The Number of New Sustainable Funds Hits an All-Time Record

Sustainable fund assets continue to surge higher in the third quarter.

Sustainable Fund Flows Slide for the Second Consecutive Quarter

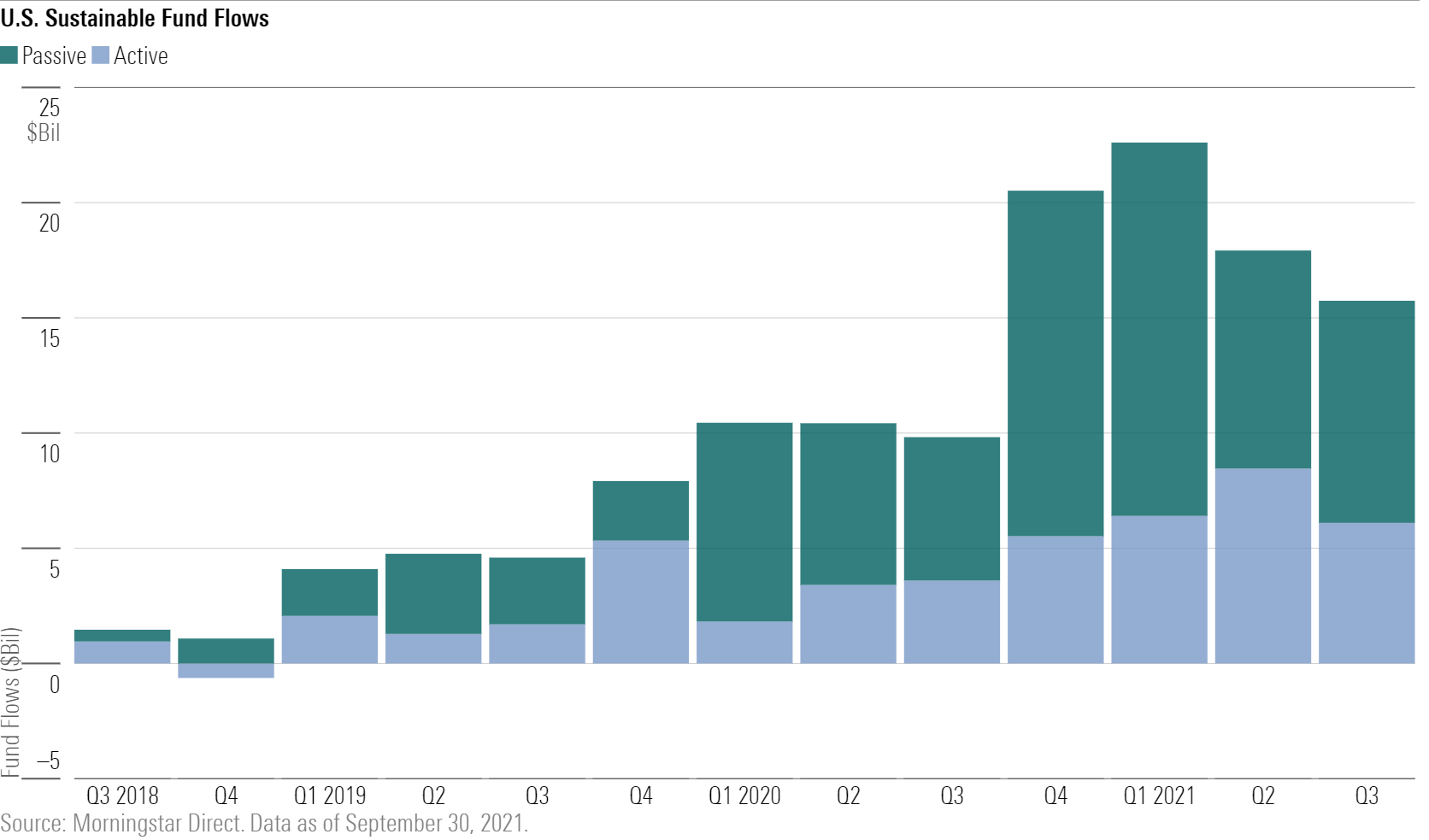

During the third quarter of 2021, flows into sustainable funds dipped below their first-quarter peak in the United States.

