Why Are Bank Stocks Doing So Well in 2021?

The latest earnings for big banks show strong profits and fewer bad loans.

Financial stocks are extending an already sizable 2021 rally as the country's biggest banks post strong third-quarter earnings, thanks to a hot market for corporate deal-making and an economic recovery that led to fewer bad loans than they had expected during the height of the pandemic.

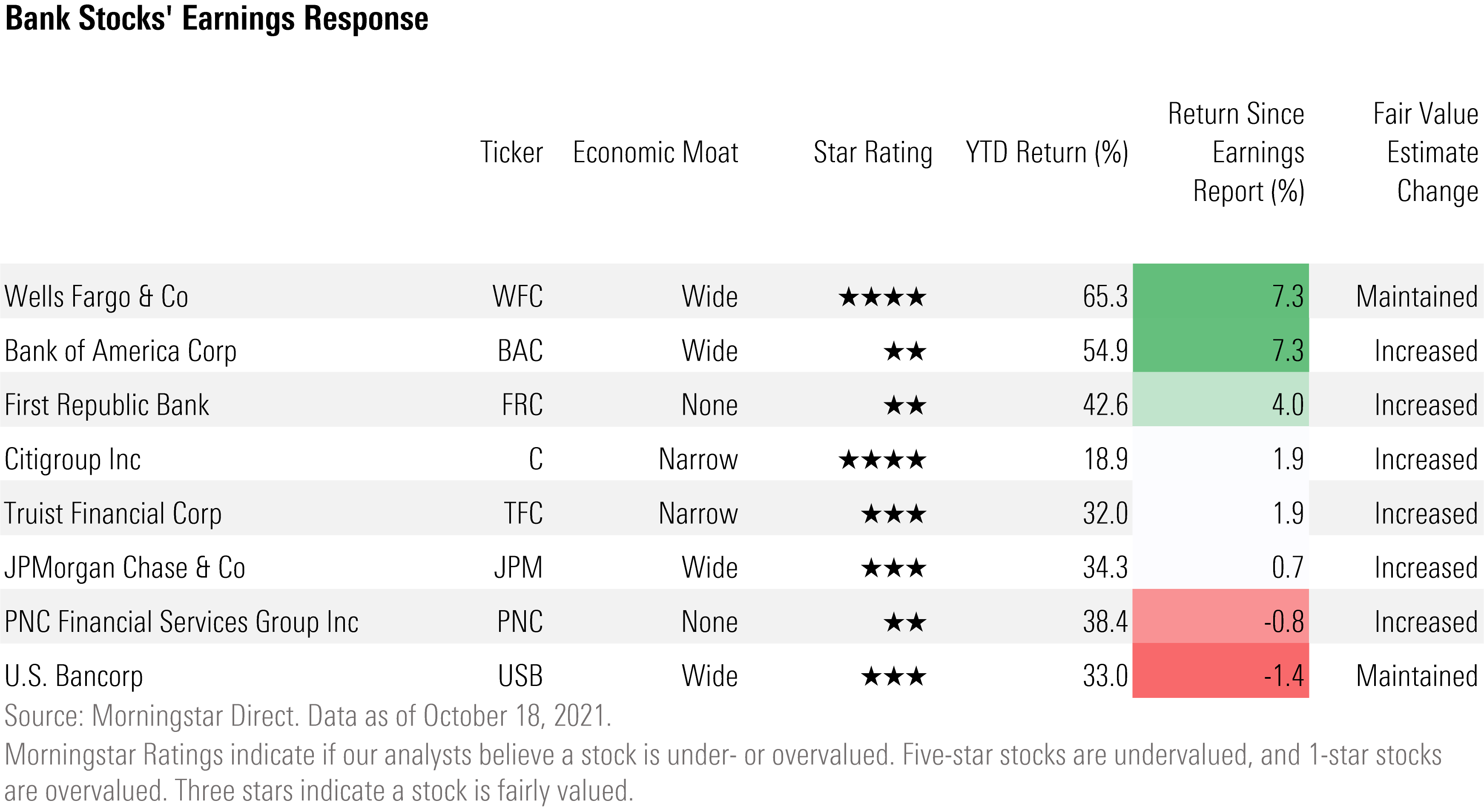

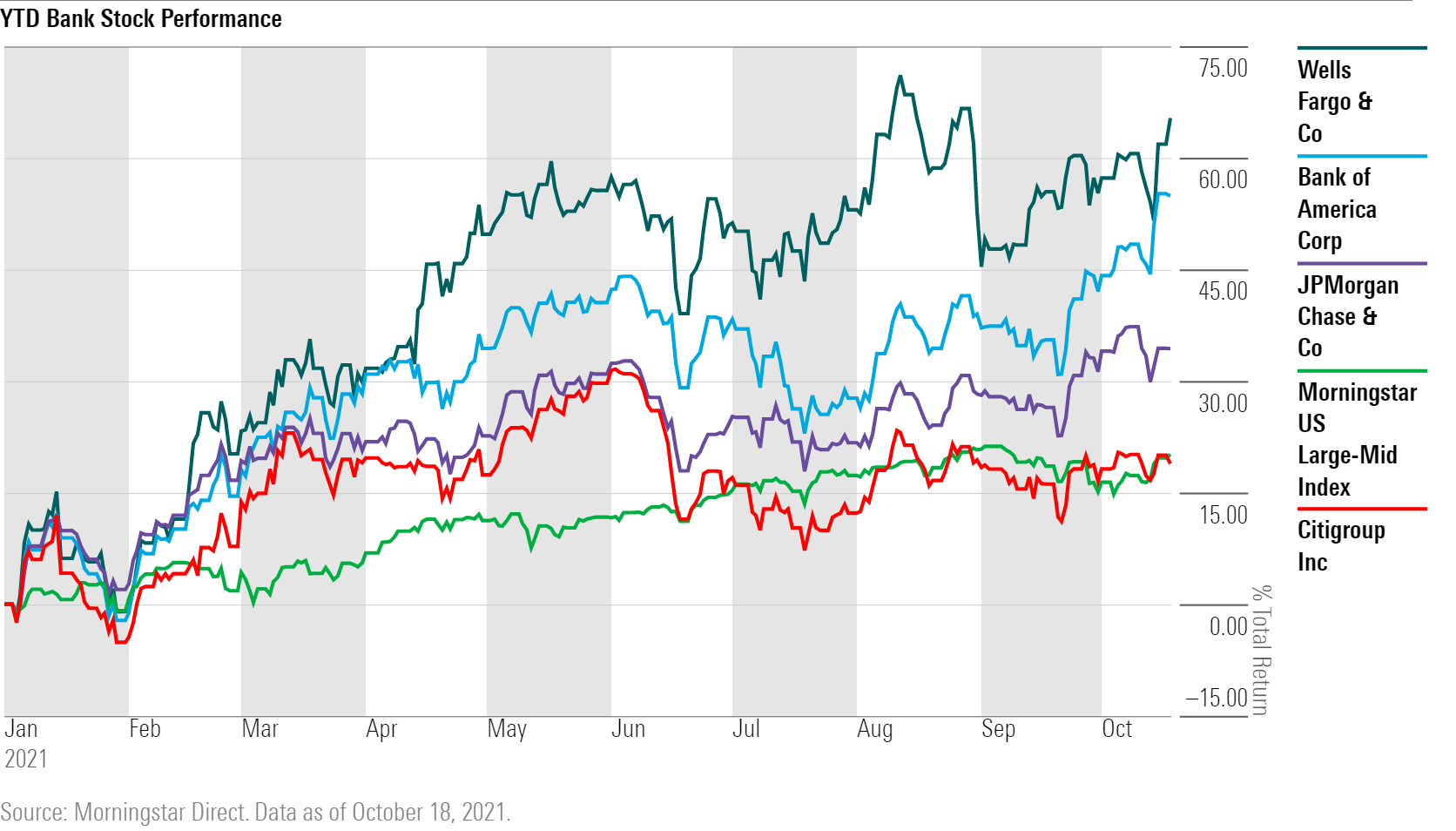

In recent days, heavyweights like JPMorgan Chase JPM and Bank of America BAC solidly beat earnings expectations for the third quarter. Bank of America, along with Wells Fargo WFC, is up more than 7% since reporting earnings. Against this strong earnings backdrop, for six of the largest banks, Morningstar analysts have raised their estimates of the stocks' value.

