33 Undervalued Stocks for the Fourth Quarter

Here are our analysts’ top ideas in each sector for the coming quarter.

For the new list of Morningstar’s top analyst picks, read our latest edition of ”33 Undervalued Stocks.”

U.S. stocks were flat during the third quarter of 2021, as measured by the Morningstar US Market Index. We think stocks are slightly overpriced today: The median stock in our North American coverage universe trades at a 4% premium to our fair value estimate.

About 24% of the stocks we cover have Morningstar Ratings of 4 or 5 stars, observes Dave Sekera, Morningstar’s chief U.S. market strategist, in his latest stock market outlook.

"With the new delta variant cases declining, we expect economic normalization to resume after the summer slowdown," he notes.

Here are some specific undervalued stocks across sectors that are among our analysts' best ideas.

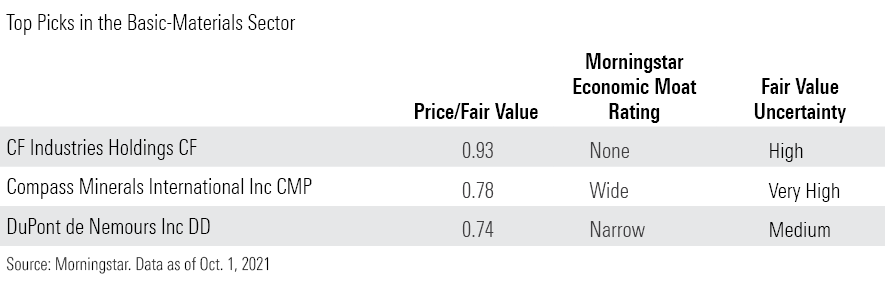

Basic Materials

Basic-materials stocks lagged the broader market during the third quarter but have paced the market during the past year, observes senior analyst Seth Goldstein. None of the basic-materials stocks in our coverage universe trade in 5-star range today.

We see long-term growth for specialty chemicals producers that sell to the automotive sector, thanks to the shift to electric vehicles. Nitrogen prices have risen from high demand but the price of U.S. natural gas is at multiyear highs, thereby limiting profits for nitrogen producers, explains Goldstein.

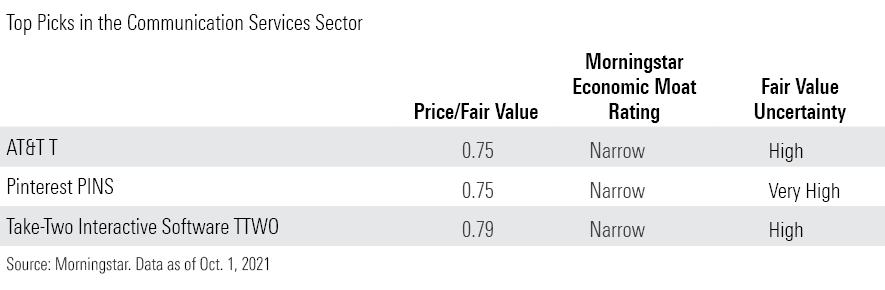

Communication Services

Communications-services stocks as a group continue to outperform the broader market, with Internet giants Alphabet GOOGL and Facebook FB accounting for most of the sector's gains, notes director Mike Hodel. "While we expect the surge in digital advertising spending that has driven both stocks higher to continue, we believe valuations now largely reflect this outlook," he adds.

Video game stocks have been among the poorest performers, after running up during the early days of the pandemic. But we think long-term trends remain favorable for the industry and these stocks are worth a look, says Hodel. Traditional telecoms have also come under some pressure recently.

