Capital Gains Roundup: 2021 Edition

Strong performance and outflows generate some big taxable distributions.

Capital gains season approaches for mutual fund investors. Once again, it will be a good news/bad news period. Most actively managed stock funds have enjoyed strong absolute gains in 2021, but that means many of them estimate that their year-end distributions to fundholders will range in percentages of net asset value from the high single digits to double digits. The taxes owed on those payouts could be the fly in the ointment of an otherwise satisfactory year for investors who hold their funds in taxable accounts.

Based on preliminary estimates from fund families large and small, growth funds once again will make significant distributions, but this year resurgent value strategies will make some big distributions, too. The confluence of another year of robust performance--the average U.S. equity fund was up 21.1%, and the typical non-U.S. strategy gained 9.6% as of October 2021--and the ongoing trend of investors swapping out traditional active vehicles for exchange-traded funds and other mostly passive vehicles has led many managers to realize gains to rebalance their portfolios and meet redemptions. Funds must pass those long- and short-term gains on to shareholders who, if they own their funds taxable accounts, must pay Uncle Sam. Fund companies have begun publishing distribution estimates on their websites, and most will actually make the payouts in early to mid-December. Below we highlight some of the bigger distribution estimates from many of the larger and more notable fund families.

Does It Matter?

First, let's review why these distribution previews matter. If you invest in a tax-sheltered account, such as a 401(k) or an IRA, and you're reinvesting your distributions, this is a nonevent. You'll owe taxes only when you begin selling your holdings in retirement. Qualified withdrawals from Roth IRAs aren't taxed at all.

If you hold a fund in a taxable account, however, you'll owe taxes on the distributed gains, even if you reinvested them, unless you've sold losing positions to offset the gains.

It's not all pain, though. Reinvested capital gains help increase your cost basis, which could reduce the capital gains taxes you owe when you eventually sell the fund. So, if you hold a serial capital-gains-distributing fund, selling it in the future may cost less than you anticipated, owing to all the cost-basis step-ups that the regular distributions triggered.

Taxable investors considering buying a fund that has predicted it will make a distribution also may consider delaying the purchase until after the payout to avoid getting distributions without the benefit of any of the gains.

Tax considerations, of course, are just one of many factors in an investment decision. Check with a tax advisor before trading to avoid or capture a distribution.

Here's a compilation of some of the larger fund shops' distribution estimates for big equity funds with links to each company's full list.

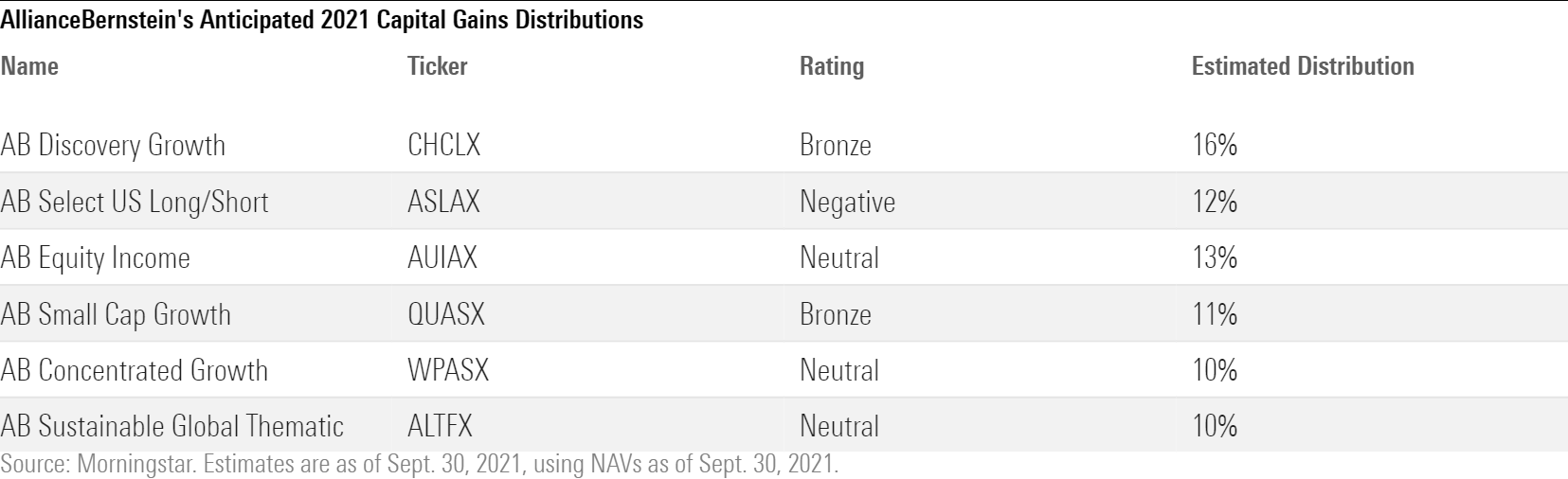

AllianceBernstein A handful of growth-oriented AB funds are on track to make sizable capital gains distributions, while the remainder range from the high single digits to the mid-double digits. The firm will make payments in mid- to late December.