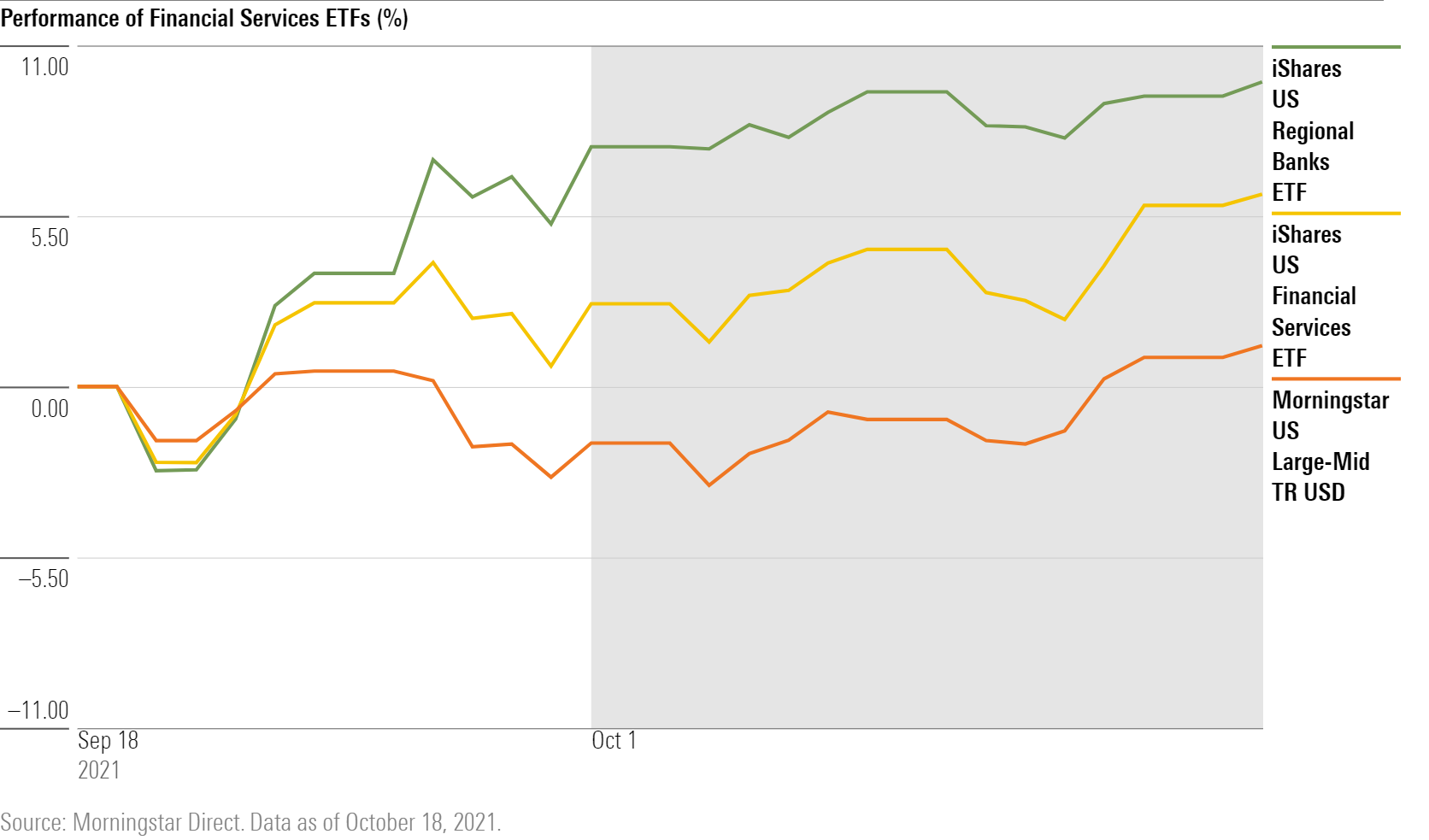

This has played out in strong gains for bank-heavy financial exchange-traded funds such as iShares U.S. Financial Services ETF IYG--whose top holding is JPMorgan--which has rallied 6.2% since Sept. 19 and is up 33.5% so far in 2021. IShares U.S. Regional Banks ETF IAT has gained 9.8% over the past month and 41.2% year to date. Meanwhile, the Morningstar US Large-Mid Cap Index is up just 1.3% in the past month and 20.1% in 2021.

