Q3 Market Performance in 8 Charts

U.S. stocks and bonds remain little changed from the second quarter

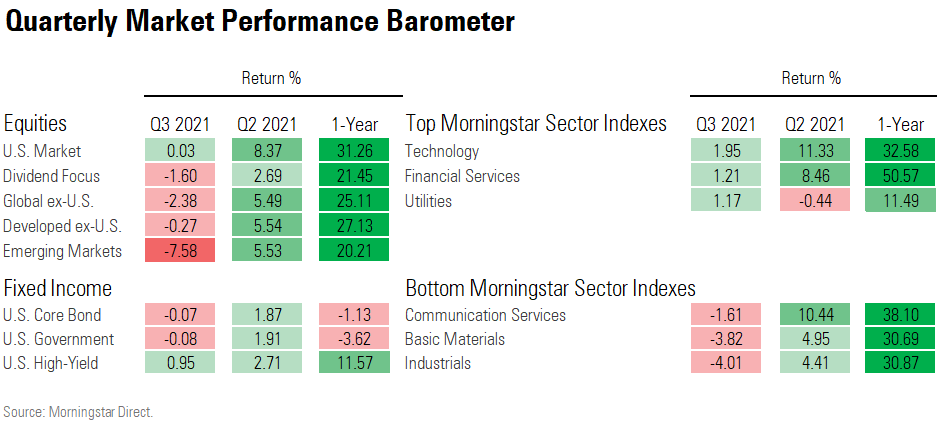

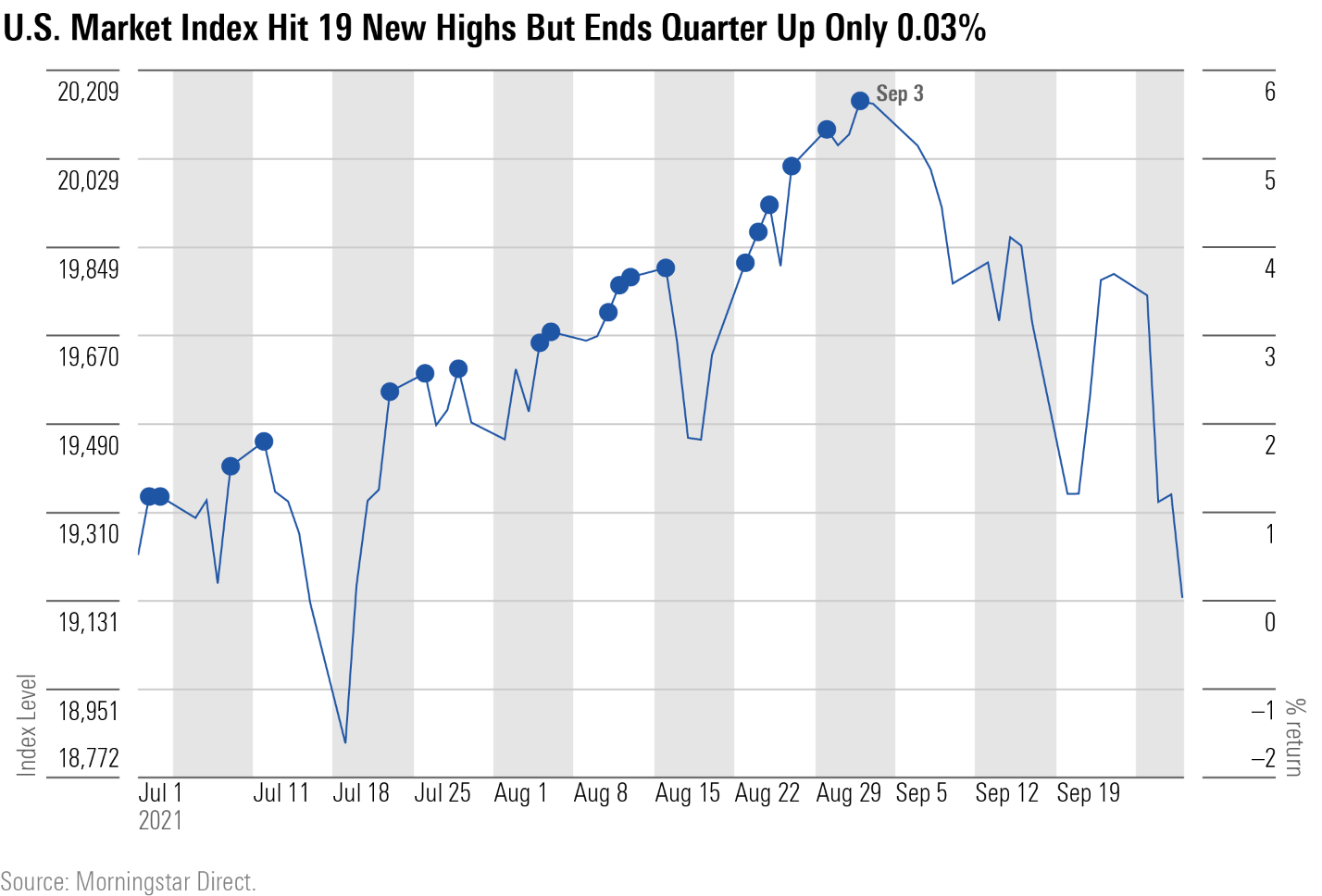

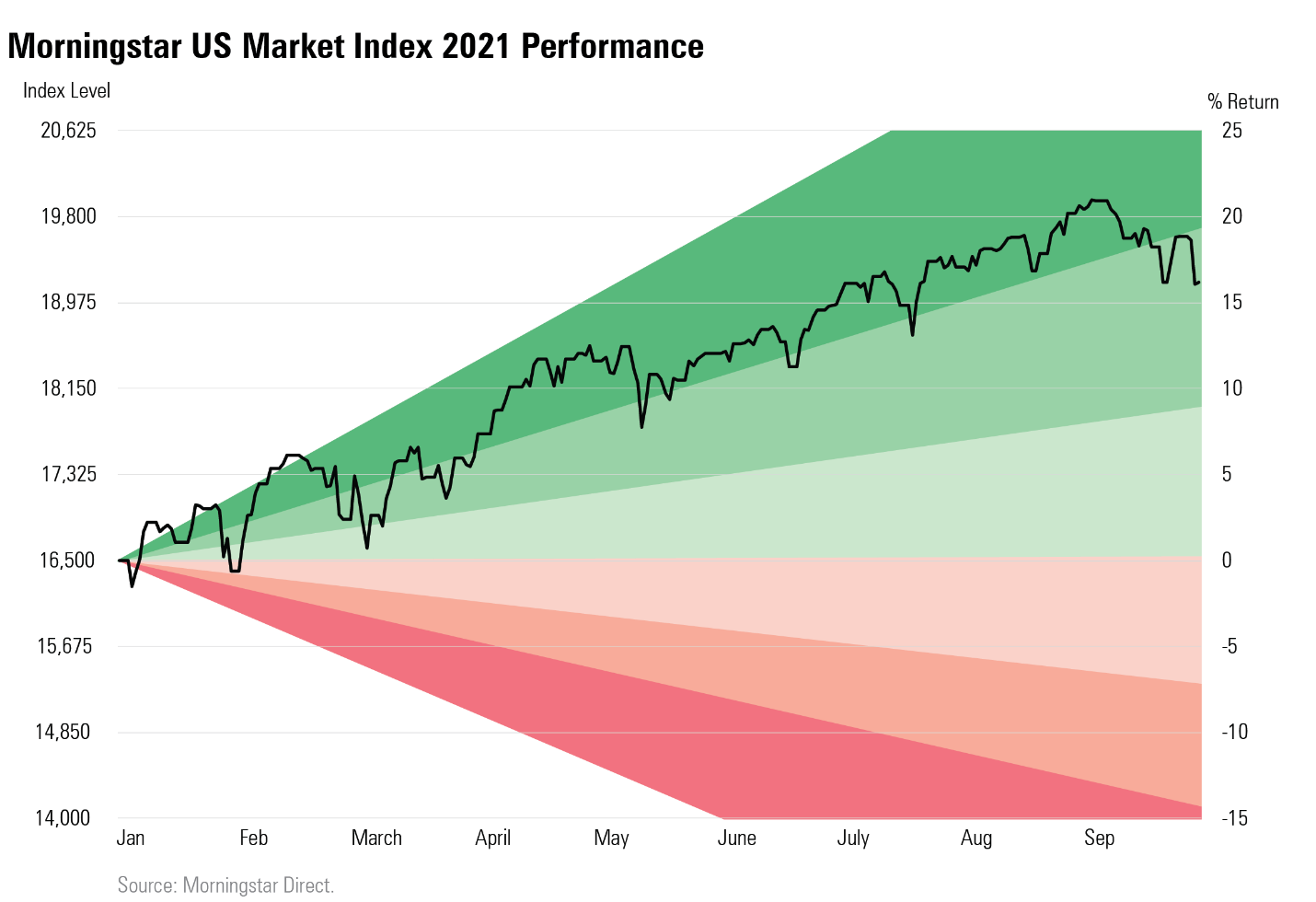

It was a round trip for U.S. stock investors in the third quarter of 2021, with the broad market posting 19 new highs before falling back to end up where it had been three months earlier. Still, major stock markets around the globe are still up strongly over the past year, a contrast to some corners of the bond market where investors are facing losses.

The Morningstar US Market Index climbed higher in July and August on optimism about the U.S. economic recovery. However, shares fell back from their highs amid worries about the impact of the coronavirus' delta variant on the economy, supply chain slowdowns leading to shortages across a number of key industries, and a regulatory crackdown in China. A jump in U.S. Treasury yields also weighed on the market.

Even with the late-quarter setback, the Morningstar US Market Index finished the third quarter up 15.0% so far in 2021, which follows a 20.9% return in 2020.

