10 Scary Stocks: 2021 Edition

These are the most overpriced stocks in our coverage universe today.

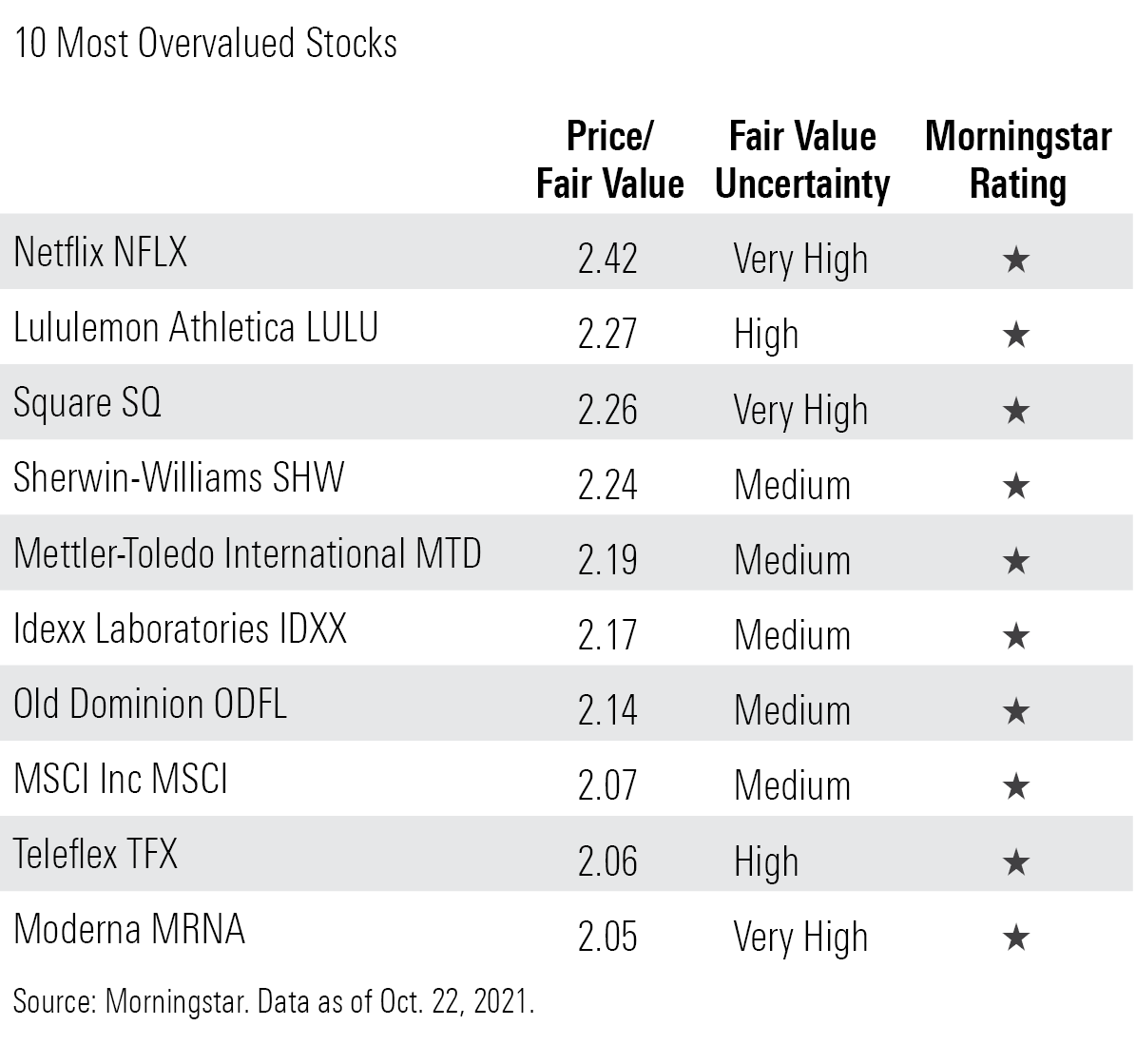

In what has become a Halloween tradition, today we're profiling spooky-expensive stocks. Specifically, among the names that our analysts cover, we've revealed the 10 most overvalued based on their price/fair value ratios. (We excluded stocks with extreme fair value uncertainty ratings.) The valuations on these names are as frightening as Michael Myers emerging from a burning house.

It's an eclectic bunch. Four of the stocks appearing on this year's roster popped up on last year's list, too, and are apparently perennially overpriced: Netflix NFLX, Lululemon Athletica LULU, Square SQ, and Idexx Laboratories IDXX.

Half of the stocks on the list carry high or very high uncertainty ratings. The uncertainty rating represents the predictability of the company's future cash flows and, therefore, the level of certainty we have in our fair value estimate of that company. Some types of companies have less predictable cash flows than others and carry higher uncertainty ratings. Firms in more economically sensitive industries, including auto manufacturers, retailers, and restaurants, generally carry higher uncertainty ratings, so do companies in highly disruptive sectors such as technology and communication services.

Given the uncertainty around the future cash flows of some of the companies listed here, there's a chance that our fair value estimates may be overly modest. But even once you take into account uncertainty--as the Morningstar Rating for stocks does--these names are still overpriced. In fact, regardless of their uncertainty ratings, all of the stocks were trading at 1 star as of this writing.