In the third quarter, the U.S. sustainable fund landscape saw $15.7 billion in net inflows. That's less than the all-time record of nearly $21.5 billion set in the first quarter of 2021, but it is higher than the $9.8 billion seen one year ago in the third quarter of 2020. The broader U.S. fund market also saw lower net inflows for the period. To put it in perspective, flows into sustainable funds dipped by 12% in the third quarter, but flows into the broader U.S. market dipped by 29%.

Flows into active sustainable funds dipped relative to the all-time record set in 2021's second quarter, attracting $6.1 billion for the period. Passive sustainable funds still dominated their active peers but by a smaller degree than in the past. Passive funds attracted net inflows of $9.6 billion for the period. This represented 61% of all U.S. sustainable flows, compared with the record 83% in the first quarter of 2020.

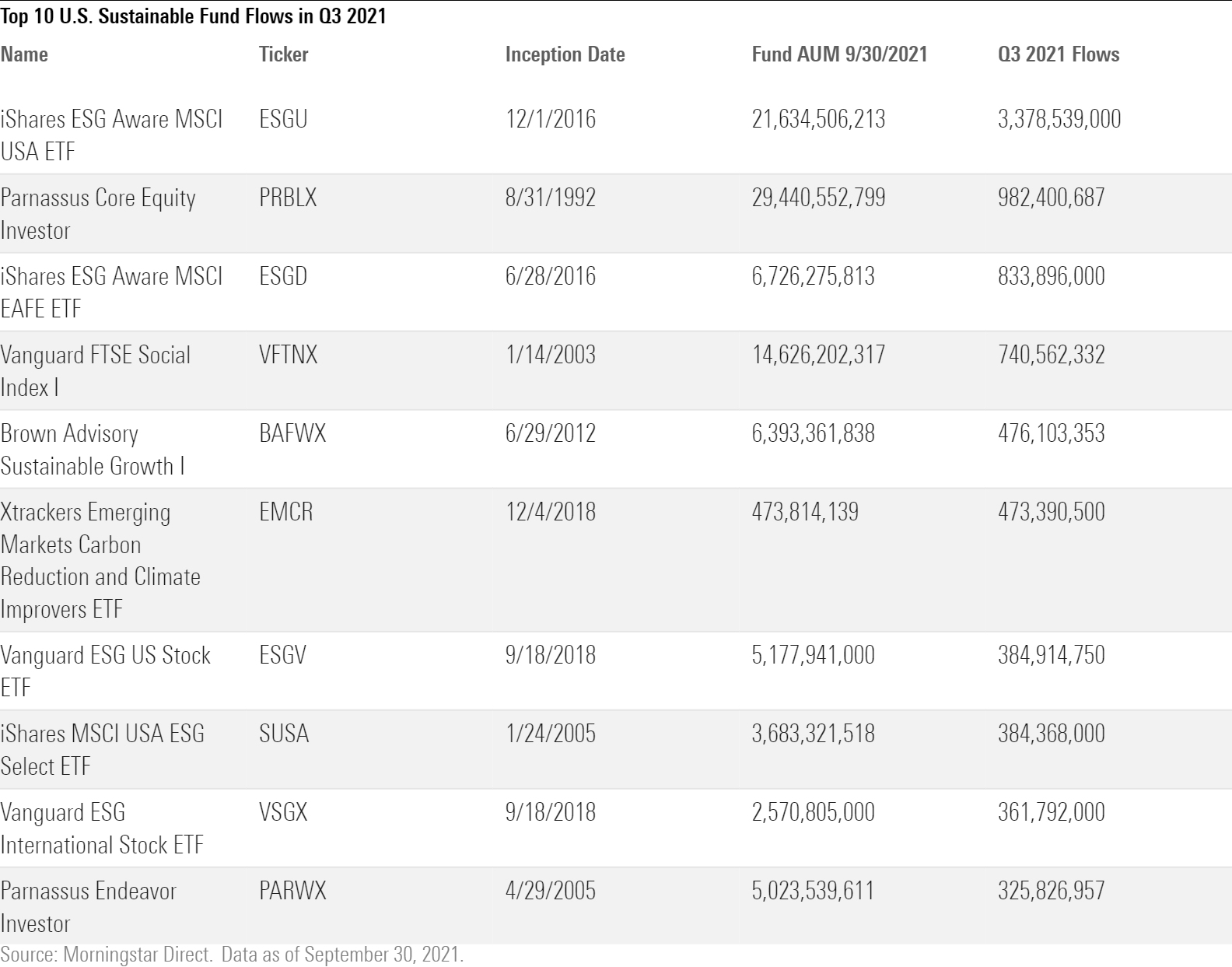

Still, seven of the 10 funds attracting the most flows in the third quarter of 2021 were passive funds, and all 10 were equity funds. Six of those were also in the top 10 for the previous quarter: iShares ESG Aware MSCI USA ETF ESGU, Parnassus Core Equity PRBLX, iShares ESG Aware MSCI EAFE ETF ESGD, Vanguard FTSE Social Index VFTNX, Vanguard ESG U.S. Stock ETF ESGV, and Parnassus Endeavor PARWX. Notably, iShares ESG Aware MSCI USA ETF topped the list for the second consecutive quarter.

