Will the SPAC Boom Benefit Investment Banks?

Two names are well-positioned to capitalize on potential SPAC opportunities.

Special purpose acquisition companies, or SPACs, have become especially popular in the past couple of years. A SPAC is formed and taken public in an initial public offering with the sole intention of merging with a private company, thereby taking the private company public.

So far in 2021, SPACs have raised over $100 billion of capital across more than 250 IPOs, compared with less than $15 billion across about 90 IPOs in 2019, according to our report published in late September (Morningstar Direct clients can find it here). SPACs are also involved in bringing some of the largest and most innovative companies public, such as $55 billion electric vehicle manufacturer Lucid Motors LCID and $16 billion financial-services platform SoFi SOFI.

Investment banks earn revenue from companies going public. So, what does this heightened SPAC activity mean for the industry?

The SPAC Boom May Be a Boon for Investment Banks

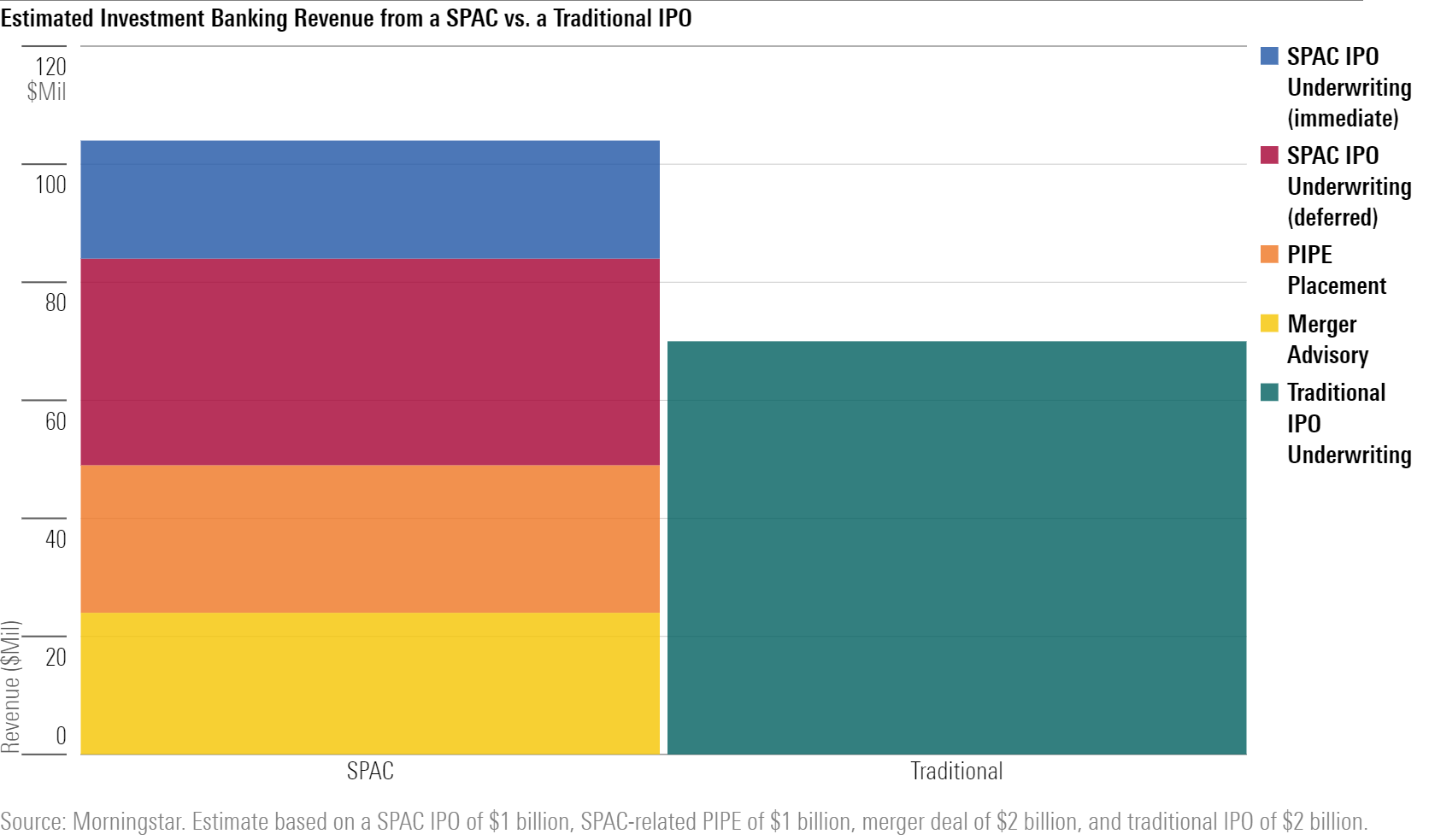

We believe the SPAC boom will positively affect industrywide investment banking revenue. We estimate that the three SPAC-related investment banking fees--initial SPAC underwriting, private investment in public equity placement fee, and acquisition advisory fees--can be as much as 50% higher than the traditional IPO underwriting fee for bringing a private company public.

We Expect Hundreds of Billions of Dollars of SPAC-Related M&A Deals Over the Next Two Years

