The Top 529 Education Savings Plans of 2021

Morningstar identifies 32 best-in-class 529 plans.

The return of students to the classroom this fall means another cycle of Morningstar Analyst Ratings for 529 college savings plans.

Each year, Morningstar's team of manager research analysts assigns forward-looking, qualitative Morningstar Analyst Ratings to a subset of the broader 529 plan universe based on our assessment of each plan's investment merits compared with its peers. In 2021, when 529 education savings assets crossed the $400 billion mark and reached $437 billion by August, our analysts reviewed 62 plans representing 97% of those assets. Of this cohort, 32 received a recommended rating in the form of Gold, Silver, or Bronze.

Morningstar Medalist plans offer investment options that we expect will collectively outperform and exhibit some combination of the following attractive features:

- A well-researched asset-allocation approach.

- A robust process for selecting underlying investments.

- An appropriate menu of options to meet investor needs.

- Strong oversight from the state and investment manager.

- Minimal fees.

Families invested in these 529 plans should be well-positioned for the future.

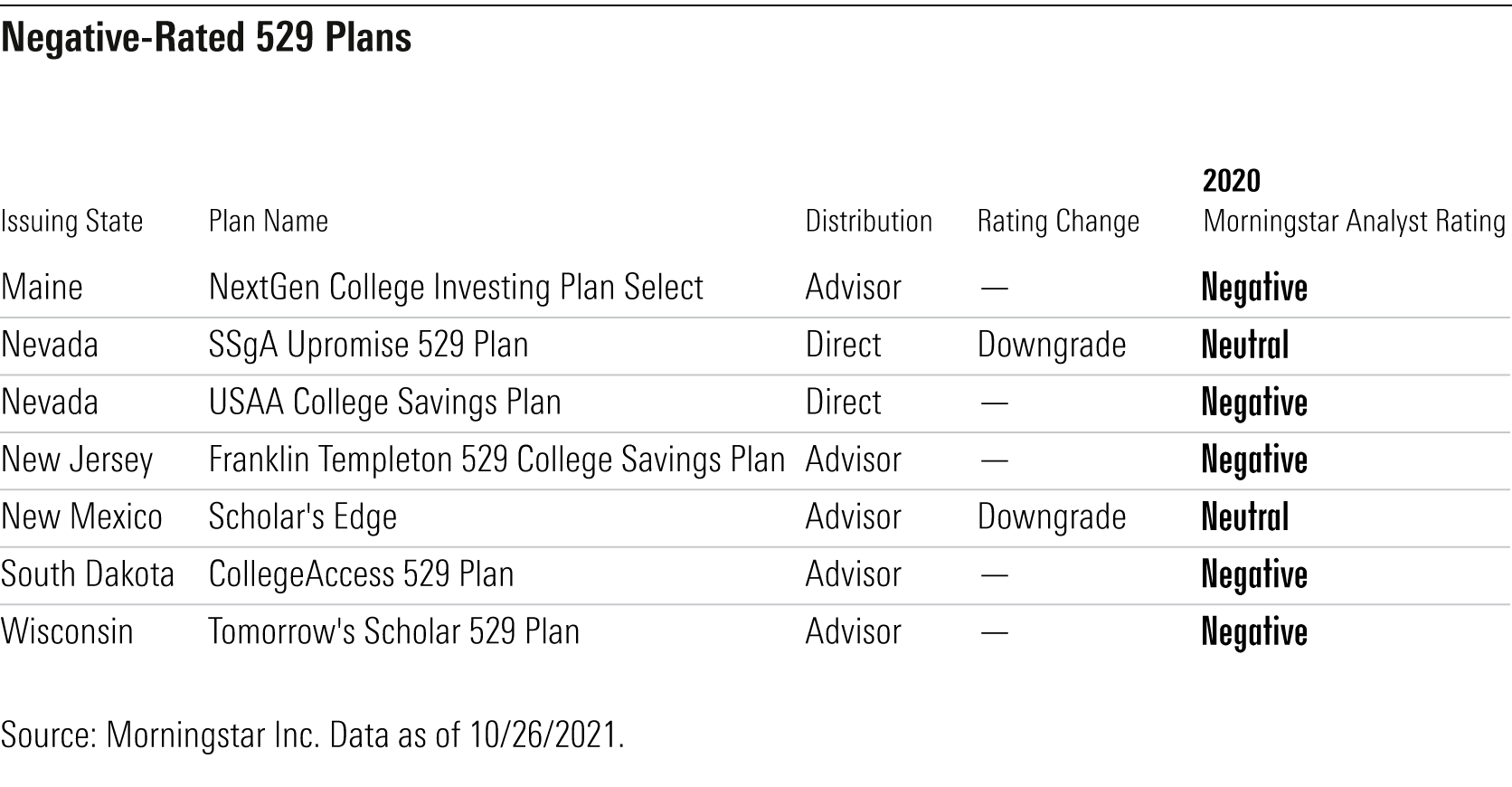

In contrast, seven plans earn a Negative rating. These offerings exhibit significant structural flaws, such as a subpar asset-allocation approach or excessively high fees, which make it unlikely that a typical 529 education savings plan participant will receive a compelling investment experience relative to alternatives. And relative to an ever-evolving landscape that continues to raise the industry standard, these plans aren't keeping pace. Education savers can find better plans elsewhere.