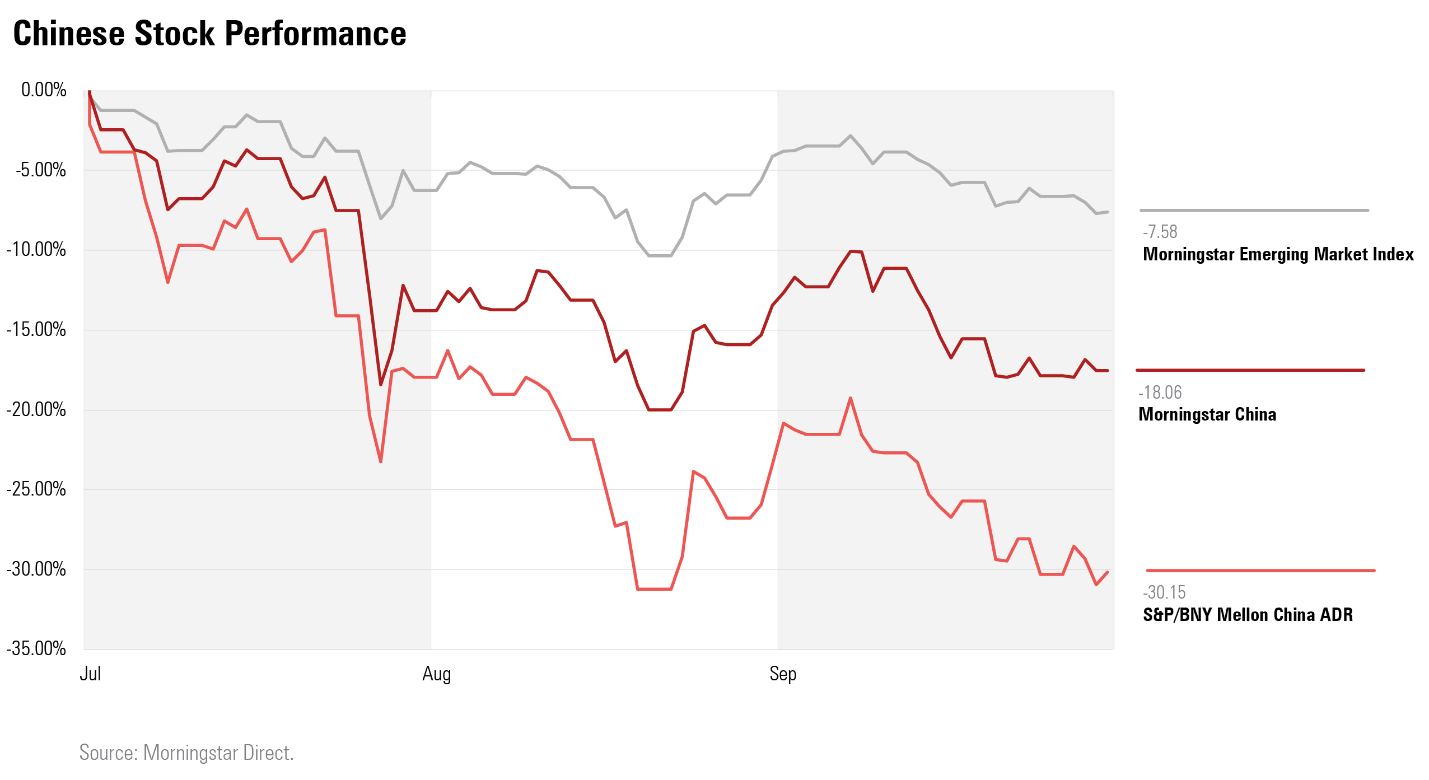

Globally, markets were rattled by the potential collapse of Chinese property giant Evergrande. Chinese stocks account for 35% of the Morningstar Emerging Markets Index, and the benchmark tumbled 7.6% in the quarter. Developed markets fared better, falling only 0.26%.