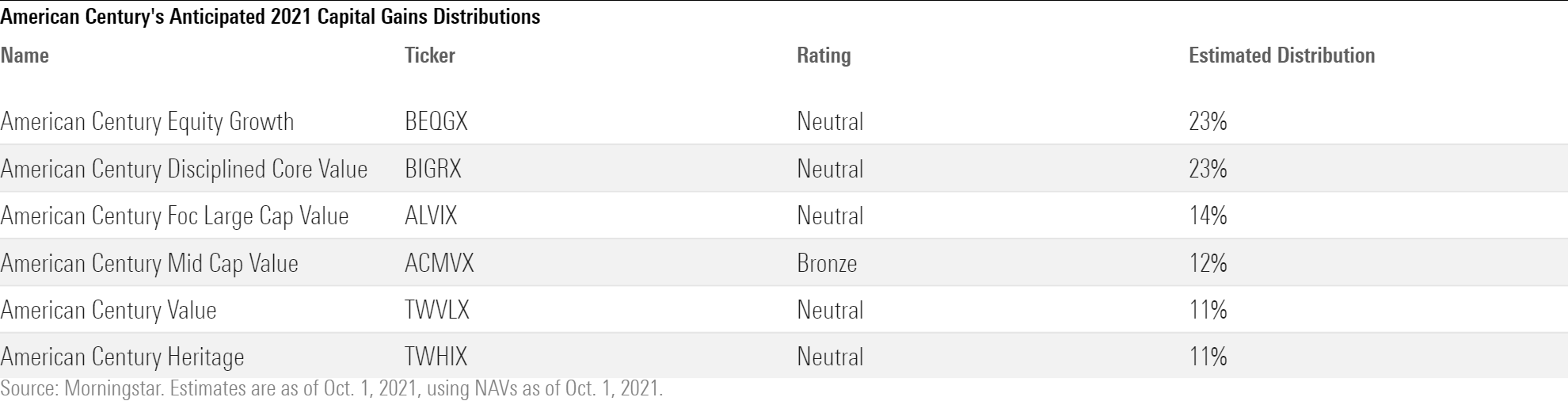

American Century American Century's equity funds are poised to pay some meaningful capital gains in December, including some of its prominent value-oriented strategies. Gains are relatively evenly split between short and long term. Neutral-rated American Century Equity Growth BEQGX plans to pay a 23% distribution on Dec. 21 owing to turnover triggered by process and personnel changes.

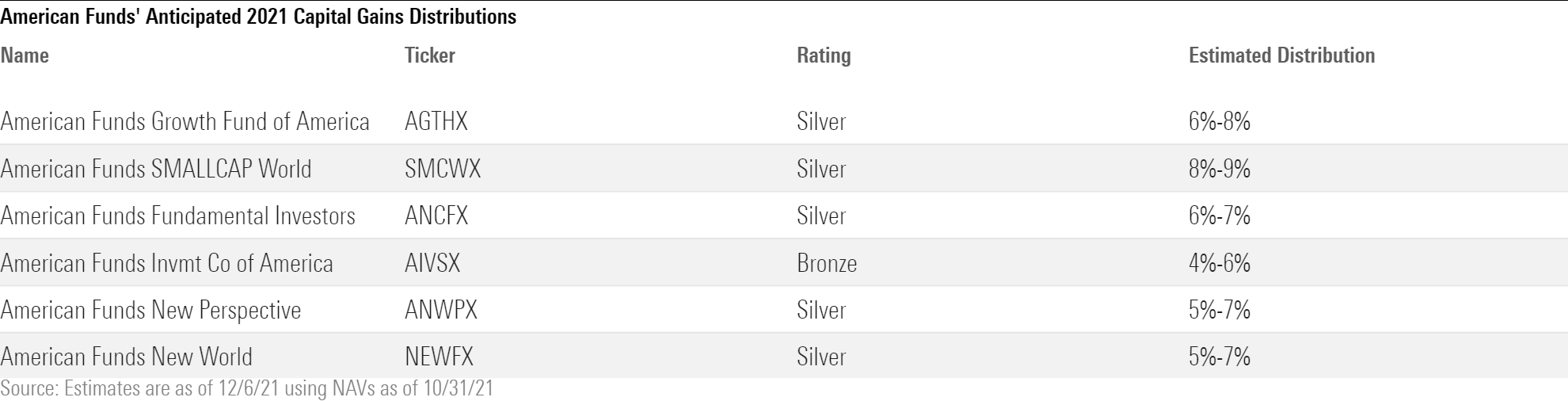

American Funds Capital gains distributions look muted for most American Funds in 2021 relative to the broader peer group. The firm provides range estimates, and most are in the mid- to high single digits and are mainly long-term capital gains, though the actual amounts will be based on gains and loses realized through Oct. 31.

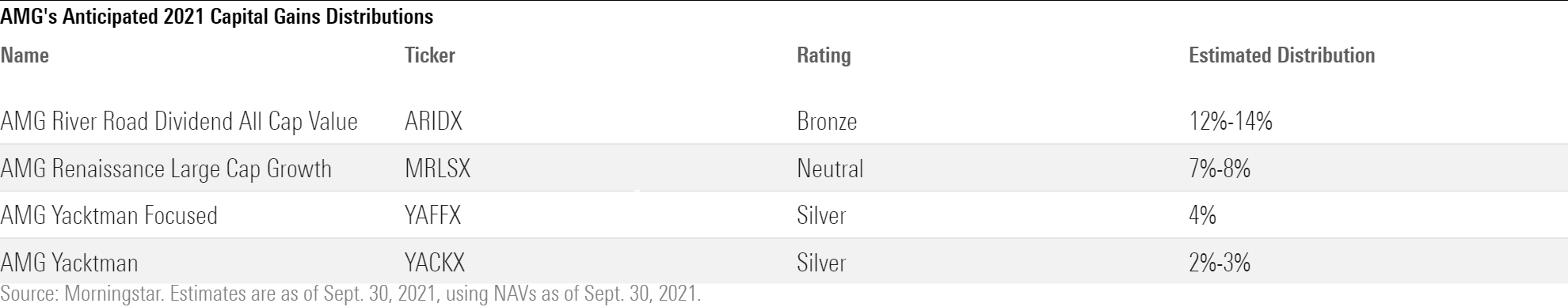

AMG Funds While a few AMG funds are set to pay out meaningful distributions, the firm's Yacktman funds, which both have Morningstar Analyst Ratings of Silver, are on track as of September's month-end NAVs to pay low-single-digit distributions, which are lower than in years past. AMG will make payments on Dec. 15.

