Energy Impacts Your Portfolio Less Than You Think

While large-value funds typically hold more in this surging sector than other categories do, the typical stake is still small.

The energy sector has had a dramatic year so far. After its 2020 slump, Morningstar’s equity analysts highlighted energy as the lone undervalued sector in an otherwise overvalued market early this year. The sector went on to race ahead of much of the market in the first half of the year, with the rollout of coronavirus vaccines a catalyst for optimism about the economy. Even after a slump in the third quarter, energy remained ahead of other sectors: The Morningstar US Energy Index was up 44.8% for the year to date through September 2021.

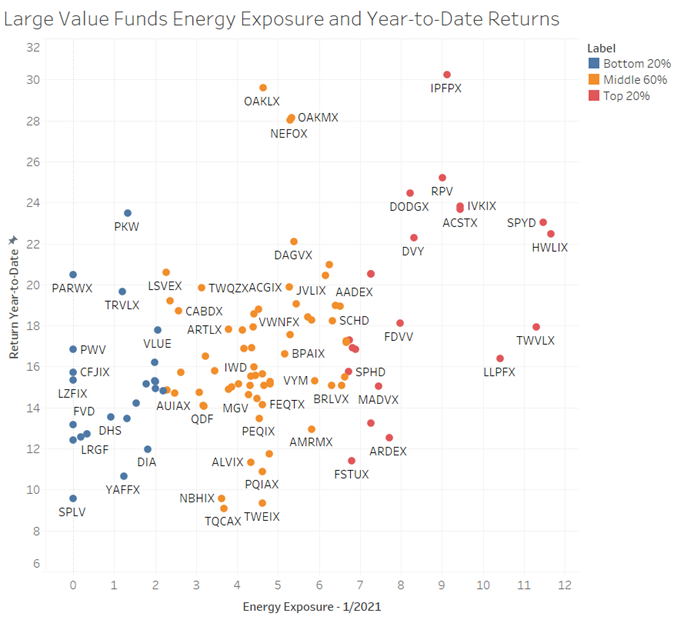

Given these high returns, investors may expect funds with the highest energy exposures to lead their Morningstar Categories. Large-value funds on average invest the most in energy, and the data do show a correlation between energy exposure and performance. That said, even among large-value funds, energy is often a relatively small stake these days compared with other sectors. Even in a year of record performance, energy was often not the leading performance driver.

Large-value funds with higher weights in energy tended to have higher returns for the year through September. For example, large-value funds that landed in the top 20% when it came to energy exposure returned 19.4% for the year to date. Those with energy stakes in the bottom quintile returned an average of 15.3%.

But how significant was the impact of energy on large-value funds overall? While large-value funds average more in the energy sector than other Morningstar Style Box categories do, the typical stake is just over 5%. That's a reflection of the energy sector's size relative to the market overall: It represented only 3.7% of the Morningstar US Large-Mid Broad Value Index as of January 2021, a far drop from its 20-year peak of 22% in 2009.

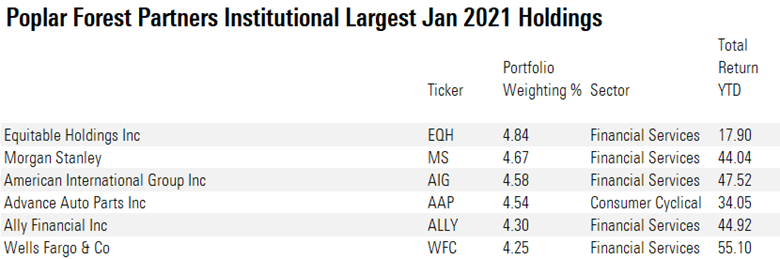

Financial services, on the other hand, averaged 16.5% in the benchmark in January 2021 and had the second-highest performance among all sectors for the year to date, with a 26.9% return. For some large-value funds, exposure to financials had a much larger impact on returns.