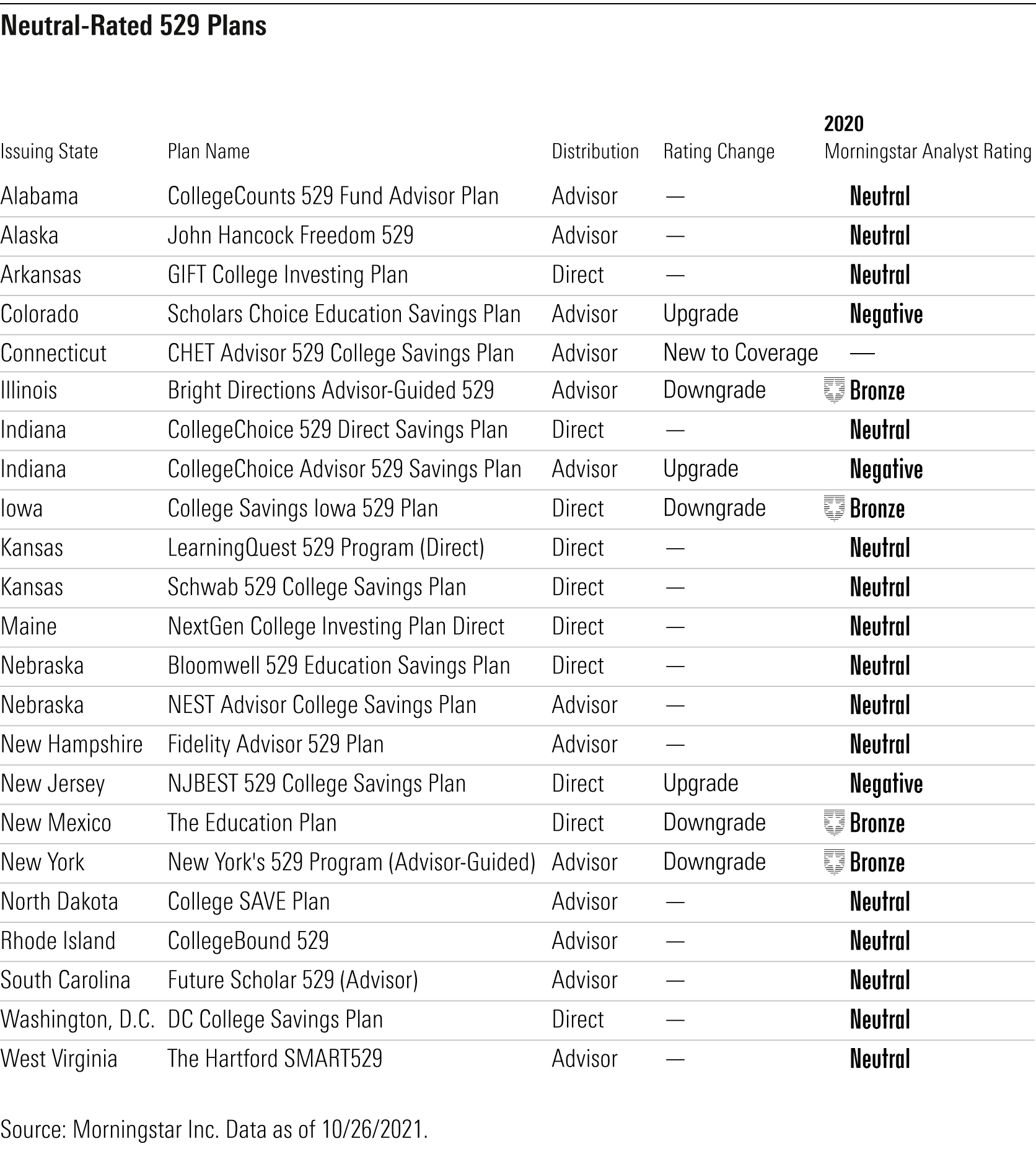

Falling between our recommended, medalist plans and those worth avoiding sit 23 Neutral-rated plans. While Morningstar analysts do not recommend Neutral-rated plans, these plans might be worth a second look for residents who qualify for additional benefits such as state income tax breaks, which don't factor into our ratings. Education savers are not required to invest in their state's plan, but residents of a state with a Neutral-rated plan should consult any tax incentives they receive from their state before deciding to look elsewhere.

