How Can Advisors Help Assemble a Secure Retirement Income Solution?

Advisors can play a key role in popularizing annuities and providing greater retirement security.

Editor’s note: This article first appeared in the Q4 2021 issue of Morningstar magazine. Click here to subscribe.

Although they remain drastically underused as a retirement income tool, annuities have the potential to provide important benefits to retirees. High-quality products that guarantee an income stream can greatly improve the stability of people’s retirement by disbursing steady payments over the course of their lifetime.

But investing in annuities is not easy, especially in the retirement accounts where most Americans hold their investments. Many types of annuities are opaque and complicated, making it difficult for normal investors to know what they are buying, and legal and operational barriers exist. For these reasons, Morningstar does not support the wholesale expansion of annuitization in retirement accounts. Instead, we’re focusing on a subcategory of the annuity universe: guaranteed-income products. GIPs, as they are known, provide a stream of income payments that begin at a certain age, often a retirement age of 65 or 70, and continue until either the annuitant’s death or a predefined period.

State and federal governments can address some of the obstacles and complications retirees face if they want to annuitize part of their retirement savings. Industry innovation, such as the inclusion of annuity products within pooled vehicles, can mitigate other barriers. We discuss what must be done in a recent white paper. Until these problems are solved, financial professionals have a large role to play in educating clients on the retirement benefits of GIPs and steering them toward the right kinds of annuities inside or outside of their retirement accounts. In this article, we discuss how investment professionals can help clients overcome the legal and operational barriers that investors typically face in purchasing annuities for retirement.

A Short History of Annuities Some form of annuity products has been around in the U.S. since the 1800s, but it wasn't until the decline of multigenerational households in the early 20th century that demand for annuities significantly grew. A growing insurance industry was eager to meet the demand, and applying scientific and actuarial principles, it began to create annuity products. By the mid-1980s, insurers' overall product mix was almost evenly distributed between traditional insurance products and annuities.

In its modern form, the term annuity refers to a wide and confusing array of products, including but going far beyond GIPs. While we support the use of a variety of annuities in the marketplace and agree that investors who are sufficiently sophisticated should have choices to customize their retirement plans, we do not believe that public policy should encourage all types of annuities regardless of their benefits.GIPs, however, can provide a relatively simple, appealing solution for retirees looking to ensure lifetime income or protect their invested principal. GIPs provide a guaranteed stream of income with a fixed or variable rate of return with some protections.

The best example of a GIP is a single-premium immediate annuity. With this type of annuity, an investor exchanges a lump sum of money in return for a stream of income for the rest of his or her life. The annuity can be fixed or variable, meaning that the income can be a set amount or can vary based on portfolio growth. While immediate fixed annuities will pay out a consistent sum of money each month, immediate variable annuities provide income that can grow over time and keep up with inflation. These annuities are particularly useful products for investors seeking a regular income payout. Unlike most annuities, they do not have an accumulation phase, meaning investors receive immediate payments of their funds upon purchase.

Another GIP is a deferred-income annuity. Here, an investor exchanges a lump sum for a stream of income payments that begin at some point in the future and continue for the rest of his or her life. If a deferred-income annuity is purchased in a tax-qualified retirement plan, it is called a qualified longevity annuity contract. Fixed-interest annuities can act similarly to a deferred-income annuity; they provide a guaranteed interest on a contract value—for example, 5% annually on a contract of $100,000—beginning at some future point through the rest of the investor’s life.

Use of Annuities Today While data on annuities is limited, it is clear that most people saving for retirement do not use them. According to the Federal Reserve's 2020 Survey of Consumer Finances, fewer than 5% of American families held an annuity in 2019. Morningstar data shows that $87.1 billion in variable annuities were sold in 2020. The Investment Company Institute's 2020 Fact Book says that about $500 billion of an estimated $11 trillion of IRA assets were held in annuities other than variable annuities as of 2019; an additional $2.3 trillion in non-IRA assets were held in annuity reserves. None of these estimates gives us a sense of how much is held in GIPs; typically, VAs would not fall into this category.

A key reason why GIPs are not widespread is their lack of availability in employer-sponsored plans. According to the Plan Sponsor Council of America’s 63rd Annual Survey of 600 plan sponsors, less than 10% of employer plans offered an annuity option in 2019. Morningstar estimates that only 1.5% of employers who filed the Form 5500 for their retirement plans—generally employers that have more than 100 participants—offered annuities. The significant discrepancy between these numbers is likely due to the limited nature of the insurance data reported on Form 5500. The actual percentage of plans offering annuities is probably between these two numbers but is most certainly low.