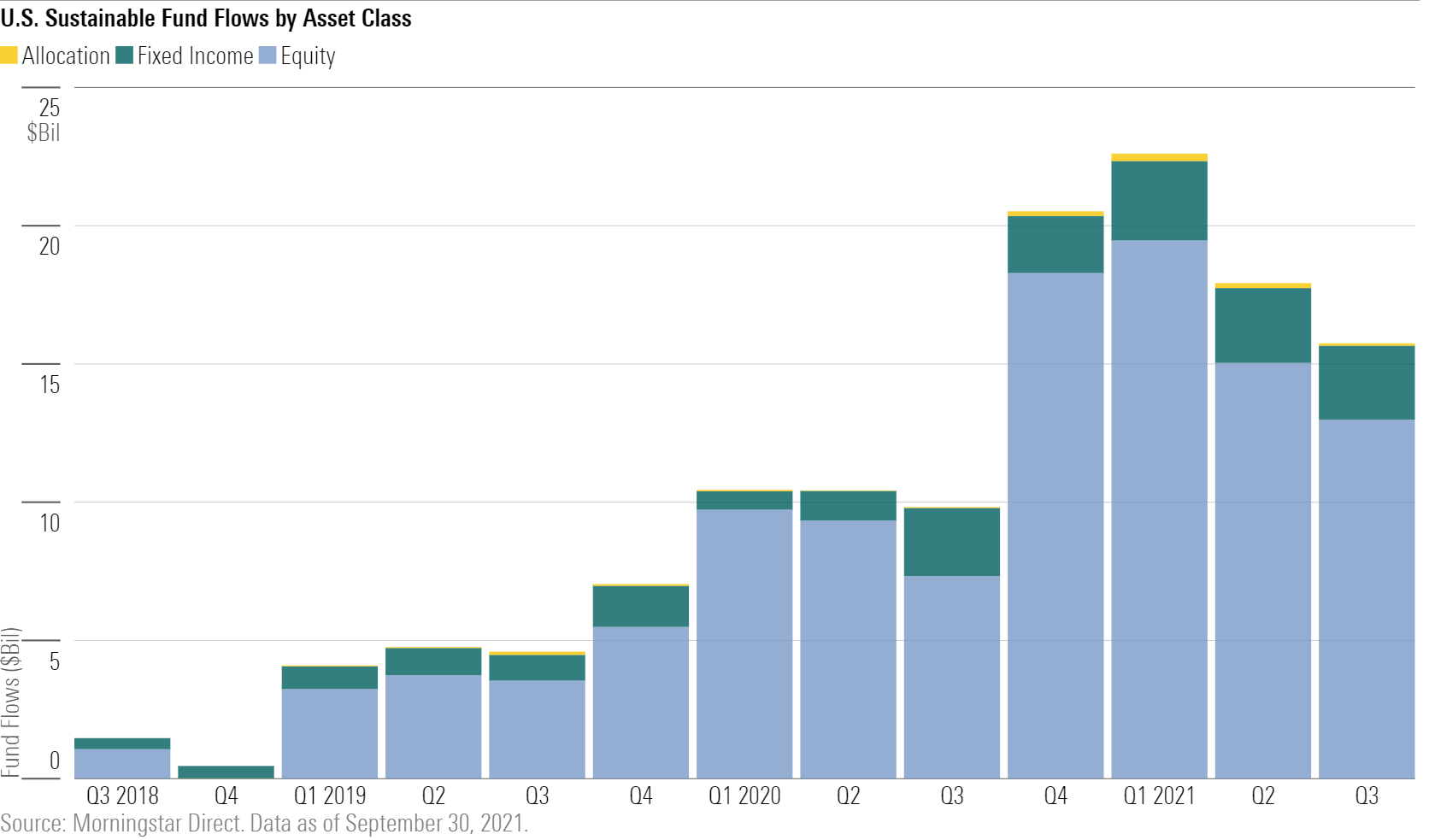

Equity funds made up the lion's share of flows, as they typically do. In the third quarter, equity funds attracted $13 billion, or 83% of all sustainable fund flows. On average over the three years ended March 2021, equity funds attracted 76% of U.S. sustainable fund flows, peaking at 93% of flows in the first quarter of 2020.

Flows into sustainable fixed-income funds have been growing steadily. They crossed the $2.0 billion threshold for the first time in the third quarter of 2020, and they have stayed above that mark since. In the third quarter of 2021, they netted $2.7 billion. The best-selling sustainable fixed-income fund was TIAA-CREF Core Impact Bond TSBIX, which attracted just over $299 million for the period.