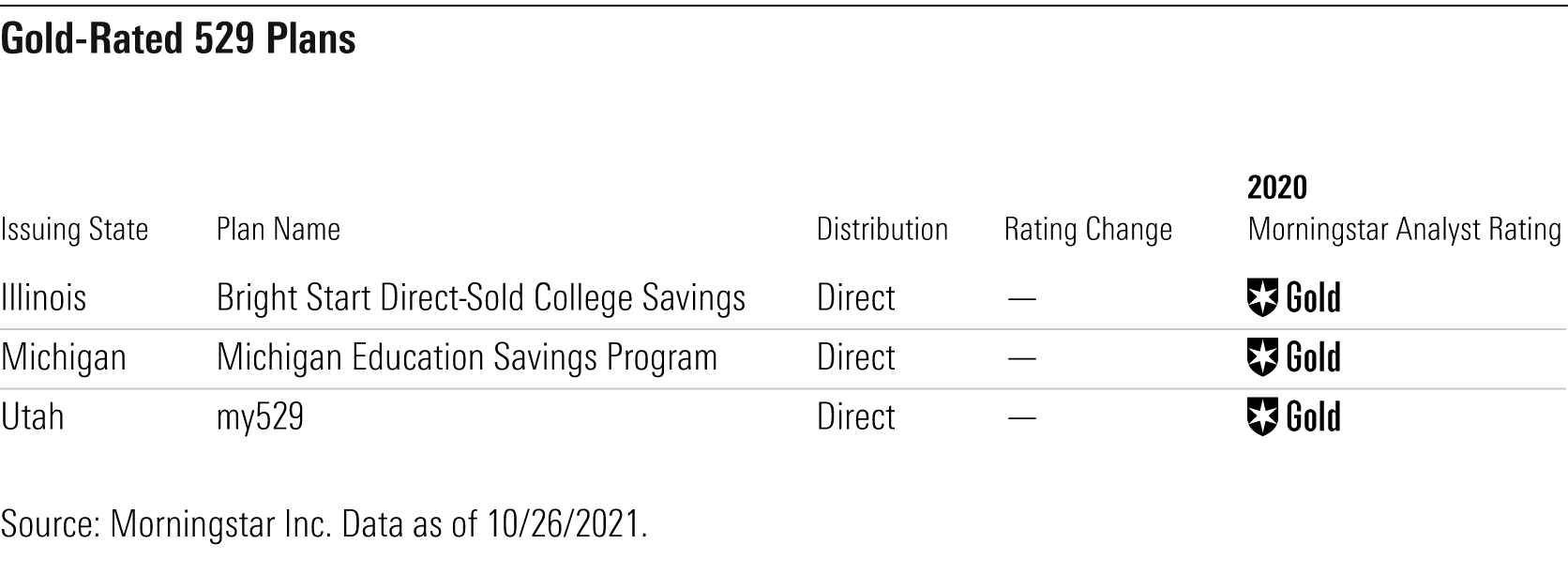

Summa Cum Laude

Three of the best and brightest 529 education savings plans merit our highest conviction, earning Analyst Ratings of Gold. These topnotch plans set the curve for their peers, offering exceptional investments while emulating savvy stewardship. Each plan earns either the highest or second-highest marks across each of the four key pillars. Both in-state residents and out-of-staters will be well served by any of these three plans.

Utah's my529 plan is the only 529 plan that's consistently received a Gold rating since we debuted our ratings in 2012, but the investment team hasn't rested on its laurels. Instead, it continues to focus on improving the plan for the betterment of investors. This year, the team collapsed its four age-based tracks into a single progressive glide path, one method of construction that we view as industry best practice. A progressive glide path makes frequent shifts between stocks and bonds relative to the stepped construction of age-based glide paths, which helps reduce the risk of selling stocks at the wrong time.

Further raising industry-standards, this plan incorporates insights from participant data and asset allocation research into this new glide path design, so set-it-and-forget-it savers should benefit from the new construction. But for those who like to take a more hands-on approach, the plan still offers its unique, customized age-based portfolios that allow investors to build their own glide path from scratch.

Although 529 plans continue to move to progressive glide paths--which reduce equity risk over time based on a child's year of enrollment rather than their age--plans with age-based transitions between stocks and bonds may also get favorable marks if the transitions are sufficiently gradual.

Illinois' Gold-rated Bright Start Direct-Sold College Savings Plan delivers a strong offering via its two different age-based series: multifirm (a mix of active and passive underlying funds) and index. Each series is divvied into three tracks that vary in stock exposure to accommodate different risk tolerances; all sport 10% steps between stocks and bonds. The thoughtful design and mix of strong active managers alongside core index funds make the plan a superb offering for investors. Our view of the plan's investment manager, Wilshire, has leveled as the team's resources are sufficient rather than robust as compared with peers'. However, the state of Illinois touts a strong investment team that has an impactful voice in the construction of this plan and supports our positive view.

