What to Watch for in This Week's Earnings Reports

Keep an eye on what companies are saying about inflation and supply disruptions.

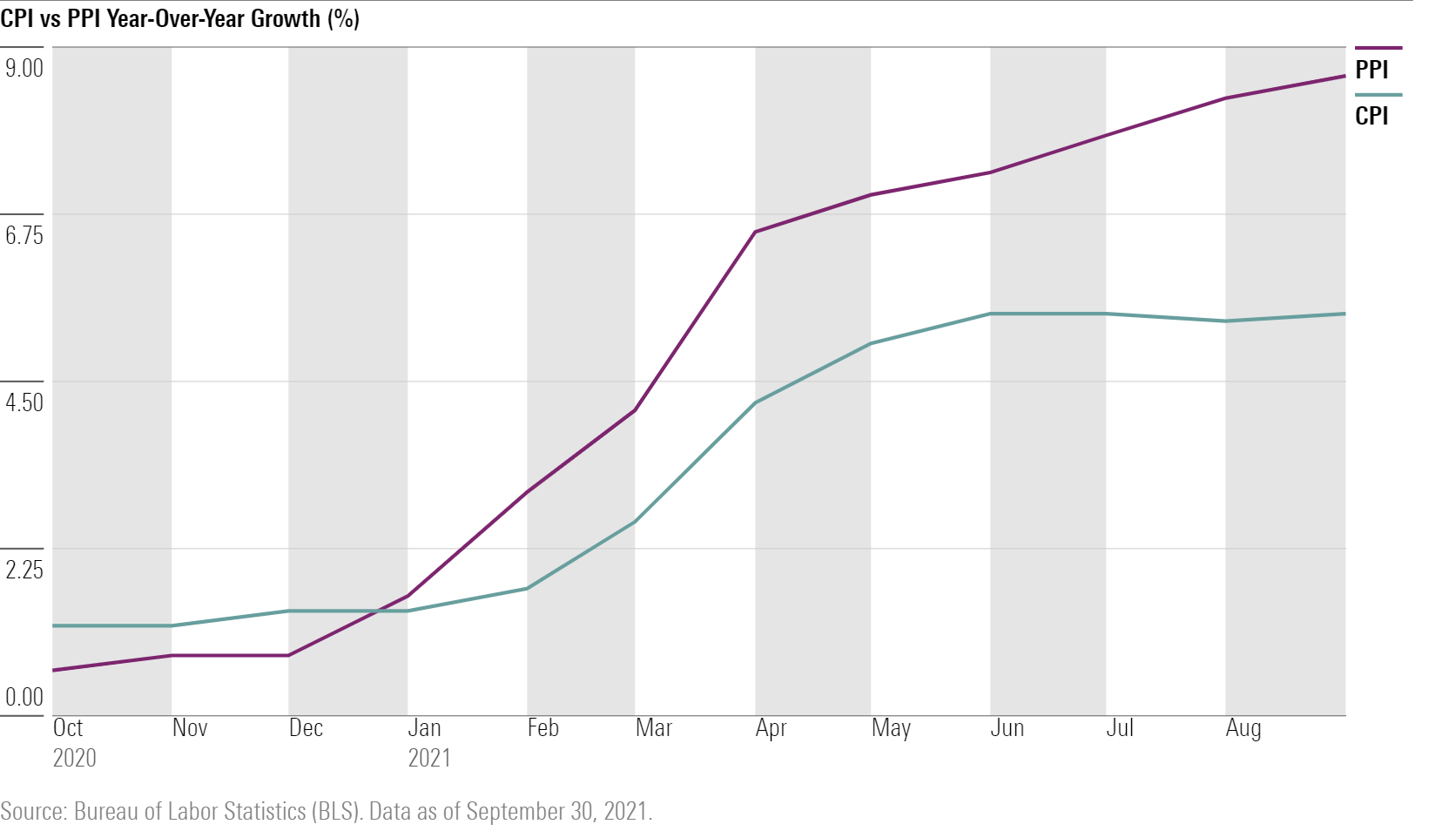

With inflation running hot and global supply disruptions hitting a wide swath of industries, more is at stake with this quarter's corporate earnings than the usual game of "which stock tops or misses Wall Street's profit forecasts."

