High-Yield Bonds Are Well-Suited for Active Management

Here's why.

A version of this article previously appeared in the January 2020 issue of Morningstar ETFInvestor. Click here to download a complimentary copy.

The high-yield bond market has historically been one of the best markets for actively managed funds. Over the trailing 10 years through December 2020, 42.3% of actively managed funds in the high-yield Morningstar Category survived and beat the average passive fund in the category as compared with 27.9% of active funds in the intermediate core bond category.

The primary criticisms against passive investing in the high-yield bond market relate to the market’s liquidity (or lack thereof), mispricing, and the merits of market-value weighting these types of issues. These considerations make active management the best route for exposure to high-yield bonds.

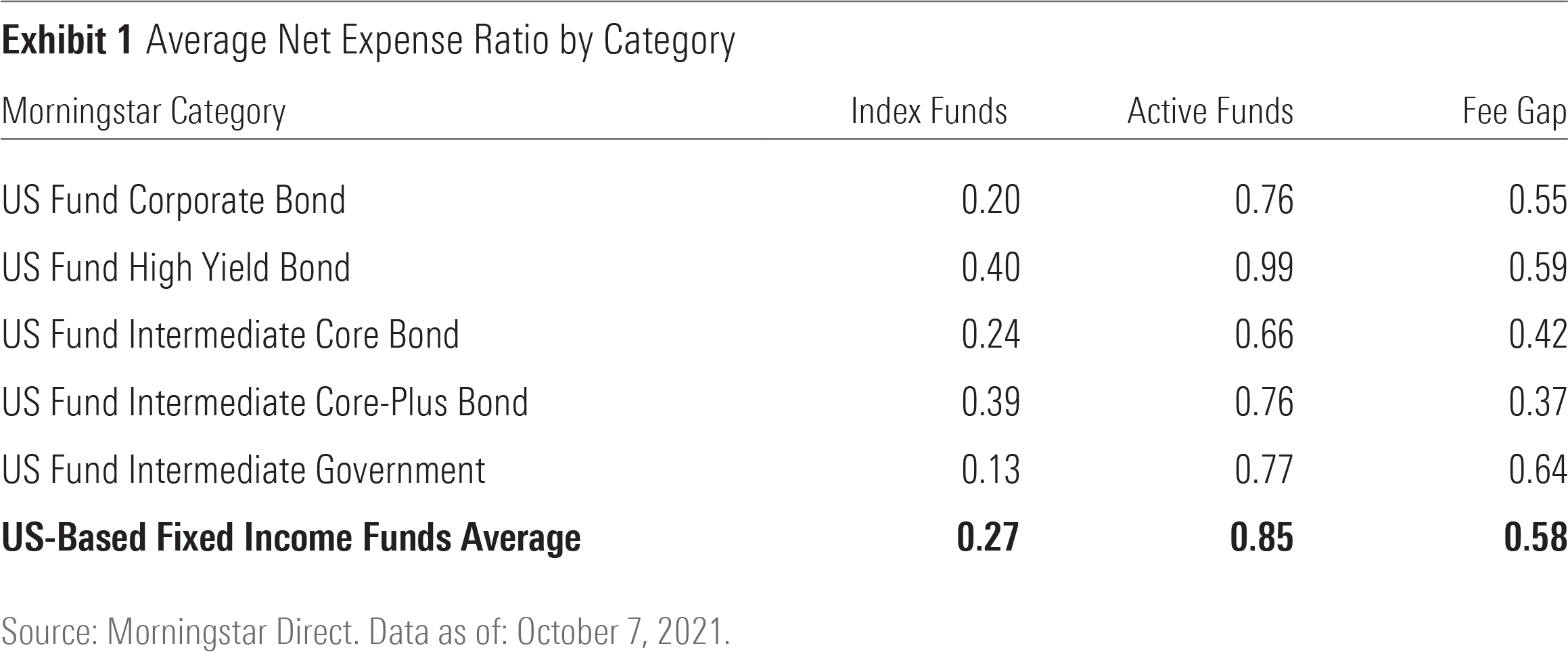

Fee Gap

Low fees are the best thing high-yield bond indexes have going for them. Although high-yield index funds are more expensive than most other types of index funds, they have a slightly larger cost advantage relative to their active peers than counterparts in the investment-grade intermediate core bond, intermediate core-plus bond, and corporate bond categories, as shown in Exhibit 1.

Liquidity Challenges

The expense ratio is the most obvious cost investors pay, but it’s not the only one. High-yield bonds tend to have limited liquidity, which can create high transaction costs for high-yield bond index funds.

