Q3 Top Stock Performers on Morningstar's Coverage List

Tech, energy, and retail stocks popped ahead of a flat market.

As the broad market took a round trip in the third quarter, technology, energy, and consumer stocks led the best performers among stocks followed by Morningstar’s equity analysts.

Among tech stocks, performance was especially strong for workforce and data management companies, and energy stocks took a volatile ride higher on the back of rising oil prices.

Each quarter we take a look back at the prior three month’s best performers, highlighting trends that drove performance and seeing where these top-performing stocks land in terms of being overpriced, cheap, or fairly valued.

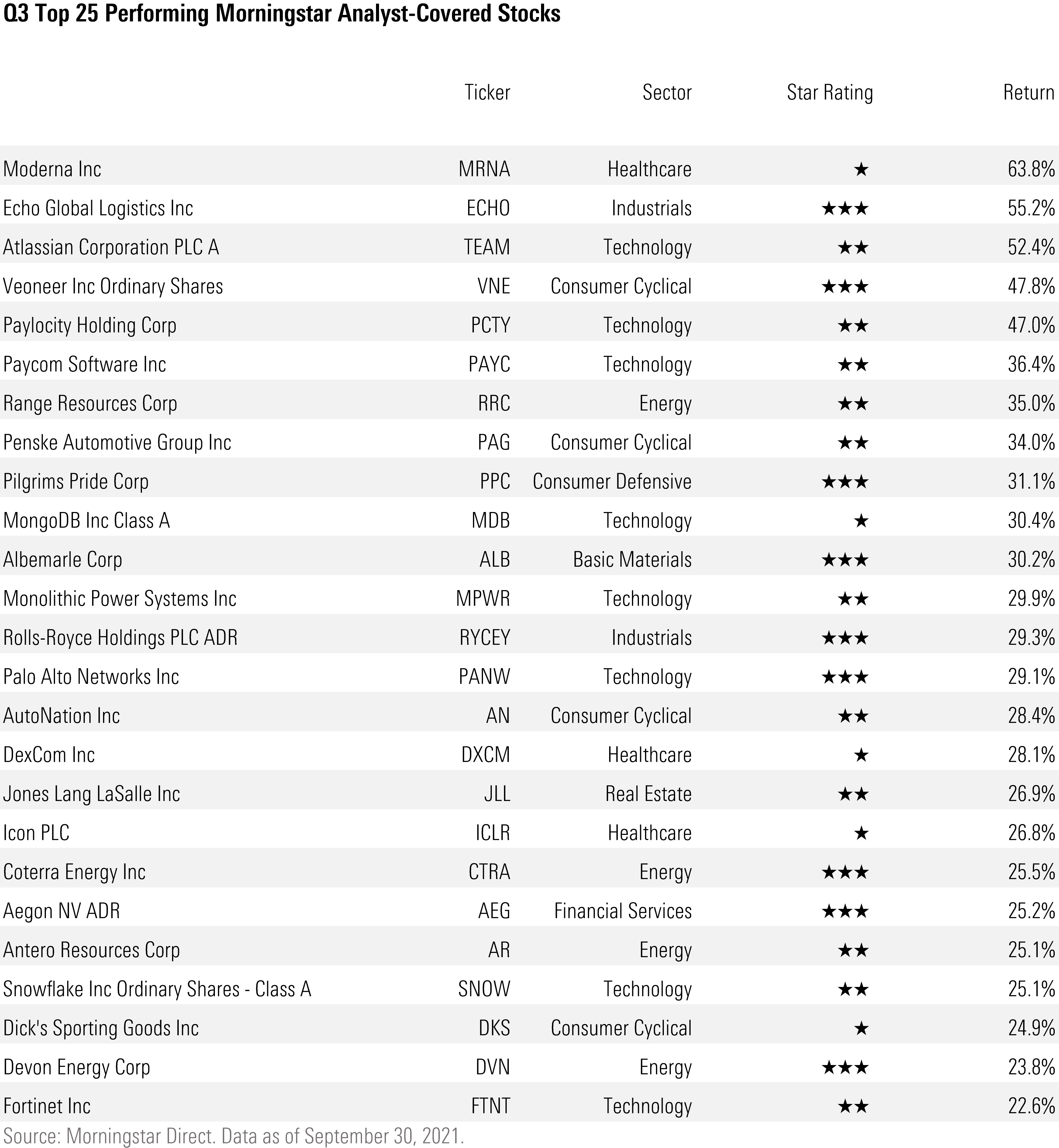

For the third quarter, here are the top-performing U.S.-listed stocks covered by Morningstar analysts:

