Investors Flock to Inflation Protection

Inflation-protected bonds are rallying as investors see price pressures sticking around.

As evidence grows that inflation pressures are proving stickier than many expected, investors have been flocking to inflation-protected bonds.

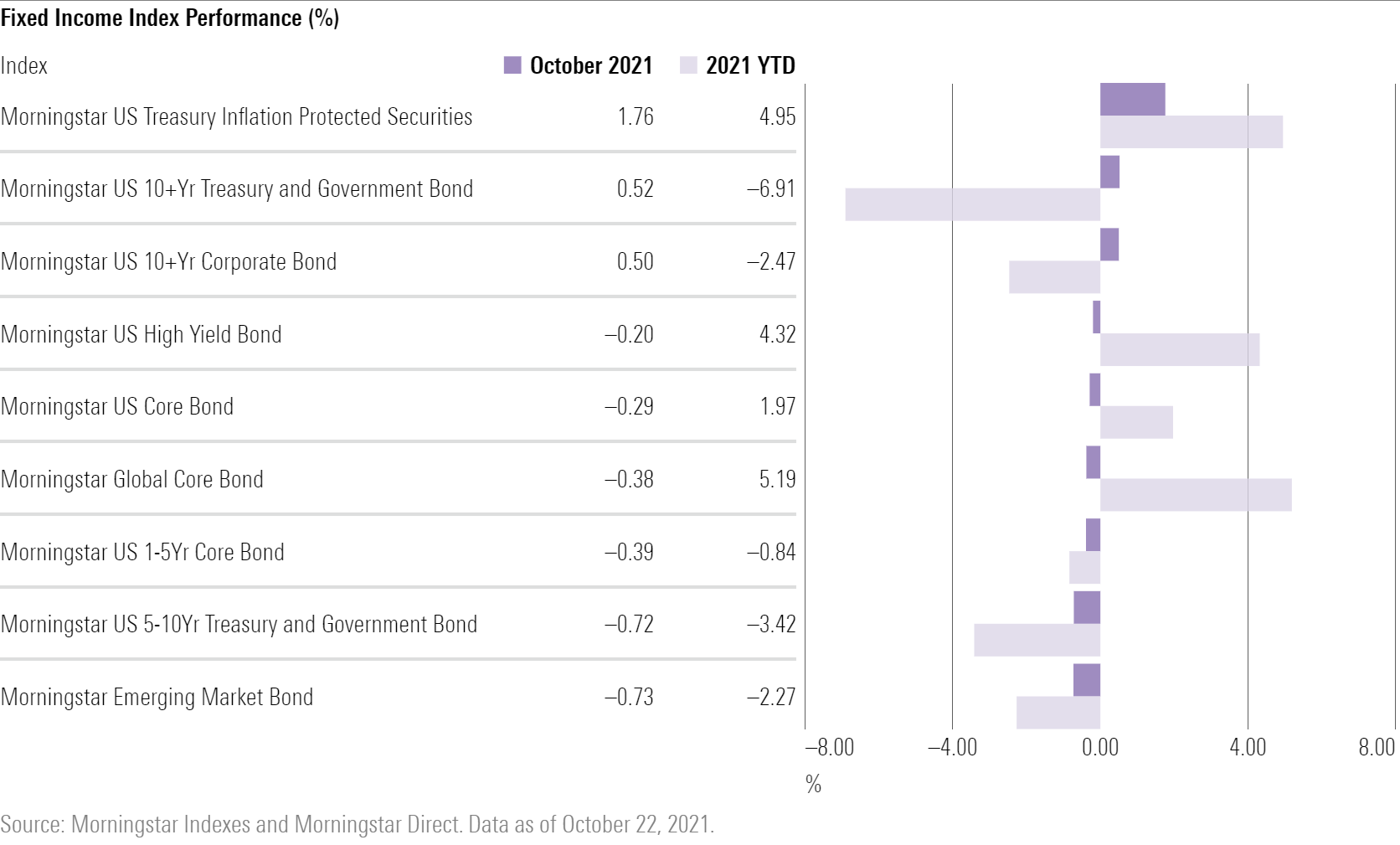

Treasury Inflation-Protected Securities--better known as TIPS--were the best-performing corner of the bond market in October and are leading fixed-income returns so far for 2021. The Morningstar US TIPS Index returned 4.95% for the year to date and 1.76% in October alone, more than any other fixed-income category this year.

Assuming returns hold through the end of 2021, this will be the third consecutive year of solid gains for TIPS. But unlike previous two years, TIPS are rallying while the rest of the bond market has been flat or posting losses.

Driving performance of TIPS have been growing inflation pressures and expectations among investors that those high price trends will stick.