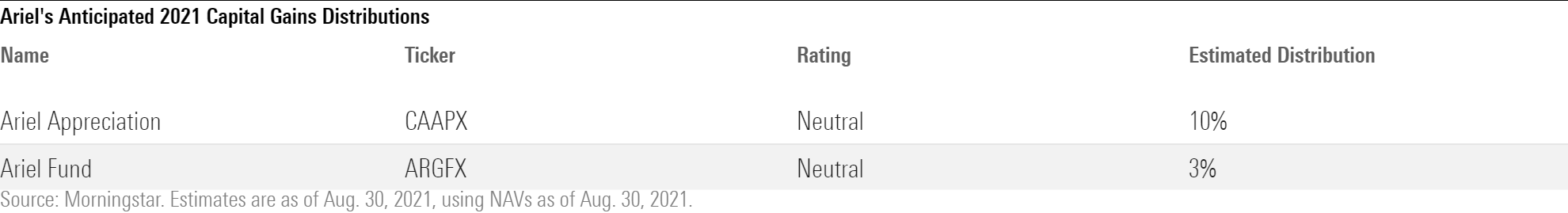

Ariel Only Ariel's U.S. strategies will make capital gains distributions this year, and they will mostly be long-term. The value boutique will make distributions, which are on par with 2020's payouts, on Nov. 18.

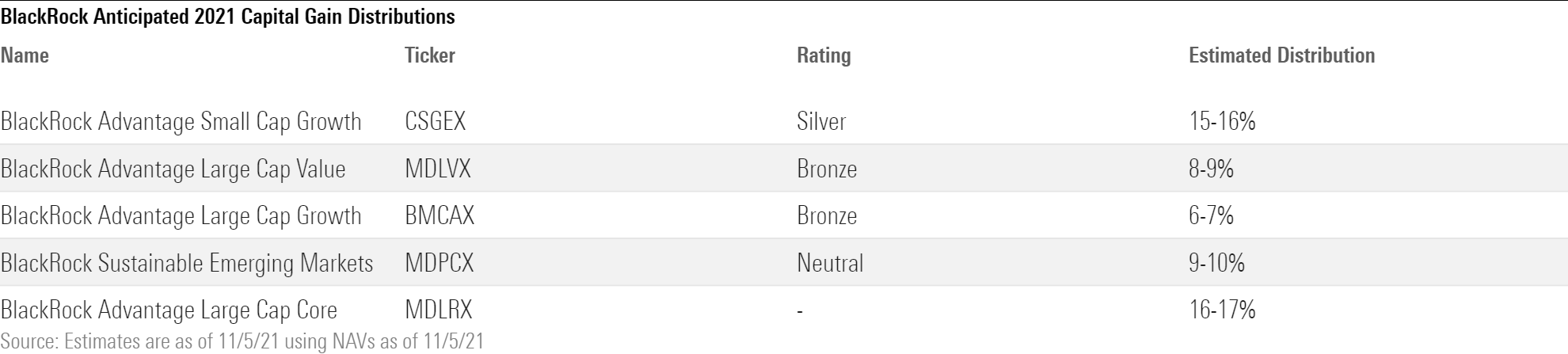

BlackRock BlackRock's quantitative equity funds will pay some of the behemoth's larger distributions, though most of the firm's actively managed strategies will pay in the mid- to high-single digits, including Neutral-rated BlackRock Sustainable Emerging Markets MDPCX, which was called BlackRock Asian Dragon until late October. BlackRock will make payments in December.