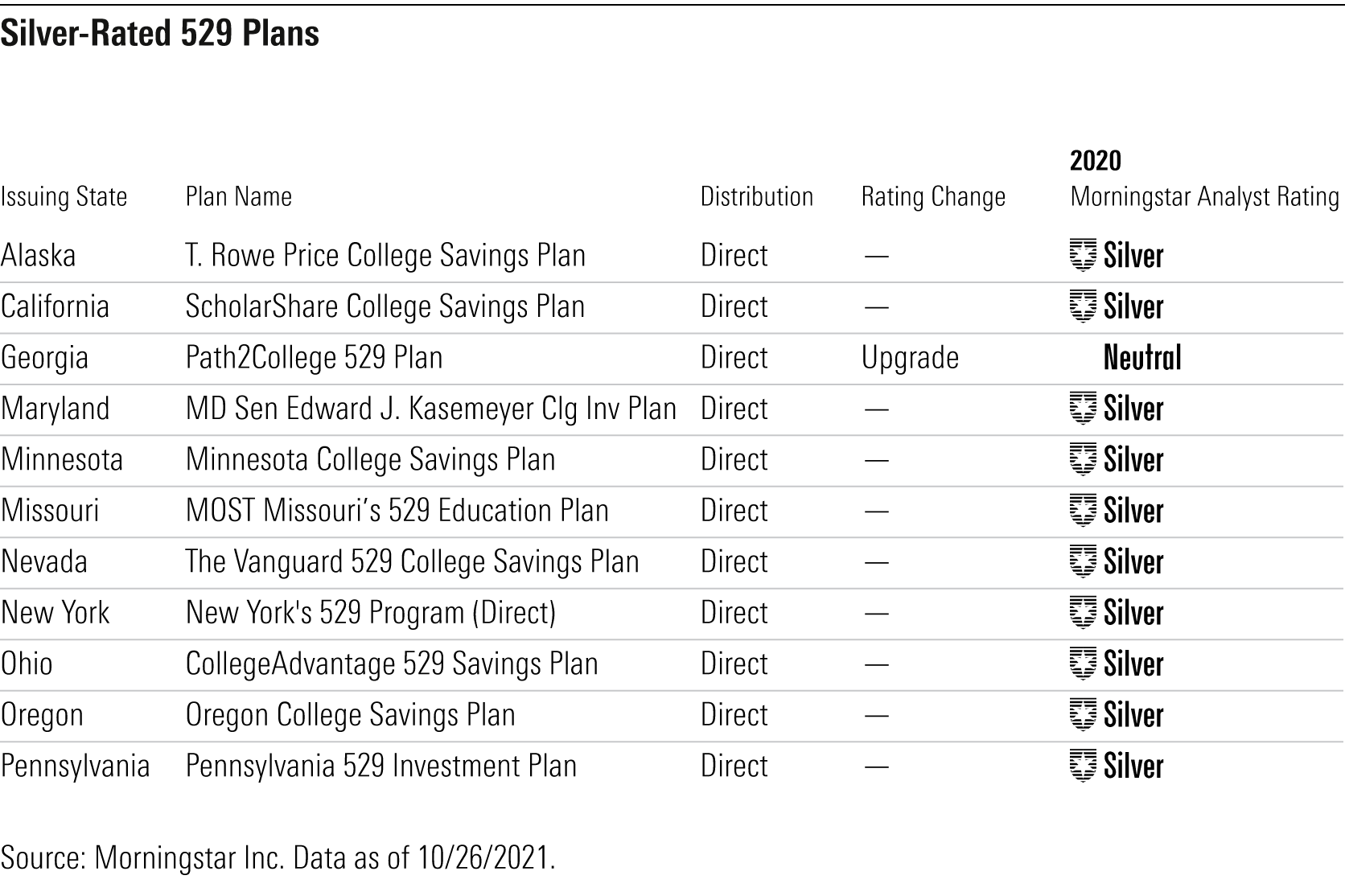

Silver-Rated 529s Hit the Headlines

The Silver-rated 529 education savings plans remained relatively consistent this year. However, there's more to this sterling group than meets the eye, as newsworthy events hit several of the plans in this class.

The Vanguard 529 Plan in Nevada received a downgrade to Silver in 2019 after seven years atop the 529 plan pyramid. Underpinning its historical strength, the plan employs Vanguard's vast research capabilities and deep experience in 529 plans, but some operational hiccups give us pause. Last year, the plan announced it would migrate to a target-enrollment approach, and as it executed this transition in October 2020, Vanguard incorrectly mapped its own recommendations to the new portfolios. This oversight left accountholders in these new portfolios exposed to up to 20 percentage points more in stocks, placing $12.5 billion in a precarious position. Luckily, most investors--roughly 268,000 accountholders--earned positive returns over that stretch, potentially up to 4.2%, according to Vanguard's estimates.

However, 4,500 accountholders did lose money, collectively shedding over $233,000 in education savings while the error persisted in the portfolios undetected by either Vanguard or Nevada. After the issue was identified in March 2021 and Nevada conducted an external review, Vanguard repaid the 2,800 accountholders that experienced more than $5 in losses. The consultant hired to oversee the identification of the adversely impacted parties noted Vanguard's timely responses to requests and "sound and conservative assumptions that favored the interests of account owners," This continues to inspire confidence in Vanguard as a steward of 529 assets. Additionally, this situation should serve as impetus to strengthen operational oversight going forward. Vanguard still offers its target-enrollment methodology as an option to other plans that it advises, and we will be monitoring the developments of any planned transitions for evidence that plans' trustees are able to properly implement Vanguard's recommendations.

Another development out West will occur in 2022, when California's ScholarShare 529 plan launches the first suite of environmental, social, and governance target-enrollment portfolios. At $12.7 billion, this step will make ScholarShare the largest 529 plan to offer an ESG-aware portfolio to participants. The portfolios will follow the same progressive glide path as the plan's current active and passive enrollment tracks, which collectively hold 61% of ScholarShare 529's assets under management. This development provides an example of a plan adapting solutions to attract younger and more socially conscious savers, but whether these overtures attract investment remains to be seen.

