10 Undervalued Stocks With Solid Dividends

We think the payouts on these names are sustainable.

It's a dividend investor's worst nightmare: That dividend that he or she has been relying on gets cut.

"It's really critical to be selective when it comes to buying dividend-paying stocks and chasing yield," explains Dan Lefkovitz, a strategist for Morningstar Indexes. "Looking for the most yield-rich areas of the market can often lead you into troubled areas and dividend traps--companies that have a nice looking yield that is ultimately unsustainable. You have to really screen for dividend durability, sustainability going forward."

What metrics should investors pay attention to when seeking stocks with durable dividends? David Harrell, editor of Morningstar DividendInvestor, suggests focusing on companies with management teams that are supportive of their dividend strategies. He also says to examine a company's payout ratio and favor companies with competitive advantages, or economic moats.

"A moat rating does not guarantee dividends, of course, but we have seen some very strong correlations between economic moats and dividend sustainability," says Harrell.

Lefkovitz argues that "distance to default" is another useful health-screening tool for dividend payers.

"Distance to default is a measure of balance-sheet strength," he says. "It gauges the likelihood of bankruptcy. It looks at leverage and volatility and gauges whether the sum of a firm's assets are at risk of falling below its liabilities."

In an effort to find attractively priced companies with defensible dividends, we turn to the Morningstar Dividend Yield Focus Index. A subset of the Morningstar US Market Index (which represents 97% of equity market capitalization), this index tracks the top 75 high-yielding stocks that meet our screening requirements for quality and financial health--with distance to default being one of those measures.

How are the index constituents chosen? For starters, only securities whose dividends are qualified income are included; real estate investment trusts are tossed out. Companies are then screened for quality using the Morningstar Economic Moat and fair value uncertainty ratings. Specifically, companies must earn a moat rating of narrow or wide and an uncertainty rating of low, medium, or high; companies with very high or extreme uncertainty ratings are excluded. We then screen for financial health using our distance-to-default measure, which uses market information and accounting data to determine how likely a firm is to default on its liabilities. The 75 highest-yielding stocks that pass the quality screen are included in the index, and constituents are weighted according to the total dividends paid by the company to investors.

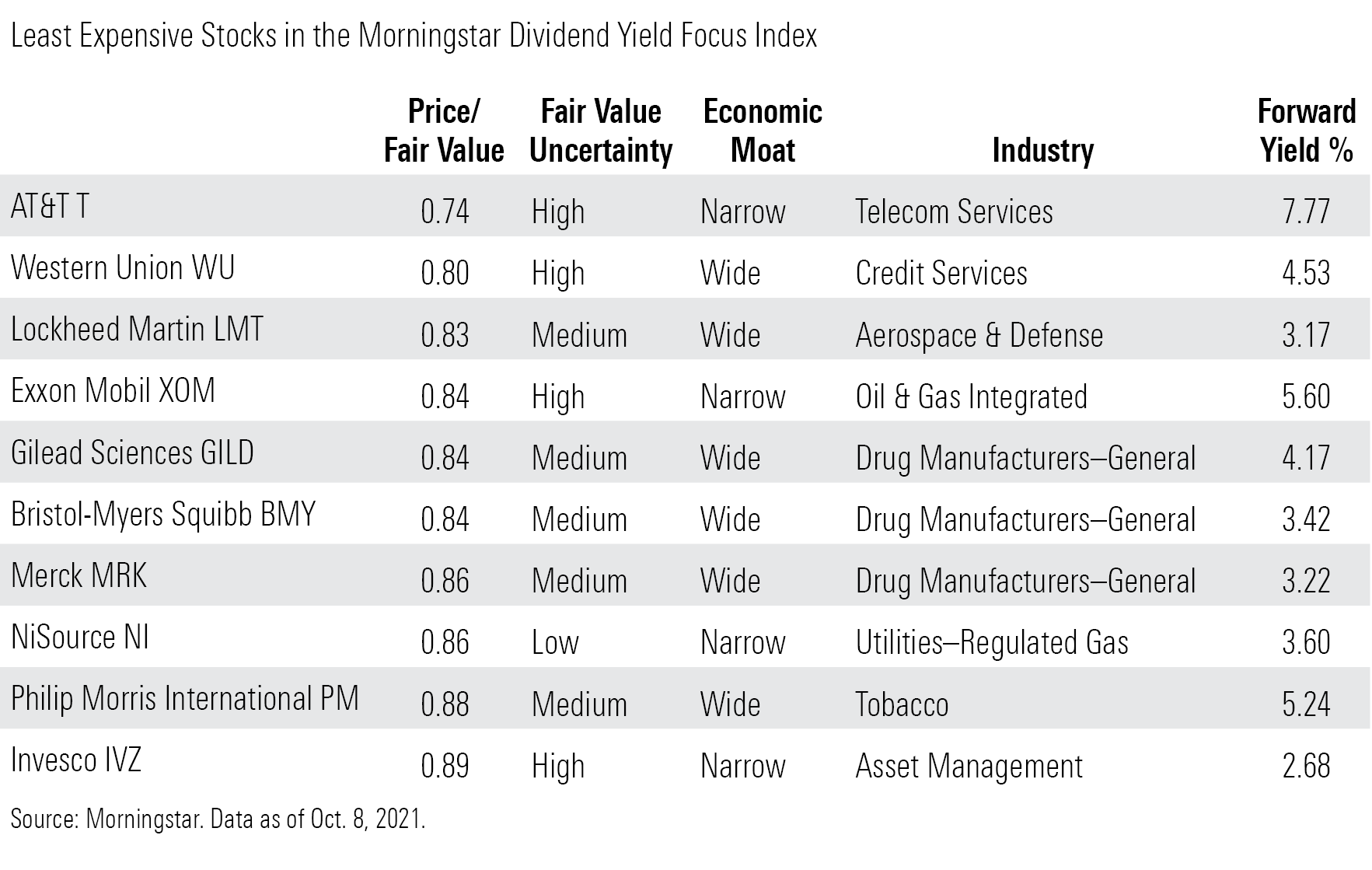

Given its focus on sturdy dividend payers, the index's holdings are a fine hunting ground for dividend enthusiasts seeking new ideas. Here are the 10 least expensive index constituents as of Oct. 8, 2021.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CGEMAKSOGVCKBCSH32YM7X5FWI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LUIUEVKYO2PKAIBSSAUSBVZXHI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)