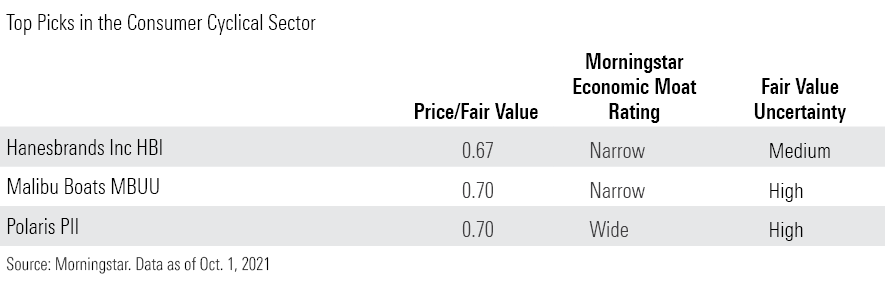

Consumer Cyclical

Despite their recent underperformance, consumer cyclical stocks appeared overvalued: The median consumer cyclical stock in our coverage universe trades at a 4% premium, estimates director Erin Lash. In particular, the apparel industry has enjoyed outsize sales as stores reopened and consumers resumed shopping, but we expect sales to slow as stimulus and unemployment benefits lessen, says Lash.

We expect consumers to begin to spend excess savings on experiences, including travel, adds Lash. In fact, the industry has been showing signs of a rebound. "We believe consumer demand for leisure travel will be enough to continue this upward momentum and push travel bookings equal to prepandemic levels by early 2023," she concludes.

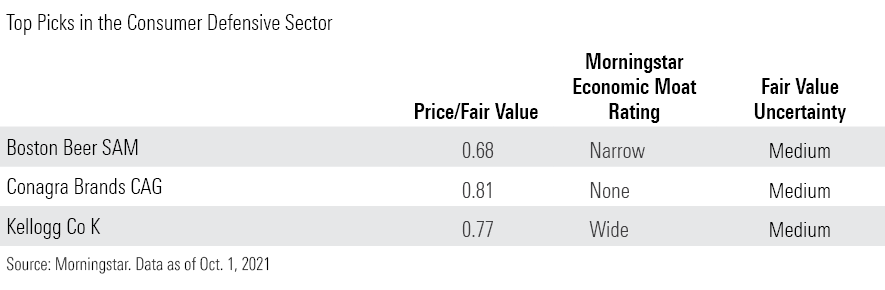

Consumer Defensive

Though the consumer defensive sector continues to lag the broader market, we think these stocks, as a group, are fairly valued, points out director Erin Lash. However, there are a good number of 4- and 5-star opportunities in the consumer packaged goods industry. "We surmise the market underappreciates the extent to which operators were investing to boast profitable top-line growth before COVID-19 took hold," explains Lash.

However, supply chain constraints continue to provide headwinds. Further, as COVID-19 cases surged, consumers resorted again to e-commerce. "Retailers that differentiate their experiences and offer convenient omnichannel options stand to retain the shoppers they've gained since the pandemic began," concludes Lash.

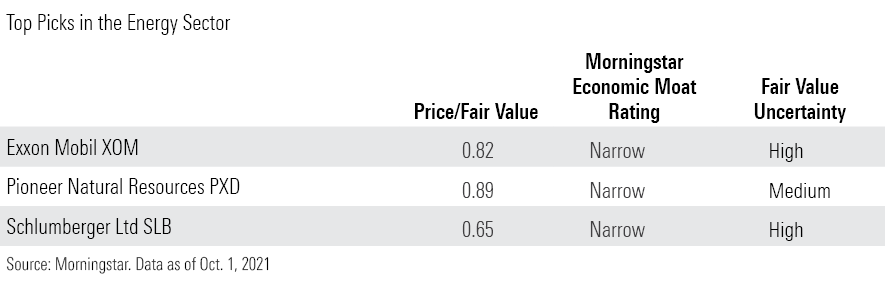

Energy

Energy stocks gave up gains during the third quarter but remain strong performers for the year to date, notes director Dave Meats. Energy stocks are slightly undervalued by our metrics, with the widest discounts in the services, integrated, and exploration and production industries.

We expect the recovery in consumption to persist. "Vehicle miles traveled has largely recovered, along with consumption of petroleum products like gasoline and diesel," explains Meats. Nevertheless, we think oil prices are frothy, and stand by our $55/bbl midcycle forecast for West Texas Intermediate crude.

