The Loser’s Curse

Buying the fund industry's winners sure beats the alternative.

The Claim

Over the past decade, many have contended that mutual funds suffer from "The Winner's Curse." Champion funds struggle to remain successful because they become too large, their investment styles lose favor, and/or their portfolio managers become distracted by their marketing obligations. The explanations vary, but the articles keep coming. And coming.

The argument is misleading. To be sure, several celebrity funds have crashed. Legg Mason Opportunity Fund beat the S&P 500 for 15 straight years, from 1991 through 2005, before reversing course. (The fund has since changed its name to ClearBridge Value LMNVX.) Another value-fund darling, Fairholme FAIRX, imploded even more spectacularly, as did veteran Sequoia Fund SEQUX. In recent years, perhaps the most highly touted bond fund, DoubleLine Total Return Bond DBLTX, has lagged most of its rivals.

But these are anecdotes, not data. For every large, well-known fund that makes headlines by disappointing shareholders, dozens go undiscussed. What of their fates? Could the winner’s curse be a mirage? Because index investing has been so unquestionably successful, might onlookers be leery of actively managed funds and therefore be readily convinced of their failures by a few lurid tales?

The Reality

They could be, they might be, and they are. My October 2014 column, "The Fund Winner Curse is an Optical Illusion," demonstrated that. As a group, the best-performing funds of the previous decade, per the Morningstar star rating (technically, I am supposed to call it the Morningstar Rating for funds), fared well over the succeeding 10 years. Funds that held the top Morningstar Rating of 5 stars in 2004 were much likelier to carry that same rating one decade later than they were to possess the bottom rating of 1 star.

This finding was meaningful for two reasons. One, our star rating doesn't do anything special. It is a risk/return calculation that is highly correlated with a Sharpe ratio. Thus, my column's conclusion could be generalized. By any measure, there was no fund winner's curse. Second, the maximum period over which the star rating is calculated is 10 years. The results were therefore fully independent. None of the performances that earned the funds their 5-star ratings were used for assessing the ratings' results.

Another Study

This article updates its predecessor. Because only seven years have passed since the original study, I cannot evaluate funds’ 10-year totals. Instead, I have measured five-year results. The tests begin on Sept. 30, 2016. All data that are used for sorting funds into initial groups--star ratings, asset size, and category return rankings--arise from that date. I then measured fund performances over the succeeding five years, from Oct. 1, 2016 through Sept. 30, 2021.

The outcome was remarkable. Never mind the winner’s curse. The real story is directly the opposite: the persistence of mutual fund returns. Prospectuses state that past performance is no guarantee of future results. Well, of course they are not. There are no investment guarantees, save from insurers or the government, and even those promises are sometimes broken. But past performance has been a surprisingly useful indicator.

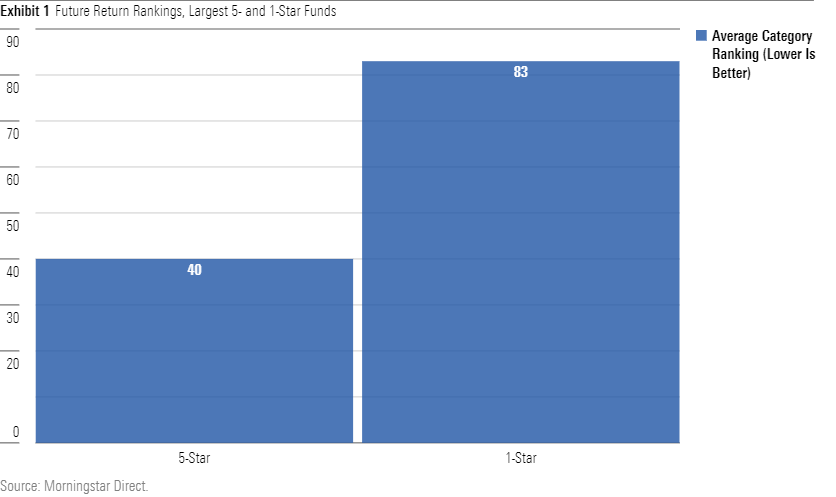

The first chart depicts the average five-year return ranking, by investment category, for the 10 largest 5-star funds. (Once again, the funds were identified in September 2016, while their performances were assessed thereafter.) Also shown--because this time, in addition to evaluating the industry’s winners, I opted also to examine its losers--are the 10 largest 1-star funds.

Quite a difference! The 5-star funds avoided the winner’s curse. Of the 10 funds, only DoubleLine Total Return Bond disappointed. The remaining nine funds ranged from average to good. But those 1-star funds ... wow. Because the results were so dramatic, I tripled-checked the computations. No mistake. Not a single 1-star fund placed in the top half of its group. Six landed in their category’s bottom decile.