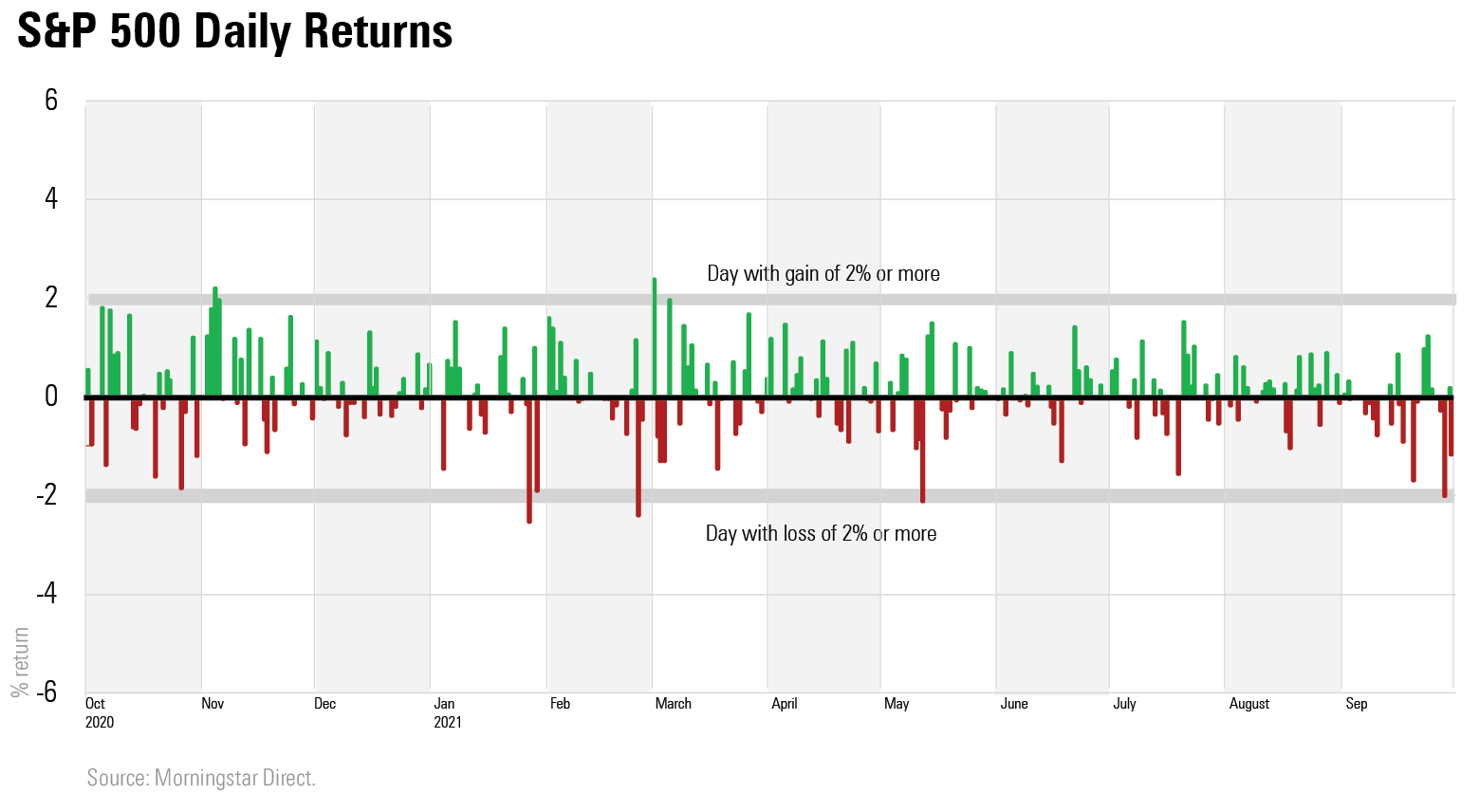

Though rising U.S. bond yields and the news surrounding Chinese stocks added some volatility to emerging-markets indexes, it was another calm quarter in the United States. The S&P 500 moved more than 2% only on one day, and it moved more than 1% on only eight days, down from 12 times in the quarter prior and 18 times in the first quarter.

