After Evergrande, Is Fantasia’s Collapse a Sign of Worse to Come?

Fund managers see the stresses on China’s property market as temporary and are on the hunt for bargains.

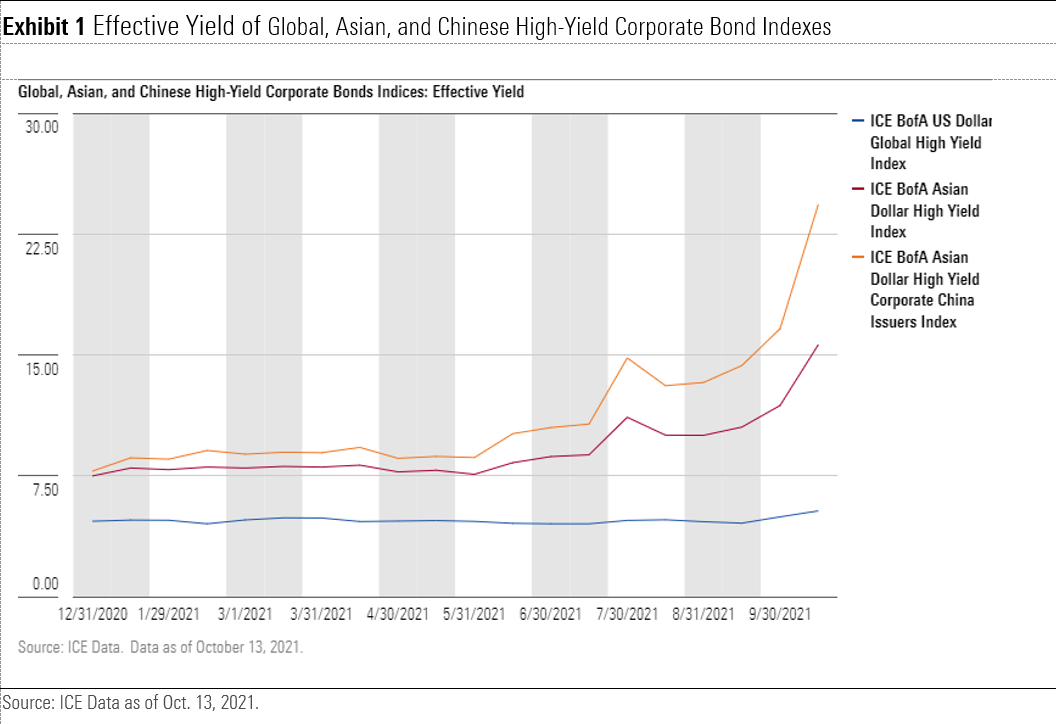

As Chinese property developer Evergrande Group lumbers from one missed bond payment deadline to the next, its troubles continue to reverberate across financial markets. On Tuesday, Oct. 12, Evergrande skipped USD 148 million in interest payments to external bondholders after missing a USD 83.5 million interest payment in late September. By Wednesday, Oct. 13, the yield on the ICE BofA Asian Dollar High Yield Corporate China Issuers Index (where the property sector accounts for more than three fourths of issues) spiked to a 10-year high of 24.3%, up from 7.8% at the end of 2021, as investors rushed to offload bonds tied to the country’s real estate industry. The yield on the broader ICE BofA Asian Dollar High Yield Index also jumped to 15.6% on Wednesday, up from 7.5% in December 2020. Many investors worry that the company’s woes signal broader weakness across the housing market, where high debt ratios are colliding with stringent new funding laws and slowing sales.

Fantasia Holdings Fails to Make Principal Payments

Those fears were stoked further on Oct. 4, when luxury-home developer Fantasia Holdings became the next Chinese real estate company to default, skipping out on a USD 206 million payment to bondholders. Unlike Evergrande, Fantasia had been widely viewed as having the cash needed to meet its financial obligations; as such, the company's failure to pay came as a shock to many. The news was followed this week by requests from a further three Chinese players--Sinic Holdings Group, Modern Land, and Xinyuan Real Estate--to delay upcoming interest payments or restructure their repayment schedules. Many prominent companies in the sector are now watching their debt trade at distressed levels on the secondary market. Some observers fear that the negative market sentiment could become a self-fulfilling prophecy if sky-high borrowing costs prevent other players in the market segment from gaining access to liquidity, triggering additional defaults.

