The Case For (and Against) Bitcoin as Digital Gold

Despite some surface similarities, the two assets are fundamentally different.

Bitcoin, the oldest and largest cryptocurrency based on market value, is often described as digital gold. And on the surface, the two assets have a few things in common. Both assets can be used as stores of value that exist outside traditional government and monetary systems. Both have a limited supply (gold in terms of limited physical supply and bitcoin because it has a built-in issuance cap of 21 million coins), making them a potentially valuable hedge against inflation. Both assets have a relatively low correlation with mainstream asset classes such as stocks and bonds. And both assets attract a fervent core of true believers whose enthusiasm can sometimes border on fanaticism.

Despite these seeming similarities, bitcoin and gold shouldn’t be considered synonymous. In this article, I’ll explain why gold makes a better safe-haven asset and portfolio diversifier, but bitcoin still holds promise for its growing role in global payment networks and transaction processing.

Safe Haven: Advantage Gold

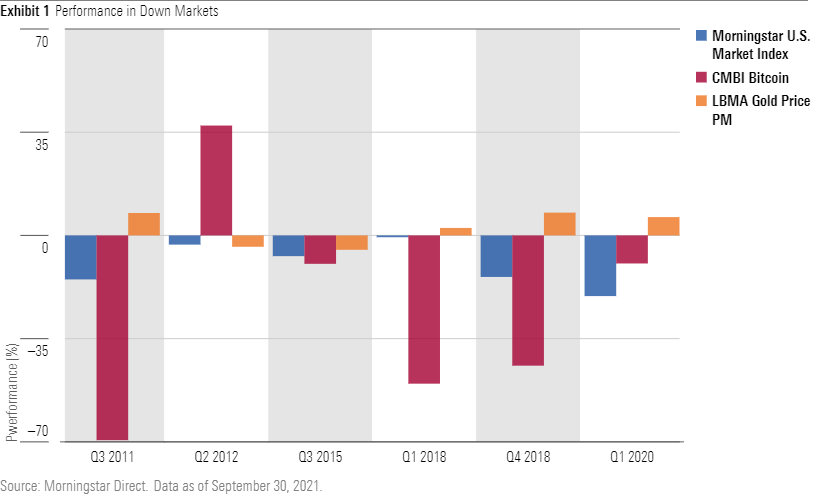

Gold has a much more reliable record as a safe-haven asset. As shown in the chart below, gold has typically generated positive returns during periods of negative equity-market performance, especially during the most dramatic downturns. When the novel coronavirus roiled the market in the first quarter of 2020, for example, gold not only held its value, but actually increased. Bitcoin, on the other hand, moved in the same direction while the equity market dropped, although its losses were less severe. In some previous market downturns, bitcoin lost far more than broad equity market benchmarks. In the fourth quarter of 2018, for example, bitcoin suffered a loss of 44.16%, compared with a 14.08% decline for the overall equity market and a 7.73% gain for gold.

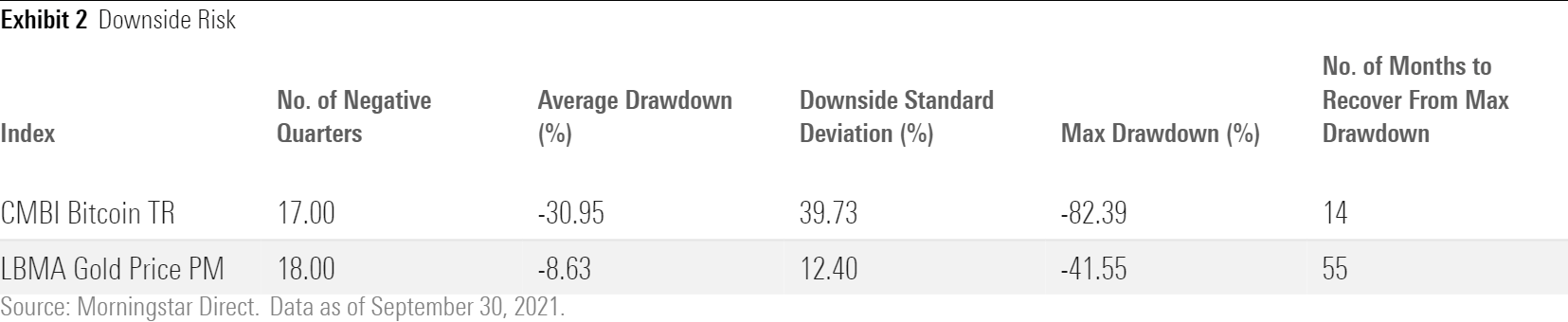

Bitcoin’s volatility profile has some interesting characteristics. As shown in the next exhibit, bitcoin hasn’t suffered more frequent downturns compared with gold; in fact, gold has suffered 18 quarterly losses over the 11-year period since September 2010 compared with 17 for bitcoin. But Bitcoin’s downturns have been far more severe, with an average drawdown of 30.95% versus 8.63% for gold. The bitcoin correction that looms largest for most investors started in 2017, when investors started getting skittish about high-profile security breaches and increasing government regulation. Bitcoin’s price declined from a peak of about $20,000 in December 2017 to about $6,000 by February 2018. Similarly, bitcoin hit an all-time high of about $63,300 in April 2021 but subsequently dropped as low as $28,900 in June as the Chinese government continued cracking down on bitcoin and other cryptocurrencies.

