Third-Quarter Market Insights in 8 Charts

Our market insights include expectations for rising inflation, the impact of Chinese regulation, and more.

U.S. equities and longer-term Treasury yields finished roughly flat in the third quarter of 2021 after a volatile September that saw rates surge and stocks decline in the face of rising inflationary pressure and a more hawkish Federal Reserve.

For the quarter, small caps, value stocks, and emerging-markets equities underperformed large caps, growth, and developed markets, respectively--a seemingly classic risk-off rotation. However, U.S. credit performed quite well, with high-yield outperforming investment-grade bonds. Not surprisingly, inflation-linked fixed income was also a relative outperformer--both in the United States and Europe--with fund flows data showing substantial interest from investors.

Commodities and commodity-linked stocks were among the best-performing assets, extending their winning streak year to date. Demand has increasingly outstripped supply across the commodities complex, most notably in energy. Energy stocks outperformed global equity market indexes by more than 10% in the third quarter for the first time in a decade.

Developments in China also garnered attention, as Chinese regulators cracked down on specific industries, and credit markets braced for a debt default by one of the country's largest property developers. Sector- and country-specific volatility responded in kind, but spillover to other markets appeared to be limited.

Every quarter, Morningstar's quantitative research team reviews the most recent U.S. market trends and evaluates the performance of individual asset classes. We then share our findings in the Morningstar Markets Observer, a publication that draws on careful research and market insights. (Morningstar Direct and Office clients can download the report here.)

Here are some of the market insights from our latest quarterly review.