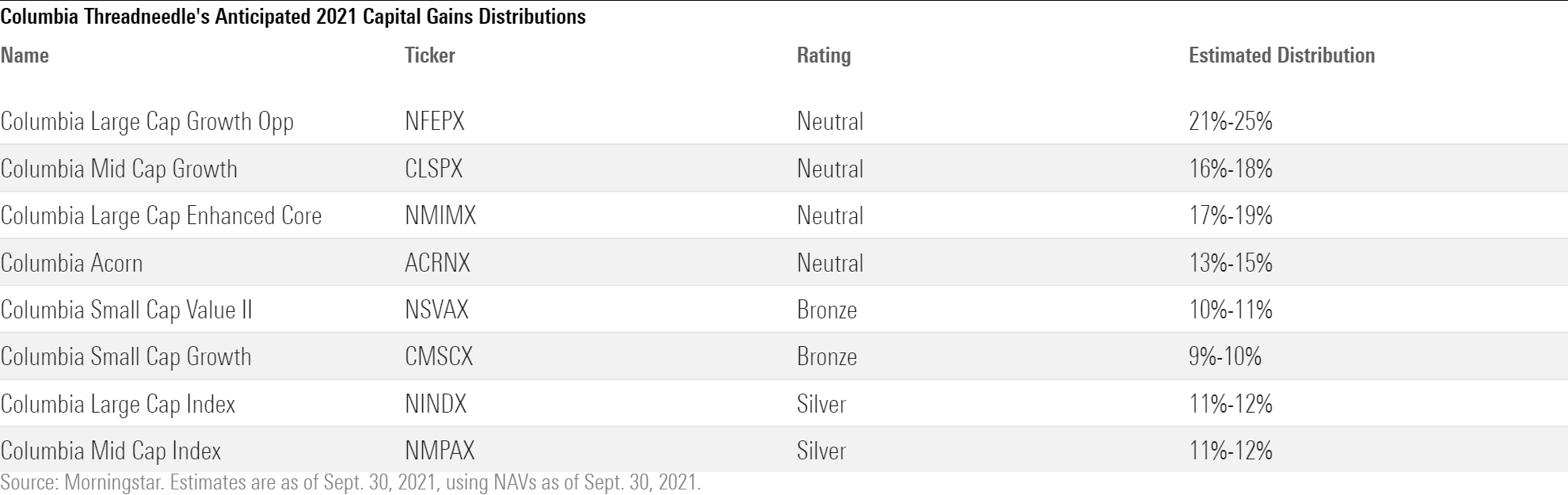

Columbia Threadneedle Growth and value strategies at Columbia Threadneedle are expected to make big 2021 payouts, continuing a trend in recent years. Even a few passive funds, which are supposed to be more tax-efficient, estimate they'll distribute gains of almost 10% of NAV in December.

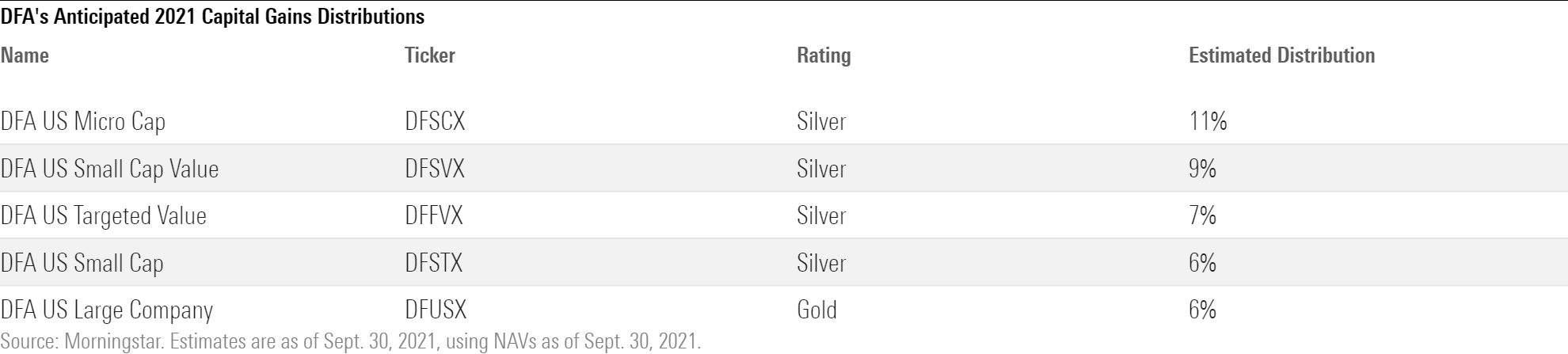

DFA Dimensional Fund Advisors will pay out distributions in mid-December. Most funds are estimating payouts in the mid- to high-single-digit range, largely comprising long-term gains.

Fidelity Many Fidelity funds are expected to pay distributions of more than 5% of NAV in December. Growth-leaning funds and sector funds account for most of the biggest gains. The large, widely followed, and Silver-rated Fidelity Contrafund FCNTX expects to pay out 8% of NAV on Dec. 13.

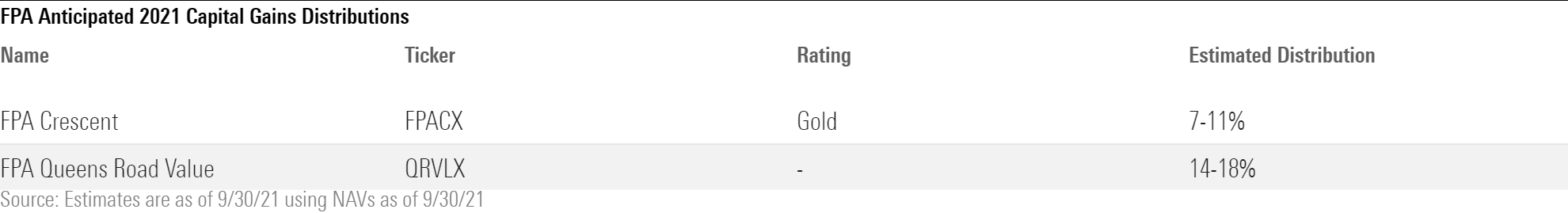

FPA FPA strategies will make mostly long-term capital gains distributions in mid-December. FPA Queens Road Value QRVLX, which Morningstar doesn't currently cover and absorbed FPA Capital in February 2021, will make a sizable payout.