Instead, we'll be getting critical information from earnings reports and conference calls on how supply chain woes--ranging from snarled ports to semiconductor shortages--and rising materials costs are affecting companies. In particular, we want to know what company managements are saying about expectations for further inflationary pressures and their ability to pass through cost increases.

Those companies that have the pricing power to quickly raise prices and pass through those higher costs should be largely unaffected. But those that cannot pass through heightened costs will suffer from profit margin compression, and their stocks will get hit.

As earnings roll out, investors should pay particularly close attention to industries such as consumer products and industrials and bellwether stocks such as 3M MMM. And on Thursday, stock market heavyweight Apple AAPL will be reporting earnings. News reports say the company will slash iPhone production thanks to the global shortage of semiconductors. That could lead to a shortage of iPhones this holiday season.

It's still relatively early in earnings season, but for those companies under Morningstar coverage that have already reported, most have generally been in line with expectations. However, the majority of earnings reports have been concentrated in the financial-services sector, mainly banks and asset managers. Those two industries typically are not impacted in the short term from inflationary pressures or supply chain disruptions.

Over this week and next, there may be even more volatility than typical during an earnings reporting season. Considering that we view the overall market as 5% to 6% overvalued, it would not be surprising to see price pressure on a number of stocks after they report earnings this quarter. Price pressure could come from the perspective that many stocks are generally overvalued to begin with, as well as from earnings shortfalls as investors lower valuations on those companies whose margins deteriorate from heightened costs.