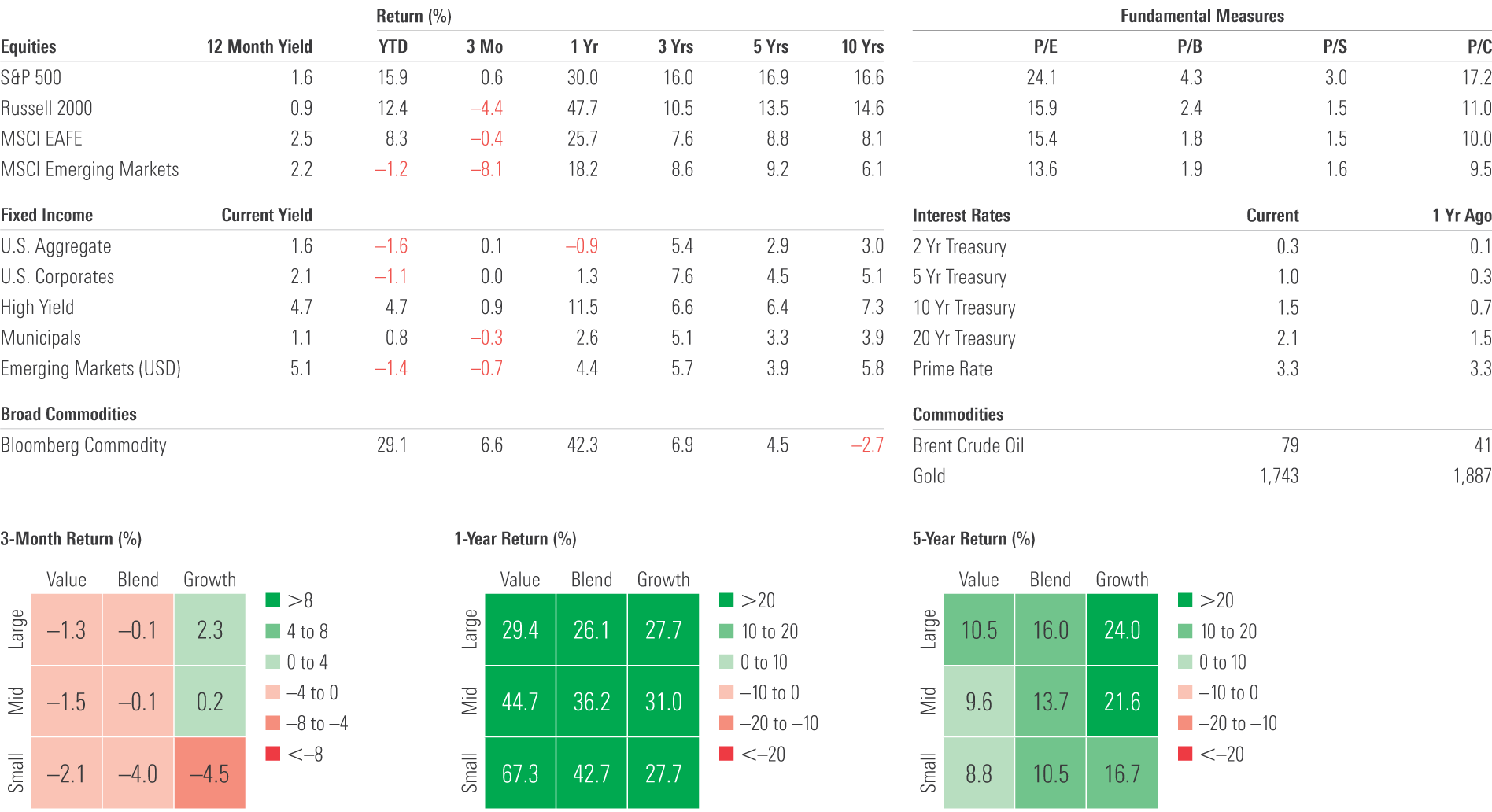

Losses in September Bring the S&P's Returns Near Zero for the Quarter

In September 2021, the S&P 500 posted its largest monthly loss since March 2020, bringing the index's overall third-quarter return close to zero. Small-cap and international stocks posted negative returns. Concerns over the global supply chain, rising inflation, and the Fed's imminent tapering announcement were all notable headwinds to equities. Commodities continued to do well and were up 29% year-to-date.

Source: Morningstar Direct. U.S. Aggregate--Bloomberg U.S. Aggregate Bond Total Return; U.S. Corporates--Bloomberg U.S. Corporate 5-10 Year Total Return; High Yield--Bank of America Merrill Lynch U.S. High Yield Master II Total Return; Municipals--Bloomberg Municipal Total Return; Fixed-Income Emerging Markets--J.P. Morgan EMBI Global Diversified Total Return; Gold--London Fix Gold PM Price Return. Data as of Sept. 30, 2021.