“The reopening of the economy has been a global phenomenon that’s creating some inflationary pressures” says explains Gemma Wright-Casparius, principal and senior fixed-income portfolio manager at Vanguard. “Combined with low interest rates, a dovish Federal Reserve, and the fact that investors have previously been underweight TIPS for the past 12 years, it’s a perfect environment for TIPS to outperform.”

TIPS are government-backed bonds designed to protect investors against inflation.

Returns on TIPS reflect a combination of the same trends that shape the rest of the government bond market, mainly expectations for economic growth and how that affects Federal Reserve policy and inflation. But unlike regular government bonds, TIPS have a mechanism that adjusts its face value in accordance with inflation as measured by the consumer price index. When the CPI rises, the face of the bonds increases, and vice versa.

There are many ways to protect a portfolio against inflation, but TIPS are perhaps the most direct method, so investor interest in TIPS tends to rise and fall along with worries about inflation.

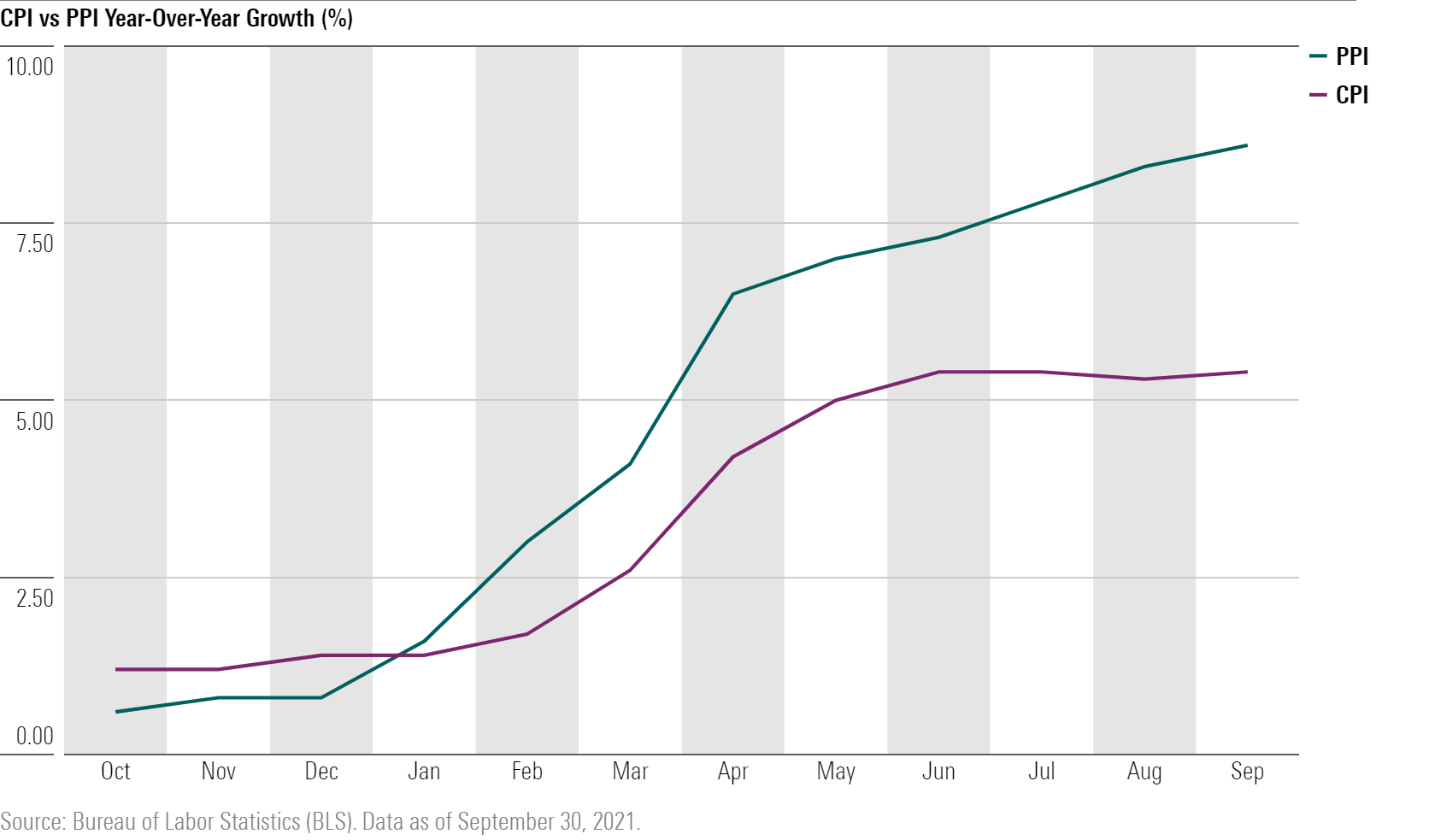

The current backdrop, meanwhile, has been one of growing concern about inflation.