Finally, Georgia's Path2College 529 Plan saw its rating upgraded substantially, moving up two tiers to Silver from Neutral after it underwent a major revamp over the past 18 months. In May 2020, the plan transitioned its age-based options to a progressive, enrollment-based construction, driven by the research of program manager TIAA (whose contract was then renewed in late 2020). A year later, it consolidated the two glide paths into one to encapsulate the team's best thinking. The Georgia Higher Education Savings Plan Board displayed characteristics of strong stewardship through the transition, minimizing interruptions and warranting an upgrade of its Parent Pillar rating to Above Average. Georgia also drove cost reductions during contract negotiations, resulting in an average cost of roughly 0.09% for the enrollment portfolios, the lowest of any 529 plan under Morningstar analyst coverage.

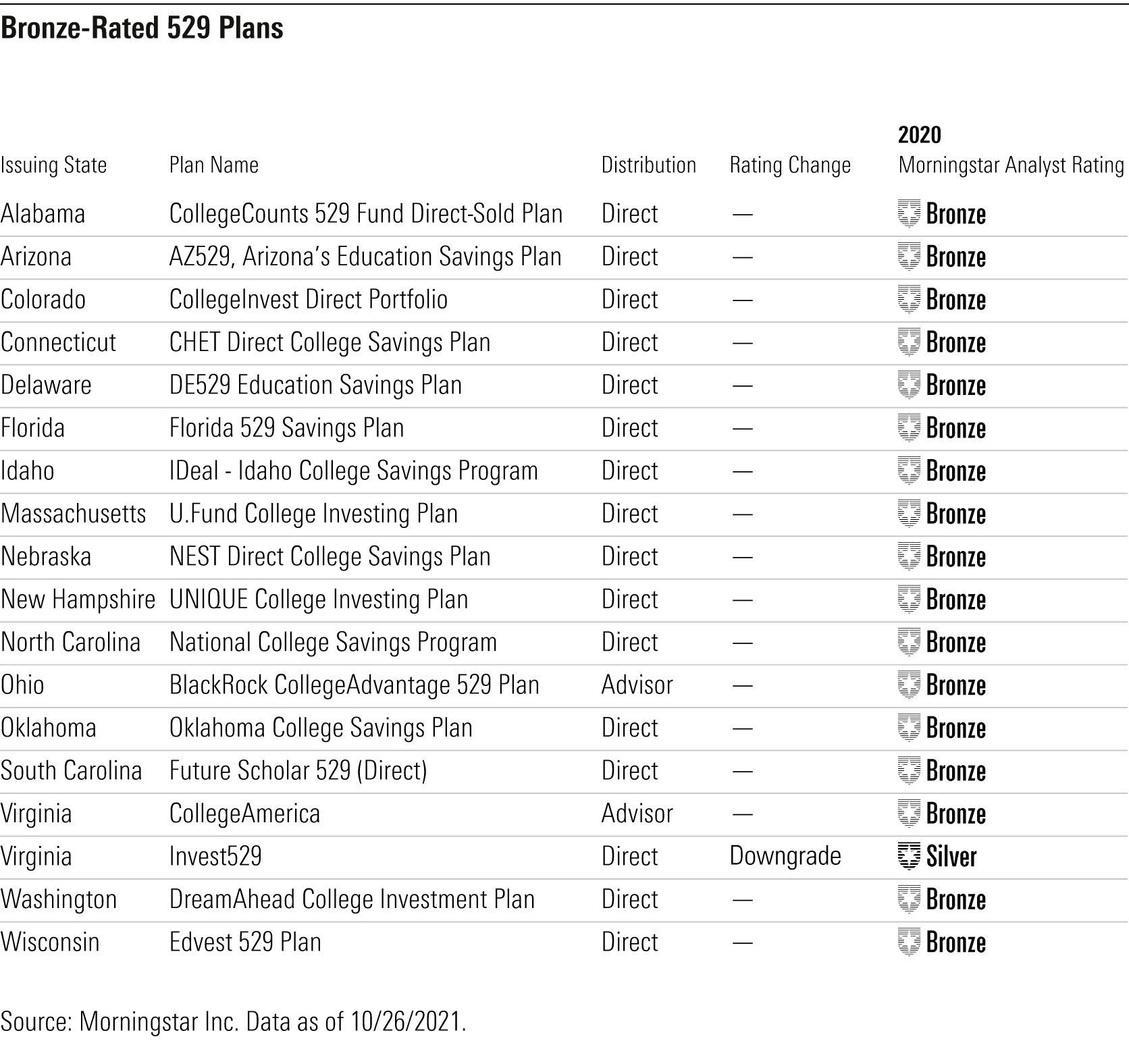

529 Plans Well Worth Consideration

Although Bronze-rated plans may not hold our highest conviction, they still deserve education savers' attention. These plans exhibit advantages that underpin our confidence in their ability to outperform over the long term, though many could yet improve on various underpinning pillars.

Once an industry standard-setter, Virginia's Invest529 took another tumble to Bronze from Silver this year, following a downgrade in 2020 from Gold. The departure of Virginia's in-house investment director Michael Nguyen in September 2021 mutes our confidence in the investment team. However, seasoned individuals remain, and we still believe Virginia's direct-sold plan stands as a compelling option for education savers relative to many alternatives.

Name-brand investment managers sit among this group, such as American Funds, BlackRock, and Fidelity. They tout well-regarded teams with robust resources, streamlined and appropriate investment options, and sound processes. Investors in these plans should benefit from these aspects over the long haul. But some age-based or enrollment portfolios in these plans tend to charge higher costs relative to their broader peers, reducing their appeal on balance.

On the opposite end of the spectrum, very low-cost plans can also be found here, such as the Florida 529 Savings Plan or South Carolina's Future Scholar 529 (Direct). These plans boast fees that are cheaper than more than 85% of their peers. However, the Florida plan lacks strength in state oversight, and South Carolina's lacks depth in the process behind its construction.

