ESG Keeps Pace in Q3

Morningstar's sustainability indexes generally keep up with the broad market for the quarter, owing mainly to technology.

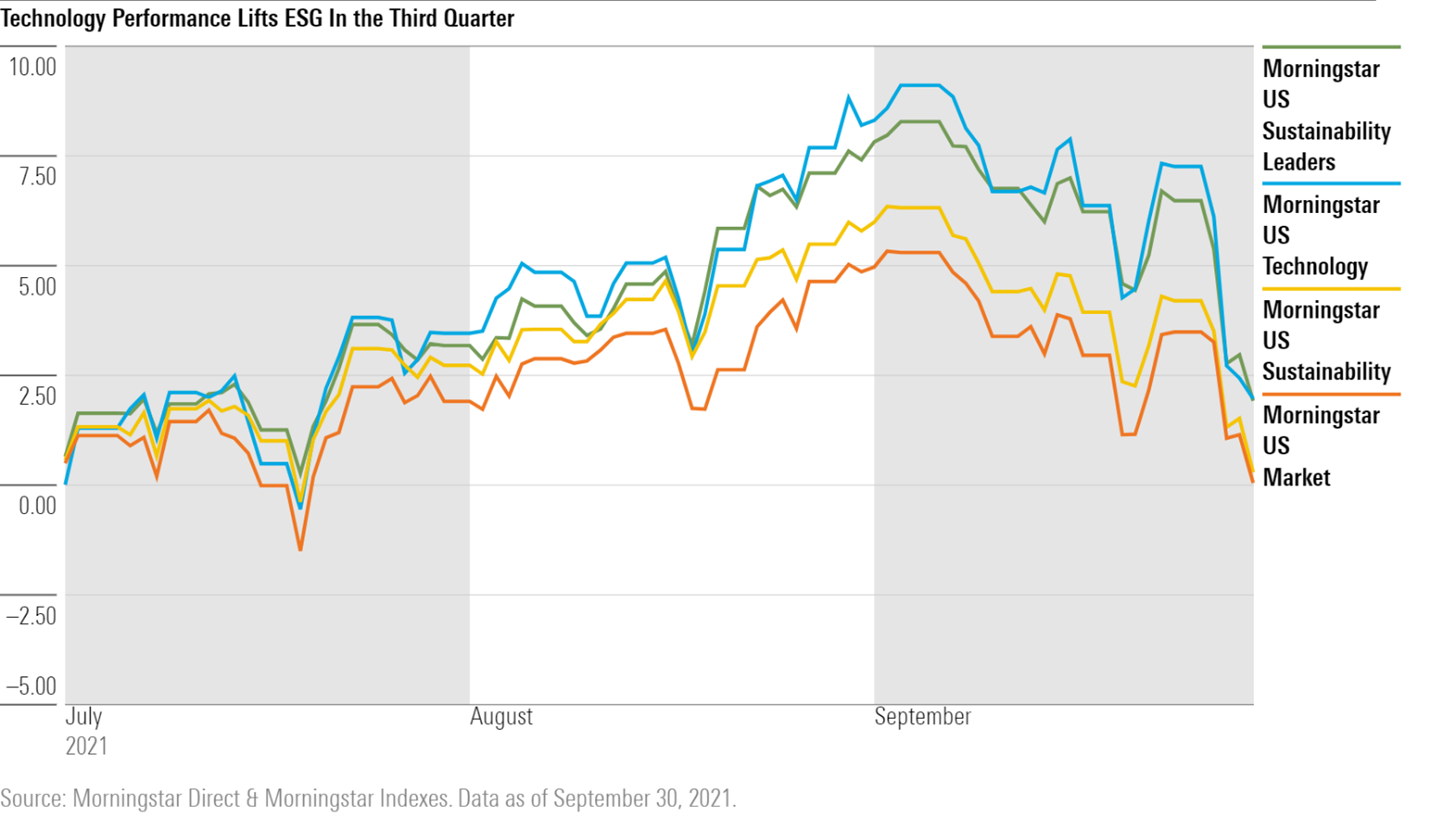

Companies with the strongest environmental, social, and governance practices outperformed the broad market in the third quarter of 2021, thanks mainly to gains in technology stocks, many of which have robust ESG profiles.