Portfolio Managers Have Largely Stuck to Their Guns …

Three weeks ago, we spoke with a number of fund managers active in the Asian corporate bond space to get their views on Evergrande and its potential impact on the broader Chinese economy. This week, we checked in on those same managers again to see whether Fantasia's stumbles, and the dramatic volatility that has ensued, have changed their outlook. We found that, overall, little had changed in the views they expressed. By and large, these managers view Fantasia's default as an idiosyncratic event rather than a manifestation of systemic risk and expect the current stress in China's property sector to be temporary. Most still expect the Chinese government to intervene to provide liquidity to the sector eventually, but they are bracing for a period of near-term turbulence, including further defaults. All mentioned viewing the current dislocation as an opportunity to find value among cheaply trading bonds. However, one investment manager--TCW--described growing warier of the sector as a result of Fantasia's collapse, which it says could signal a dwindling willingness to pay on behalf of companies in the Chinese property business.

Barings

Omotunde Lawal, Baring’s head of emerging-markets corporate debt, says that neither Fantasia’s default nor the liquidity struggles faced by other developers have altered its investment outlook. She notes that, given the sector’s constant need for funding, any liquidity crunch can send shocks through the system. Lawal views the recent market sell-off as technically driven, not fundamentally driven, and is optimistic that the Chinese government will take steps to inject liquidity into the sector, pointing to the Chinese central bank’s recent statements as supporting this view. She argues that the current market dislocation offers opportunities to buy good companies at attractive prices. Barings has never owned bonds issued by Evergrande or Fantasia in its portfolios. On the other hand, Barings Emerging Market Debt Short Duration and Barings Emerging Market Corporate Bond were among the top owners of debt issued by fellow Chinese real estate developer Kaisa Group as of Aug. 31, with 3.6% and 3.3% stakes, respectively, in the company’s debt, according to Morningstar data.

Pimco

Pimco’s emerging-markets head Pramol Dhawan and Asian credit manager Stephen Chang likewise haven’t changed their outlook as a result of Fantasia’s defaults. In recent comments, they restated that they do not think recent events signal the presence of systemic risk across China’s real estate sector. Noting the sector’s importance to the country’s economy, they expect the Chinese government to intervene to ease mortgage quotas or expand companies’ access to local bond markets if economic data signals that the crisis is prompting a broader slowdown.

