Robinhood Enters the Realm of Proxy Voting

Here's how the popular trading platform's recent acquisition is part of a bigger trend--and how it impacts investors.

Robinhood HOOD recently acquired Say Technologies, a shareholder engagement platform that simplifies the proxy voting process for investors and helps them communicate with the CEOs and leadership teams of the companies in which they're invested.

Proxy voting allows investors to have a say in executive compensation, board director approval, and a wide variety of environmental, social, and governance concerns. Despite the growing interest in ESG, few individual investors are putting their votes to use. On average, individual shareholders vote on just 32% of their shares, compared with the 80% rate of participation among the entire shareholder base, according to a Harvard study.

Bringing Households Closer to Their Votes

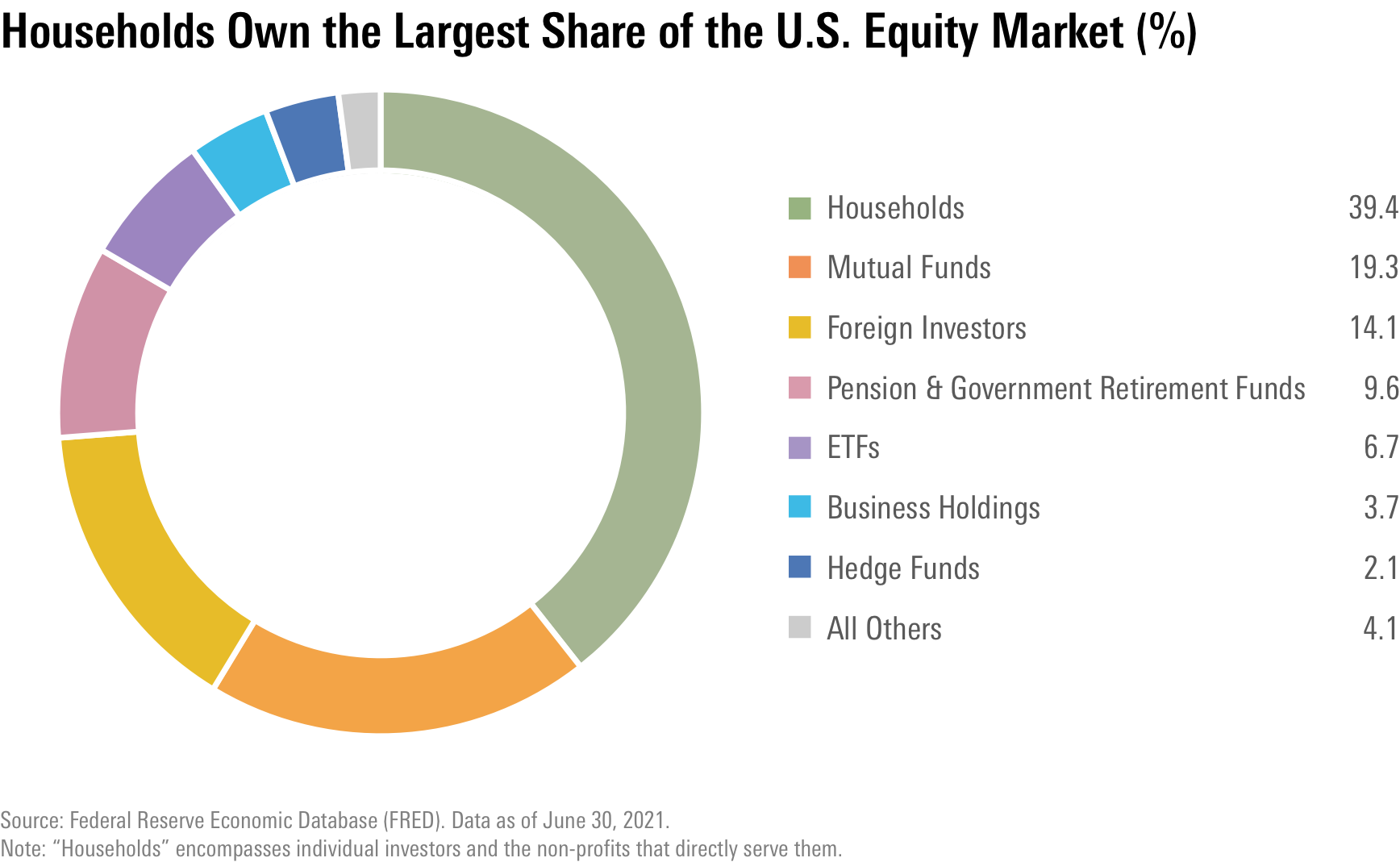

Low engagement among retail investors is meaningful, since collectively, they own more of the U.S. stock market (in terms of directly held equity) than any other group.