While global economies reopened after COVID-19 slowdowns, shortages of workers, materials like microchips and even shipping containers have persisted. "Supply-side issues are raising costs for producers." says John Briggs, global head of desk strategy at NatWest Markets. "For a few months, the producers are willing to absorb those costs--but if they expect the costs to stay elevated over 18 months, that's when they pass some of the cost onto consumers."

As supply issues persist, investors have continued to pour money into TIPS. “There’s clearly been a lot of demand for inflation protection,” Briggs says.

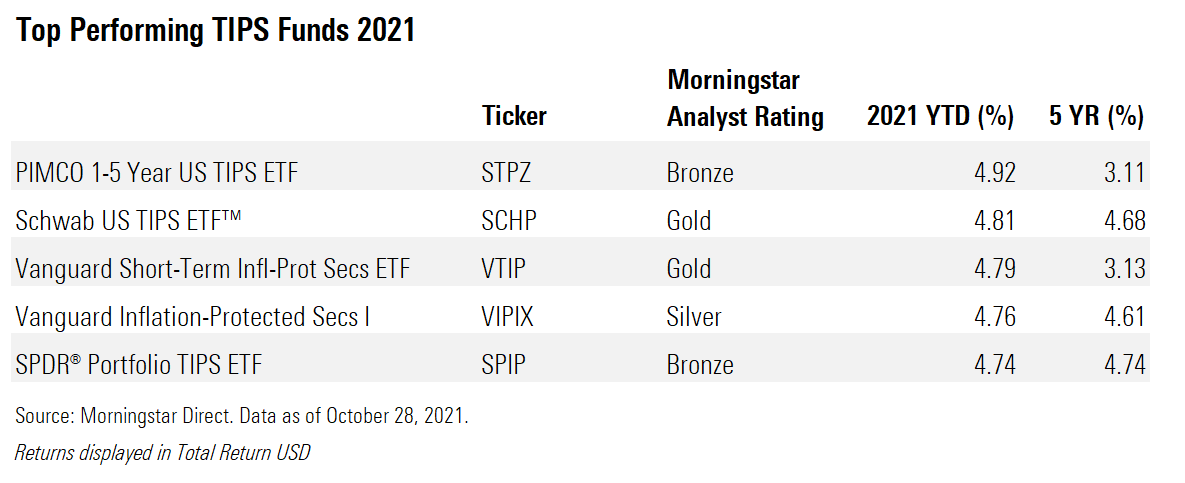

Against this backdrop, mutual funds that focus on TIPS are also providing investors strong returns in a year when inflation concerns are weighing on other corners of the bond market. The average TIPS fund is up 4.83% so far in 2021, compared with a 1.65% decline on the Morningstar U.S. Core Bond Index and a 2.4% decline in the Morningstar U.S. Treasury and Government Bond Index.