A Broader View

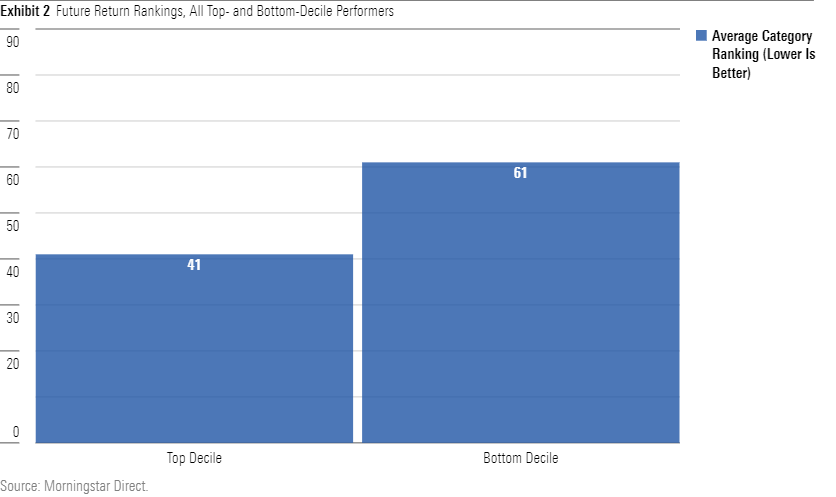

Now that’s what I call a loser’s curse. Of course, the sample size is modest. The conclusion could therefore be a fluke (although probably not, because the general data rule is that if smoke is ever that thick, even over a small amount of ground, a fire exists). Consequently, I greatly enhanced the study to include all mutual funds, not just the giants. This time, rather than sort funds by their 2016 star ratings, I did so by their previous 10 years’ returns. I compared the top-decile performers, as measured by their 2016 10-year category rankings, to the bottom-decile funds.

The discrepancy between the top- and bottom-ranking funds’ results shrunk, which is to be expected when expanding from 20 funds to several hundred. However, the gap was still substantial. The funds that had posted relatively strong returns from October 2006 through September 2016 performed, on average, a full quintile better than those that had posted relatively weak returns. The curse afflicted the mutual fund losers, not the winners.

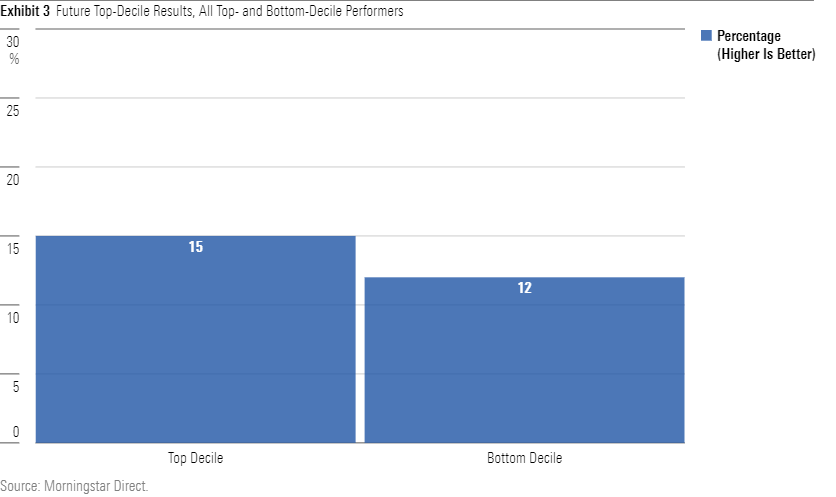

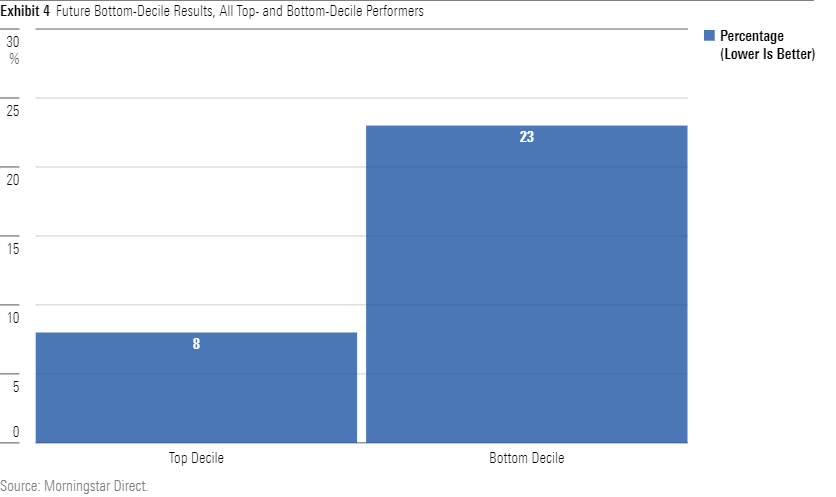

Two additional charts provide further details. The first shows the percentage of top- and bottom-decile performers, from October 2006 through September 2106, that subsequently placed in their category’s top decile.

Those figures didn’t differ greatly among the two groups. The winners edged the losers, but their victory margin was slight, as some losers did indeed recover sharply. However, reversing the test, to see how many funds landed in the bottom quintile, reconfirmed the initial observations. The losers persisted. They were more than twice as likely to remain in the bottom quintile as would be dictated by chance, and 3 times as likely to land there as were the winners.

Wrapping Up

To some extent, these findings owe to the prolonged bull market. Since 2009, investment conditions have been unusually consistent. Stocks have performed well; interest rates have declined; growth companies have generally outgained value stocks; and the U.S. stock market has been steadily among the world’s best. Under such conditions, relative performance is likelier to persist.

Nonetheless, the evidence does not support the existence of a “winner’s curse.” Quite the contrary.

John Rekenthaler (john.rekenthaler@morningstar.com) has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)