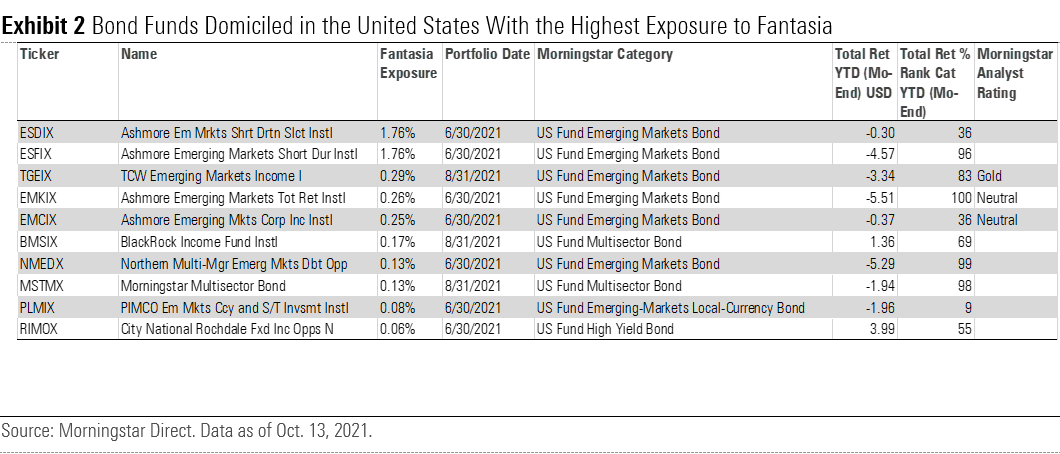

Pimco held some exposure to Fantasia in Pimco GIS Asia Strategic Interest Bond (0.17% as of June 30), which has a Morningstar Analyst Rating of Bronze. Pimco also had exposure in Pimco GIS Asia High Yield Bond (0.79%) and Pimco GIS Emerging Markets Opportunities (0.11%). However, these stakes were smaller than the benchmarks’ exposures, and the managers trimmed the positions throughout the summer and fall. They characterized Fantasia’s default as an example of idiosyncratic risk, not contagion resulting from Evergrande’s troubles. However, they also noted that softening demand for housing will likely make the next six months particularly challenging for Chinese property developers. Pimco therefore continues to focus on developers in coastal Tier 1 and Tier 2 cities, which the managers see as most resilient. Noting the difficulty many companies currently face in getting access to credit given sky-high yields, they aim to stick to firms that won’t need to refinance debt during the next six to nine months. Bonds issued by Guangzhou R&F Properties, Redsun Properties, and Kaisa Group were among the new additions to Pimco GIS Asia High Yield Bond during the month of September, according to Morningstar data.

BlackRock

BlackRock’s Asian fixed-income team was holding an overweight stake in Evergrande and its subsidiary Scenery Journey when last month’s bad news hit the headlines, with a 0.3- percentage-point overweighting in the credit in BGF Asian Tiger Bond (which carries a Silver rating on its cheapest share class) and a 0.2-percentage-point overweighting in BGF Asian High Yield Bond. BlackRock’s Asian bond chief Neeraj Seth also found himself on the wrong side of Fantasia’s bond default this week. BGF Asian High Yield Bond had a 0.2-percentage-point overweighting in the company relative to its benchmark as of September 2021, though this had been trimmed from an 0.7-percentage-point overweighting in June.

The team still expects the Chinese government to intervene to prevent a disorderly collapse of Evergrande, but it recognizes that the recent tightening of financing channels within the property sector may spell additional volatility for less well-capitalized issuers. It favors property developers that have met two or three of the Chinese government’s “three red lines.” One such issuer was Kaisa (3.35% of assets for BGF Asian High Yield Bond as of August 2021), which the team added to in August and liked for its improving credit profile (it currently meets all three red lines) and solid land bank quality (that is, access to desirable land for construction projects).

UBS

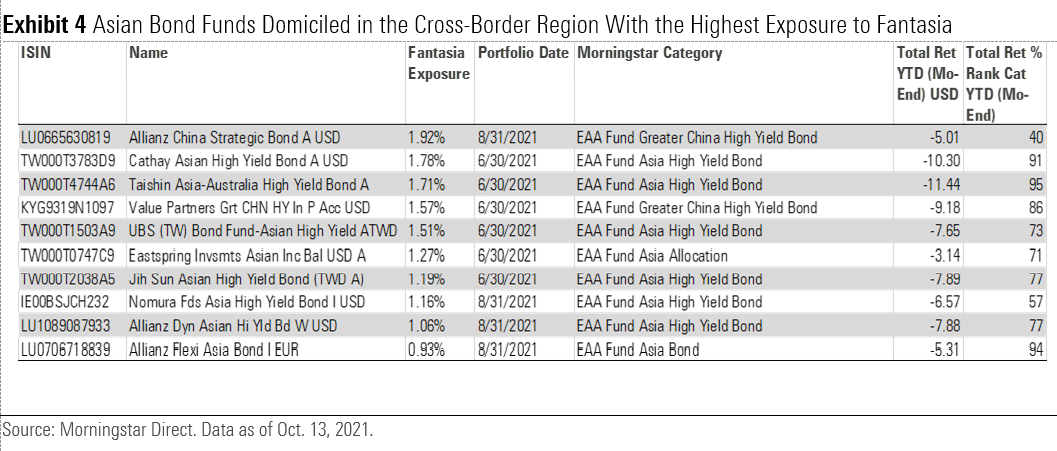

UBS’ Asian credit team also had a small overweighting in Fantasia in its actively managed USD credit portfolios, including a 0.20-percentage-point overweighting in UBS (Lux) Asian High Yield as of the end of September 2021. Unlike Evergrande’s missed coupon payment, Fantasia’s USD 206 million missed principal payment on Oct. 4 was a surprise to the market, according to UBS. The team intends to maintain its exposure to Fantasia and expects recovery values to be in the range of 20-30 cents on the dollar.