One might expect that the decline of defined-benefit plans would increase demand for some type of guaranteed income at retirement. Social Security fits that need for many Americans. The Social Security formula would replace 50% of income for those with average wage earnings equal to the median income of just under $36,000 in 2019. For the bottom two quintiles, it would replace approximately 84% and 55% of income, respectively, based on income data from 2019. Furthermore, Social Security benefits are indexed to inflation, meaning that benefit payments fluctuate in step with the Consumer Price Index for Urban Wage Earners to account for inflation losses, while commercial annuity payments are usually fixed. On the other hand, those at the top two quintiles in 2019 would have approximately 47% and 38% of their income replaced, respectively. Consequently, for those for whom Social Security is not sufficient and who have funds to purchase other assets, GIPs are an opportunity to fill the void of guaranteed income.

Legal and operational barriers are largely responsible for the depressed use of GIPs as retirement investments. As we discussed, government action is required to solve some of these problems. Until that happens, financial advisors can step in to help clients overcome the challenges. Here is a breakdown of the legal and operational barriers holding GIPs back and what advisors can do to help clients get around them.

Legal Barriers There are three central legal barriers that advisors can help clients solve:

Barrier: Liability risks. Many investors lack easy access to annuities because they are not offered in their employer-sponsored retirement plan. Under the Employee Retirement Income Security Act, employers are potentially liable for selecting annuity benefit providers for 401(k), 403(b), and other sponsored plans. Annuities often come with higher fees and are more complex than mutual funds and collective investment trusts, which increases the likelihood of litigation. This greater risk level has deterred employers from offering annuities in sponsored plans.

Solution: Advisors can help clients shop for a high-quality GIP and help them determine how much of their retirement portfolio to allocate to it, even if it is not offered in an employer-sponsored plan.

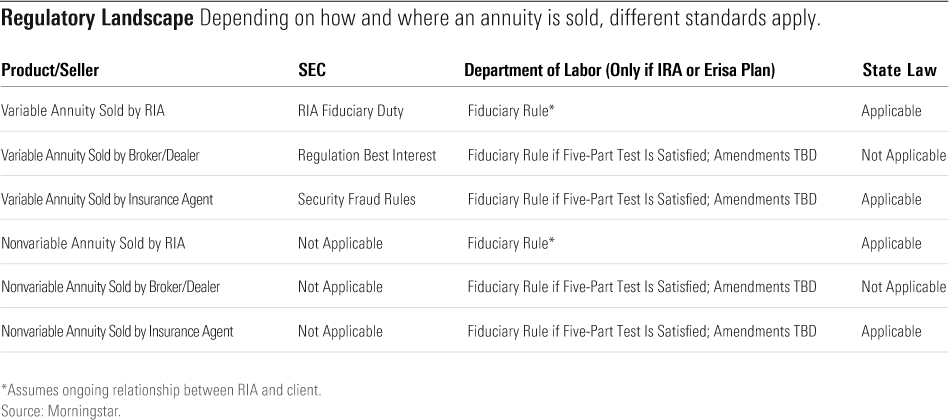

Barrier: No federal standard on annuity advice.The standards that govern annuities advice vary based on the type of account in which the annuity is purchased, the individual through whom the purchase is made, and the type of annuity being purchased. This lack of standardization can erode investors' confidence in annuities. A brief summary of the varied regulatory landscape is shown below.

Annuities that are offered through employer-sponsored plans are subject to Erisa standards, but employees do not typically receive personalized advice regarding annuities in those plans. People most commonly purchase annuities by rolling over their 401(k) assets into an annuity held in an IRA. The Regulation Best Interest standard applies to rollovers into variable annuities but not to annuities that do not qualify as securities, such as single-premium immediate annuities.

In some situations, investors also receive Erisa fiduciary protections. For all annuities sold by Registered Investment Advisors, Erisa protections apply only if a five-part test for investment advice is satisfied; the most limiting condition of this test is that an ongoing relationship between the RIA and the client must exist.

Annuities sold by broker/dealers and insurance agents are also subject to the fiduciary rule only if the five-part test is satisfied, a typically much less common occurrence than in the case of an RIA. Individuals making one-time annuity purchases are not protected by the fiduciary rule, though this could change depending on amendments to a rule the Department of Labor is expected to make later this year.

Accounts managed by RIAs containing annuities benefit from the availability of advisors, who can recommend an allocation toward a GIP. Despite the absence of a uniform standard and notwithstanding the regulatory gaps, RIAs have often earned a Certified Financial Planner designation as well. RIAs who have a CFP designation are fiduciaries and must act in their clients’ best interests—even when recommending products that do not qualify as securities. Because of their CFP designation and the importance of building investor trust, RIAs should abide by their fiduciary duty in their interactions with their clients regardless of the type of annuity at issue.