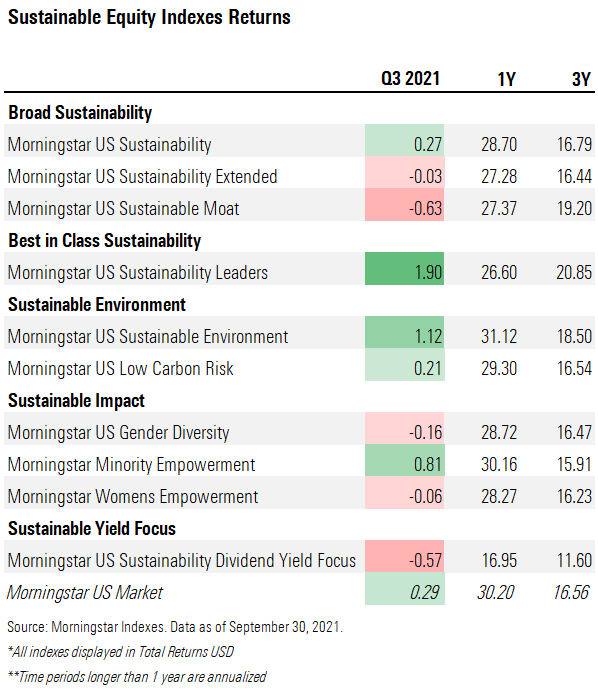

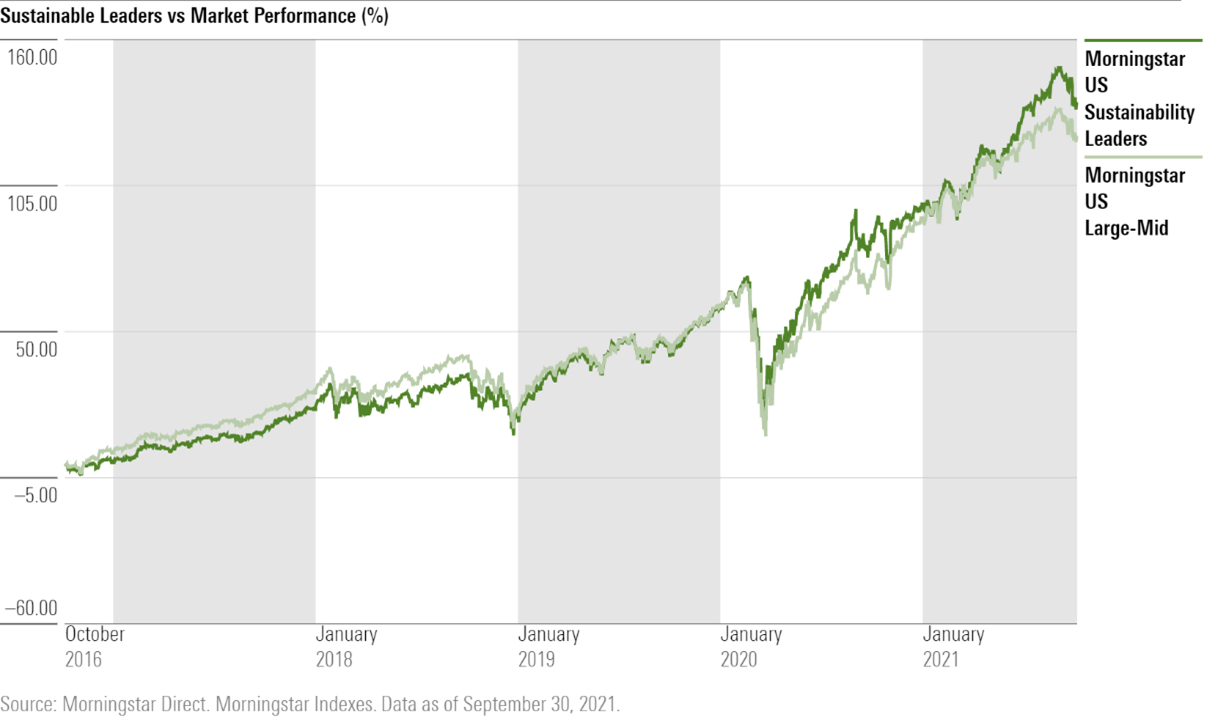

The Morningstar US Sustainability Leaders Index, which screens for the 50 U.S. large cap companies with the lowest ESG risk, returned 1.90%. Meanwhile, the Morningstar US Large Cap Index--the universe of stocks that the Morningstar US Sustainability Leaders Index draws from--returned just 0.51%. The broader Morningstar US Sustainability Index rose 0.29%, in line with the Morningstar US Market Index, weighed down by losses in industrials and basic materials.

