabbatical and home purchase.

A heavy equity weighting makes sense for their retirement assets, given that they're at least 15 to 20 years from retirement. However, my After Portfolio aims to address a few issues. Given relatively lower valuations in non-U.S. stocks today, holding more overseas will likely improve their equity portfolio's return potential, so I bumped up that weighting across their accounts. I also aimed to reduce the portfolio's strong bias toward large-growth stocks. That weighting has served them well over the past decade, and growth stocks have also stood up reasonably well to inflation historically, but high valuations argue for neutralizing that big bet on large growth.

Kate and Mark also indicated that they would like to streamline their portfolio a bit, so I addressed that goal on a couple of fronts. For starters, their individual equity holdings are small relative to their growing portfolio, and those positions also tended to amplify their bet on large-growth stocks. Moreover, they were duplicative of the holdings in some of their growth-oriented funds. I retained the individual equities that are highly rated by Morningstar's equity analyst team and scaled back the lower-rated ones.

In addition, I sought to reduce the duplication of specific holdings across multiple accounts. While I retained several of their highly rated active funds, such as Oakmark International OAKIX, I concentrated them in specific accounts. I also focused on total market index funds in their taxable accounts an effort to bring down the portfolio's costs and reduce the drag of taxes. I skinnied down Mark's 401(k) to include a single target-date fund, as it includes U.S. and international equity and bonds in a single shot. I relocated Vanguard New York Long-Term Tax-Exempt VNYUX to his taxable account because the fact that its income is tax-free is a nonissue as long as it's located inside of his Roth account.

While Kate and Mark can readily undertake the repositioning in their tax-sheltered accounts, they'll want to be deliberate about enacting changes in their taxable accounts to avoid generating a big tax bill.

Editor’s note: Names and other potentially identifying details in portfolio makeovers have been changed to protect the investors’ privacy. Makeovers are not intended to be individualized investment advice but rather to illustrate possible portfolio strategies for investors to consider in the full context of their own financial situations.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IFAOVZCBUJCJHLXW37DPSNOCHM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GQNJPRNPINBIJGIQBSKECS3VNQ.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)