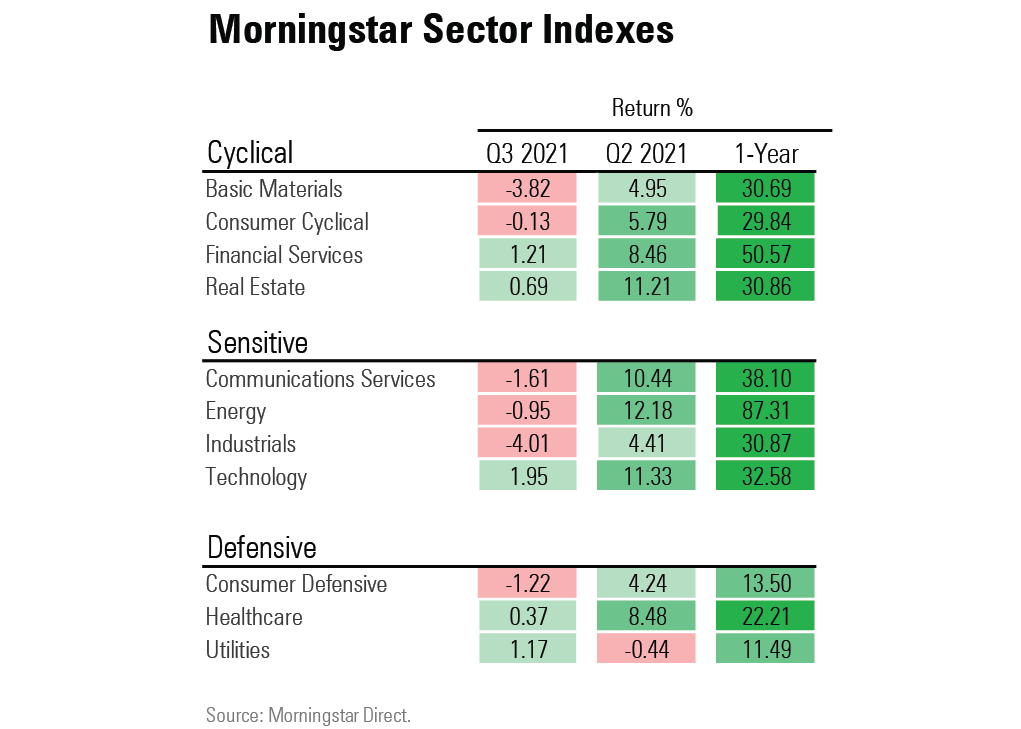

Amid the overall soft performance of U.S. stocks, financial-services and technology companies led gains among sectors.

Increases in shipping costs and commodities prices hit basic-materials and industrials companies the hardest. The communication-services sector also suffered, hurt by a 2.39% drop in Facebook (FB) shares and a 32.43% fall by Zoom (ZM).