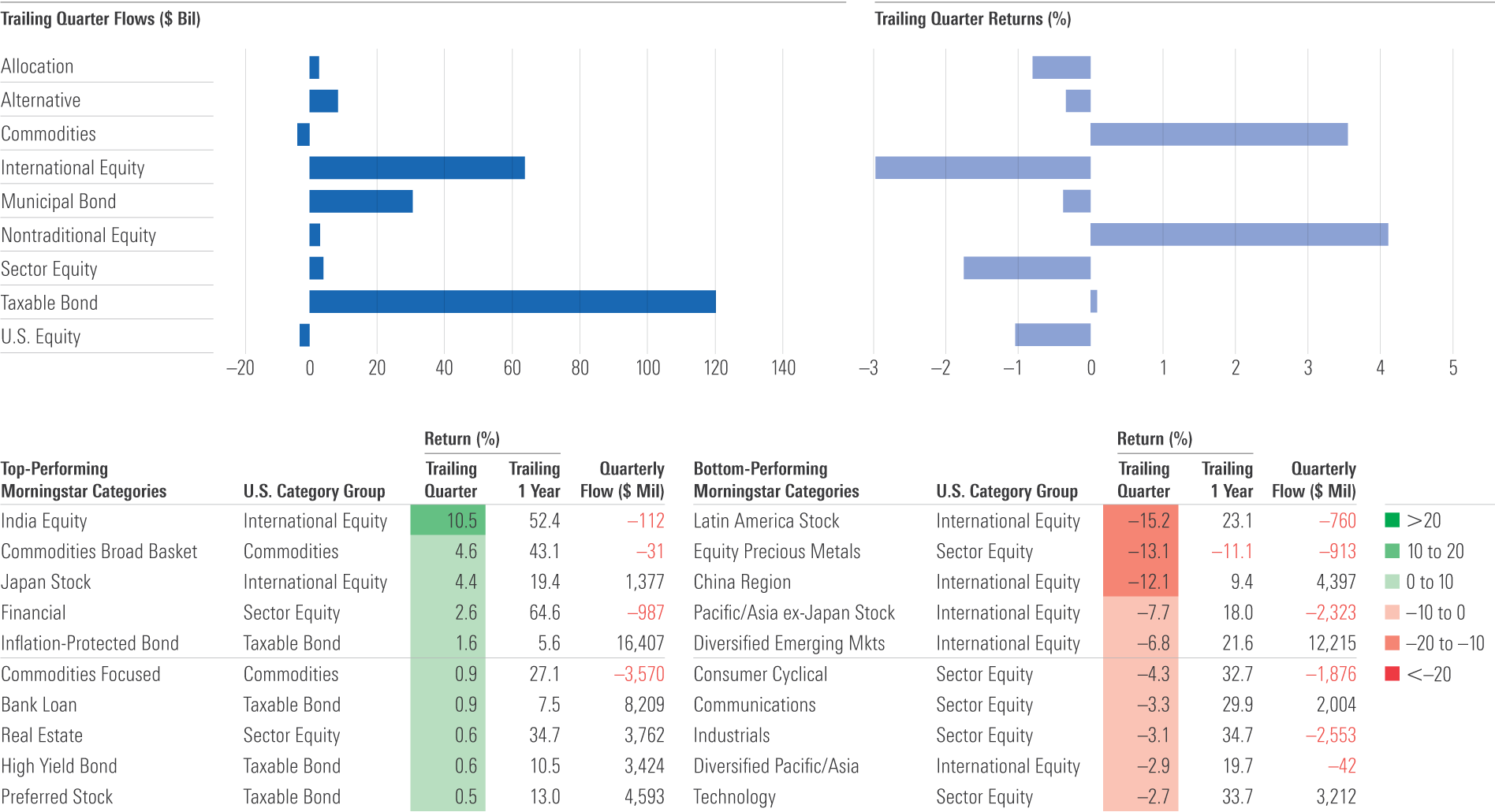

Top- and Bottom-Performing Morningstar Categories

The taxable-bond and international-equity category groups took the lion's share of inflows in the third quarter, with the inflation-protected bond and high-yield bond Morningstar Categories registering an increase in flows. In China, government regulation sparked an equity market rout, but Chinese equity funds still attracted almost $4.4 billion in net inflows. By contrast, commodities funds recorded a net outflow despite sizable positive returns.

Source: Morningstar Direct. Data as of Sept. 30, 2021.

Global Central Banks Start to Raise Rates: Appropriate or Overly Aggressive?

A number of central banks have shifted to a more hawkish policy stance of late, with South Korea and Norway each raising their benchmark interest rate in the third quarter. While this may be a precursor to policy tightening more broadly, it's worth remembering that both countries were among the first to hike rates in the last cycle, only to reverse course as the global economic recovery lost steam.

Source: Macrobond. Data as of Sept. 30, 2021.