Here's our business outlook for three of the fiendishly priced names.

Moderna MRNA

"Moderna's mRNA technology has gained rapid validation as sales of its COVID-19 vaccine soar in 2021, but we think the firm has yet to secure a narrow economic moat around its business, largely because of uncertainties tied to an evolving virus and the changing competitive landscape for innovative vaccines.

"In a record-breaking span of just 11 months, Moderna created, developed, manufactured, and got regulatory authorization for mRNA-1273, a two-dose COVID-19 vaccine that is one of the first two mRNA vaccines ever authorized (alongside Pfizer/BioNTech's BNT162b2). The pandemic accelerated Moderna's evolution into a commercial-stage biotech, and we expect that the firm's ramp-up in manufacturing and clinical know-how will pave the way for faster timelines for additional programs. Moderna's mRNA platform, involving rapid design and similar manufacturing across programs, allows the company to pursue multiple programs in parallel. Moderna also retains full rights to most of its programs, although key partnerships with Merck MRK and AstraZeneca AZN help support its efforts in oncology.

"We expect the firm to report $21 billion in COVID-19 vaccine sales in 2021, with $20 billion in sales in 2022 as pandemic-related demand begins to decline but demand for boosters expands. We see potential for sustained revenue in the low-single-digit billions annually if higher-risk populations continue to receive annual vaccines beyond the pandemic, although there is high uncertainty around the number of long-term competitors (including new mRNA players) and pricing.

"Moderna's most advanced program outside COVID-19 is for cytomegalovirus, a leading cause of birth defects, but several other vaccines are in earlier trials, targeting other respiratory viruses like RSV and influenza. We see each of these as more than $1 billion annual sales opportunities. Moderna is also pursuing therapeutic cancer vaccines with Merck, as well as regenerative therapeutics and intratumoral immuno-oncology therapies with AstraZeneca, which we include in our valuation. We don't include Moderna's secreted or intracellular protein programs in our valuation, given the early stage of their development."

--Karen Andersen, strategist

Read more: Maintaining Our Moderna FVE Following FDA Booster Vote

Netflix NFLX

"From its origins as a DVD-rental-by-mail service, Netflix has morphed into a pioneer in subscription video on demand, or SVOD, and the largest online video provider in the United States and likely the world. Our economic moat rating of narrow is based on intangibles resulting from the use of Big Data stemming from the firm's massive worldwide subscriber base.

"Already the largest provider in the U.S., Netflix expanded rapidly into markets abroad as the service now has more subscribers outside of the U.S. than inside. The firm has used its scale to construct a massive data set that tracks every customer interaction. It then leverages this customer data to better purchase content as well as finance and produce original material such as Stranger Things. However, the firm has recently ramped up its production using more-traditional methods.

"We believe that many consumers use, and will continue to use, SVODs like Netflix as a complementary service, especially as SVOD prices increase and pay-television bundle prices decrease (owing to the shift to over-the-top, or OTT, delivery). Media firms will continue to reap the benefits of both an additional window for existing content and another platform for new content. Larger firms like Disney+ and WarnerMedia have launched their own SVOD platforms to compete against Netflix. We think this usage pattern and increased competition will constrain Netflix's ability to raise prices without inducing greater churn.

"We expect that Netflix will expand further into local-language programming to offset the weakness of its skinny offering in many countries. This will likely generate a competitive response from the firm's global and local rivals, which will augment their own first-party content budgets. In turn, we think Netflix's international expansion will continue to hamper margin expansion."

--Neil Macker, senior analyst

Read More: Netflix Beats Low Subscriber Guidance

Sherwin-Williams SHW

"As Sherwin-Williams entered its fiscal third quarter, management was optimistic that supply chain issues and soaring raw material costs would ease during the final quarter of 2021. Instead, these issues have worsened, which forced management to lower its full-year outlook. Management now sees high-single-digit full-year sales growth and midpoint adjusted earnings per share of $8.45 compared with previous guidance of high-single-digit to low-double-digit sales growth and midpoint adjusted EPS of $9.30.

"While end-market demand has remained strong, supply chain disruptions have constrained Sherwin's production output. Making matters worse, raw material costs continue to soar; Sherwin expects its raw material prices to increase by a high-teens percentage this year. As such, we no longer expect the firm's gross margin to eclipse 45% in 2021. Management said that lower volumes will account for about two thirds of the firm's gross margin contraction with unfavorable price/cost responsible for the rest.

"We believe Sherwin's downward-revised outlook is likely achievable, and we've adjusted our 2021 forecast accordingly. However, our long-term outlook hasn't changed, and we've maintained our $137 per share fair value estimate. We continue to see the company's stock as overvalued.

"Sherwin announced it will acquire Specialty Polymers for an undisclosed amount. The company manufactures water-based polymers and generated $112 million of sales in 2020. It's also been a long-standing supplier to Sherwin-Williams. We see this deal as a relatively small vertical integration play, which should boost Sherwin's resin supply and reduce the firm's reliance on Gulf Coast resin production, which can be disrupted by hurricanes (Specialty Polymers' operations are in Oregon and South Carolina). This relatively small acquisition is inconsequential to our fair value estimate."

--Brian Bernard, director

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ROHC7ZXJXZU7LIKGTTYJTD667I.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TP6GAISC4JE65KVOI3YEE34HGU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)