A Quarter in the Red

We look under the hood at the quarter’s Morningstar Style Box trends and their (lack of) impact on investors.

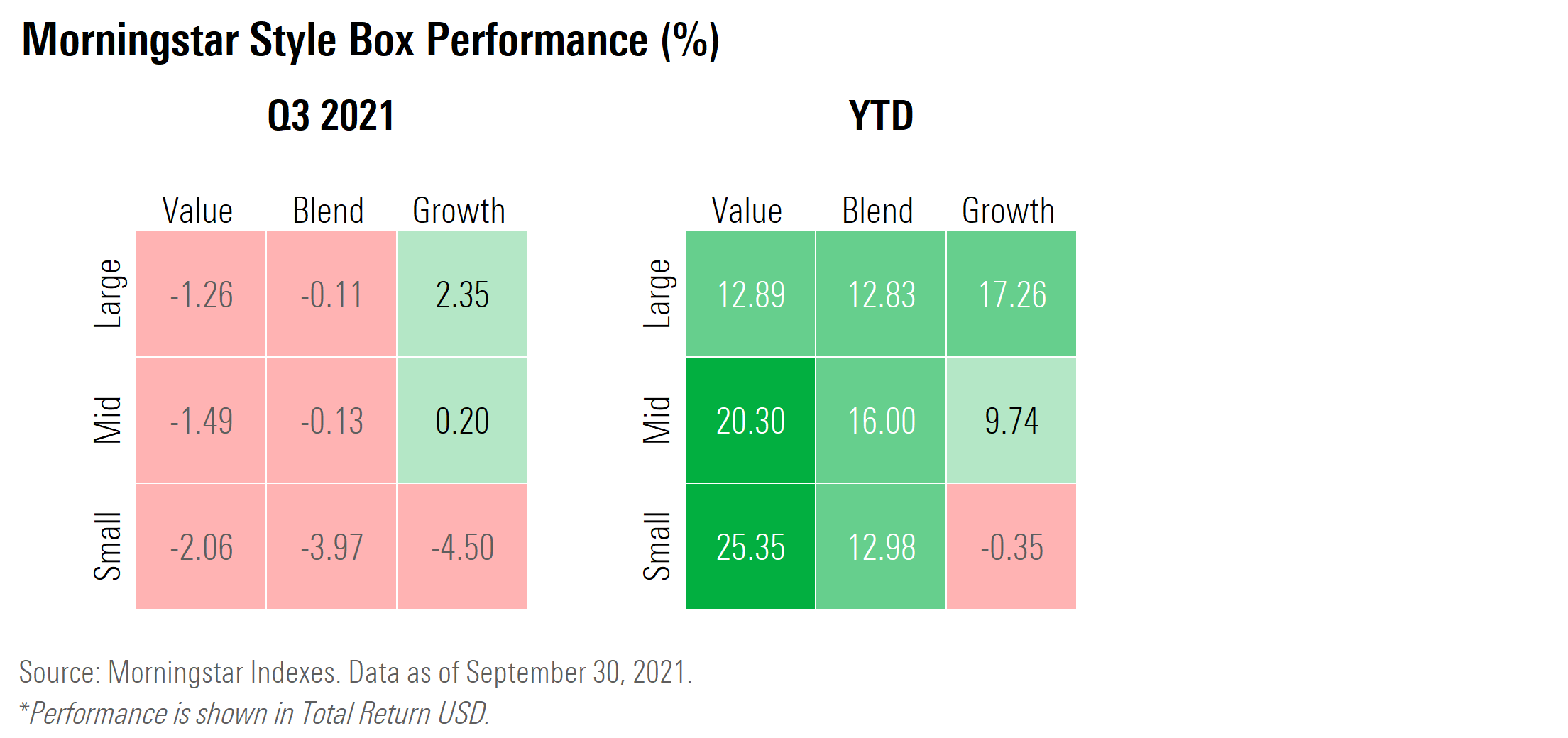

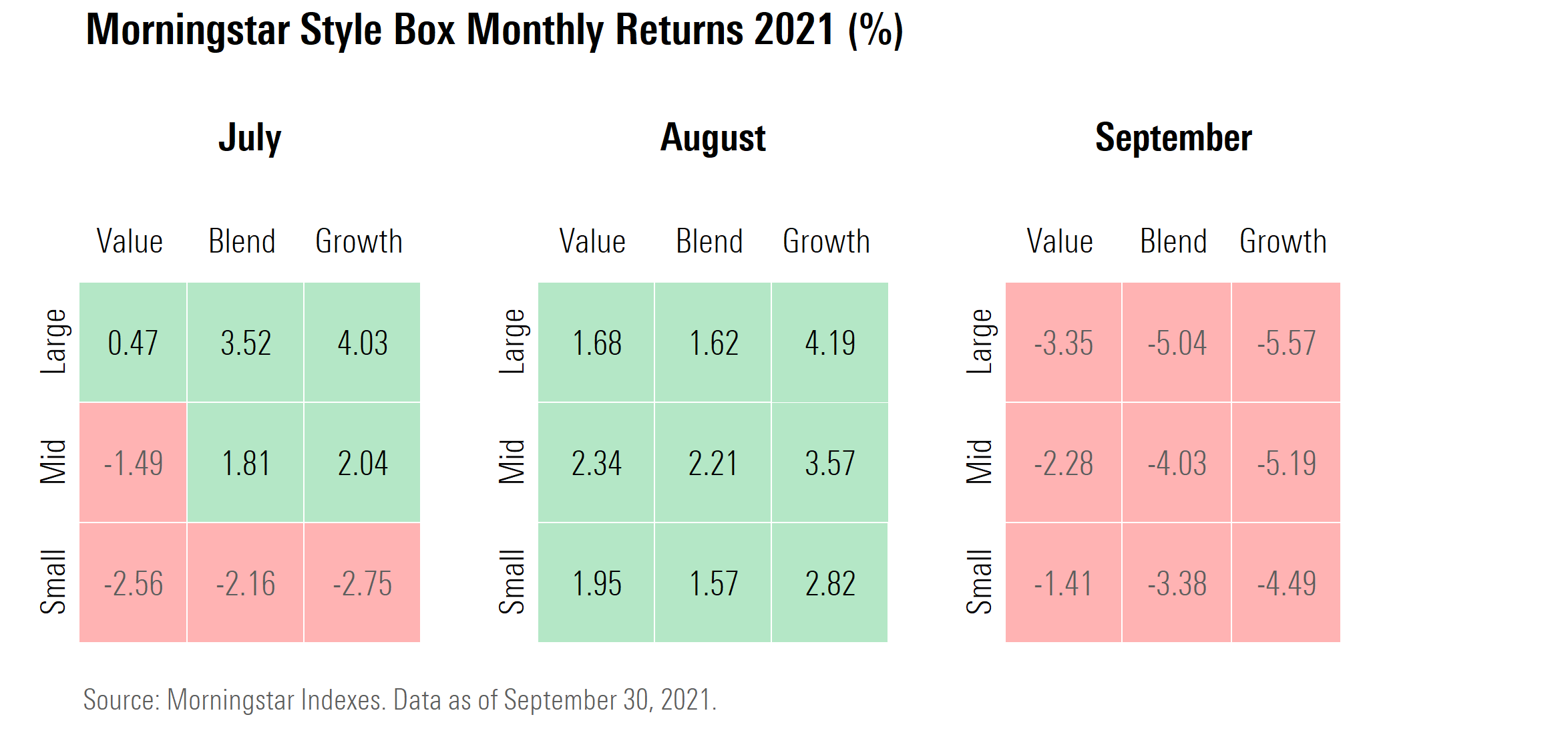

A September swoon in growth stocks took a big bite out of the group’s performance upswing in the third quarter, with only large-cap growth stocks finishing the period in the green.

But while much of the focus in 2021 has been on the back-and-forth performance swings in the value versus growth performance gap, the bigger story in the third quarter was market capitalization. Large-company stocks were on balance the strongest performers, followed by midsized companies and then small-cap stocks.

As growths stocks generally fared better than blend and value names, the Morningstar U.S. Large Growth Index returned 2.35% while the Morningstar U.S. Small Growth Index fell 4.5%. For the year to date, however, it’s more of a value story, with mid-value and small-value leading performance among U.S. stocks.

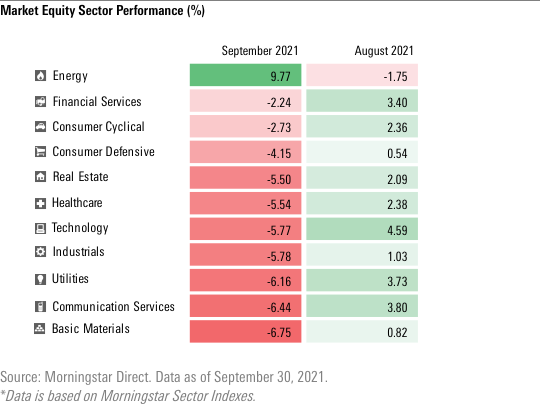

September marked a change of change of tenor across the stock market as the Morningstar U.S. Market index lost 4.58%, the largest monthly loss the index has seen since March 2020.