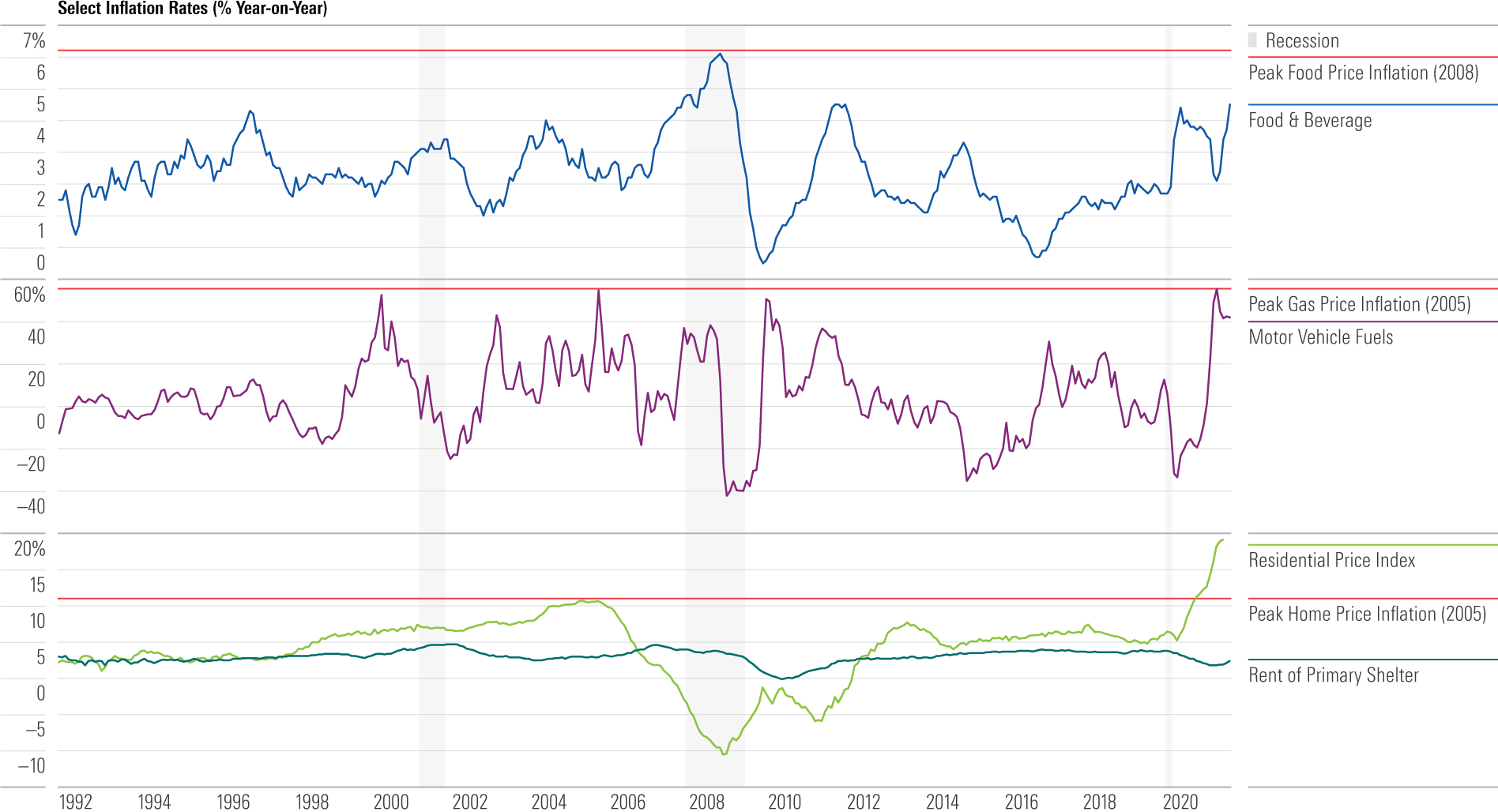

Housing Price Inflation Is Well Above the Mid-2000s Pace

Comparing today's inflation environment with previous periods can provide valuable context. Food inflation is currently elevated but remains below its 2008 peak. Gasoline prices are rising at a pace similar to, but not above, mid-2000s peaks. By contrast, housing prices are rising at a much faster clip than at any time in the past 30 years, something the official "shelter" category of the consumer price index fails to capture.

Source: U.S. Bureau of Labor Statistics, Federal Housing Finance Agency. Data as of Sept. 30, 2021.