Liquidity relates to the ability to buy or sell a security quickly and easily without significantly affecting its price. When securities aren’t traded very often or in high volumes, as is the case for most high-yield bonds, the investor who wants to trade them must offer a price concession to get someone to take the other side of the trade.

Transaction costs tend to be more pronounced among high-yield than investment-grade bonds. A paper published by Pimco in August 2018 examined liquidity in the corporate bond market and found that the average cost per trade was inversely related to the issues’ credit rating. For example, trades involving corporate bonds rated B+ and below cost nearly twice as much to trade as those rated BBB.

Although every fund in the high-yield market faces high transaction costs, the effects are more acute for index funds because they are often forced to trade to match index changes regardless of the price impact. For instance, a passively managed fund may need to sell an issue that is removed from the index to ensure its performance remains tight to the benchmark, but the lack of liquidity in the issue can cause the price to move against the manager. An actively managed fund could hold off on selling that issue.

The limited liquidity of high-yield bonds can make high-yield bond index funds hard to track. For example, during the five-year period through September 2021, the average rolling 36-month tracking error for index funds in the high-yield category was nearly 60% higher than the corresponding figure for index funds in the corporate bond category. To reduce transaction costs and tracking error, the first generation of passively managed high-yield bond funds limited their exposure to the most-liquid bonds. IShares iBoxx $ High Yield Corporate Bond ETF HYG screens for bonds with at least $400 million in outstanding face value, while SPDR Bloomberg Barclays High Yield Bond ETF JNK requires bonds to have at least $500 million in outstanding face value.

While screening for liquidity is pragmatic, these liquidity screens limit these funds’ exposure to the available opportunity set. For example, the ICE BofAML U.S. High Yield Constrained Index has a lower minimum liquidity threshold of $250 million per issue. More than 25% of its constituents, representing 12% of the index, originated from issues that were smaller than $400 million. Without fully capturing the opportunity set, JNK and HYG’s performance may diverge from their active peers, which reduces confidence that their fee advantage will translate to strong category-relative performance.