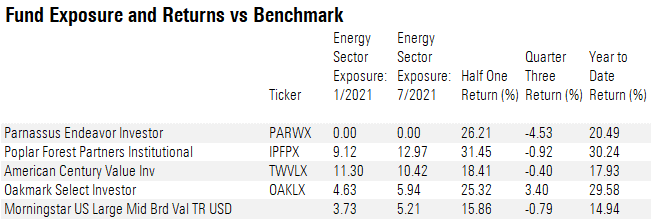

While some funds took advantage of energy's tailwind during the first half of 2021, not all capitalized on their energy exposure. On the other side of the coin, some funds that were underweight in energy were able to overcome this headwind and post above-average performance. We looked at some interesting funds covered by Morningstar analysts using the Portfolio Analysis tool in Morningstar Direct to compare fund sector weights and stock picks against their large-value category benchmark, the Morningstar US Large-Mid Broad Value Index.

Morningstar Analyst-Rated Funds

Poplar Forest Partners IPFPX had one of the largest energy stakes in the large-value category coming into 2021. The fund recently changed its approach to energy. In September 2020, lead manager J. Dale Harvey parted ways with the fund's energy analyst "because of missteps involving highly leveraged firms," as noted by strategist Alec Lucas in the fund's report. Harvey resumed covering the energy sector and shifted some of the fund's energy holdings in the quarter prior to 2021.

With its overweighting in energy, the fund was able to capitalize on the energy tailwind. One of its three energy holdings, Murphy Oil MUR, returned 111% for the year to date and was the second-largest contributor to fund performance.

Although Poplar Forest Partners was the top performer in the large-value category for the year to date, energy wasn't the biggest driver of that return. Performance attribution analysis shows that financial services had a larger influence on the fund's performance. Five of the fund's top six holdings entering 2021 were in the financial-services sector, and the fund was overweight in the sector relative to the benchmark.

American Century Value TWVLX, sporting the third-highest energy exposure in the category at the start of 2021, performed as you might expect a fund with an energy overweighting to perform: It outperformed the benchmark by 3 percentage points. Energy was a large contributor to returns, but financial services was the largest, led by JPMorgan Chase JPM and Wells Fargo WFC.

Energy has been a large part of American Century Value's story over the past decade. As associate director Tom Nations points out in his report, lead manager Michael Liss viewed energy sector valuations as too attractive to ignore following the 2014-16 oil price collapse. Nations notes that starting in September 2015, the strategy's energy stake ranged from 10% to 20%, versus 4% to 14% for its prospectus benchmark, the Russell 1000 Value Index.

Parnassus Endeavor PARWX, in contrast, has had no energy exposure throughout 2021, in part because of its exclusionary screen on fossil fuels and nuclear power. And yet the fund outperformed in energy's strong first half and underperformed greatly when energy dropped during the third quarter. In the first half, the fund's performance was driven by its 24-percentage-point overweighting in technology, headlined by Applied Materials AMAT and Seagate Technology Holdings STX, which returned 66% and 44%, respectively.

During the third quarter, the fund was hurt by stock picks in the consumer cyclical, healthcare, and industrials sectors. All in all, however, it has bested the benchmark by 5.5 percentage points so far this year.

Oakmark Select OAKLX has the fourth-highest year-to date return among Morningstar-rated large-value funds. With an average exposure to energy, the fund succeeded in other areas. Oakmark benefited from being overweight in financial services while also making strong stock picks such as CBRE Group CBRE and Capital One COF within the sector. During the third quarter, the fund performed unlike many other value funds, a reflection of manager Bill Nygren's willingness to invest in nontraditional value names such as Netflix NFLX. Nygren believes "traditional metrics such as price/earnings do a bad job showing how the firm's value has changed over time; he thinks it's reasonably priced on a price/subscriber basis," notes director Katie Rushkewicz Reichart in her report.

As dramatic as the performance of energy stocks has been so far this year, the sector is a relatively small stake even in most large-value portfolios today. While the sector can act as a tailwind or a headwind, other sector decisions and stock picks often had a bigger impact.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/d8236d6f-dcec-4d1b-b5ba-e086adefd364.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/737HCNGRFLOAN3I7RKGB7VPEKQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZU2N7Y2TDFFL3EAFRGYANDSBJY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FNDLNORUIBFD5KKEXASUD67L6Q.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/d8236d6f-dcec-4d1b-b5ba-e086adefd364.jpg)