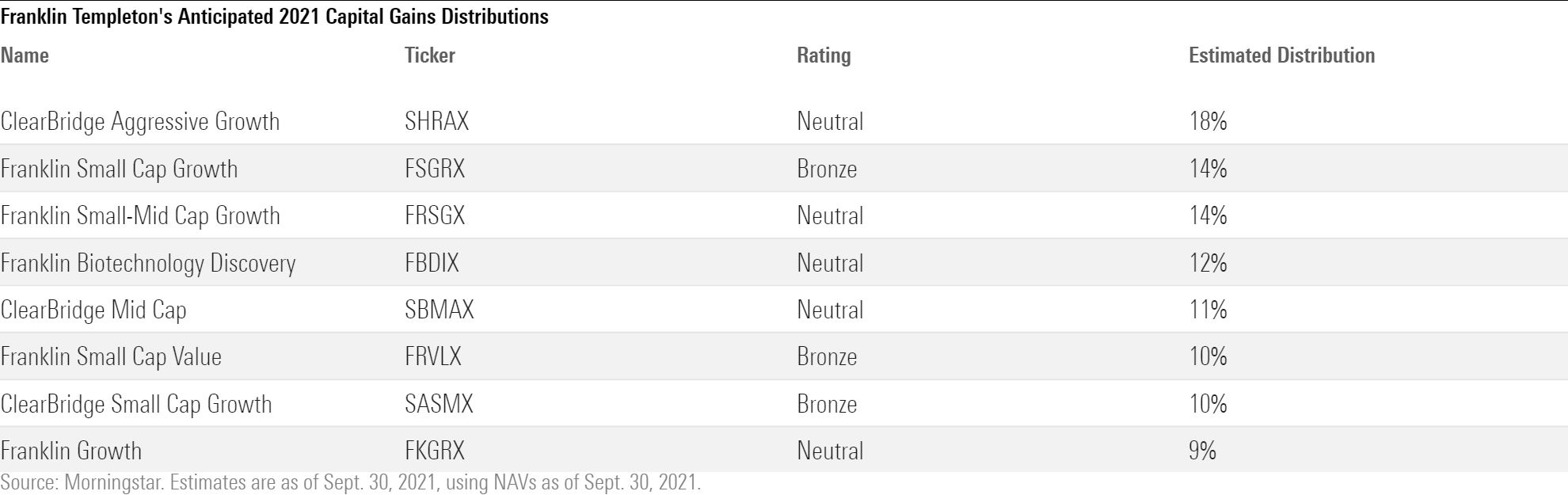

Franklin Templeton Several Franklin Templeton funds continue the family's trend in recent years of making double-digit year-end distributions. The firm, which merged with Legg Mason in 2020 but continued to see outflows in 2021, will make most of the payments in December.

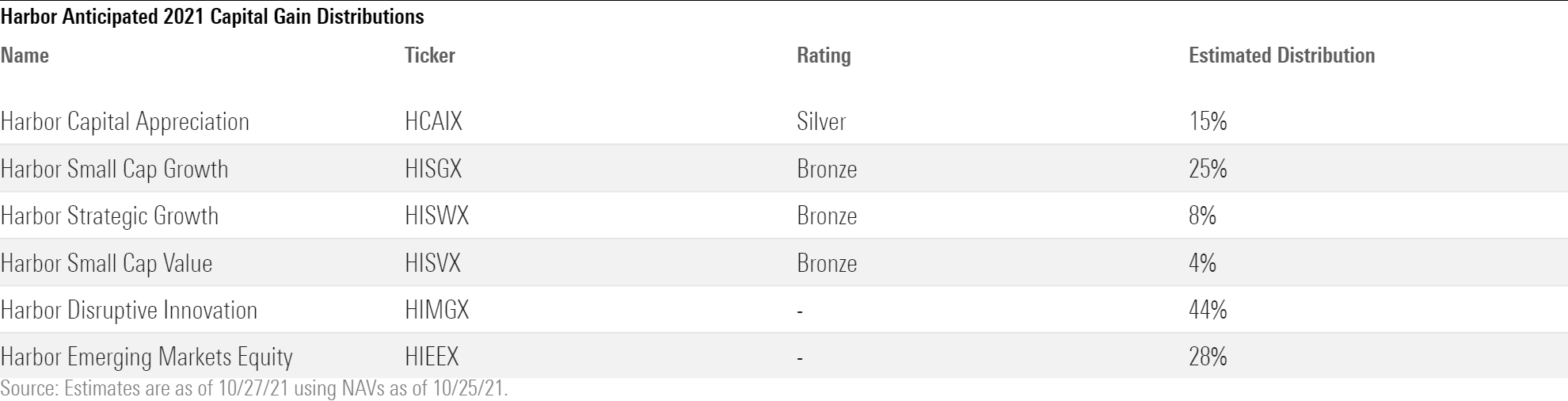

Harbor Funds Harbor Funds' growth offerings will make the biggest capital gains distributions of the subadvised fund family on Dec. 20. Harbor Disruptive Innovation HIMGX, which Morningstar currently doesn't cover and used to be called Harbor Mid Cap Growth, will pay a whopping 44% of its Oct. 25 NAV because of a subadvisor and strategy change, and Harbor Emerging Markets Equity HIEEX will pay 28%.