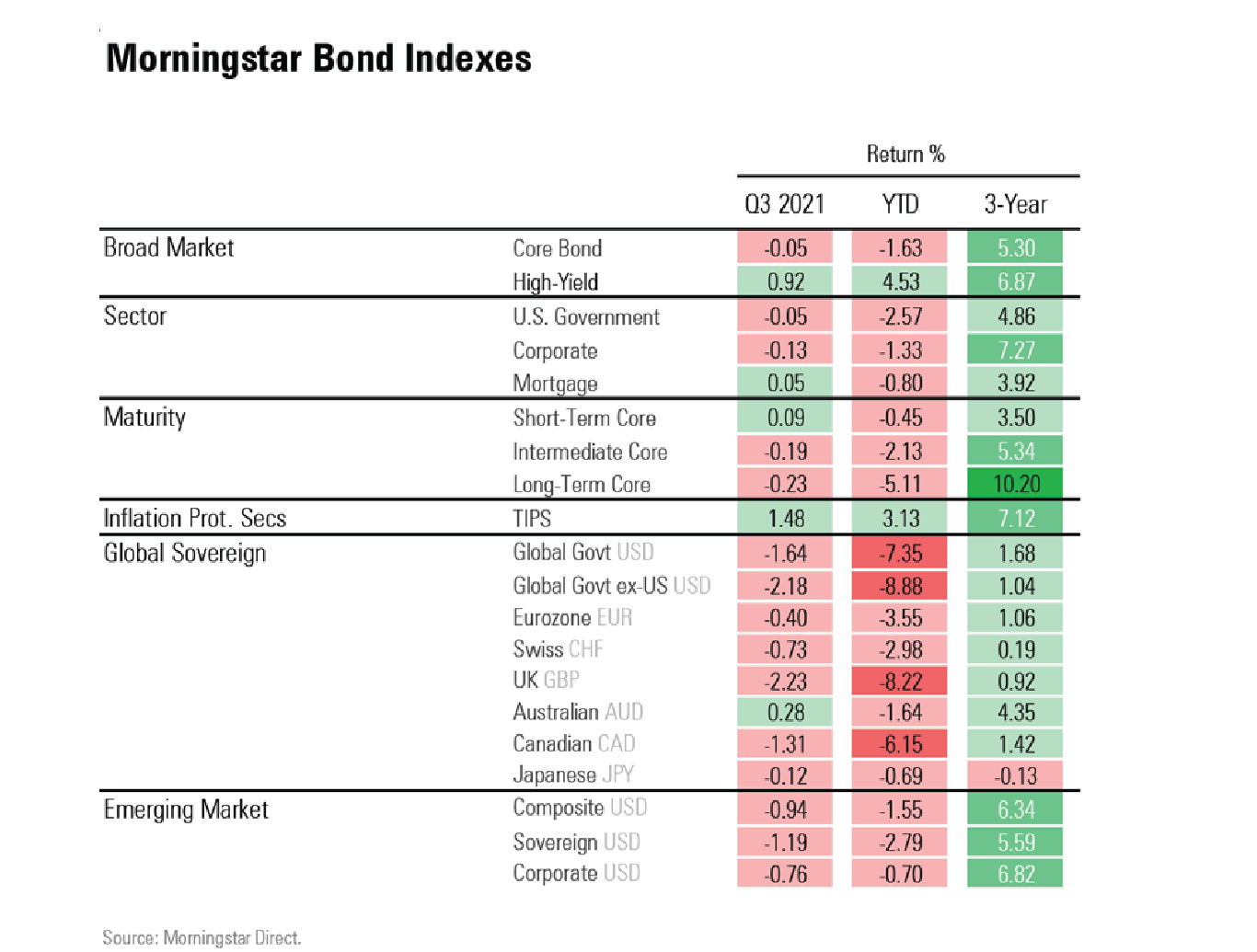

In the bond market, the third quarter began with a rally as the prospect of a slower recovery pushed the yield on the 10-year U.S. Treasury note to its lowest level since February. But after a higher-than-expected inflation forecast from the Federal Reserve and an indication that it could raise interest rates next year, bond prices fell back and yields rose.