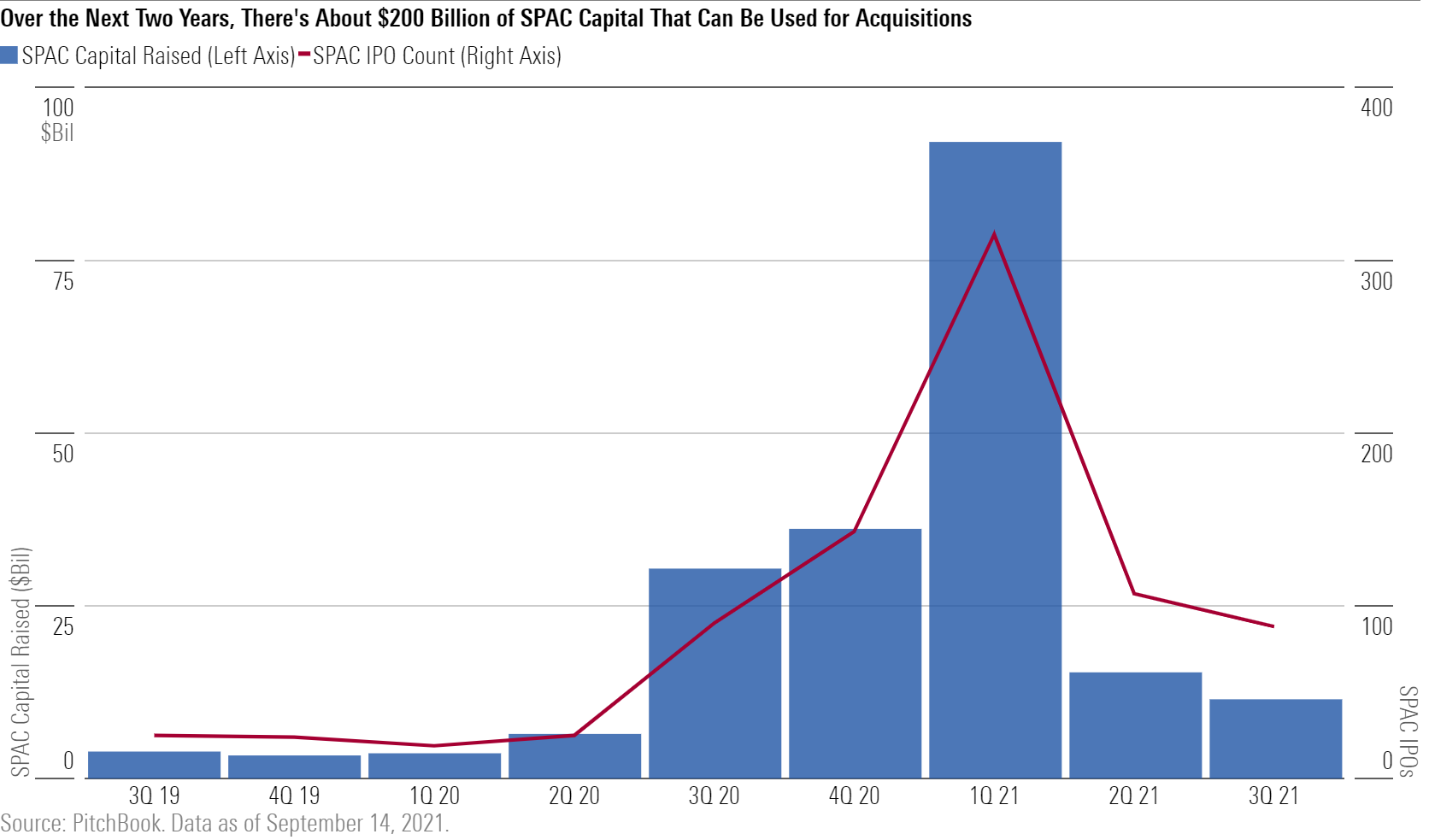

Given that SPACs typically must merge with a company within two years of the SPAC's IPO, we can use the amount of SPAC capital raised in recent years to forecast SPAC-related mergers and acquisitions volume. Based on data from PitchBook, a Morningstar company, we can see that there have been over 750 SPAC IPOs since the third quarter of 2019 and that they raised around $200 billion of capital.

We roughly estimate that there's $17 billion-$20 billion of investment banking fees up for grabs from the $200 billion of SPAC IPO capital raised over the past two years.

Who Benefits From SPAC Activity?