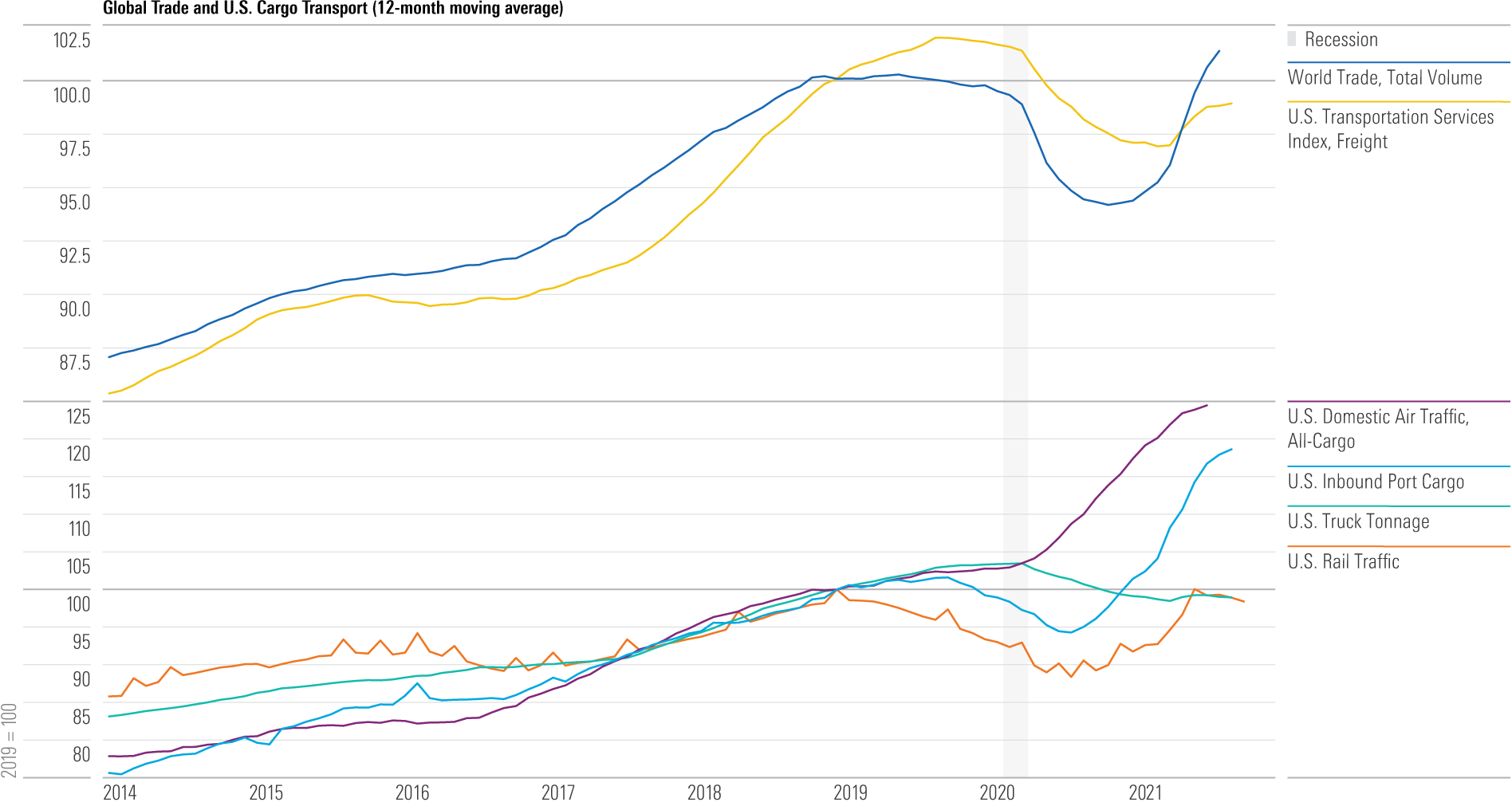

A Sluggish Ground Game Is Slowing the Supply Chain

Global trade volumes have surged back above levels seen before the pandemic, but a number of factors have conspired to slow the delivery of those products to their end users. This is particularly evident in the U.S., where domestic freight transportation remains depressed. In particular, truck and rail traffic have failed to keep up with the volume of goods at U.S. ports and airports.

Source: U.S. Department of Transportation, Netherlands Bureau of Economic Policy Analysis, Macrobond. Data as of Sept. 30, 2021.