Low costs don't guarantee our highest-conviction view, but it's worth acknowledging that a reduced price lowers the performance hurdle needed to generate returns for investors and often serves as a persistent edge over more-expensive peers.

More 529 Education Savings Plans Are Just Meeting Expectations

The class of Neutral-rated plans expanded the most of any group year over year, increasing to 23 total plans from 18. In total, there were three plans upgraded from Negative, four plans downgraded from Bronze, and one plan earned an inaugural Neutral rating.

Colorado's Scholars Choice Education Savings Plan improved on its failing grade from last year, garnering an upgrade to Neutral. The plan underwent a complete overhaul in July 2021 following a transition in program manager to TIAA. The development quells concerns surrounding the uncertainty of prior program manager Legg Mason's 2020 acquisition by Franklin. In addition, TIAA has since made enhancements, so the plan now sports a structurally improved glide path and a completely new and more compelling investment lineup.

Four plans lost our conviction this year as their ratings fell to Neutral from Bronze: New Mexico's The Education Plan, Illinois' Bright Directions Advisor-Guided 529 College Savings Program, the College Savings Iowa 529 Plan, and New York's 529 Program (Advisor-Guided).

The plans received downgrades for varying reasons. Ted Miller, executive director of the New Mexico Education Trust Board, retired suddenly. He was an integral part of the plan's ongoing oversight and the positive improvements made to it in 2019. As a result, his departure is meaningful.

The Illinois Bright Directions Advisor-Guided 529 College Savings Program offers a less attractive fund lineup and fewer age-based tracks than its direct-sold sibling, while also coming with a higher price tag. The College Savings Iowa 529 Plan delivers a set of glide paths that court unnecessary timing risks compared with the other plans that use Vanguard's investment advice. Finally, New York has failed to make meaningful price improvements amid a cost-cutting industry, thus dimming its plan's prospects.

Morningstar initiated coverage of the Connecticut Higher Education Trust Advisor 529 College Savings Program following its transition to Fidelity as program manager in March 2021. The plan's Neutral rating aligns with Fidelity's other advisor-sold plan, issued by New Hampshire. The plans benefit from Fidelity's well-resourced asset-allocation team and sound process, but high fees are an obstacle to higher confidence in this offering.