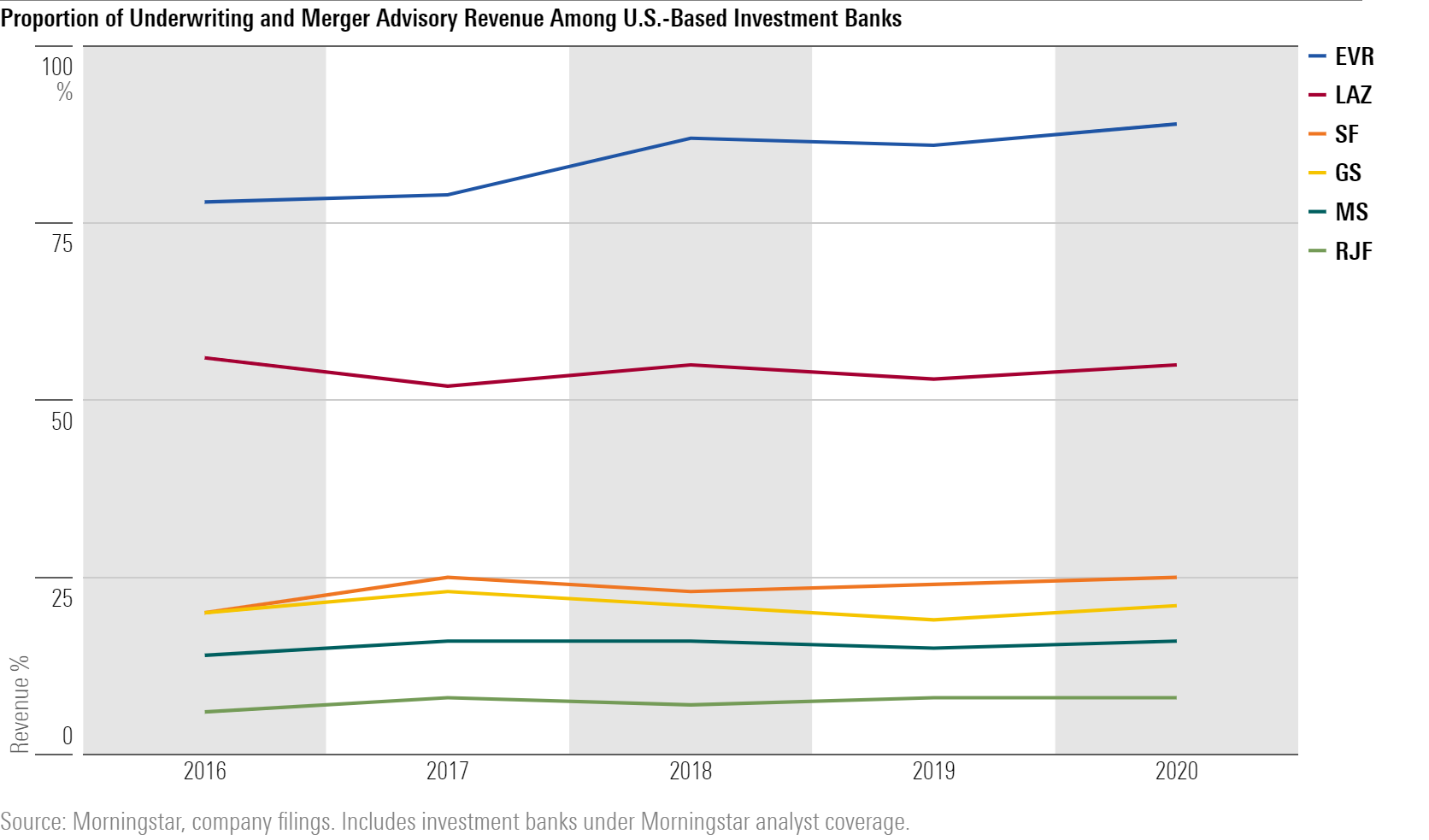

Investment banks that will benefit the most from SPAC activity are the ones with a high proportion of underwriting and merger advisory revenue. Banks with substantial trading, investment management, or traditional banking businesses will have benefits related to SPACs diluted by their diversification.

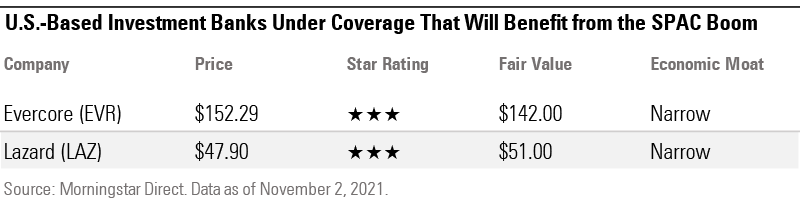

In our U.S. investment banking coverage, we believe Evercore EVR will see the most benefit from SPACs, followed by Lazard LAZ.

We wouldn't be surprised if SPACs are increasing Evercore's underwriting revenue by over 15%, if not closer to 30%, and its total investment banking revenue by about 4.5%. Evercore is an investment bank with a heavy focus on mergers and acquisitions. About 80% of the company's net revenue is from financial advisory, such as merger and restructuring advisory, and 10% of revenue is from underwriting.