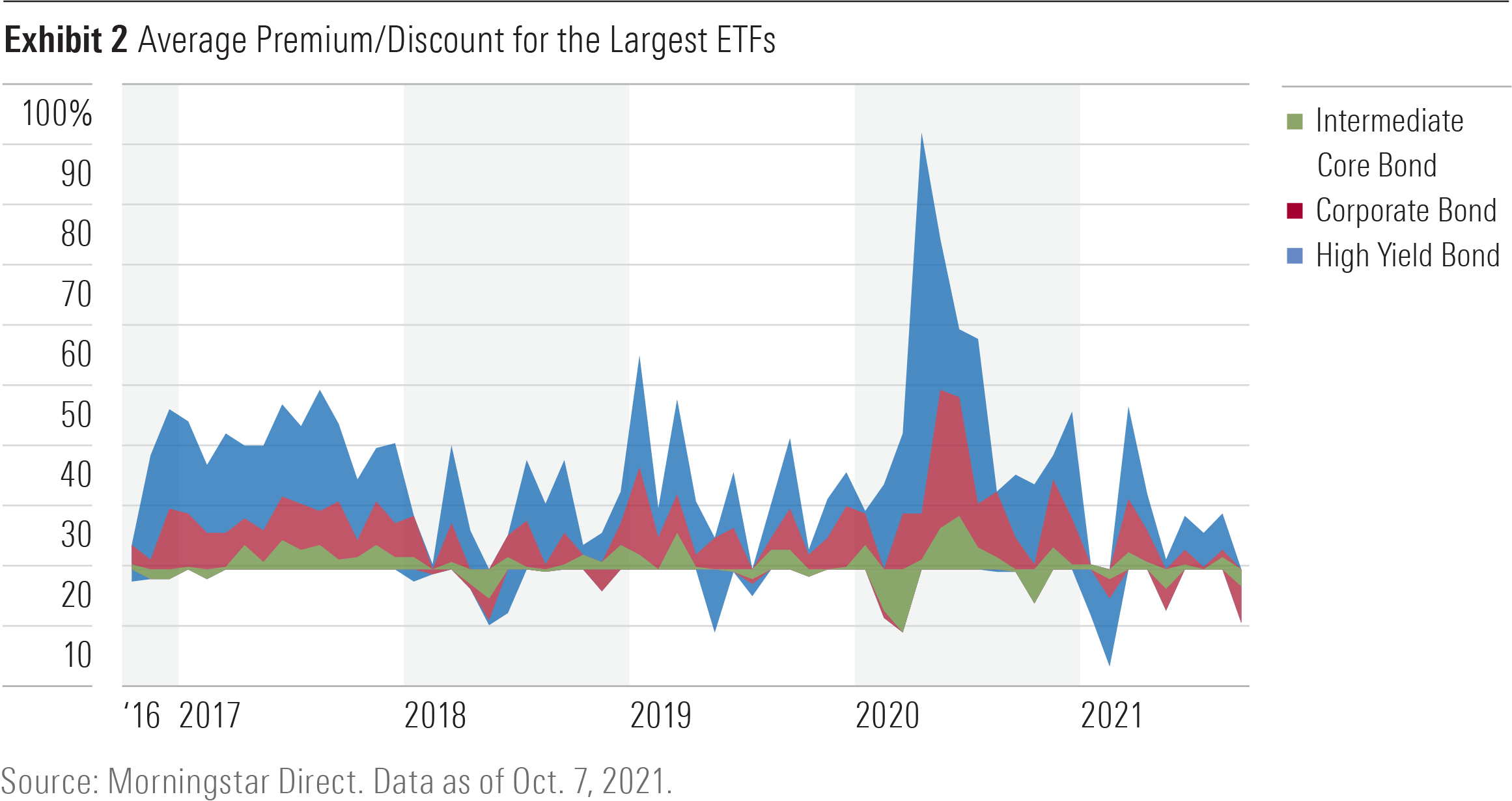

NAV/Premium/Discount

High-yield bonds’ limited liquidity can also cause high-yield exchange-traded funds to trade away from the net asset value of their holdings. It is often expensive for Authorized Participants (a special breed of market maker) to arbitrage these gaps because the quoted prices behind each fund’s NAV could be different than the prices at which they can transact. That’s because bid-ask spreads are wide here, many of these bonds may have stale prices, and the APs may have to offer price concessions to entice others to trade the desired bonds. For the arbitrage to be worthwhile, a larger premium or discount is often required than for an investment-grade bond ETF, as Exhibit 2 shows.

Premiums and discounts among high-yield bond ETFs might be more of a red herring than a red flag. These ETFs are generally more liquid than their underlying holdings and often serve as the primary price discovery vehicles.

The Trouble with Market-Value Weighting

In addition to complications regarding to the liquidity of high-yield bonds, there are also concerns related to merits of market-value weighting in this opportunity set. The primary concern relates to the tilt toward the most indebted issuers, though this isn’t as problematic as it may first seem. After all, some active investors hold each of those bonds in proportion to their market value. As such, market-value weighting is the most accurate representation of the opportunity set. It free-rides off the collective wisdom of market participants in determining the value of its securities, promoting low turnover, and minimizing transaction costs. To the extent that larger issues are riskier, they should offer higher returns to compensate.

Mispricing

A stronger argument in favor of active management relates to mispricing in the high-yield bond market. There is a greater chance for mispricing here than in the investment-grade market because there is less trading, resulting in less competition and less price discovery. For instance, credit rating agencies may be slow to update ratings in response to changing credit quality. Because those ratings influence bond prices, that sluggishness can create opportunities for more-nimble investors.