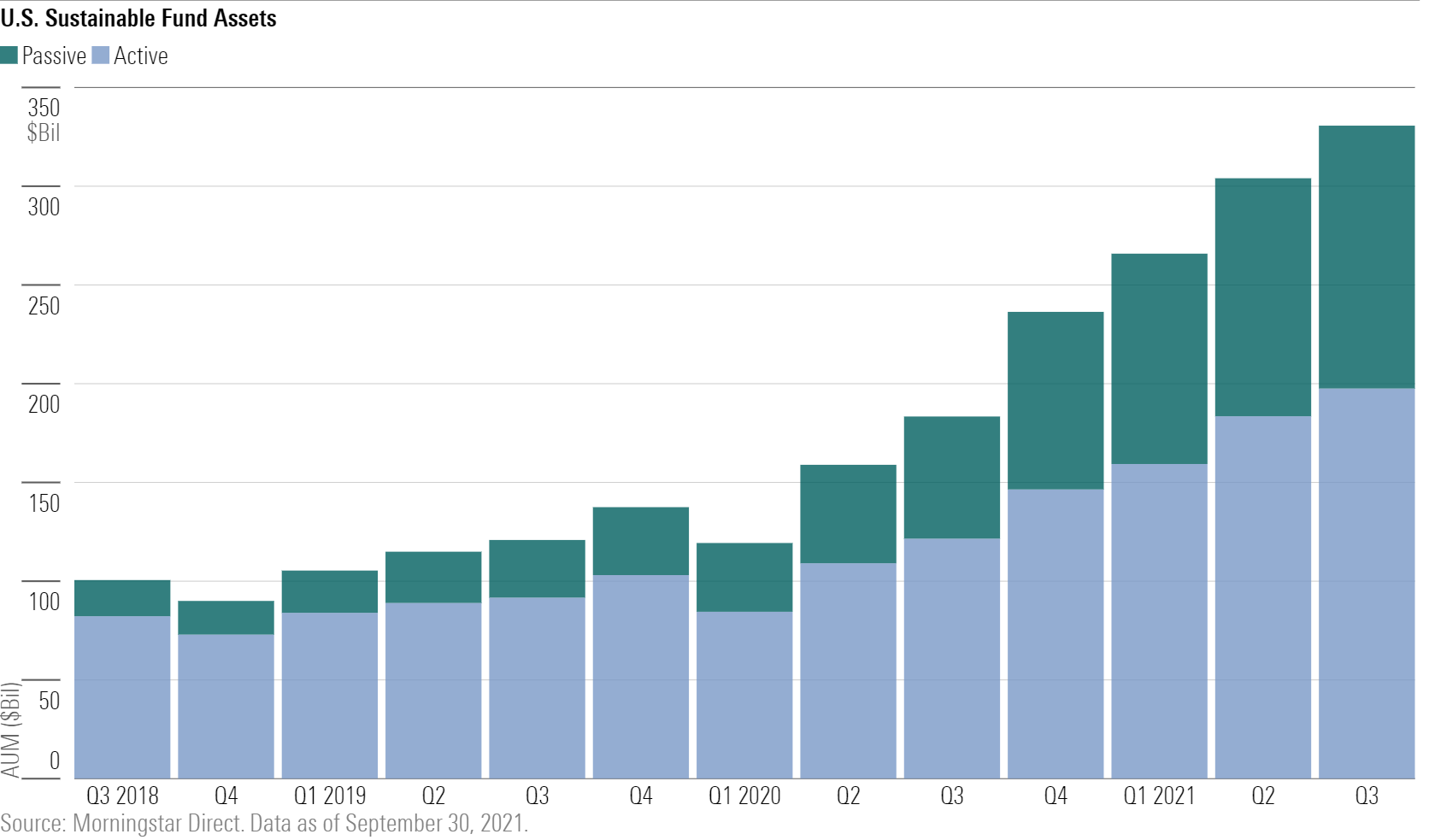

Assets in Sustainable Funds Hit a New Record

Assets in U.S. sustainable funds have stayed on a steady growth trajectory. As of September 2021, assets totaled more than $330 billion. That's a 9% increase over the previous quarter and 1.8 times the $183 billion from the third quarter of 2020. Active funds retain the majority (60%) of assets, but their market share is shrinking. Three years ago, active funds held 81% of all U.S. sustainable assets.