Under the surface, the September declines were broad-based. Energy, the only sector with losses in August, came out on top in September with a return of nearly 10% as every other sector turned negative. The sector’s strong performance was led by the “Oil and Gas - Exploration and Production” industry, as oil giants posted strong gains; for example, ConocoPhillips COP was up 22.0% and ExxonMobil XOM was up 7.9%. Meanwhile, the utilities, communication services, and basic materials sectors each lost over 6%.

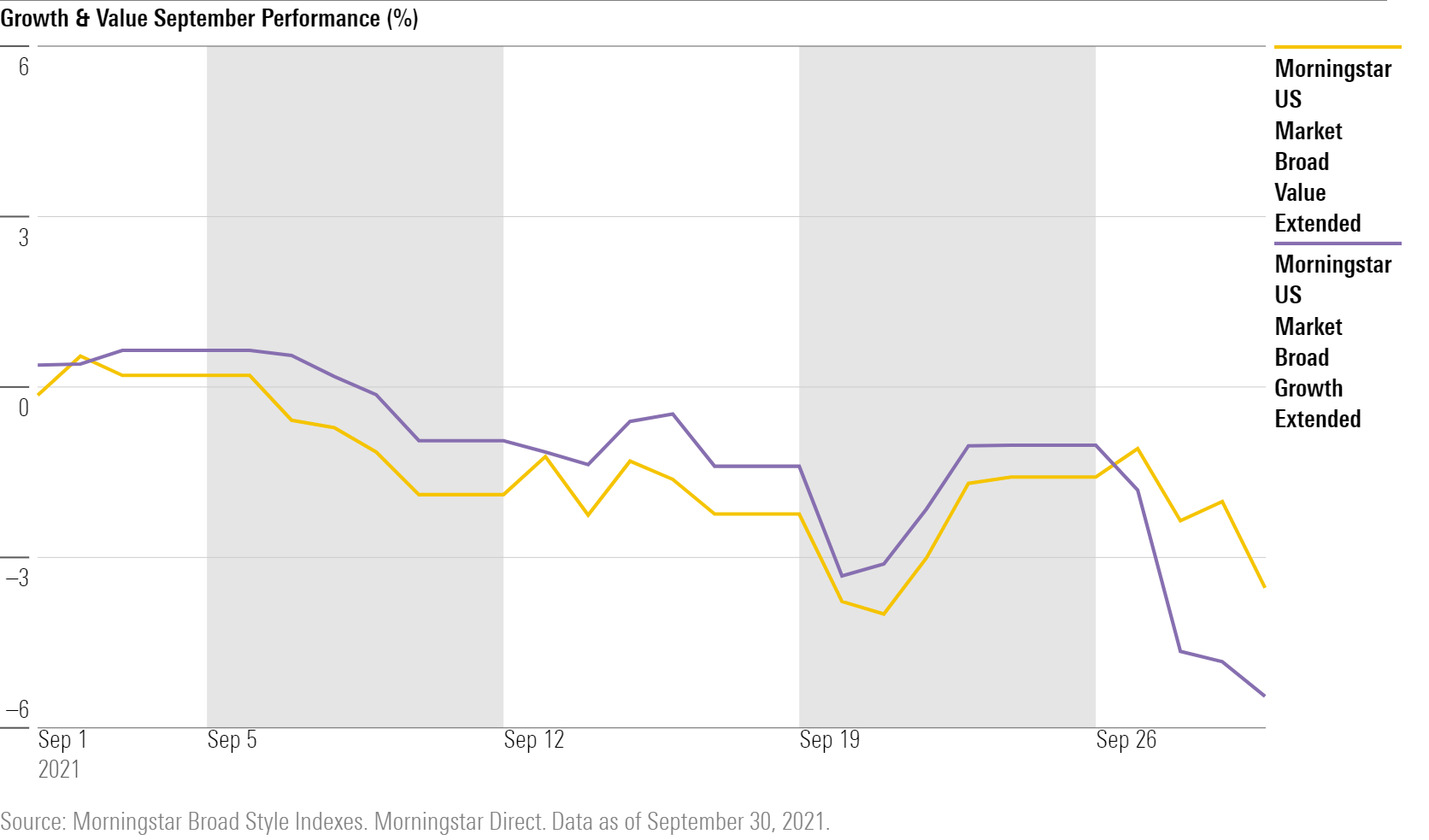

Growth and value were neck-and-neck in negative territory until the final week of September, when high-tech, large growth names saw some of the steepest losses. For the month overall, Leading detractors included Microsoft MSFT, down 6.61%, Facebook FB, down 10.54%, and Adobe ADBE, which lost 13.26%.