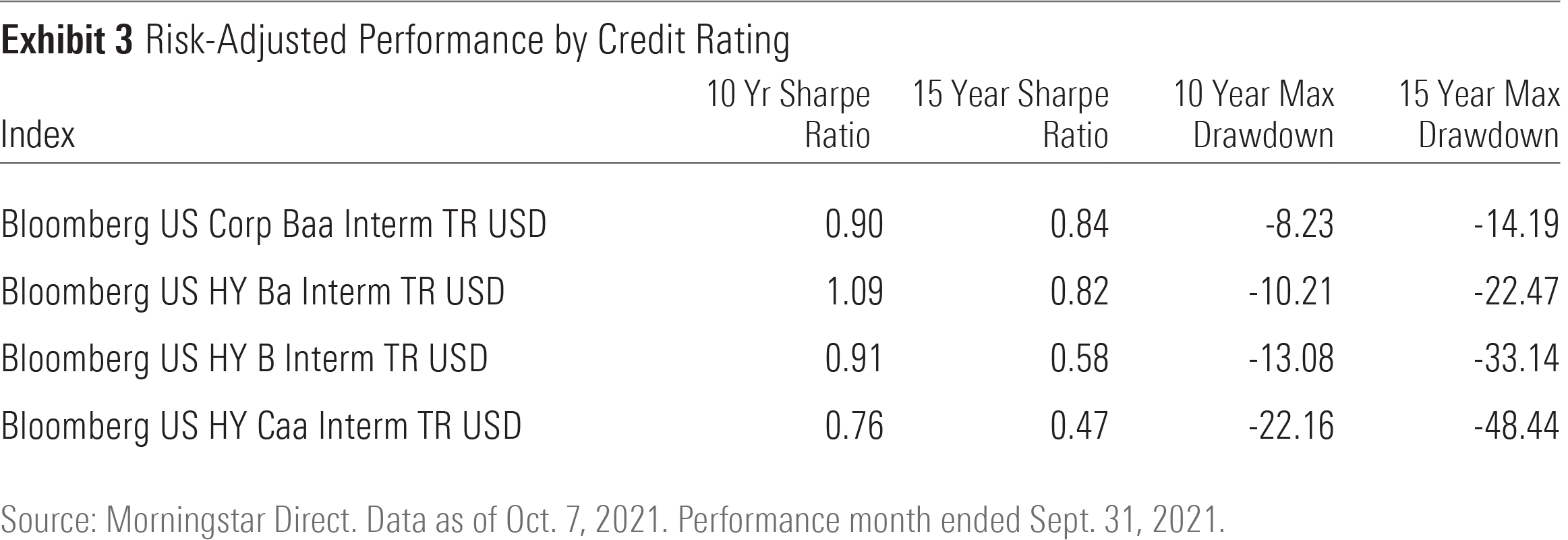

There are also other pockets of inefficiencies unique to the high-yield market. For instance, the lowest-rated bonds may be overvalued by investors reaching for yield. As Exhibit 3 shows, lower-rated bonds have historically delivered subpar risk-adjusted performance.

Conversely, “fallen angels” (issues that were initially rated as investment-grade but have since been downgraded) may be undervalued when they are downgraded to below-investment-grade because those downgrades often create forced selling. Fallen angels tend to occupy the upper strata of the junk-bond credit quality spectrum and are the likely catalyst for the strong performance of the Bloomberg U.S. High Yield Ba Index.

Investment Options

Actively managed funds represent the best option for exposure to the high-yield bond market. There are a handful of funds in the category with Morningstar Analyst Ratings of Gold and Silver, all of them actively managed. To date, there is only one passively managed Morningstar Medalist in this market: Bronze-rated iShares Broad USD High Yield Corporate Bond ETF USHY. All other index funds we rate in this category carry Neutral ratings. USHY benefits from a low-fee and a broadly diversified portfolio, but its Process Pillar rating currently stands at Average, reflecting the limitations of indexing in this market. That said, there are some interesting high-yield bond index strategies worth a look.

Vanguard High-Yield Corporate VWEHX is one of the cheapest active high-yield bond funds around. Its Investor share class charges 0.23%, less than many passive alternatives. Active security selection and liquidity management is a bonus. This fund effectively controls risk by favoring bonds with ample liquidity and underweights the lowest-quality high-yield bonds.

BlackRock High Yield Bond BHYAX is more expensive (0.93% expense ratio) but also worth considering, as it was upgraded to Gold from Silver in October 2019. It applies a flexible approach to security selection, scaling risk with the level of compensation the market offers. Like Vanguard High-Yield Corporate, this fund tends to stick with the most-liquid issues in the market, and its managers are empowered with flexibility to trade in other segments of the market. For instance, they may invest up to 10% of the portfolio in equity securities in place of CCC rated debt.

Some high-yield index funds seek to mitigate exposure to potentially overvalued areas of the high-yield market and profit from inefficiencies. For example, IQ S&P High Yield Low Volatility Bond ETF HYLV (0.40% expense ratio) favors lower-risk high-yield bonds, which have historically offered better risk-adjusted performance than the lowest-quality high-yield bonds, as they are less likely to be overvalued by yield-oriented investors.

IShares Fallen Angels USD Bond ETF FALN (0.25% expense ratio) may allow investors to profit from forced selling of bonds that are downgraded to below-investment-grade. This index fund offers broad market-value-weighted exposure (with a 3% issuer cap) to such bonds. Over the trailing 10 years through December 2019, the index this fund tracks beat the broad ICE BofAML U.S. High Yield Total Return Index by 2.6 percentage points annually, while favoring higher-quality bonds.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Morningstar, Inc. does not market, sell, or make any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/30aa6d58-cc92-46c5-8789-50161dc392a9.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MFL6LHZXFVFYFOAVQBMECBG6RM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EGA35LGTJFBVTDK3OCMQCHW7XQ.png)