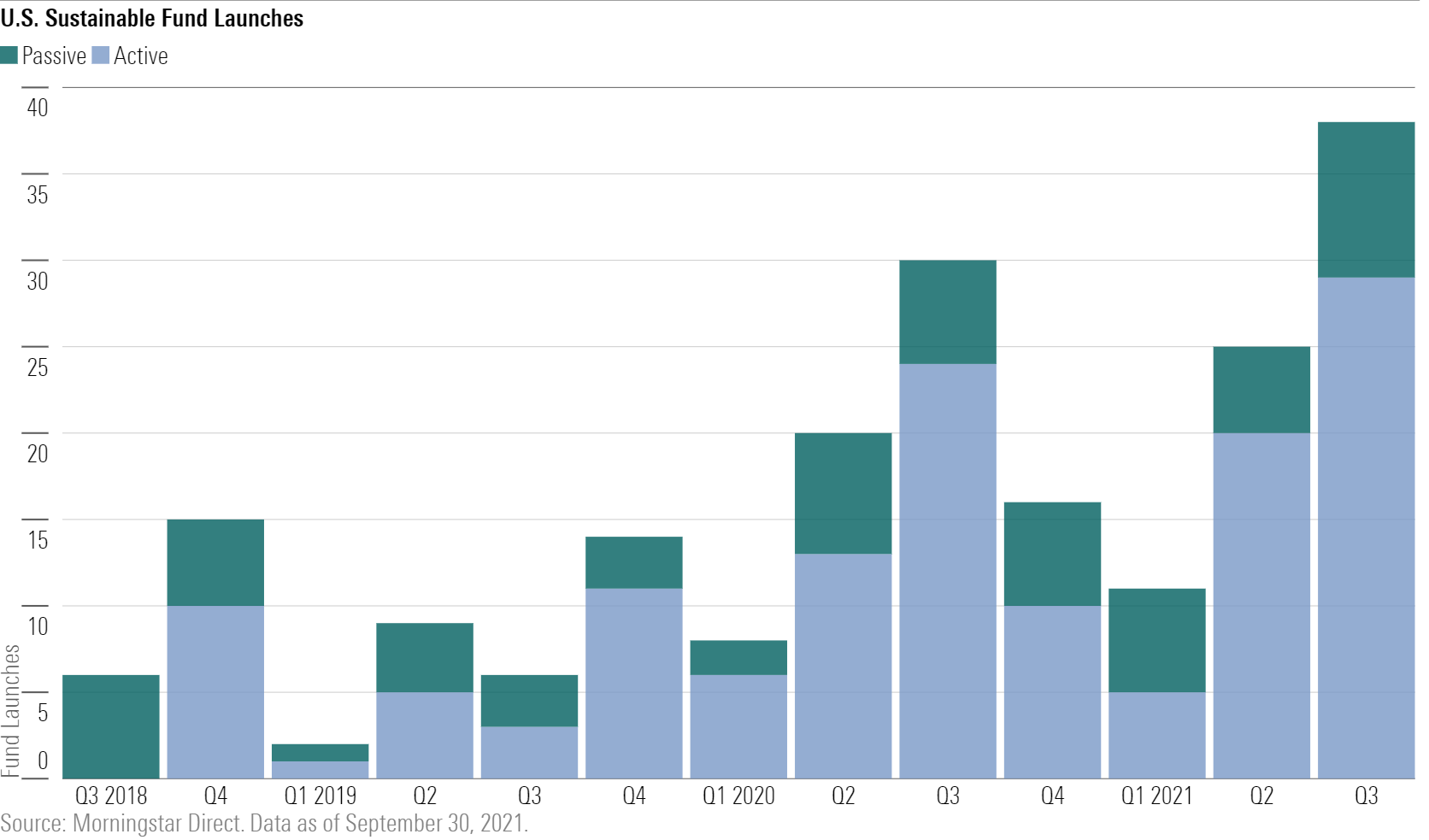

A Record Number of New Funds Launch With Sustainability in Mind

As U.S. flows into sustainable funds have gained traction, asset managers have responded by growing their sustainable fund lineups. In the third quarter of 2021, 38 funds with sustainable mandates were launched in the U.S. This is the highest number of sustainable funds launched in one quarter, beating the record of 30 funds set in the third quarter of 2020. Of those 38, 29 were equity funds, and 25 were exchange-traded funds.

Once again, most of the new sustainable funds available in the U.S. are actively managed offerings. Fifteen of the new funds focus on climate action, such as Goldman Sachs Future Planet Equity ETF GSFP, which targets environmental sustainability themes, including clean energy, resource efficiency, sustainable consumption, the circular economy, and water sustainability. Two of the new offerings focus on the theme of affordable housing: Impact Shares Affordable Housing MBS ETF OWNS and MetWest ESG Securitized MWESX.