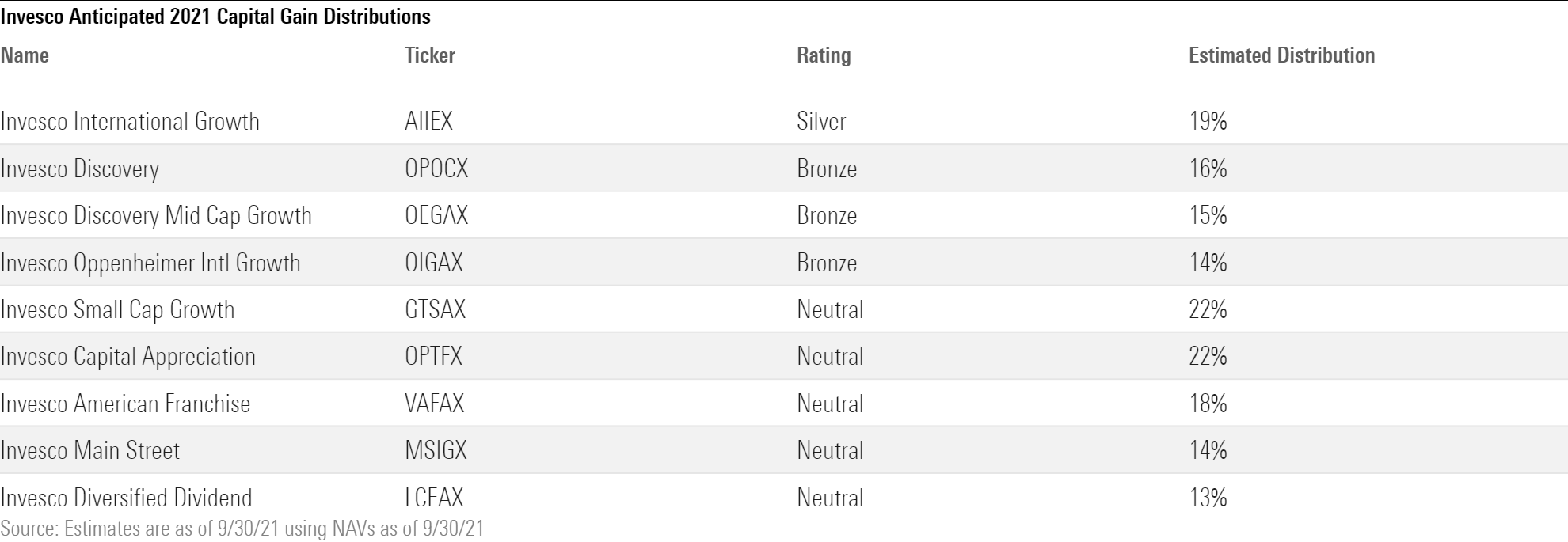

Invesco Several Invesco funds will pay double-digit capital gains distributions in mid-December. Most, like Bronze-rated Invesco Oppenheimer International Growth OIGAX, are growth-oriented and have been stung with heavy outflows over the trailing year ended Oct. 31, 2021.

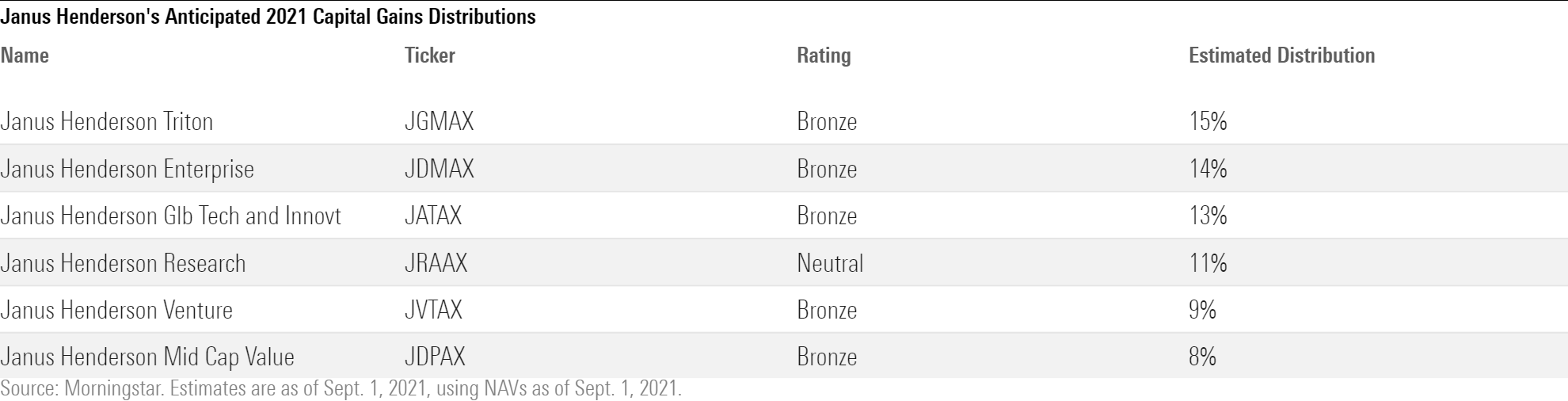

Janus Henderson Several Janus Henderson funds are planning to make double-digit percentage capital gains distributions in December, a big increase from 2020, when most payouts were in the mid- to high single digits. The firm has made its estimates based on Sept. 1 figures and will make payments in late December.

J.P. Morgan A host of sizable J.P. Morgan funds are on track to make meaningful capital gains distributions in December. The estimates, based on Sept. 30 NAVs, ironically include the uncovered JPMorgan Tax Aware Equity JPEAX, which estimates a 13% distribution on the heels of a roughly 9% distribution last year. Perhaps it should consider a name change.