Riskier high-yield bonds fared better than safer core and Treasury bonds in the sell-off. But as a result, only high-yield bonds and Treasury Inflation-Protected Securities are positive on the year. Most bond sectors are on track for a negative year

For the Morningstar US Core Bond Index--which tracks the largest sectors of the investment-grade U.S. bond market--it would be the first year since 2013 that it ended in the red. For U.S. Treasuries, it would be the worst year since 2017.

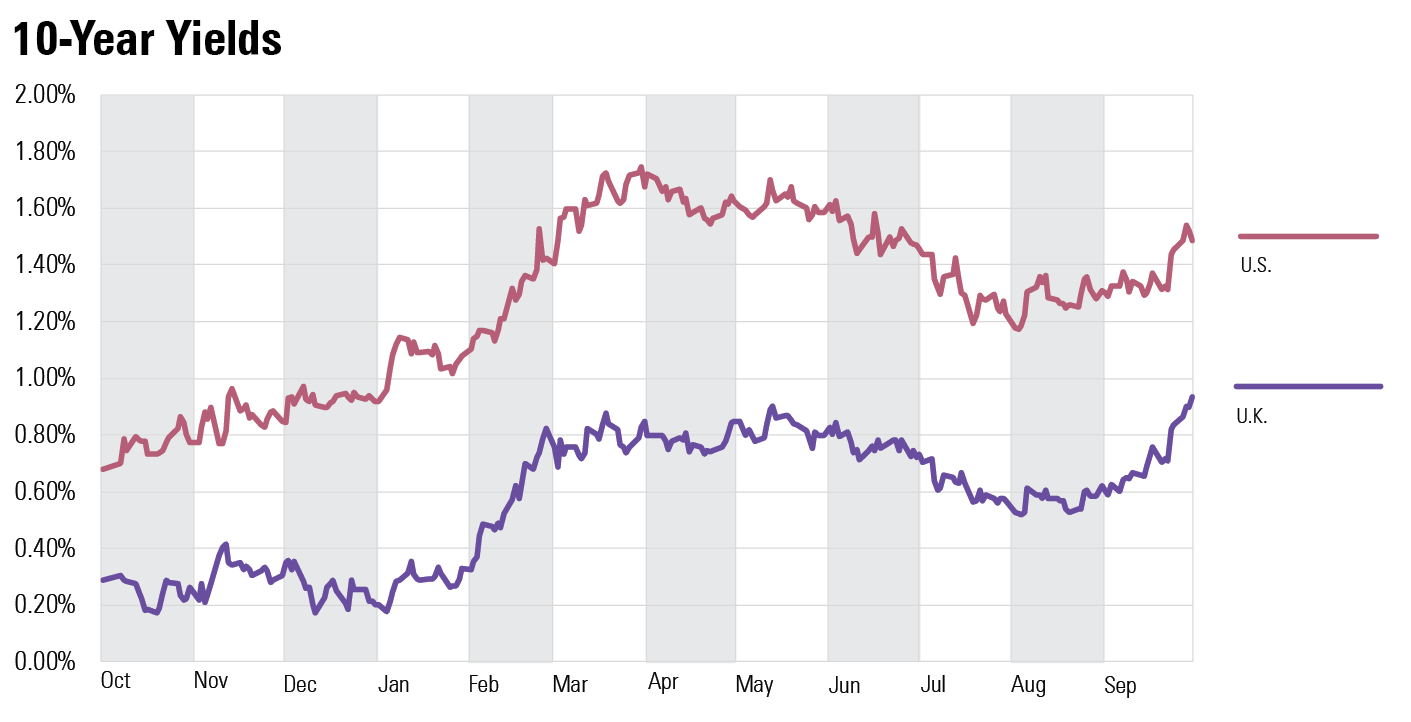

Rate increases and rising inflation especially hit global bonds. Global government ex-U.S. bonds are down 8.88% for the year to date, and U.K. bonds were hit particularly hard as a growing energy crisis sent fuel prices skyrocketing and enhanced concerns of rising inflation. In addition, similar to the Fed's trajectory, the Bank of England indicated that it would raise rates in the next year, sending the yield on the 10-year gilt to a one-year high.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)