How to Get the Highest Yield Out of Your Dividends

Mind the tax consequences.

A version of this article previously appeared in the September 2021 issue of Morningstar ETFInvestor. Click here to download a complimentary copy.

Today's low-yield environment poses a challenge to those trying to maximize investment income. Chasing ever higher yields amplifies exposure to riskier stocks and bonds. Also, income is typically taxed at higher rates than capital gains, throwing another obstacle in the way.

The taxes applied to dividend income changed for the better about 18 years ago with the Jobs and Growth Tax Relief Reconciliation Act of 2003. The legislation introduced lower tax rates for qualified dividend income, or dividends meeting certain criteria.

The tax advantages are meaningful, especially when the QDI benefit is compounded over time. Most investors using index-tracking exchange-traded funds in a taxable account stand to benefit, whether they're looking for income or not.

A Qualified Advantage

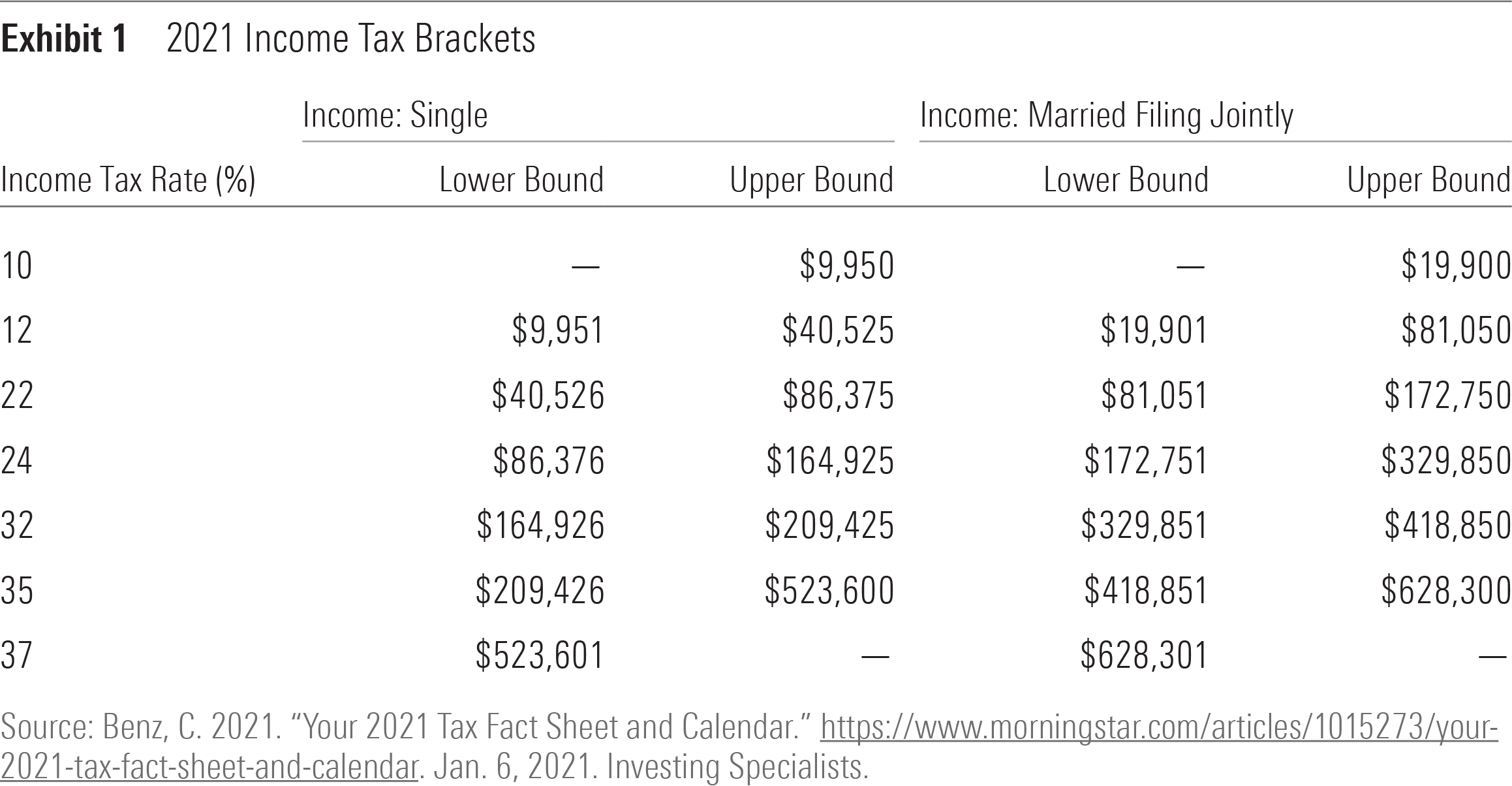

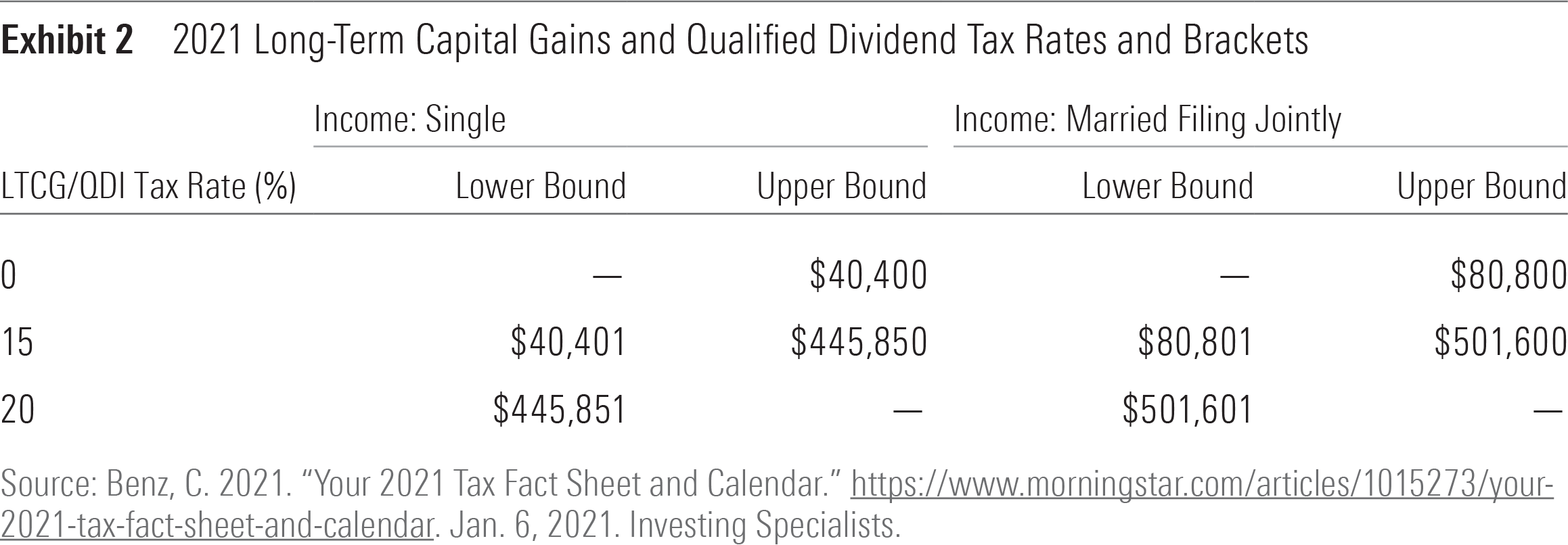

The tax advantage bestowed by QDI is far from trivial. The IRS taxes ordinary income at various rates between 10% and 37%, depending on your income. By comparison, qualified dividends get taxed at a long-term capital gains rate of 0%, 15%, or 20%. Like ordinary income, the applicable rate is determined by income, though the thresholds don't line up perfectly with those for ordinary income. Exhibits 1 and 2 outline the ordinary income and long-term capital gains tax breakpoints for the 2021 tax year.

Qualified dividends can have a sizable impact on long-term wealth. Suppose an investor's annual income is $400,000, placing her in the 35% income tax bracket and the 15% long-term capital gains bracket. Let's say she also parked $100,000 in a dividend-paying fund with a constant yield of 3% each year.

If none of the 3% dividend payment is qualified, then the dividend payment is taxed at the investor's ordinary income tax rate of 35%. At the end of year one, our hypothetical investor keeps $1,950 of the $3,000 pretax dividend payment. However, the entire dividend payment gets taxed at the 15% long-term capital gains tax rate if it is deemed as QDI. In that scenario, she would keep $2,550 of the $3,000 in annual pretax dividend payments.