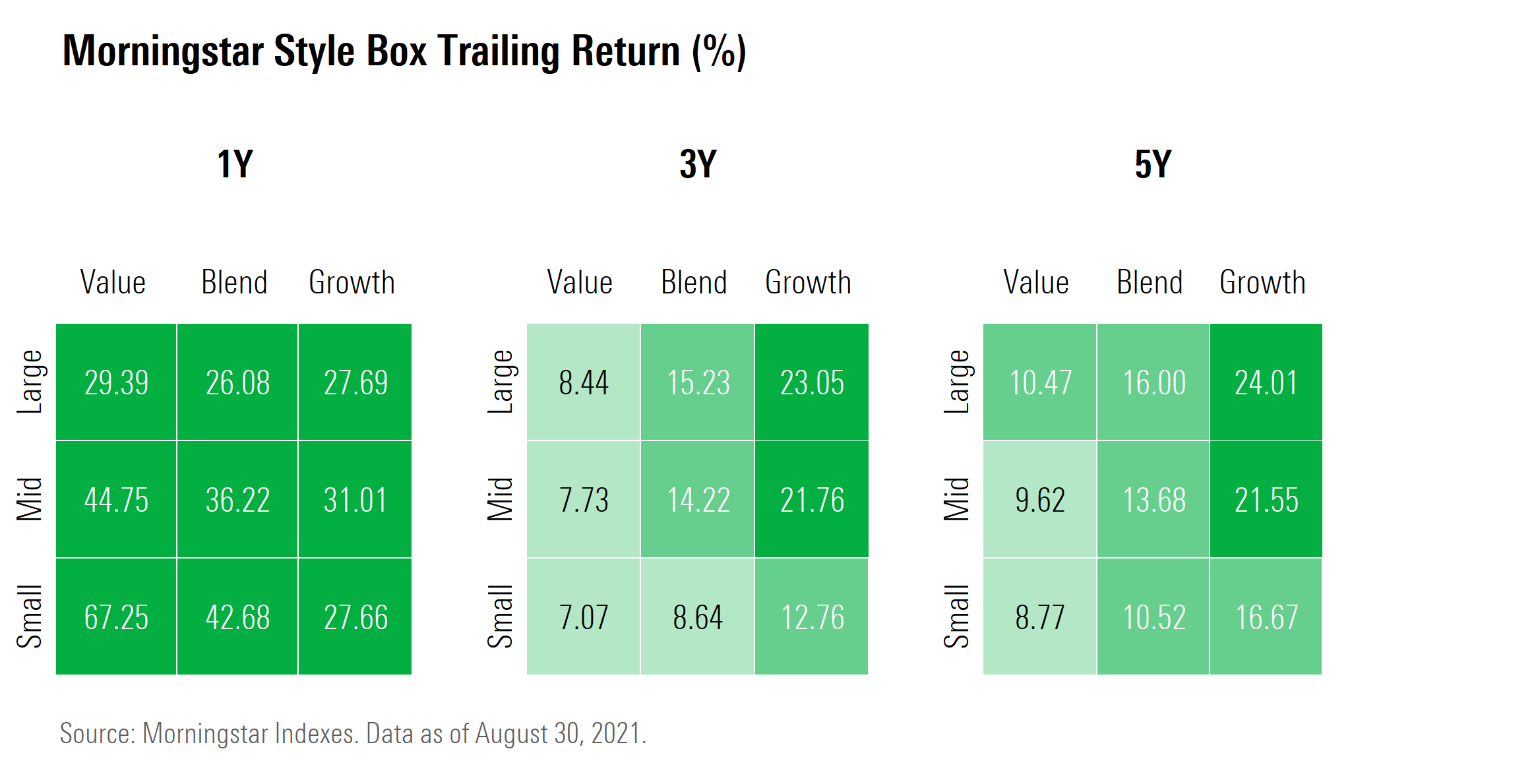

Despite September’s widespread losses, the Morningstar Style Box is a sea of green throughout the one-, three-, and five-year trailing performance periods, highlighting the importance of playing the long game.