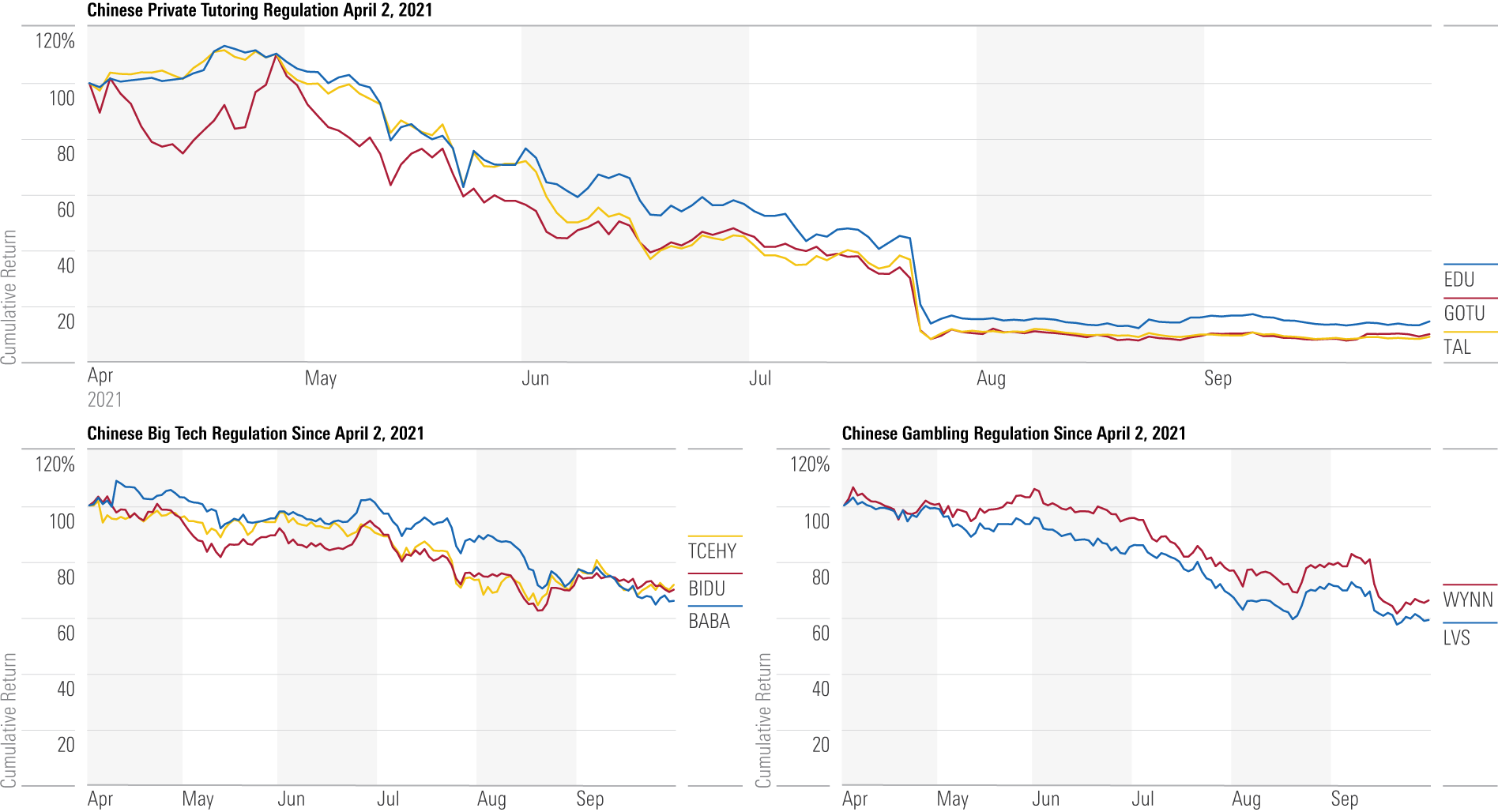

Chinese Regulation on Key Businesses Tightens

China's central authority launched a series of regulatory crackdowns targeting three of the most profitable businesses in the country: private tutoring companies in July, big tech monopolies in August, and Macau casino gambling in September. U.S.-listed equities of affected companies in turn took a beating in the third quarter, while volatility in Chinese stocks increased as investors weighed the escalating Chinese regulatory risks.

Source: Morningstar Data. Data as of Oct. 15, 2021.