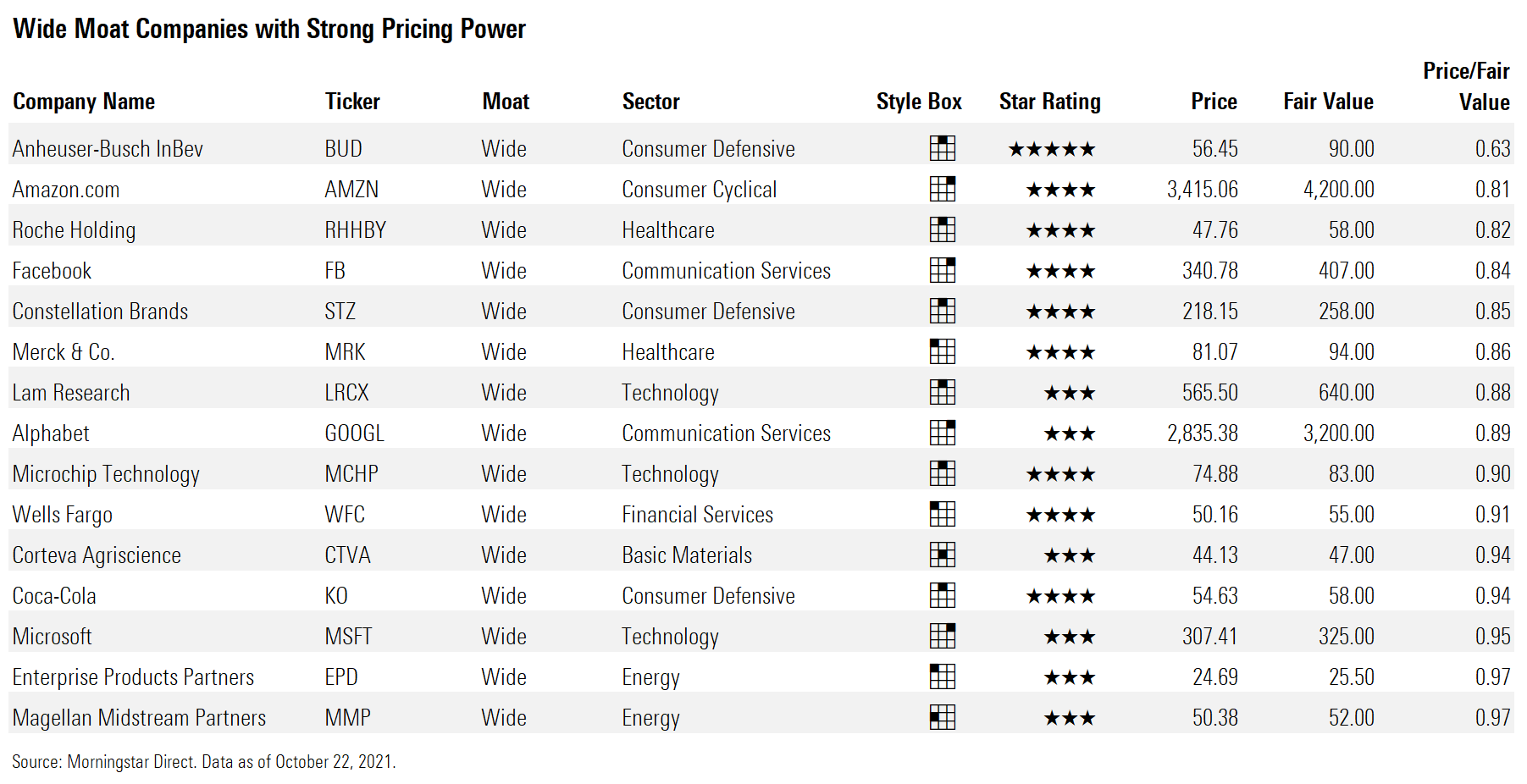

The key for investors will be to determine which of these companies will be able to quickly raise their prices and maintain their operating margin structure versus those that do not have pricing power and will suffer from lower margins. Companies with an economic moat, especially those with a wide Morningstar Economic Moat Rating, will generally have stronger pricing power based on their long-term, sustainable competitive advantages. Economic moat ratings reflect a company's long-term competitive advantage, such as high switching costs or efficiencies of scale. A company with a wide economic moat can fend off competition and earn high returns on capital for many years to come.

Stocks to Watch

Inflation has already started to rear its ugly head and is pressuring corporate profit margins.

One recent example is Procter & Gamble PG, whose report last week could point to rough waters ahead for consumer products businesses.

Procter & Gamble's organic sales rose 4% in the first quarter, reflecting a combination of higher prices and volumes; however, the firm's operating margin contracted by 260 basis points as higher commodities and transportation costs more than offset the increased revenue. It appears that these cost pressures are unlikely to abate over the next few quarters as the company ramped up its full-year expectations for the heightened costs of commodities and freight by 20% from its outlook just less than three months ago.

Yet, while costs will pressure Procter & Gamble's margins in the short term, with its wide economic moat rating, we continue to forecast that the firm will be able to improve its operating margin into the mid-20% area (about 200 basis points above the average of the past three years) over the next five years. As such, we held our fair value estimate unchanged at $118 per share on this 2-star stock.

This week, we will see more earnings releases from companies in sectors that are directly impacted by inflation and supply chain disruptions, such as the industrials sector.

Industrial bellwether 3M reports before the stock market opens on Tuesday, and we expect that investors will be able to glean a significant amount of insight from its conference call. That's because 3M's product portfolio consists of a significant amount of so-called short-cycle exposure, meaning its inventory turnover occurs quickly (that is, an order placed today will be filled tomorrow) and is highly exposed to inflationary pressures. As a result, it requires pricing power to quickly raise prices to protect margins.

3M also has a significant amount of exposure to the industries at the center of the supply chain troubles, such as autos, and to semiconductors through its electronics exposure. Management has already publicly commented on the difficulties in supply logistics such as port congestion and manufacturing disruptions as well as raw material inflation in numerous products. The combined impact of these headwinds is expected to push down the company's margins by 100 to 150 basis points. We'll be listening to hear if management is experiencing any changes in these pressures and whether these issues are easing, remaining consistent, or continuing to worsen.

We give 3M a wide economic moat based on its cost advantages and intangible assets and rate the stock at 3 stars as it is only trading at a slight discount to our fair value. 3M is an innovative powerhouse that leverages its research and development platform across multiple product categories, with byproducts that include patents, brands, and proprietary technology. The key to any changes in our valuation will be based on whether or not 3M is able to quickly pass through these cost increases, and if not, how much of a lag there will be before they can raise prices, or most concerningly, if any lag would result in a lower margin structure over the long term.

Moats Matter

Over the past few quarters, we have highlighted that across an otherwise overvalued market, companies that we rate with a wide economic moat are generally fairly valued, but no-moat and narrow-moat companies are overvalued. In addition to valuation, we have also focused on wide-moat companies this year as we expect that they have the best ability to pass through cost increases more quickly than no-moat or even narrow-moat companies.

Among the stocks of the company's we rate with a wide economic moat, here are those that we think have strong pricing power and are currently undervalued to fairly valued:

/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HHSXAQ5U2RBI5FNOQTRU44ENHM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/737HCNGRFLOAN3I7RKGB7VPEKQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)