The $600 QDI advantage in this hypothetical scenario isn't small, especially when compounded over time. Let's ignore capital appreciation and reinvest the aftertax dividend payment back into the fund at the end of each year to isolate the effect of QDI. After 10 years, the investor will have $121,303 if none of the dividends are qualified, or $128,634 if 100% of the dividends are qualified. That's about a 6% difference in ending wealth. All else equal, a fund with a greater portion of QDI should deliver better aftertax performance.

Making the Grade

Capturing the QDI tax benefit isn't exactly rocket science. The IRS outlines three rules that dividends must satisfy to be considered QDI:

1) Dividends must be paid by a U.S. corporation or qualified foreign corporation.

2) Shares paying dividends must be held for at least 61 days of a 121-day window. That period starts 60 days before the stock's ex-dividend date.

3) Dividends must not come from a source exempt from qualified status.

Each of those items deserves a little unpacking. The dividends from foreign companies may be treated as qualified only if the company is incorporated in a U.S. possession, the stock is tradable on an established U.S. exchange, or they are eligible for the benefits of an income tax treaty with the United States.

Most foreign stocks qualify through the latter. Stocks listed in Hong Kong and Singapore are among the largest markets without a requisite treaty, but they represent less than 3% of the total market cap of the broader foreign market. All things equal, foreign stock funds will likely pay out a little less of their dividends as qualified dividends.

The 61-day holding period could cause problems, but this is where savvy portfolio managers and well-constructed, low-turnover strategies shine. High-turnover strategies may introduce excessive trading, which increases trading costs and potentially prevents a portion of an ETF's holdings from meeting the 61-day requirement.

The second criterion has an important yet overlooked wrinkle: It applies to the stocks held by an ETF and the ETF itself. For example, a fund provider may report 100% of an ETF's dividends as QDI. But investors that have held the ETF for 60 days or less of the specified 120-day window wouldn't be allowed to claim those dividends as QDI on their tax return.

The third item addresses dividends from several sources and is more clearly detailed in IRS Publication 550.[1] It prohibits dividends from certain sources, including REITs [2], master limited partnerships, money market funds, and several others from achieving qualified status. Investors should be mindful of this rule when evaluating high-yield strategies with REIT exposure because they will likely take a QDI hit. Funds focused on maximizing their dividend yields are prone to be overweight in REITs because their unique tax structure requires them to distribute 90% of their net income as dividends. The yields on REITs may look attractive, but their QDI does not.

The good news is that investors don't need to determine the qualified status of their holdings. Brokerages and fund providers will list ordinary dividends in box 1a of form 1099-DIV and the amount of those dividends satisfying QDI criteria in box 1b.