Robinhood and Say Technologies aren't the only ones making shareholder engagement more accessible to the individual investor.

For one, JPMorgan JPM announced its decision to acquire OpenInvest, a company built to help financial advisors and individuals invest according to their values. These and other advances in shareholder engagement technology are bringing household investors closer to their votes.

Here are three ways such advances are breaking down barriers to proxy voting:

1) Simplifying a Complex Process Robinhood's Say Technologies provides a platform where investors can communicate directly with other shareholders and pose questions to the leaders of the companies that they invest in. In the style of Reddit, investors ask and "upvote" questions ahead of earnings calls, and executives answer a selection of the top questions.

For example, during Tesla's second-quarter 2021 earnings call, retail investor Robert M. asked:

"Elon has said that Tesla will be opening up the Supercharger network to other EVs later this year. Can you share more details on how this will be structured? Will this be select brands? Will they contribute to the growth of the network?"

Over 2,000 investors upvoted this question, representing a total of 367,000 Tesla shares. Elon Musk responded during the call, and Tesla posted the answer on the Say platform.

Users are then reminded to submit their votes through the app at the time of the annual shareholder meeting.

Other platforms like Proxymity are also allowing investors to submit their votes easily online. The technology is moving toward making shareholder engagement and proxy voting simpler and more scalable than it is today.

The nuts and bolts of today's voting process are commonly referred to as "proxy plumbing." Proxy plumbing deals with distributing ballots, counting votes, and communication with shareholders--three opaque, complex tasks with many intermediaries. Most votes today are sent "by proxy" (hence the name), meaning they are sent at different times and through different channels. As such, vote-counting isn't fully automated. It's common for votes to be over- or undercounted. But new solutions are modernizing the process and allowing individual investors to participate in a once-clunky process, all through online platforms and modern, social-media-style user experiences.

2) Meeting Investors Where They Want to Be Met Social media and intuitive user experiences are well-received among millennial and Generation Z investors, groups that generally support ESG ideas more than any other generation. Robinhood's acquisition of Say Technologies has the potential to bring engagement-style ESG investing to the young crowd, giving it more opportunity to speak out on corporate governance issues. The median Robinhood investor is 31 years old, and over half of all the app's users are investing for their first time.

Sustainable investing continues to grow rapidly across all ages and investor types. For investors who prefer funds over individual stocks, companies such as Tumelo offer a channel for fund investors to communicate with their pension providers to have a say in how their shares are being used to reach ESG and impact goals.

Whether they're investing in individual stocks, pension plans, or funds, new forms of communication are evolving to make retail investors part of the shareholder engagement process.

3) Helping Investors Understand Their Options to Make Impact Most individual investors don't have the time or money to understand specific ESG issues related to the companies they're invested in, nor how they can be addressed through proxy voting. The few who do tend to have backgrounds in sustainable investing.

But other engagement-focused startups are working to change that. Startups YourStake and OpenInvest both provide tools to help investors understand the impacts of their portfolios. Financial advisors can use either of these platforms to generate reports on how their clients' investments are reducing carbon emissions or improving diversity, for example, as compared with a benchmark.

Gabe Rissman, co-founder of YourStake, explains the necessity of having access to the right information. "YourStake got its start providing individual investors an easier way to join shareholder engagement campaigns," Rissman said in an interview. "But investors didn't have a clear idea of what was going on in their portfolios. We were putting the cart before the horse. Now we focus on helping financial advisors communicate the impact of their portfolios to their clients. And when investors see issues in their portfolios, they want to fix them. The data motivates."

Disruptions in the shareholder engagement space offer new opportunities to align the interests of all stakeholders, and individual investors are a necessary piece of the puzzle.

Jackie Cook, Morningstar's director of investment stewardship research, contributed to this article.

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RZEYRM7QNVE63FSD5LZOBHHTTQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AET2BGC3RFCFRD4YOXDBBVVYS4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IORW4DN3VVC3BC4JO7AQLSJTF4.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)