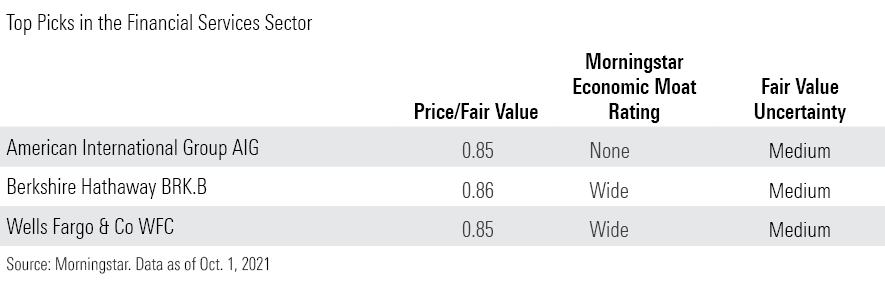

Financial Services

Financial-services continued to outperform during the third quarter. The average stock in the sector is about fairly valued, comments director Michael Wong. "Most of the primary drivers of earnings for financial sector stocks have continued to trend positively," highlights Wong.

Although we expect loan-loss provisions to tick up over the next several quarters, we think banks are well capitalized. We expect earnings to trend upward for property and casualty insurers during the next few years, and investment banks are firing on all cylinders.

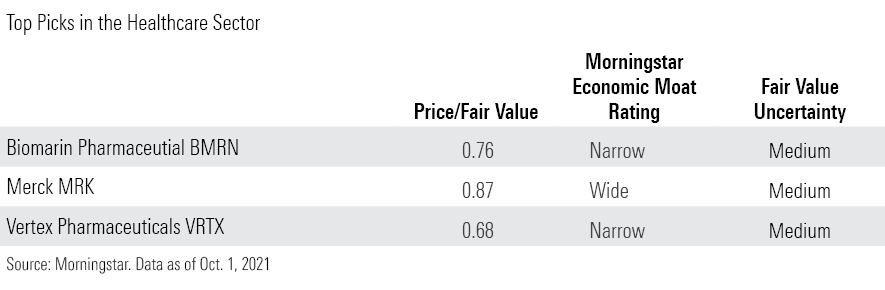

Healthcare

Valuations in the healthcare sector look a bit high, with the average stock in our coverage universe trading about 5% ahead of our fair value estimate. We think the sector's fundamentals are strong based on continued innovation, and we expect an acceleration in growth for several more elective healthcare areas for the remainder of 2021, asserts director Damien Conover.

The drug manufacturers and biotech firms remain the most undervalued--more than likely driven by expected changes in U.S. healthcare policy. "While changes in U.S. drug pricing policies to help reduce out-of-pocket costs are likely, we don't envision major changes," says Conover.

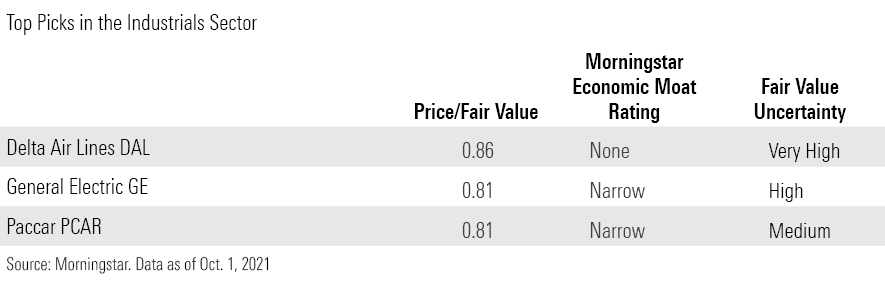

Industrials

Industrials stocks have lagged, rattled by supply chain disruptions and rising costs. Despite that, the sector remains overvalued, but there are pockets of opportunity, notes director Brian Bernard. For instance, airlines look more attractive after recent underperformance.

However, we expect the sector to continue to face headwinds, as many companies have warned of revenue and profit shortfalls ahead of third-quarter earnings. "Despite these warnings, we think investors may be unpleasantly surprised by second-half 2021 earnings results," suggests Bernard.