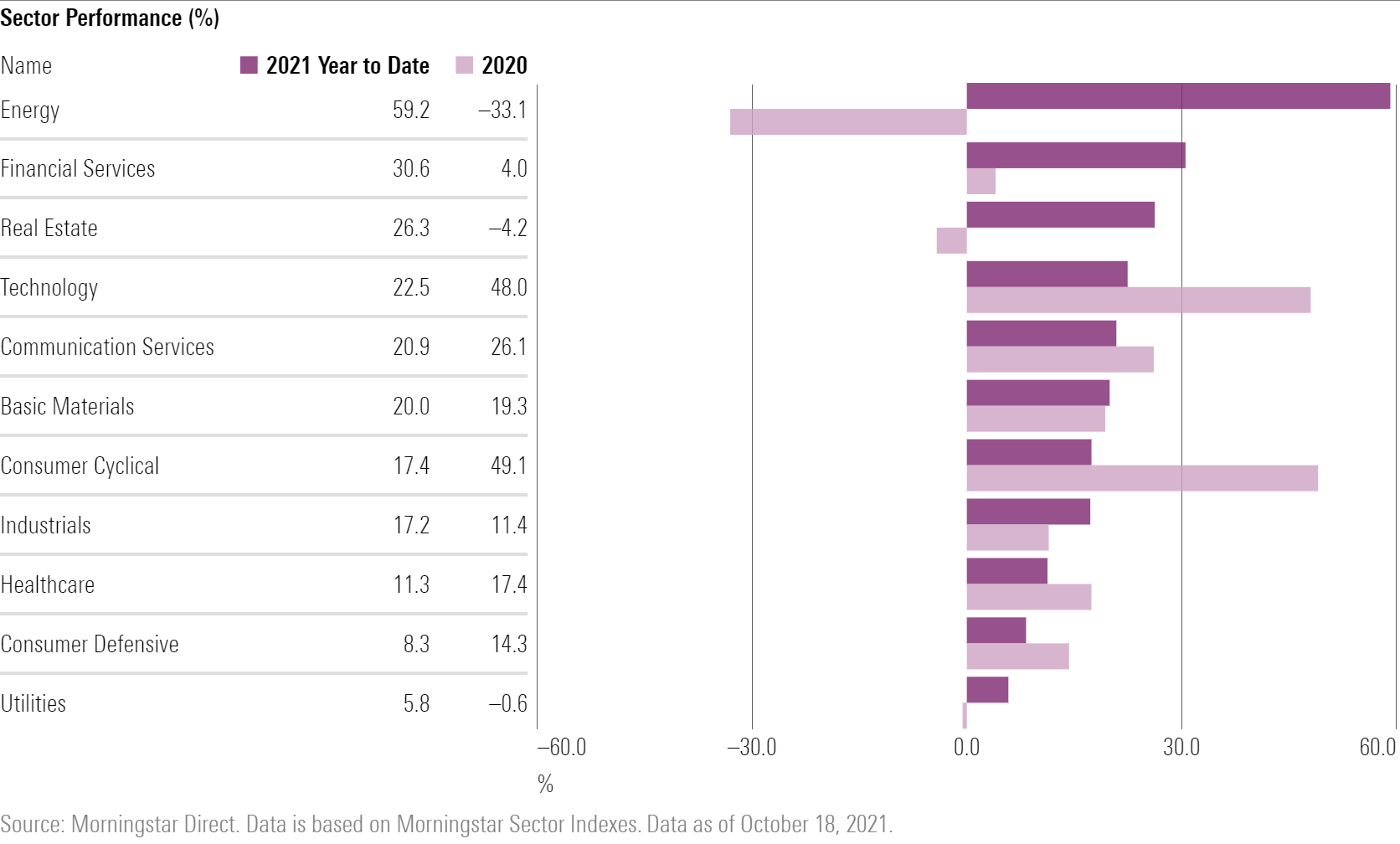

Financials, broadly, have been the second-best-performing sector in the U.S. stock market in 2021, lagging only energy stocks, which surged on the back of higher oil prices. Financials were far behind in 2020, weighed down by concerns about the impact of the pandemic-driven recession as lenders marked down loan portfolios in anticipation that large numbers of borrowers would be unable to make their payments.

The latest leg up for financials has come following third-quarter earnings.

One factor giving a boost to bank profits has been the reversal of 2020's loan-loss reserves set aside amid the recession. When banks set aside provisional cash to cover any loans that go bad, two things can happen to these reserves: If loans are repaid, the reserves get added back to the balance sheet as earnings, and if loans go bad, the reserves get converted to losses in the form of net charge-offs. This quarter, Bank of America was at a 50-year low for net charge-offs, according to Morningstar senior equity analyst Eric Compton.

While that 2020 headwind has turned into a tailwind, Compton thinks the loan-loss reserves story is now nearly played out. "It's hard to tell exactly, but I'd say banks are about 80% done releasing the loan-loss reserves," he says. "You'll see a few small reserve releases, I think, for the next several quarters. However, they won't be nearly as large as what we've witnessed in the first half of 2021."

While the reversal of loan-loss reserves had largely been predicted for this year, an unexpected boost to profits has come from fees earned in a booming mergers and acquisitions market, along with a strong pipeline of initial public offerings, including special-purpose acquisition companies, or SPACs.

That, of course, has benefited traditional investment banking firms, such as Goldman Sachs GS, which financial-services equity research director Michael Wong notes had its second-best quarter in its history with financial advisory and wealth management services reaching record revenue levels.