But despite its downside volatility, bitcoin has also generally snapped back quickly, in part because the price has been supported by a broad increase in popularity and adoption in recent years. Even after dropping 82% starting in July 2011, bitcoin bounced back within 14 months. Gold, on the other hand, has gone through prolonged multiyear slumps, such as the nearly 10-year period from September 2011 through July 2020, when it languished below $1,800 per ounce. This highlights the different role in portfolio each asset can play. While gold has been a reliable hedge against market downturns, it’s ultimately not a productive asset. As Warren Buffett has said, it just sits there. Bitcoin, on the other hand, has been more idiosyncratic and prone to downside volatility but has also been much more rewarding on the upside.

Diversification Value: Advantage Gold

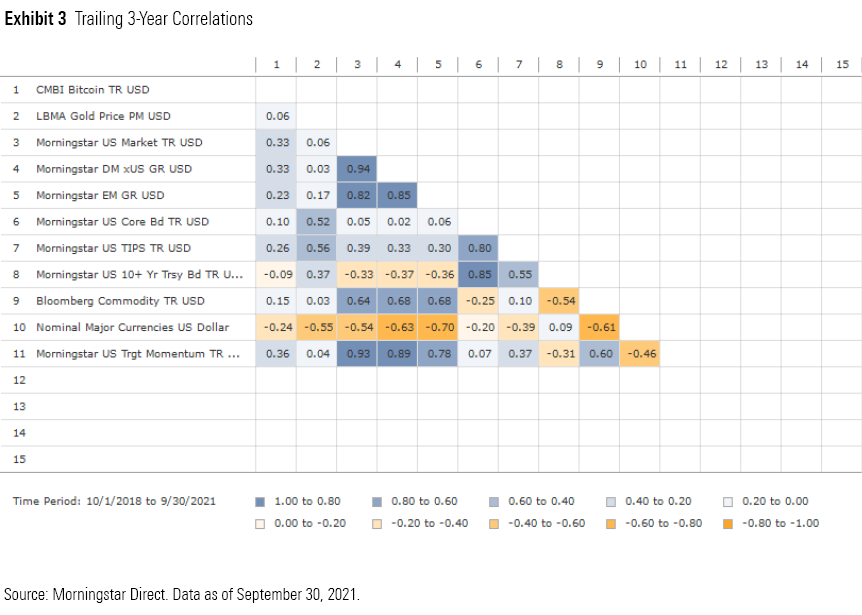

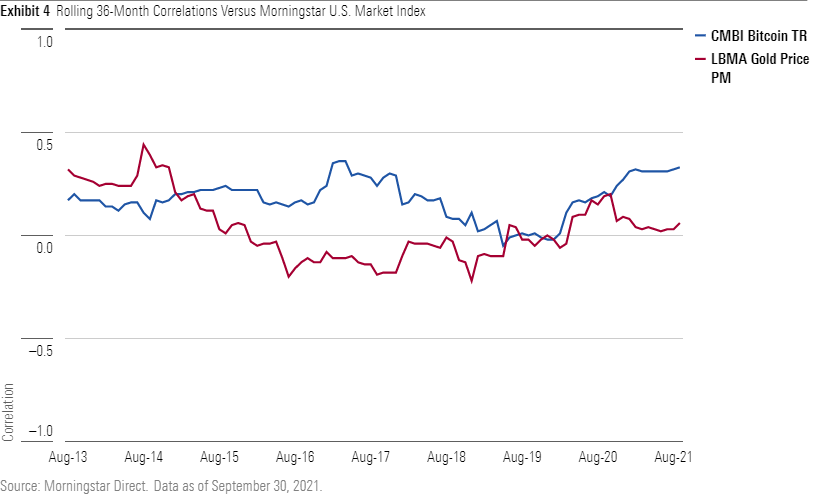

Both bitcoin and gold have fairly low correlations with traditional assets, but gold has the edge in terms of diversification value. As shown in the chart below, gold’s correlation with U.S. and foreign stocks has been close to zero over the past three years, compared with a more positive number for bitcoin. Bitcoin has also shown a positive correlation (albeit a relatively low one) with momentum stocks, underscoring its nature as a more speculative asset.