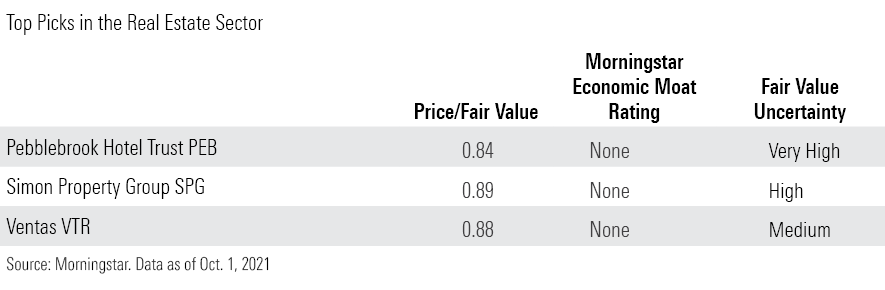

Real Estate

Since the successful development of COVID-19 vaccines, the real estate sector has performed in line with the broader market, notes analyst Kevin Brown. We think the sector is about fairly valued today.

The hotel and retail industries, in particular, have tremendously outperformed since the vaccine rollout. "The vaccine allows travelers to return to hotels and shoppers to return to stores, significantly reducing the risk of bankruptcy for these companies and making the path to recovery clearer," explains Brown. We expect hotels and malls will enjoy growth for years.

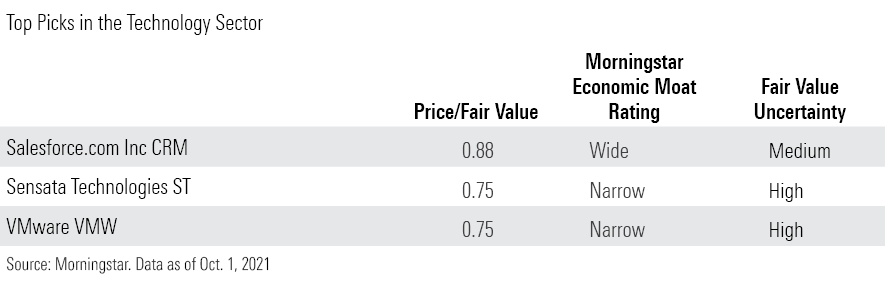

Technology

Technology stocks outperformed the broad market in the third quarter; the sector is about 5% overvalued by our metrics, reports director Brian Colello. "Across most of tech, we're still bullish on the secular tailwinds supporting growth in such areas as cloud computing, 5G, and the Internet of Things," he adds.

Software is the most overvalued subsector by 16%; hardware is the most attractive, trading about 2% below our fair value estimate. We expect the global chip shortage to stretch until mid-2022, which bodes well for the near-term results for chipmakers that are shipping virtually every chip they can build, concludes Colello.

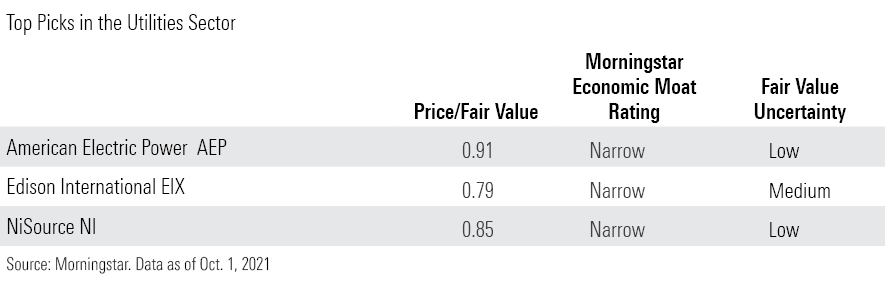

Utilities

Utilities are the worst performing sector this year, notes strategist Travis Miller. About 25% of the U.S. utilities we cover are undervalued today. "We don't see any immediate signs that utilities' performance will improve markedly during the next few quarters," he says. Inflation remains a near-term obstacle, as some utilities adjust their spending plans.

That being said, utilities remain one of the few places in the market where investors can find stable, growing income, adds Miller. Moreover, policymakers are turning to utilities to implement their environmental goals.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)