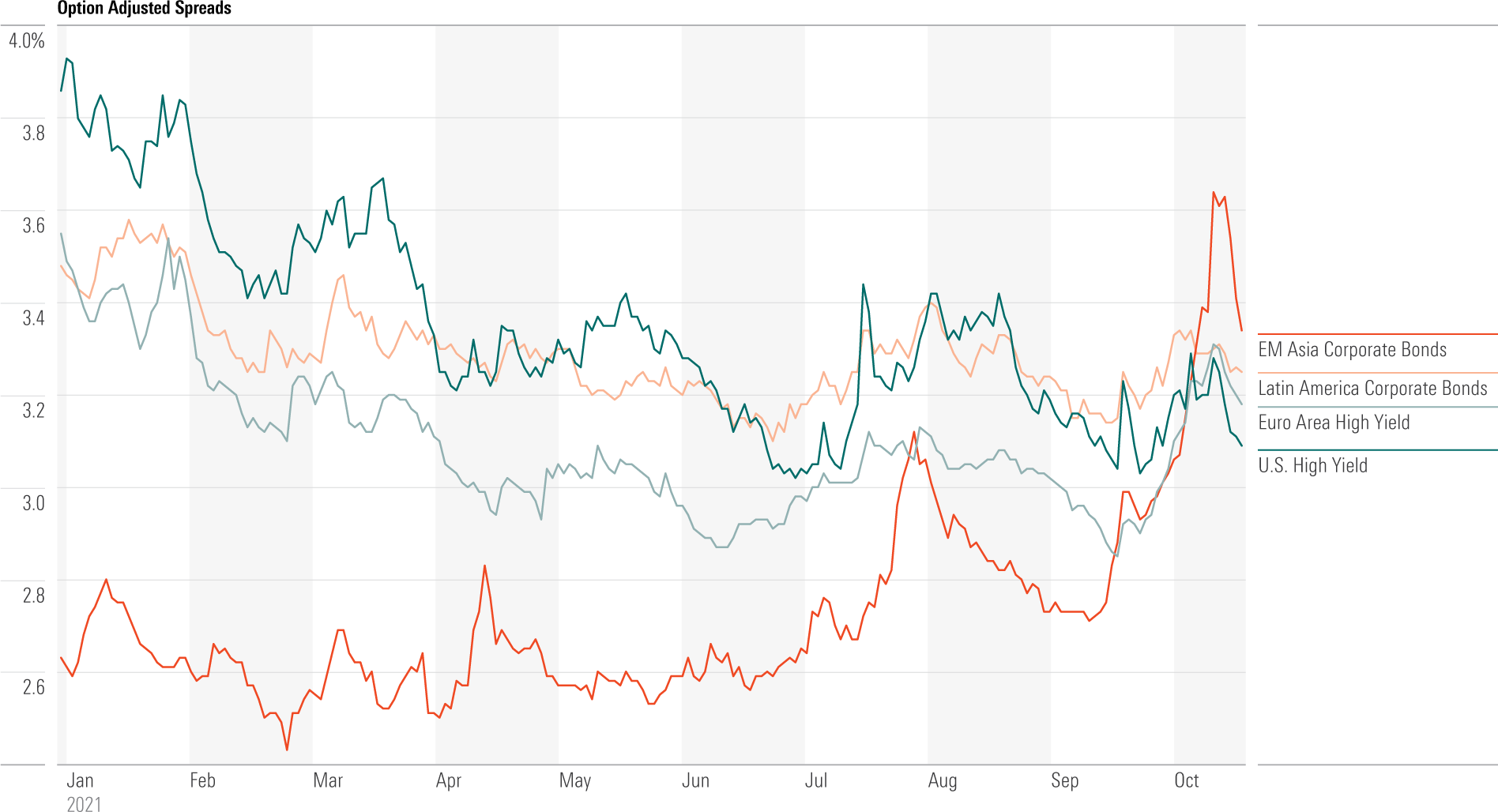

Volatile Asian Credit Markets Exhibit Limited Spillover Globally, for Now

U.S. high-yield credit spreads narrowed toward year-to-date lows in September and were only moderately impacted by fears of a widespread default among China's property market developers. European high-yield credit saw spreads widen, though that was likely attributable to region-specific risks. Notably, other emerging markets (for example, Latin America) were seemingly insulated from developments in Asia.

Source: Federal Reserve Bank of St. Louis. Data as of Sept. 30, 2021.