Globally and across all markets, 61% of Morningstar's ESG-screened indexes beat their broad market equivalents during the third quarter. Within the standard Morningstar Sustainability Index family, which is methodologically aligned with the Morningstar Sustainability Rating for funds, 13 of the 22 indexes outperformed. Half of the Morningstar Sustainability Leaders Indexes beat their broad market equivalents. Additionally, 70% of the Morningstar Low Carbon Risk Indexes beat their non-ESG counterparts in the first quarter.

Morningstar Direct clients can find our full quarterly U.S. ESG performance PDF here. Here's how different realms of U.S. sustainability fared this quarter, as well as over the one- and three-year time frames:

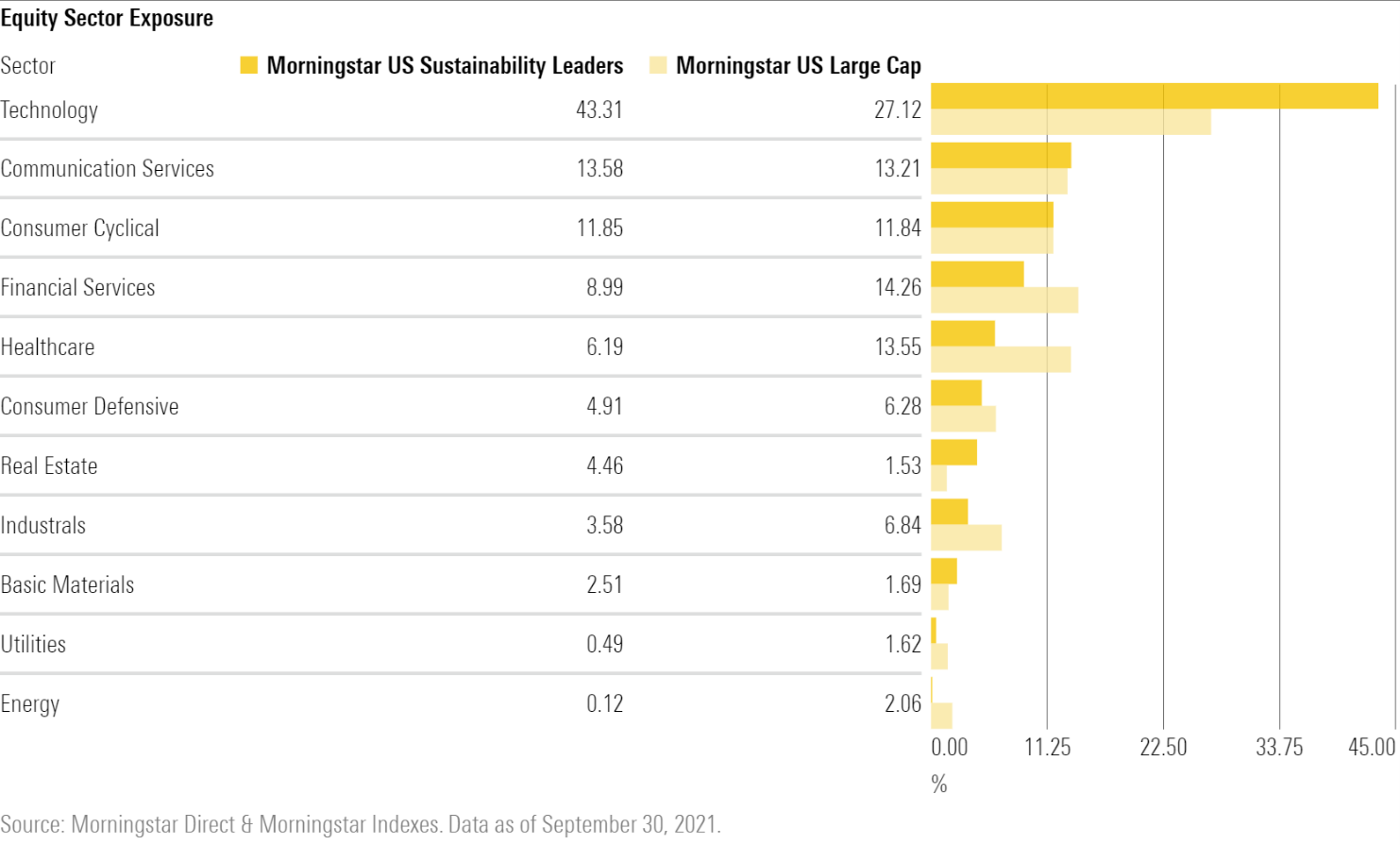

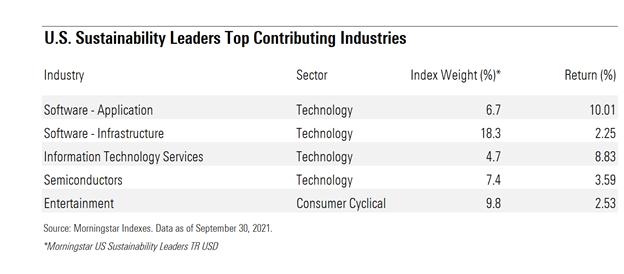

Sector weightings can vary from one Morningstar ESG index to the next--not all sustainable indexes are overweight in technology. But this quarter, that's where most of the ESG gains came from. The Morningstar US Sustainability Leaders Index provides one example. Nearly half of the index (43%, to be exact) is made of technology companies--a much higher concentration than the broader large-cap universe.

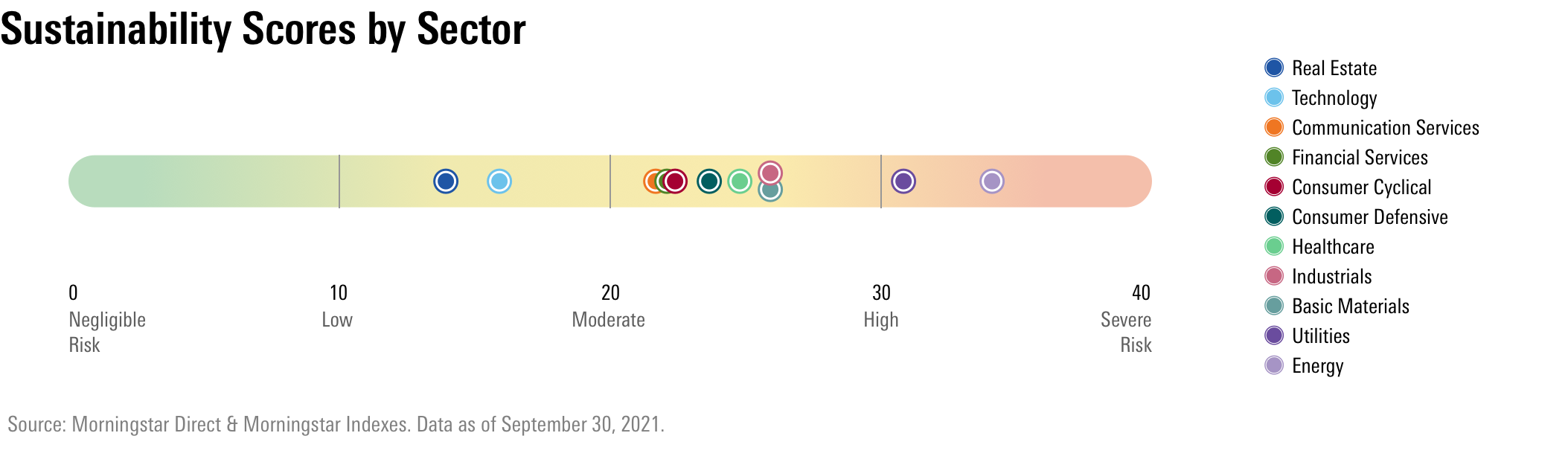

When we look at the ESG Risk Ratings of each Morningstar sector index, we see that the technology group is currently doing a better job of handling sustainability risk than any other sector, save for real estate.