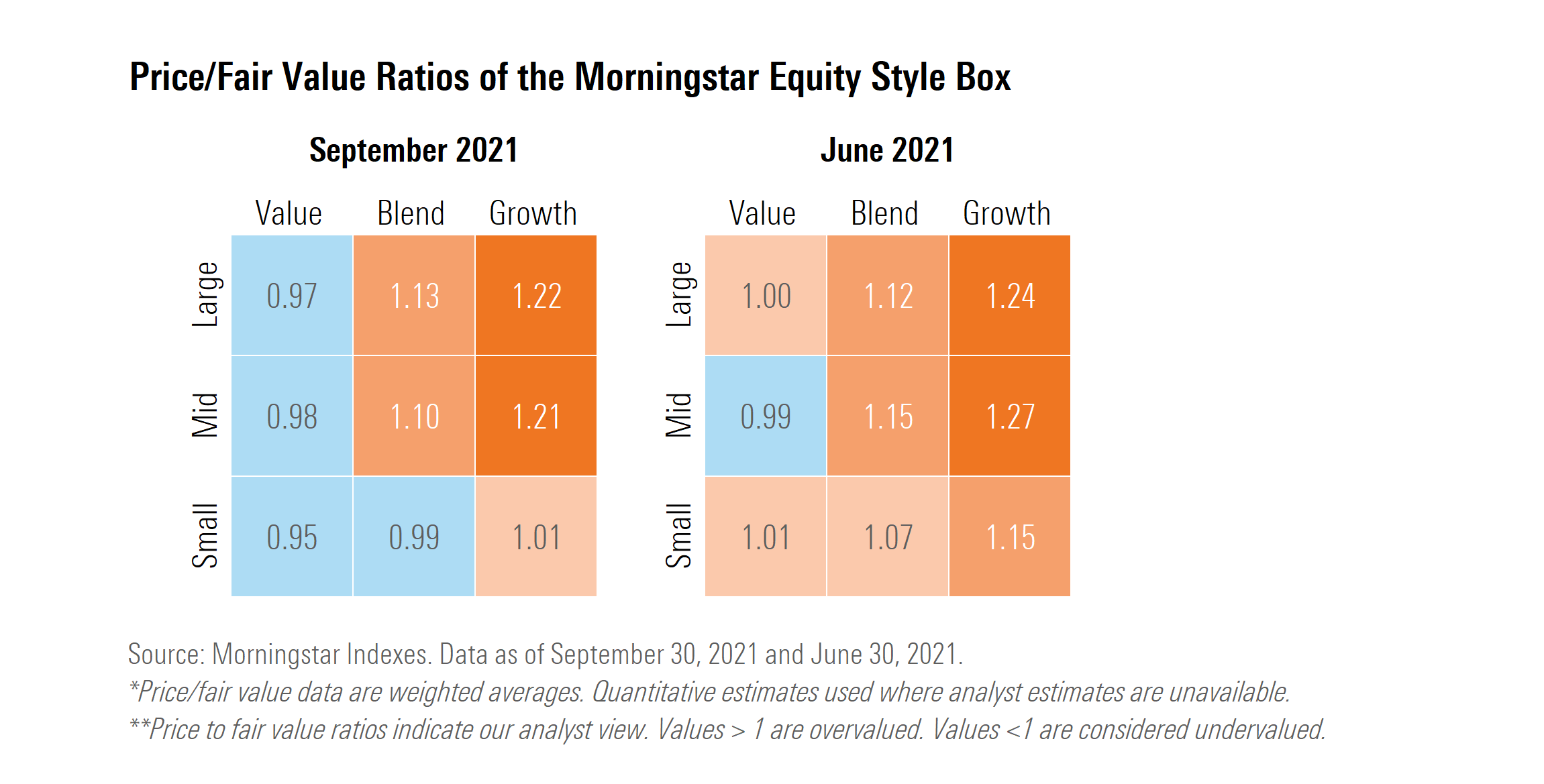

And for now, U.S. equity valuations are high: The Morningstar U.S. Market Index ended the quarter at an 8% premium. Large- and mid-growth companies are the most richly valued, continuing the trend we saw last quarter. Fairly valued pockets can still be found in value and small-cap stocks.

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F2S5UYTO5JG4FOO3S7LPAAIGO4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7TFN7NDQ5ZHI3PCISRCSC75K5U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/QFQHXAHS7NCLFPIIBXZZZWXMXA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)