How Dividend Funds Stack Up

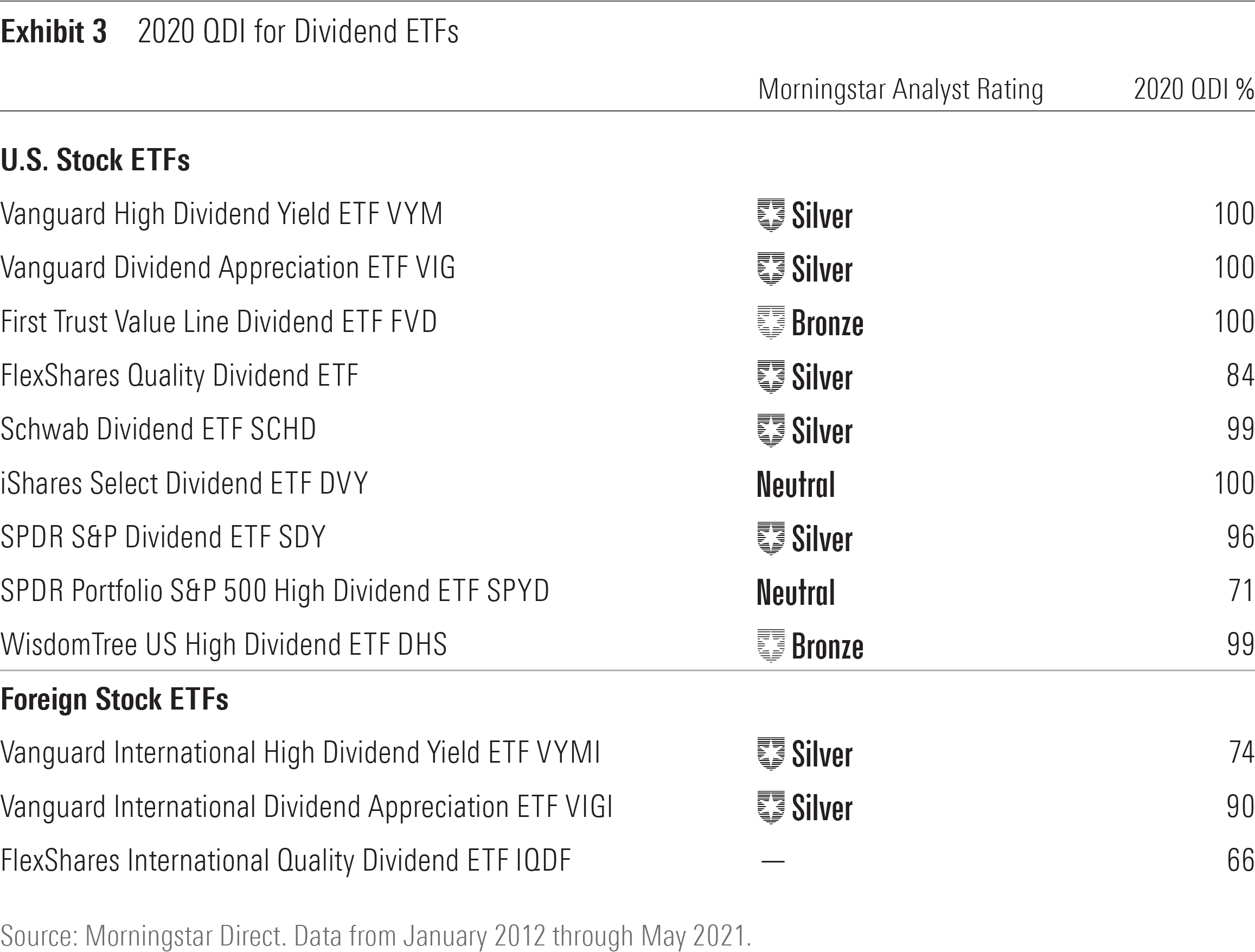

Past QDI payouts should be a reasonable indicator of future QDI. Historical tendencies may indicate how well an ETF's underlying strategy and its management team are able to capture the qualified dividend benefit. Exhibit 3 lists dividend ETFs from several providers, their Morningstar Analyst Ratings, and 2020 QDI.

Overall, U.S. dividend ETFs delivered great QDI results in 2020. Most paid out more than 80% of their dividends in the form of QDI. SPDR Portfolio S&P 500 High Dividend ETF SPYD landed at the back of the line, with only 71% of its dividends meeting QDI standards. Part of the reason is likely tied to its REIT exposure, which averaged about 18% for the year. Many of the other U.S. strategies had an advantage because they explicitly avoid REITs.

As expected, foreign-stock ETFs came in a little lower than the U.S. cohort. FlexShares International Quality Dividend ETF IQDF had the lowest percentage of QDI of the bunch, with only two thirds of its dividends eligible for QDI treatment. IQDF and its U.S. sibling FlexShares Quality Dividend ETF QDF share a common drawback. Turnover in both funds tends to run high, hovering in the 70%-80% range in any given year. As mentioned before, high turnover may hurt QDI by preventing some constituents from meeting the 61-day holding period requirement.

There are two more items to keep in mind. First, QDI applies only to dividends received from taxable accounts. Distributions made from tax-deferred accounts, such as a traditional IRA, are subject to ordinary income rates whether they are qualified dividends or not.

Second, maximizing QDI should not be the end goal. Qualified dividends should take a back seat to sound investment processes and low fees. But investors don’t necessarily need to trade one for the other. Some of Morningstar's highest-rated dividend ETFs, those with Bronze and Silver ratings, are featured in Exhibit 3. Not only do they tend to have high QDI, but they should perform well over the long run.

References

1) https://www.irs.gov/pub/irs-pdf/p550.pdf

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Morningstar, Inc. does not market, sell, or make any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/78665e5a-2da4-4dff-bdfd-3d8248d5ae4d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CGEMAKSOGVCKBCSH32YM7X5FWI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LUIUEVKYO2PKAIBSSAUSBVZXHI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/78665e5a-2da4-4dff-bdfd-3d8248d5ae4d.jpg)