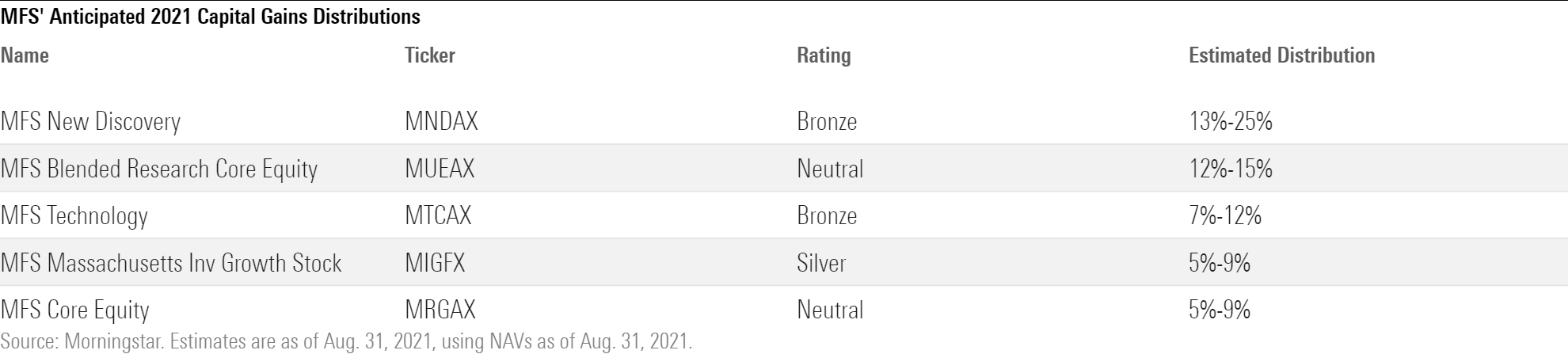

MFS MFS' Bronze-rated small-cap growth fund MFS New Discovery MNDAX likely will make one of the fund family's largest distributions, partly owing to trimming winning positions. The firm's estimates as of Aug. 31 mostly comprise long-term capital gains.

Oakmark A few Oakmark funds will make capital gains distributions this December, including two globally focused funds that didn't pay in 2020. Most of the funds in the shop's lineup won't distribute capital gains, and some funds, such as Silver-rated Oakmark Select OAKLX, have rebounded from recent performance slumps.

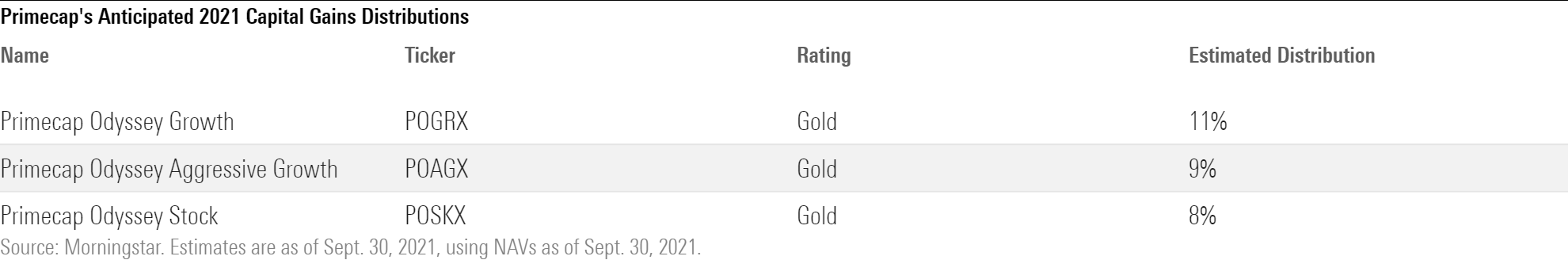

Primecap Through October, Primecap funds had another subpar year relative to their Morningstar Category peers, which could add to the capital gains sting for recent investors who have not experienced the funds' much better long-term performance. The strategies, which are all rated Gold, will make payments on Dec. 15.

T. Rowe Price Many prominent T. Rowe Price funds will make meaningful distributions. While most funds are growth-oriented U.S.-focused strategies, such as T. Rowe Price New Horizons PRNHX, popular global and balanced strategies, such as T. Rowe Price Capital Appreciation PRWCX, also will make big distributions. New Horizons and Capital Appreciation are closed to new investors, which helps control the strategies' capacity but also can force managers to realize gains to meet shareholder redemptions instead of satisfying them with cash inflows. T. Rowe Price Mid-Cap Growth RPMGX, for instance, will reopen on Dec. 1 after experiencing heavy outflows; it has been closed since 2010. Taxable investors who have been waiting for the Gold-rated fund to reopen may want to wait until after it pays its distribution on Dec. 14 to investors of record as of Dec. 10.