Broker/dealers and insurance agents should watch for future Labor Department and SEC guidance and enforcement of Regulation Best Interest and the fiduciary rule. Some states are also adopting fiduciary standards that could be stricter than Reg BI.

Solution: By always following fiduciary duties, or the SEC's Regulation Best Interest, advisors can compensate for the lack of a uniform federal standard by putting their clients' interests first.

Assessing whether purchasing an annuity is in a client’s best interest can be difficult—especially when considering complex annuities that are hard to compare. The Morningstar Annuity Intelligence tool can help RIAs satisfy their fiduciary duties.2 Being transparent about costs and conflicts when recommending annuity products will pay off in the long term by generating greater client acceptance of annuities, even if it is less profitable in the short run.

Barrier: Lack of uniform protection standards against default.One of the major risks that comes with purchasing an annuity is that the issuer will default, which could jeopardize the investment and destabilize annuitants' retirements. Evaluating the credit risk of an issuer and the amount of the investment that is covered by a guarantee is, therefore, a critical prerequisite to making prudent investments in annuities. Annuitants are at risk if their annuity premium is above the coverage limit.

Solution: Through research and sharing information, advisors can ease clients' fears about their annuity being unable to meet its commitments.

Annuities are regulated and guaranteed by state-mandated guarantee associations rather than the federal government. Although the number of state-level regulations can appear daunting, state guarantees are substantially consistent, with all states requiring issuers to cover at least $250,000 in the present value of annuity benefits. The obstacles posed by inconsistency among states are, therefore, more perception than reality.

In cases where individuals annuitize greater amounts than the applicable state guarantee, financial advisors should ensure that the issuer’s credit rating is satisfactory. Advisors should discuss with their clients the exact amount that is guaranteed. Advisors should also inform their clients that even where their premiums exceed the coverage amount, default risk is mitigated by the fact that insolvent insurance companies’ contracts are usually purchased by other insurance companies before default.

Operational BarriersIn addition to legal barriers, investors face obstacles that make annuities difficult to use. In this section, we suggest practical steps that investment professionals can take to counteract five prevalent operational barriers that their clients face in purchasing annuities.

Barrier: Rarely offered in employer plans.As we discussed, employers tend not to offer annuity products in employer-sponsored plans because of liability concerns. Consequently, employees who want to purchase annuities often can only do so through rollovers into IRAs or by purchasing them in taxable accounts.

Solution: Advisors can point their clients toward pooled vehicles as alternatives to employer-sponsored plans.RIAs can steer their clients into a combination of annuities and pooled investment vehicles, such as mutual funds and collective investment trusts, supplementing investment assets with guaranteed income. Because few pooled vehicles invest in annuities, RIAs can provide a valuable service in identifying them for their clients. Advisors can help expand the market for pooled investment vehicles, which puts the burden of selecting annuity products on institutional investors, who are presumably better equipped than individual investors to navigate the complexity.

Barrier: Too difficult for clients to confront longevity risk.One of the major benefits that annuity products, especially GIPs, provide for retirees is ensuring that they will continue receiving stable income payments for a set period of years—even until death. In this way, annuities serve as a hedge against longevity risk, which is the risk that individuals will outlive their retirement savings. The flip side is that investors must also consider the risk that they won't live long enough to at least recover their initial investment. However, a recent study showed that more Americans underestimate their life expectancy than overestimate it.3 Consequently, many potential annuitants are probably not accurately assessing longevity risk.

Solution: By explaining that GIPs address longevity risk, advisors can motivate their clients to annuitize.RIAs can clear up misconceptions for their clients. Studies have shown that people tend to assess their life expectancy differently depending on how the question is posed. When the question is framed in terms of what age the person will live to, the median response is age 85; if die by is used instead, the response falls to a median age of 75.4 RIAs can help their clients more accurately assess longevity risk—and, thus, draw their attention to annuities—by discussing life expectancy and retirement planning within the longer-term framing. Research shows that when clients expect to live longer, they may be more receptive to adding guaranteed income streams to their retirement portfolios for longer periods of time.

Barrier: Perception that insurance company will come out ahead financially.Concern about whether an annuity will truly benefit the annuitant or turn a fat profit for the issuer creates uncertainty for clients.

Solution: Advisors can help clients add a death benefit to reduce worries that insurance companies will receive a windfall from the annuity. Death benefit protections are often available as optional riders or guarantees alongside annuities. Morningstar Annuity Intelligence allows users to sort annuities that offer death benefits from those that do not. Advisors can also reframe the concern about whether the insurer will reap a windfall from the annuity. They can point out that the concern should be about the client's own best interests, not the insurance company's, and remind the client of the need to plan around life's uncertainties.

