BlackRock’s Move to Open Up Proxy Voting to Clients Removes a Giant Rubber Stamp

Large investors in BlackRock’s index funds will now be able to vote on shareholder resolutions themselves.

BlackRock, the world’s largest asset manager, agreed to give big investors the ability to vote on shareholder proposals, which by some estimates would transfer votes to investors representing as much as $1.5 trillion in indexed assets.

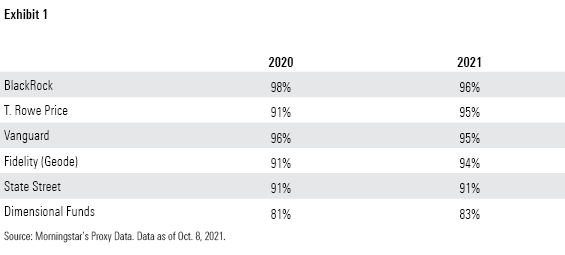

In the past, BlackRock and other passive fund managers, such as State Street and Vanguard, which have dominated the market, have been widely criticized for regularly voting with management on shareholder proposals. For example, BlackRock cast votes with management 96% of the time on so-called say-on-pay votes regarding compensation packages for named officers at S&P 500 companies, according to Morningstar research.

These groups below are among the largest fund providers in the United States and offer index funds. Here's a summary of their say-on-pay voting (S&P 500 companies):

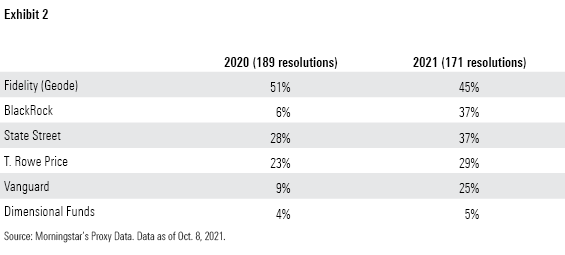

BlackRock has supported shareholder resolutions addressing environmental and social concerns at U.S. companies much less, although its support is improving.

Beginning in 2022, BlackRock says large investors in its institutional index portfolios can choose to cast their own votes on a range of shareholder proposals, including what resolutions they want to vote on.

“This is an excellent development,” says Jackie Cook, director of sustainability stewardship research for Morningstar. “Besides giving more voting power to the providers of capital, any institution that insists on having a say in the voting of their portion of shares is unlikely to rubber-stamp the status quo.”

Regulators have been pushing for more investors to have a greater ability to exercise their proxy votes. For example, asset managers Northern Trust and DWS have developed a new service that lets pension funds exercise their votes in pooled pension schemes. U.K. regulators were pushing for pension funds to have the ability to vote their own shares.

Indeed, the Securities and Exchange Commission recently proposed some updates to how money managers disclose their proxy voting. These would, among other things, require funds to disclose the number of shares voted and should give investors more clarity about how BlackRock votes for its clients.

For pooled funds where institutions take their own voting position, we would want to see the number of shares voted "for" or "against," on each ballot item--both on behalf of clients and according to BlackRock’s own voting position,” Jackie says.

“By letting more clients vote their own proxies, BlackRock is pre-empting any regulatory action that would come sooner or later. There is only so much power concentration that policymakers can tolerate,” says Hortense Bioy, Morningstar’s global director of sustainability research.

BlackRock's move follows a decision by Vanguard, the world's second-largest asset manager, to allow subadvisors of its actively managed funds to vote shares separately from the funds it manages by itself.

To be sure, BlackRock will continue to vote the majority of its equity fund assets and will also continue to engage with companies and policymakers. Larry Fink, BlackRock’s CEO, sends out a widely read letter to CEOs each year that lists BlackRock’s priorities and requirements of the companies in its portfolio. Still, it is possible that the move could improve investors’ views of BlackRock.

“My hope here is two-fold: that BlackRock continues to advance their own house view in terms of supporting ESG issues and advocating for them publicly,” says Alyssa Stankiewicz, a sustainability analyst with Morningstar Research Services. In addition, she said, “I hope to see improving transparency around proxy voting and engagement, so we can hold firms accountable for their practices.”

/s3.amazonaws.com/arc-authors/morningstar/d53e0e66-732b-4d50-b97a-d324cfa9d1f8.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZNBDLNQHFDQ7GTK5NKTVHJYWA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HE2XT5SV5ZBU5MOM6PPYWRIGP4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AET2BGC3RFCFRD4YOXDBBVVYS4.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/d53e0e66-732b-4d50-b97a-d324cfa9d1f8.jpg)