It’s also worth noting that bitcoin’s correlation with the U.S. equity market has generally trended up in recent years, while gold’s correlation has actually moved lower. For the 36-month period ended Sept. 30, 2021, for example, bitcoin has had a correlation coefficient of 0.33 with U.S. stocks compared with just 0.06 for gold. Over the past 10 years, bitcoin has played an unparalleled role in portfolio construction thanks to its low correlation with stocks, which allowed it to increase portfolio returns without a commensurate increase in risk. Now that bitcoin is moving more closely in tandem with U.S. stocks, its value as a diversification tool is somewhat lower than in the past. (To be fair, bitcoin’s correlation with most major asset classes is still pretty low in absolute terms.)

Both assets have had a negative correlation with the U.S. dollar, but gold has shown a stronger negative correlation against the greenback. Gold typically fares better during periods of U.S. dollar weakness as investors seek out alternative stores of value. In addition, a falling dollar leads to higher commodity production costs, which also tends to shore up gold prices. Bitcoin should also provide some protection against a weaker dollar, but its high volatility and idiosyncratic risk might make it a less reliable hedge.

Bitcoin might have an advantage when it comes to providing a hedge against rising interest rates, though. Over the past three years, gold has had a slight positive correlation with longer-term bonds, meaning that gold prices tend to rise when bond prices are increasing and fall when bond prices are declining. Bitcoin, on the other hand, has had a negative correlation with longer-term bonds, which could be valuable during periods of rising interest rates.

Inflation Hedge: Draw

Part of the narrative of bitcoin as digital gold relies on the idea that it should hold its value as a long-term hedge against inflation. While gold has a somewhat mixed record as a shorter-term inflation hedge, its rarity, beauty, and usefulness in jewelry and industrial applications have helped gold maintain its value over longer periods.

Bitcoin, on the other hand, has no intrinsic value; instead, its value is mainly based on what people are willing to pay, as well as potential network effects. As the number of connections and dollar value of transactions processed on the Bitcoin network continue increasing, the price of bitcoin should (theoretically) increase as well.

Bitcoin’s limited supply is another reason often cited for why it should serve as a hedge against inflation. Bitcoin has a built-in “halving” protocol that occurs about once every four years and involves cutting the rewards given to the miners who process and validate all transactions on the blockchain in half, effectively limiting the increase in bitcoin supply. So far, each halving has been followed by an increase in bitcoin’s price. At this point, though, it’s tough to measure bitcoin’s performance as an inflation hedge. Inflation has been unusually low during most of bitcoin’s lifetime, so it’s hard to say how it would fare during a more sustained period of higher inflation.

Digital Money: Advantage Bitcoin

Bitcoin’s strongest advantage against gold may be in its role as an alternative to traditional fiat currencies. Gold has long been used as a medium of exchange (dating back to ancient Egypt around 1500 B.C.), but it’s not always practical to haul around large amounts of gold coins or bricks. Bitcoin, on the other hand, is easily portable and transactable. In contrast to gold, it doesn’t require physical storage, although it does involve some extra layers of security (don’t forget the password to your digital wallet!). Compared with gold, bitcoin comes closer to being a form of money because it ticks off the boxes as being a medium of exchange, unit of account, and store of value.

Over the long term, bitcoin also has the potential to emerge as the dominant native currency for the Internet. As a peer-to-peer digital cash system with built-in trust, Bitcoin (the network) is the most established and secure blockchain. Although the Bitcoin network is more limited than some competing protocols in the number of transactions it can process, it's by far the most secure settlement layer of Internet money. This security advantage means it will likely evolve as the dominant platform for large, institutional transactions. As the dollar value of transactions processed continues rising, the value of the Bitcoin network should also increase. That, in turn, would be positive for the value of bitcoin (the currency), because the currency and the network are interdependent. The currency and the network are inexorably linked because the blockchain can't function without a native currency to incentivize the resources required to protect it.

Conclusion

Ultimately, the notion that bitcoin is digital gold stems from an attempt to fit an entirely novel asset class into existing mental frameworks. While bitcoin definitely qualifies as a nonmainstream asset class and potential store of value for investors wary of traditional financial systems, it’s fundamentally different from gold in some important ways. Whether bitcoin will eventually prove itself as a more reliable hedge against inflation and market downturns remains to be seen. For now, it’s best thought of as a more speculative asset that stands to benefit as the first mover in the rapidly evolving cryptocurrency space.

/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PLMEDIM3Z5AF7FI5MVLOQXYPMM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/I53I52PGOBAHLOFRMZXFRK5HDA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CEWZOFDBCVCIPJZDCUJLTQLFXA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)