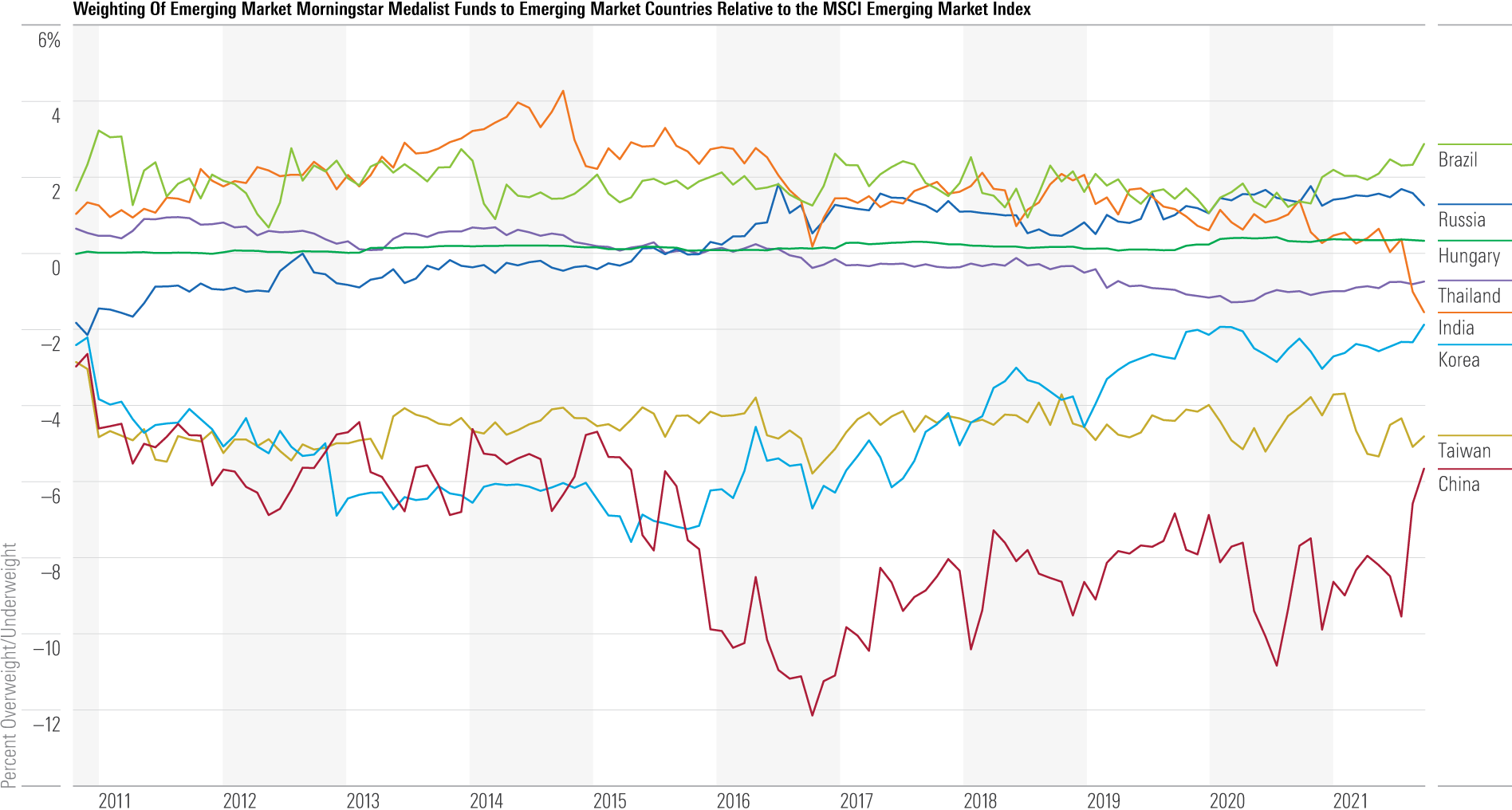

Active Managers Add China Exposure but Remain Underweight

Increased worries about China's economic growth and regulation from the Chinese Communist Party has led shares of Chinese-listed stocks to decline this year. Although their allocation to China is at its highest since 2015, Morningstar Medalist active fund managers are still significantly underweight the country relative to the MSCI Emerging Markets Index. Meanwhile, managers remain overweight Russia and Brazil.

Source: Morningstar Direct. Data as of Sept. 30, 2021.

/s3.amazonaws.com/arc-authors/morningstar/e4122fbe-ff74-4b9f-852e-64b09e476cb8.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e4122fbe-ff74-4b9f-852e-64b09e476cb8.jpg)