But the big diversified banks have also benefited from their investment banking operations. Eric Compton points to JPMorgan, which generally has earned between $500 million and $700 million per quarter in advisory-related fees. In the most recent quarter, JPMorgan pulled in $1 billion. Compton notes a similar story at Bank of America, which earned just over $600 million in advisory fees in the third quarter, up from a typical range of $200 million to $400 million.

Morningstar analysts expect the high-volume fee environment to hold up. "Investment banking shows no sign of letting up," explains Compton.

One potential positive for banks going forward are rising interest rates, which translate into higher net interest margins--essentially the difference between what banks can lend versus the cost of borrowing. "The yield environment is still not as strong as it could be for banks," says Compton. "We have recovered from July and August's lows, but the federal-funds rate hasn't gone up yet. We expect the federal-funds rate to rise in late 2022."

The downside for investors looking to put money to work in financial stocks is that thanks to this year's rally, opportunities to find undervalued banks are scarce. Just three U.S. banks on the Morningstar's coverage list are currently trading at 4- or 5-star prices: Wells Fargo, Citigroup C, and Huntington Bancshares HBAN.

Here's a look at Eric Compton's take on the largest U.S. banks.

JPMorgan Chase

"Wide-moat JPMorgan reported excellent third-quarter earnings, beating the FactSet consensus estimate of $3.00 per share with reported earnings per share of $3.74. The bank once again benefited heavily from reserve releases, which totaled roughly $2 billion this quarter. Excluding the release of reserves, EPS was closer to $3.03, and the bank's return on tangible common equity was closer to 18%. As we had expected, reserve releases are slowing down, and the latest release gets the bank pretty close to our estimate of 'normalized' reserve levels. Although we believe that there are potentially more reserves for the bank to release, we think it might be less than $1 billion that remains on JPMorgan's books.

"Management essentially left its 2021 guidance unchanged, with the main update being a decrease in expected card net charge-offs to 2.0% for the year from 2.5%. After updating our projections, we are increasing our fair value estimate for the bank to $149 per share from $143. This change was driven by time value of money (roughly $2), lower expected credit costs, and higher fees."

Bank of America

"Wide-moat Bank of America recorded solid third-quarter earnings, beating the FactSet consensus EPS estimate of $0.71 with a reported EPS of $0.85. Like peers, Bank of America is seeing historically strong credit quality as net charge-offs fell to 20 basis points of average loans--a 50-year low. Asset improvements led to a provision benefit of $624 million and a $1.1 billion release in reserves. Credit wasn't the only item that outperformed our expectations, as wealth management and investment banking fees came in ahead of our projections.

"The bank also seems poised to reach its goal of gaining an additional $1 billion in its quarterly net interest income run rate by the fourth quarter, which we thought the bank might miss. After increasing our net interest income and fee projections, we are increasing our fair value estimate to $38 per share from $35."

Wells Fargo

"Wide-moat Wells Fargo reported middling third-quarter earnings. While the bank exceeded the FactSet consensus estimate of $1.00 per share with reported EPS of $1.17, we think the outlook for expenses and net interest income was a bit soft. Even after excluding the $250 million charge related to recent issues with the Office of the Comptroller of the Currency, the bank's expenses came in a bit above our expectations. Management attributes a good chunk of this to higher revenue, and indeed, fees and salary expenses were two key items that came in above our expectations.

"Management was reticent to give any guidance for 2022 and instead deferred to next quarter's call. Net interest income was also a bit weak, and we expect it to come in at the very bottom of management's previous guidance of down 0% to 4%. The one bright spot was fee growth, with investment banking, wealth, mortgage, and service fees all exceeding our expectations, a pattern we have seen with peers as well."

Citigroup

"Narrow-moat Citigroup reported decent third-quarter earnings, easily beating FactSet consensus EPS of $1.71 with reported EPS of $2.15. The bank benefited from a provisioning benefit once again, as credit costs remain nonexistent. Charge-offs have been exceptionally low for the industry this quarter, and Citi's card balances have also fallen substantially, further helping to lower the bank's credit costs. Expenses continued to build, up 3% over last quarter as the bank continues to invest in its back-end and regulatory initiatives. Revenue would have been up roughly 2% if not for the estimated $680 million loss on the bank's sale of its consumer operations in Australia. It's good that the bank is pruning some of its less successful operations, but this serves as a reminder of some of the bad investments the bank has made over the years.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ROHC7ZXJXZU7LIKGTTYJTD667I.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TP6GAISC4JE65KVOI3YEE34HGU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)