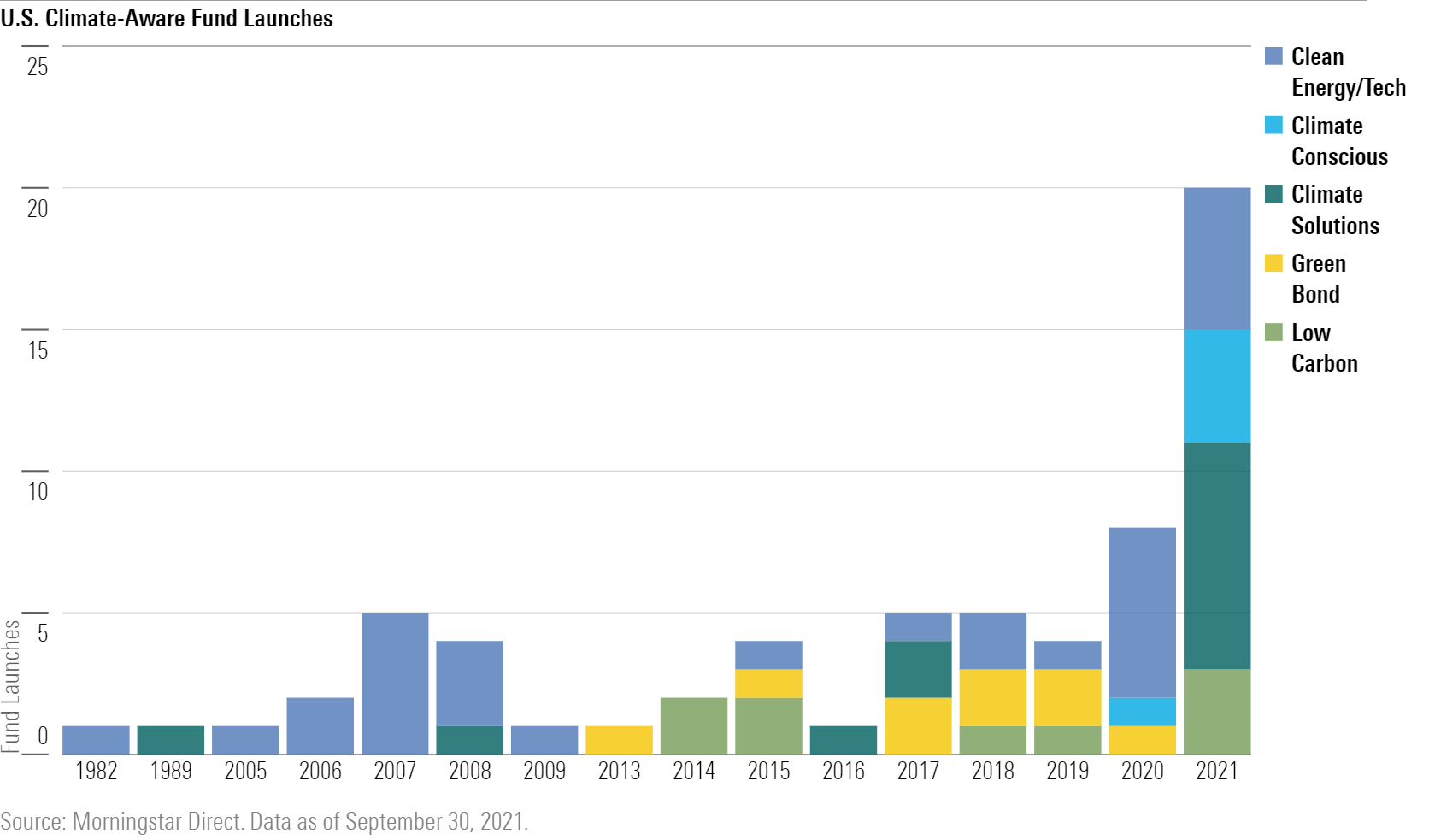

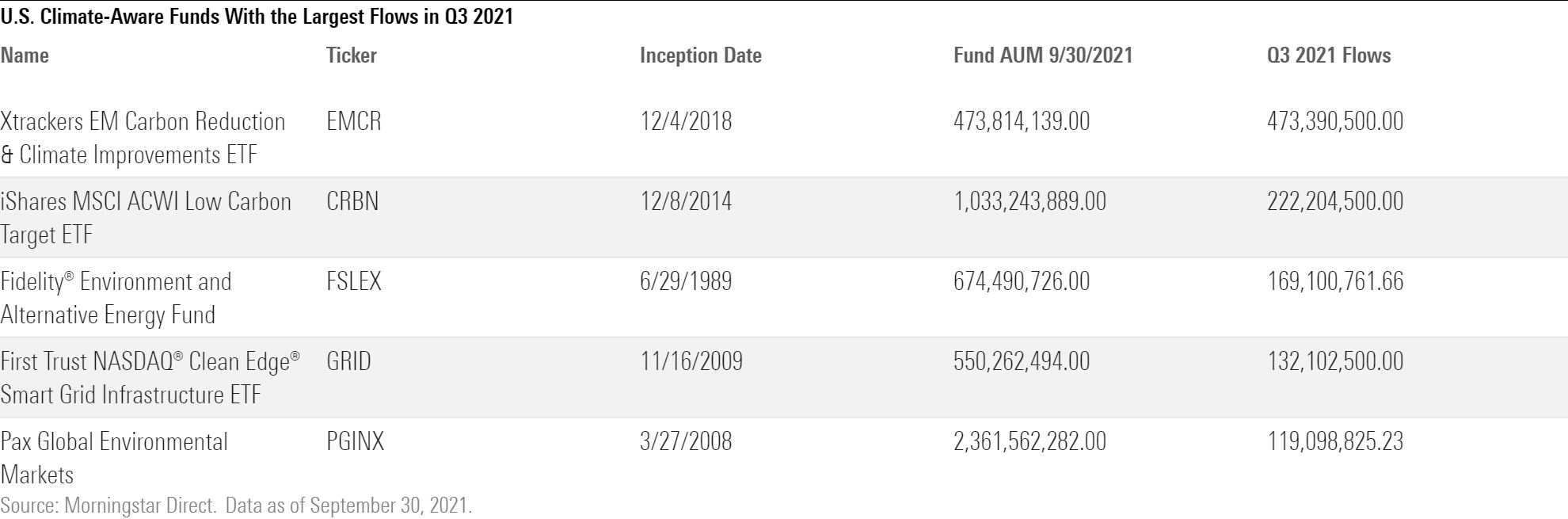

A Record-Breaking Year for Climate-Aware Funds

In the first three quarters of 2021, 20 climate-aware funds launched in the U.S. This is already more than in any previous year, bringing the total number to 65.

In our report "Investing in Times of Climate Change," we dig into the global landscape of climate-aware funds. We group climate-focused products into five categories:

- Low carbon funds seek to invest in companies with a educed carbon intensity and/or carbon footprint relative to a benchmark index. These funds are well diversified.

- Climate conscious funds select or tilt toward companies that consider climate change in their business strategies and therefore are better prepared for the transition to a low-carbon economy. These funds are also well diversified.

- Climate solutions funds only target companies that are contributing to the transition to a low-carbon economy through their products and services and that will benefit from this transition. These funds are less well-diversified and tilt toward industrials and technology.

- Clean energy/tech funds invest in companies that contribute to or facilitate the clean energy transition. These funds are concentrated in the industrials and technology sectors.

- Green bond funds invest in debt instruments that finance projects facilitating the transition to a green economy.

All but one of the climate-aware funds launched this year have been equity funds, and 17 have been ETFs. Half of the funds in this cohort are actively managed.

Repurposing Funds for Sustainable Outcomes

Most of the new options available to investors were launched with sustainable mandates, but firms also occasionally change the investment strategies of existing funds to target sustainable outcomes. In the third quarter of 2021, four equity and two fixed-income funds were repurposed to adopt sustainable mandates. The largest fund repurposed to incorporate sustainability was JPMorgan Small Cap Sustainable Leaders VSSCX, with $318 million in assets. The fund seeks to invest in companies that are sustainable leaders, according to the firm's proprietary qualitative framework.

The new offerings and the repurposed funds brought the total number of sustainable open-end and exchange-traded funds in the U.S. to 484 at the end of the quarter.

For global sustainable fund flows for the third quarter, read our full paper.

Editor's Note: This version of the article has a corrected Flows table and removed reference to the number of top flow-getters launched in the third quarter.

/s3.amazonaws.com/arc-authors/morningstar/987376c2-20a0-406b-b3ec-df530324b39c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/987376c2-20a0-406b-b3ec-df530324b39c.jpg)