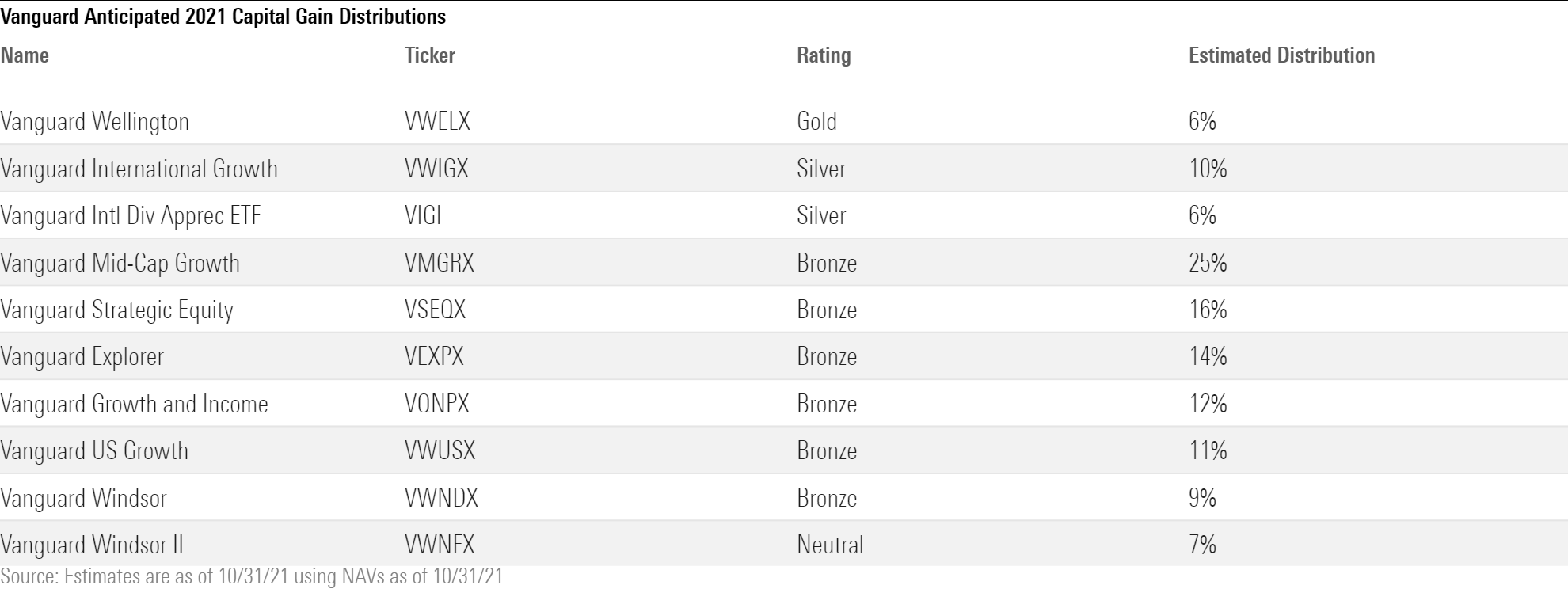

Vanguard A handful of Vanguard's actively managed funds will make meaningful distributions in December. Among them are Bronze-rated Vanguard Mid Cap Growth VMGRX, which modified its subadvisor allocation in mid-October, and Vanguard Strategic Equity VSEQX, managed by the firm's in-house quantitative equity team. Vanguard International Dividend Appreciation ETF VIGI, which changed its target benchmark earlier in the year, is also making a notable payout given its exchange-traded structure, which typically limits distributions relative to open-end funds.

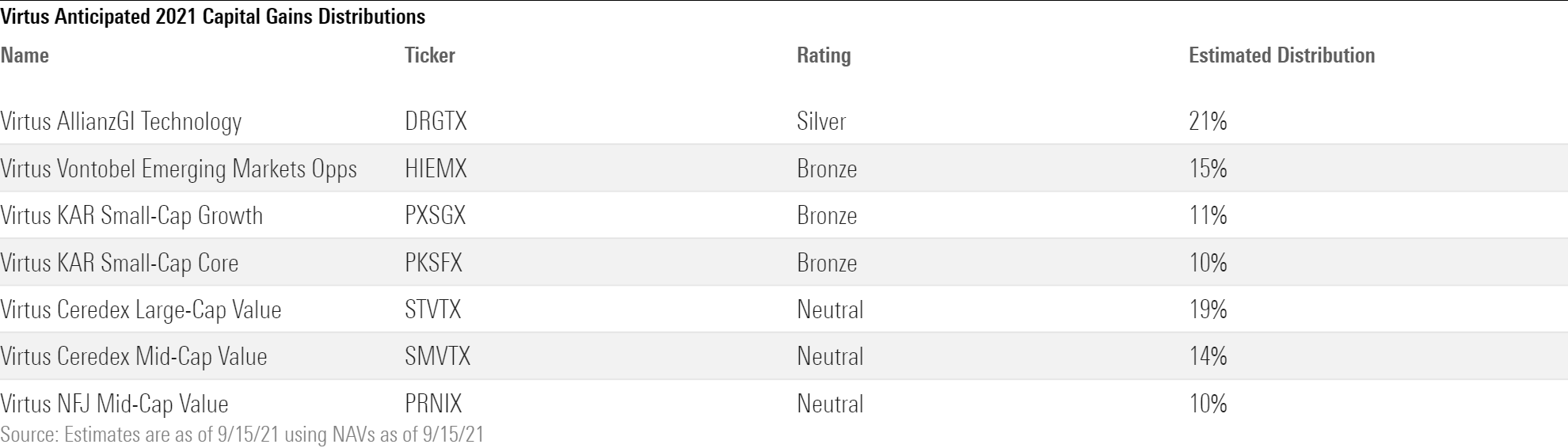

Virtus Funds from across Virtus' multiboutique stable will make sizable double-digit distributions in December. A few funds, like Virtus KAR Small-Cap Growth PXSGX and Virtus KAR Small-Cap Core PKSFX, both Bronze-rated, are closed to new investors but will make distributions after years of strong performance and outflows from existing shareholders.

Editor's Note: This article has been updated to include the correct 2021 information for Harbor Funds.

/s3.amazonaws.com/arc-authors/morningstar/19600385-fb06-404d-9876-a1d5f7cdae8a.jpg)

/s3.amazonaws.com/arc-authors/morningstar/f941dc8b-2530-4a0b-ad78-555027eae4c1.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/19600385-fb06-404d-9876-a1d5f7cdae8a.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/f941dc8b-2530-4a0b-ad78-555027eae4c1.jpg)