Overall, the UBS team continues to believe that an outsize ripple effect on China’s property and banking sector as a result of Evergrande’s fall is unlikely. The managers argue that other developers can replace Evergrande’s share in the market and that, while the troubled developer has USD 300 billion of liabilities, it makes up roughly only 0.2% of China’s total bank assets. Meanwhile, UBS has grown more positive on bonds issued by Evergrande since its default, estimating their recovery value at 30-40 cents on the dollar. (As of early October 2021, Evergrande bonds traded close to 20 cents on the dollar.)

HSBC

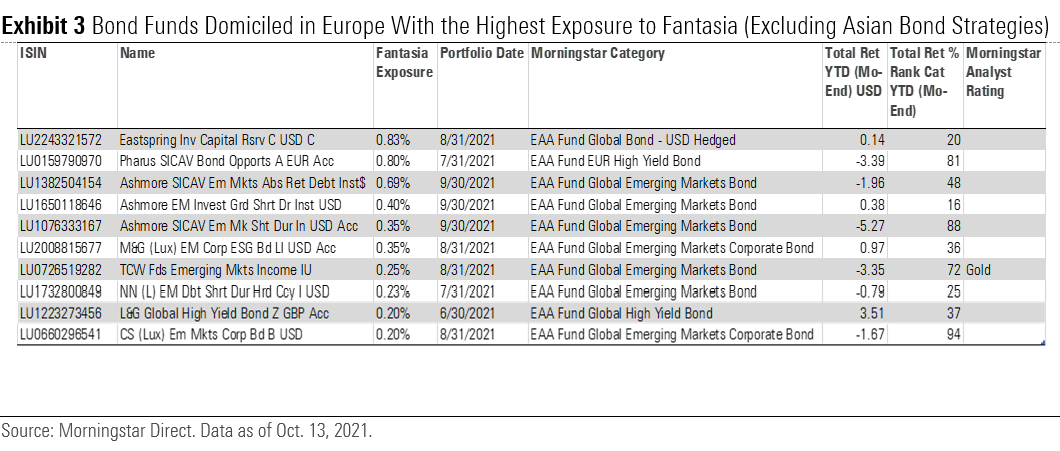

HSBC’s Asian fixed-income investment management head Alfred Mui had kept exposure to Evergrande well below the benchmark weights in his high-yield and investment-grade portfolios but maintained a small overweighting in Fantasia in Neutral-rated HSBC GIF Asia Bond (0.50% to the benchmark’s 0.11% as of August 2021) and in HSBC GIF Asia High Yield Bond. However, Mui aggressively trimmed that stake throughout August and September to well below benchmark levels, citing poor governance and weak project execution as key triggers.

Like many peers, Mui and his team ultimately expect the Chinese government to step in with policy measures to support the property sector. However, noting that the timing for such an intervention is unclear, the managers reduced their property exposure in HSBC GIF Asia Bond from roughly 8.1% to 4.8% between July and September 2021, primarily through the sale of smaller B rated property developers they think are less able to withstand a credit dry spell. Given current low prices, Mui now sees value in short-dated BB rated Chinese developers that he says were oversold and that show a strong capability to service their debts. The team prefers developers such as Kaisa and Sunac, whose management Mui sees as higher quality. He has selectively added here, bringing the portfolio’s China real estate stake up to roughly 5% as of early October.

Ashmore

London-based emerging-markets specialist Ashmore also had significant exposure to the Chinese real estate sector, as of the latest portfolio data communicated to Morningstar (June 2021). In addition to significant holdings in Evergrande, its Emerging Markets Short Duration strategy also held close to 2% of assets in Fantasia. The firm has not yet communicated on any position changes or adjustments since its June 2021 portfolios. However, at the end of September 2021, its managers were still generally positive on the sector, arguing that most issuers, except the most indebted, should survive even in a prolonged period of credit tightening.