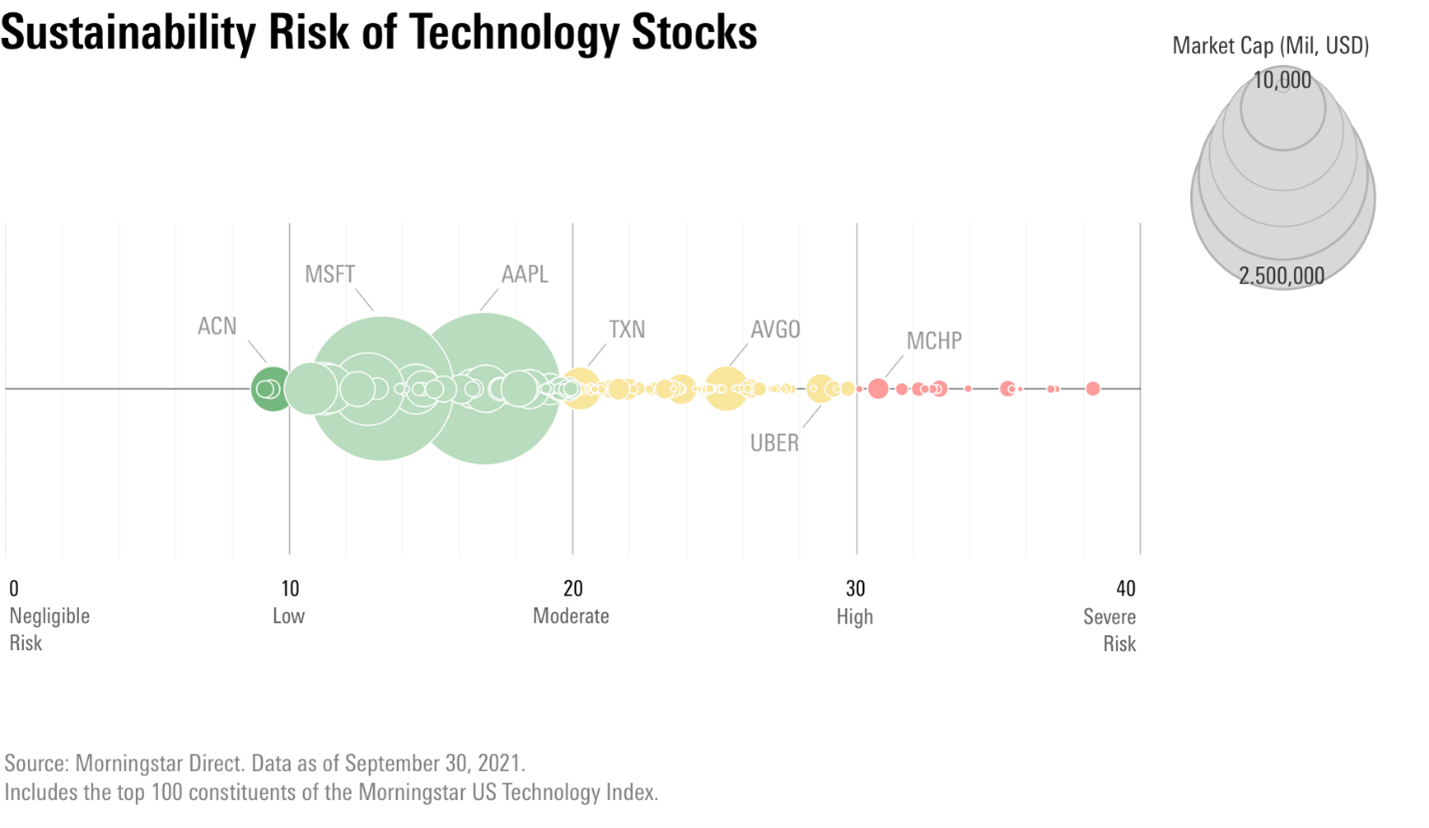

The technology sector scores well on sustainability measures overall, but a look at the company level shows nuance. Of the 100 largest companies in the Morningstar US Technology Index, most have ESG Risk Ratings that fall within the Low to Moderate space. The fact that both Microsoft MSFT and Apple AAPL, two of the largest companies in the entire stock market, both score well on ESG characteristics pulls the entire sector's ESG rating further into Low territory.

Almost all of the quarter's gains among sustainability leaders came from within technology. The sustainable leaders in the software application industry returned 10% during a quarter in the red, and the information technology names on the list returned over 8%. Zooming out to longer-term performance periods, sustainability leaders have kept pace with the broader market. Over the past five years, the Morningstar US Sustainability Leaders Index has either just tailed the Morningstar US Large-Mid Cap Index or come out just ahead.

Impact-specific areas of the sustainability space also outperformed in the third quarter. The Morningstar US Sustainable Environment Index, which screens for companies with the lowest environmental risk scores (the "E" in ESG), returned 1.12%. The Morningstar Minority Empowerment Index, which contains companies with the strongest racial and ethnic diversification policies selected in collaboration with the NAACP, also saw modest gains of 0.81%. Both indexes were buoyed by gains in technology stocks.

Katherine Lynch contributed to this report.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q7DQFQYMEZD7HIR6KC5R42XEDI.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DJVWK4TWZBCJZJOMX425TEY2KQ.png)