Barrier: Lack of transparency.Annuities suffer from a lack of transparency regarding their terms and costs. No federal disclosure requirements apply to annuity products other than variable annuities. Thus, annuities, in stark contrast to mutual funds or exchange-traded funds, are not as easily comparable. Nor are they subject to disclosure requirements or standardization that ensure investors know exactly how much the issuer charges.

Certain companies have standardized fee data to help customers compare products such as single-premium immediate annuities and deferred-income annuities. Fixed-interest-rate and fixed-index annuities do not have an industry- standard way to compare costs, which consist of the purchase price and the cost of material riders, which vary based on an individual’s circumstances. Because information tends to be opaque or sparse, annuity purchasers or their advisors often need to comb through annuity contracts with substantial variations in commissions, administrative fees, and surrender charges.

Solution: Advisors can help their clients understand the costs and terms associated with annuities.Useful tools have emerged to interpret and simplify complex fee data to help investors make informed choices. For example, to be able to present quality choices to plan sponsors, Hueler Income Solutions restricts its referrals to immediate-income annuities, deferred-income annuities, and fixed-interest annuities from a limited number of providers.

The disclosure requirements for variable annuities are far less accessible than those applying to mutual funds. Issuers of variable annuities must make a shortened summary prospectus available online but do not have to provide expense ratios or other fees in standardized ways to facilitate easy comparison. Variable annuities can be compared based on their management fees, but such fees do not represent all of the costs involved, because individual costs vary based on the riders purchased. Moreover, when insurance representatives recommend a variable annuity to customers, they need only have a reasonable basis to believe that the customer would benefit from features of the annuity. Insurance reps are essentially being held to a suitability standard compared with the best-interest standard that applies to securities brokers.

Advisors can ensure that their clients do not make misguided purchases because of lack of transparency and commensurability. Advisors should guide clients toward simple annuities, such as GIPs, and clarify all relevant terms and costs.

Barrier: Annuities are irreversible and illiquid.Annuities are irreversible or have complex surrender charges as required by their cost and benefit structure. As such, they do not offer the liquidity of other products. Annuities cannot be bought or sold on an exchange or redeemed with the issuer upon demand. They are complex contracts with specific periods, terms of renewal and surrender, and fees associated with exit.

Based on the type of annuity, different costs to liquidating a product apply. An annuitant can typically cash out an annuity product, but the cost might outweigh the benefit. Normally, if an annuitant seeks to take out the contract’s permitted withdrawal amount, he or she will not be penalized for doing so.

Most annuity contracts charge penalties for withdrawals that exceed specified limits, such as allowing only one withdrawal per year, up to 10% of the current value of the contract. Possible exceptions for special circumstances or hardships exist for penalties, such as terminal illness or disability.

Surrender fees can also raise the cost of liquidating annuities. A surrender fee is an amount of money charged as a penalty for making a large withdrawal during a predetermined surrender period. If an annuitant decides to withdraw funds beyond the permitted limit during the surrender period, the withdrawal could be subject to surrender fees and additional penalties by the insurer. If the annuity maturity date has passed, then an annuitant can likely withdraw funds without penalty.

Surrender charges and additional penalties vary among annuity products. With most fixed-interest annuities, an annuitant can withdraw the principal at any time; however, the withdrawal may be subject to interest penalties. Fixed-index annuity products typically have a 10-year surrender period, generally charging 7% in the first year of the contract. Surrender fees on variable annuities often amount to 7% of the cash value of the annuity during the first year of the contract. Surrender fees for fixed-index annuities are usually higher than those for variable annuities. Withdrawals from variable and fixed-index annuities before the contract ending typically result in both principal and interest penalties.

Solution: When helping clients purchase annuities, advisors should review the terms for opting out and ensure clients know the surrender charges.

Advisors' Huge Role Many significant policy proposals are being considered in the annuities space. While Congress is focused on tax changes that make saving for retirement more attractive in general, federal agencies can have a direct impact on the greater adoption of GIPs during retirement. While we wait for these developments, advisors can play a key role in popularizing annuities and providing greater retirement security for their clients. As investment professionals, they can also encourage innovation and the development of technologies that reduce barriers to annuitization.

Jasmin Sethi is associate director of policy research at Morningstar.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q7DQFQYMEZD7HIR6KC5R42XEDI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5N6PBZJLMJEIXBH6EHTKPDK6NE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FIN36RNGOFABFDS2NCP2RCCG3I.png)