… But Some Say Issuers' Reduced Willingness to Pay Could Point to Larger Transparency Issues

BlueBay

BlueBay Asset Management attracted attention in late September when its investment team stated that it had begun adding exposure to Evergrande’s bonds to some of its portfolios, arguing that prices on the company’s short-dated debt fully accounted for its financial woes. (BlueBay had previously experienced some pain caused by a modest overweighting in Evergrande’s bonds in its Emerging Markets High Yield Corporate Bond strategy in the lead-up to the default.) The move was less surprising to those familiar with BlueBay’s recent investments in its distressed debt and special situations expertise, including the creation of a dedicated emerging-markets illiquid corporate credit team. Still, the group was far from upbeat about the overall Chinese property market, noting that any broad-based government intervention to ease financial conditions in the sector was unlikely to materialize until late 2021 or early 2022.

In recent comments this week, the team noted that Fantasia’s default has caused many investors to question the level of disclosure among Chinese property sector issuers, driving market tensions higher. The team notes that even investment-grade companies, which so far have been spared the worst of the market’s dislocation, could potentially face near-term price pain. BlueBay anticipates further defaults among Chinese developers in the coming months as long as policy support for the sector remains elusive. Overall, however, the managers see the current market dislocation as an opportunity, noting that current high yields and low cash prices across the sector provide opportunities for bottom-up security selection.

TCW

While some managers seemed relatively unperturbed by Fantasia’s sudden collapse, TCW’s emerging markets-debt team says that recent events have altered its perspective. The team, which includes Penny Foley, David Robbins, Javier Segovia, and Alex Stanojevic, comanages Gold-rated TCW Emerging Markets Income (sold in the United States as TCW Emerging Markets Income TGEIX and in Europe as TCW Funds Emerging Markets Income).

In comments this week, the team members expressed concern at the recent slew of requests by Chinese real estate companies with stated large cash positions to delay payments to bondholders. Noting that these events have led them to question the reliability of financial disclosures in the sector, they say they have decided to reduce their funds’ exposure to the Chinese real estate industry. The managers worry that recent events might be a signal that companies are being urged by the government to use cash to finish projects and pay suppliers at the expense of paying bondholders. More concerning, they say, is the possibility that financial statements overstate developers’ financial viability by leaving out cash leakage or significant contingent liabilities, or that companies are engaging in market manipulation and using defaults to acquire bonds from the secondary market at large discounts. Going forward, the team stresses that assessing companies’ willingness to pay (not just their ability to do so) could become a much more important factor when analyzing the Chinese property sector than it was in the past. Like the other managers we spoke with, TCW’s emerging-markets-debt team expressed caution as to the Chinese real estate sector’s near-term prospects. It cited lower property demand and tight government policies as factors likely to depress property pricing and impact funding for homebuyers and developers. However, it joined many peers in expecting the Chinese government to intervene with market-stabilizing measures over the longer term, noting a number of recent positive signs in that direction by the country’s central bank and regulators.

TCW held a 0.29% stake in Fantasia as of August 2021 in its flagship TCW Emerging Markets Income strategy, having cited the company’s June 2020 earnings report of ample unrestricted cash, among other fundamentally attractive attributes.

As the situation evolves, we will continue to monitor exposure to the Chinese real estate sector within our cohort of rated funds. As often when faced with market volatility, investors should strive to keep a cool head. Despite short-term stumbles, emerging-markets bond exposure can yield significant carry and diversification benefits, if kept to a moderate allocation in an otherwise diversified portfolio and owned for the long term--that is, a full market cycle of at least five years. Choosing portfolio managers with ample experience in the region, on-the-ground resources, proven track records of successfully navigating through other risk-off periods, and reasonable management fees should also help investors reap the best long-term rewards from the asset class.

Mara Dobrescu, Patrick Ge, Mike Mulach, and Saraja Samant also contributed to this piece.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PLMEDIM3Z5AF7FI5MVLOQXYPMM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/I53I52PGOBAHLOFRMZXFRK5HDA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CEWZOFDBCVCIPJZDCUJLTQLFXA.jpg)