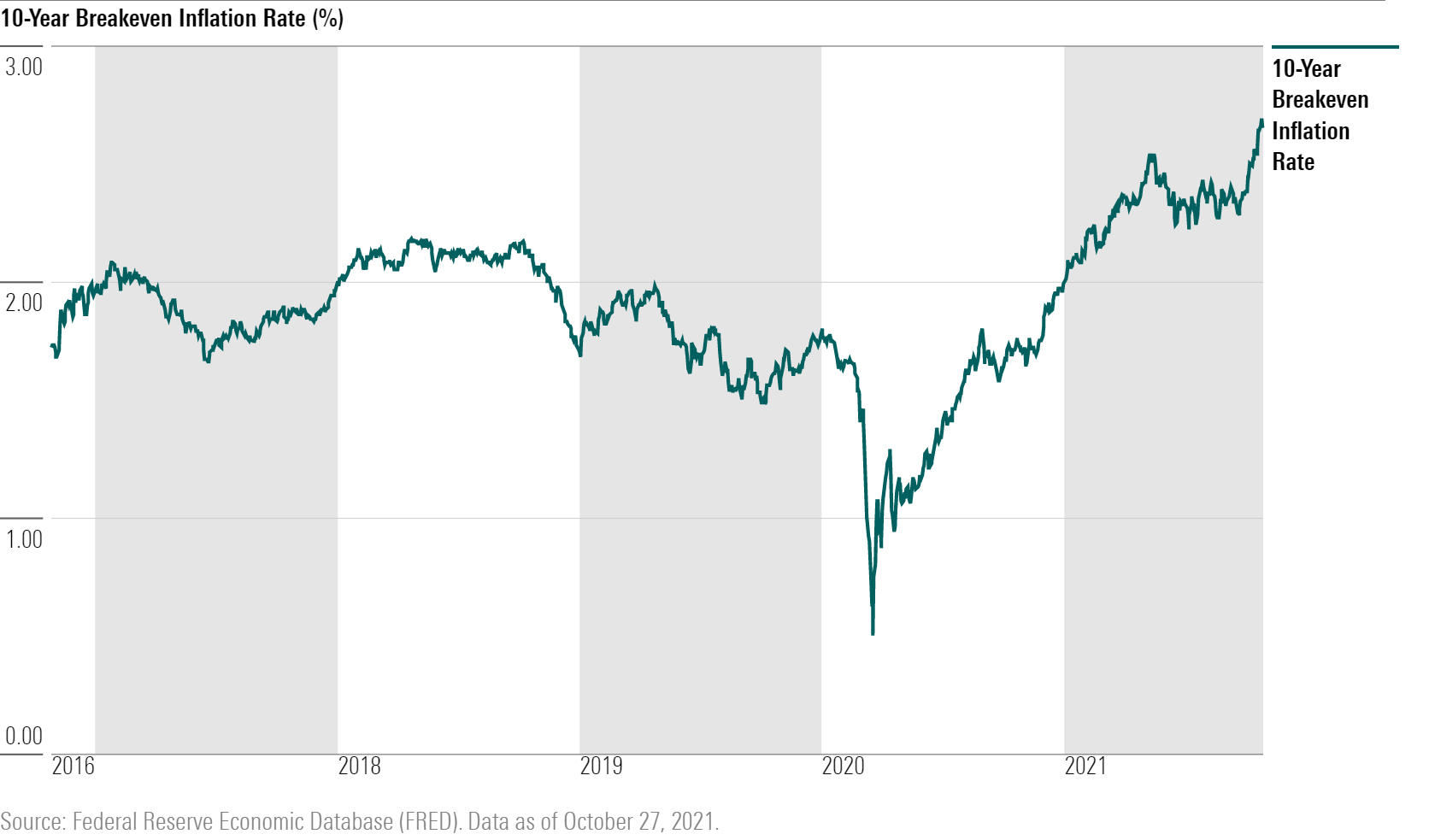

The TIPS market itself provides a window into rising inflation expectations through something known as the “breakeven” rate, which compares yields on TIPS with their non-inflation-adjusted counterparts. The breakeven rate is essentially the expected rate of inflation for the time period covered by the bonds.

Take the 10-year breakeven inflation rate, which is the difference between the 10-year nominal Treasury yield and the 10-year TIPS yield--representing the market's expectation of what inflation will be 10 years down the line. Currently, the difference between 10-year TIPS and nominal Treasury yields is 2.67%, up from 2% at the start of 2021 and a level last seen in April 2006. In fact, the last time that the 10-year breakeven rate rose above 2.5% was during the summer of 2013.

To Wright-Casparius, the rise in inflation expectations is warranted. “Inflation will remain stubbornly high and above target for much of 2022 before it moderates,” she says. “And some of this is based on global pressures from a synchronized reopening post-COVID. Investors need to ask themselves: Do their portfolios need inflation protection or not?”

Stickier inflation pressures are also beginning to reshape expectations for what the Fed and other major central banks will do with official interest rates next year, Wright-Casparius says. In recent weeks the Bank of England signaled it intends to raise rates at some point in 2022, and last week the Bank of Canada signaled a faster pace of rate increases, saying they didn’t believe inflation would be quite as transient, Wright-Casparius says. “What the market is beginning to question is, is the timing and face of the Fed’s 2022/23 policy adjustment going to be as quick as that of Canada, Europe, England?”

Preston Caldwell, head of economics at Morningstar, believes that the upward pressure on prices will still prove relatively short-lived. “We think the market is now overrating the amount of inflation which will occur over the next five years,” he says. “While inflation has heated up in 2021, the sources of that inflation will be temporary in our view.”

Caldwell notes that most of the excess inflation has come from a single sector: vehicles, where supply has been constrained due to the global semiconductor shortage. That semiconductor shortage has also lifted prices among household goods and electronics. "Though an exact timeline isn't clear, we expect the semiconductor shortage to be eventually resolved--perhaps by the end of 2022. This will contribute significant deflationary pressure." Caldwell says.

And while oil prices continued to rise in October, Morningstar expects an an eventual drop in oil prices. “Today’s frothy (oil) prices will induce a supply response, which should push prices down over the next few years to our $55 per barrel forecast.”

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PKH6NPHLCRBR5DT2RWCY2VOCEQ.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5GAX4GUZGFDARNXQRA7HR2YET4.jpg)