Seven 529 Plans Flunk Out

We downgraded two plans to Negative this year: Nevada's SSgA Upromise 529 Plan and New Mexico's Scholar's Edge. Nevada's oversight of the SSgA Upromise 529 Plan lacks discipline as the state's resources have gotten spread thin by overseeing four additional 529 plans. And, the plan's glide path has structural issues that State Street Global Advisors hasn't rectified since it was instituted. Ted Miller's departure (noted above) weighs heavily on the Scholar's Edge plan. Egregious fees diminish its prospects further.

Most Negative-rated plans charge high fees that investors are better off avoiding. With such high fees, there's little incentive to choose these plans when you can find similar offerings at a more desirable cost elsewhere. Prices can depend somewhat on how a plan is distributed--plans that are sold exclusively through financial advisors often layer on commission fees to compensate advisors for financial advice. But as other compensation models, such as fee-based advice, become more popular, investors have more freedom to avoid these commission charges, which are often bundled into a front-end load or all-in expense ratio rather than reported as a separate line item. That makes these plans worth skipping.

Bending the Curve

Three plans received Analyst Ratings that diverged from the ratings suggested by their scores: the Maryland Senator Edward J. Kasemeyer College Investment Plan, North Dakota's College SAVE, and Rhode Island's CollegeBound 529.

Morningstar analysts overrode the recommended ratings for these plans for different reasons. North Dakota and Maryland offer 529 investment options that are nearly identical to other plans that receive different ratings, and we felt that the other plans' (Arkansas' GIFT and Alaska's T. Rowe Price College Savings Plan, respectively) ratings conferred more accurate expectations for the investment strategies' ability to outperform. In Rhode Island's case, the incremental changes being applied to the glide path effective October 2021 alleviate some of our concerns and show signs of positive improvements, warranting an override.

This year, we waived two overrides that were in place in 2020. In the past, we had conviction in the mix of factors contributing to the overall Bronze rating for Ohio's BlackRock CollegeAdvantage 529 Plan, if not each individual pillar, and that ultimately led to an override. With more data at our disposal now, our belief in the team's process has strengthened, justifying our highest conviction through an upgrade of the plan's Process rating to High from Above Average; this shift generates a quantitative score that no longer necessitates an override.

Indiana's CollegeChoice Advisor 529 Savings Plan earned an upgrade to Neutral this year without changes to its four underlying pillars, as we waived a previously instituted override that kept this plan at Negative. The investment team at Ascensus, alongside the state's two consultants, will be rolling out enhancements in early 2022 that address past concerns surrounding the glide path and lineup construction. As a result, the need for an override was no longer necessary. We expect overrides to appear infrequently over time.

Morningstar Analyst Rating Inputs

We began rating 529 education savings plans in 2012, and over that period these tax-advantaged investment options have gained tremendous popularity.

Assets have climbed from $167 billion to over $437 billion as of Aug. 31, 2021, and with increased stature comes increased sophistication. In July 2020, we rolled out our enhanced rating methodology, reflecting our updated views on what an industry-standard plan looks like and what aspects of a plan warrant our highest conviction. We evaluate plans based on four key pillars: Process, People, Parent, and Price. Pillar-level research informs our holistic view of plans and results in the Analyst Rating for 529 plans.

The 2021 ratings feature a total of 11 upgrades or downgrades compared with 27 in 2020. The implementation of our enhanced ratings methodology in 2020 sparked an increased number of upgrades and downgrades compared with prior years, but with this rubric well-exercised for a second year running, our forward-looking ratings were unsurprisingly more stable. Going forward, we expect there to be fewer ratings changes each year as compared with 2020, and 2021 fell within our expectations.

/s3.amazonaws.com/arc-authors/morningstar/a3ffb7d7-3689-49a2-bfde-9235ef1e06ad.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BC7NL2STP5HBHOC7VRD3P64GTU.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IFAOVZCBUJCJHLXW37DPSNOCHM.png)