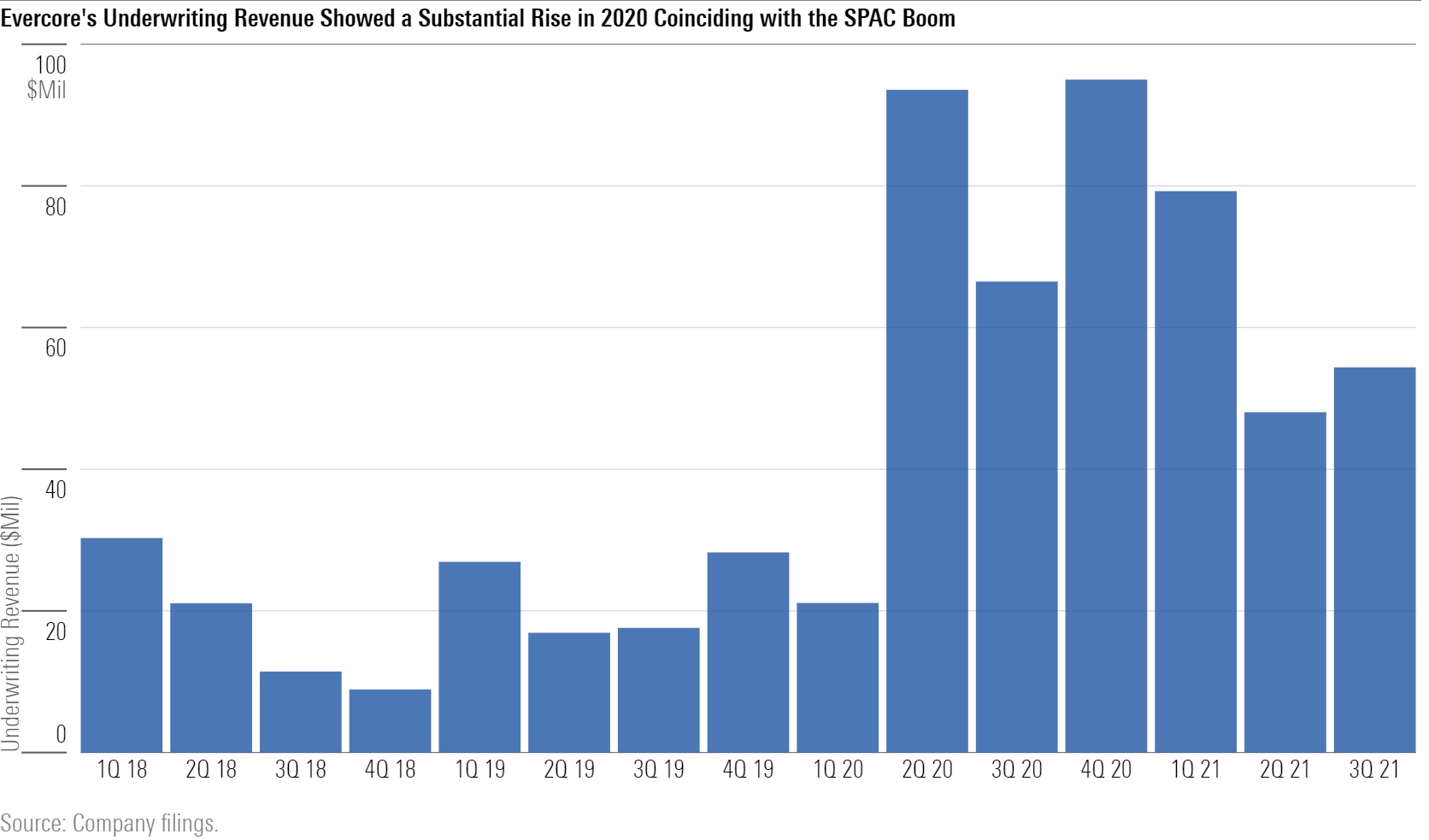

We can see that Evercore's underwriting revenue has been significantly elevated since the SPAC boom; it was over 200% higher in 2020 than in 2019. While some of this is attributable to an industrywide increase in capital-raising and Evercore's strengthening reputation in its institutional equities business, we believe the company benefited quite a bit from SPACs.

Over 50% of Lazard's net revenue comes from financial advisory, with the remainder coming from asset management. As the company doesn't have securities underwriting and trading businesses, benefits related to SPACs will show up in its M&A advisory business. While Lazard won't participate much in the fee pools for SPAC and PIPE underwriting, SPACs are definitely a net positive for its investment banking revenue, whereas SPAC-related revenue at other investment banks is being partially offset by the loss of traditional underwriting revenue from bringing private companies public.

/s3.amazonaws.com/arc-authors/morningstar/75bbf764-3b6f-4f5a-8675-8f9488c74c04.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PLMEDIM3Z5AF7FI5MVLOQXYPMM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/I53I52PGOBAHLOFRMZXFRK5HDA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CEWZOFDBCVCIPJZDCUJLTQLFXA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/75bbf764-3b6f-4f5a-8675-8f9488c74c04.jpg)