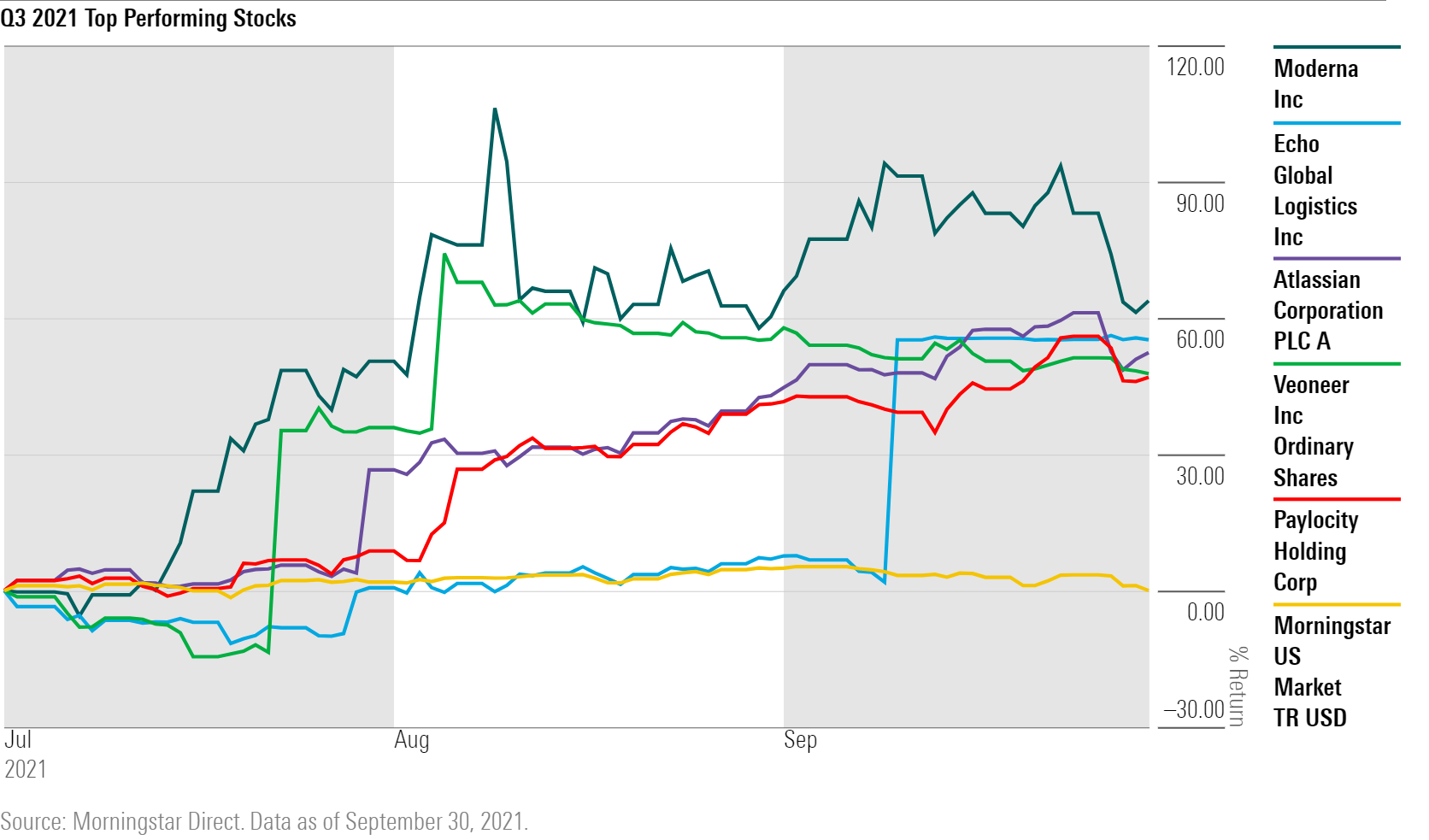

The best-performing stock in the group was pharmaceutical company Moderna MRNA, which has been thrust into the spotlight thanks to its coronavirus vaccine. Moderna extended its rally from 2021’s second quarter by another 63.8% takeoff in the past three months. The vaccine maker is now up 211.9% for the year to date. The second-strongest performer was Echo Global Logistics ECHO, up 55.2% in the third quarter, followed by Atlassian TEAM with a 52.4% rally.

Moderna’s current price places it as the third most overvalued company on Morningstar’s coverage list, trading at a 142% premium to its estimate fair value at the time of writing. Paylocity PCTY trades at a 32% premium to its estimated worth, while Atlassian is 29% above its fair value estimate.

Tech, Energy, and Consumer Cyclical Stocks Run Ahead

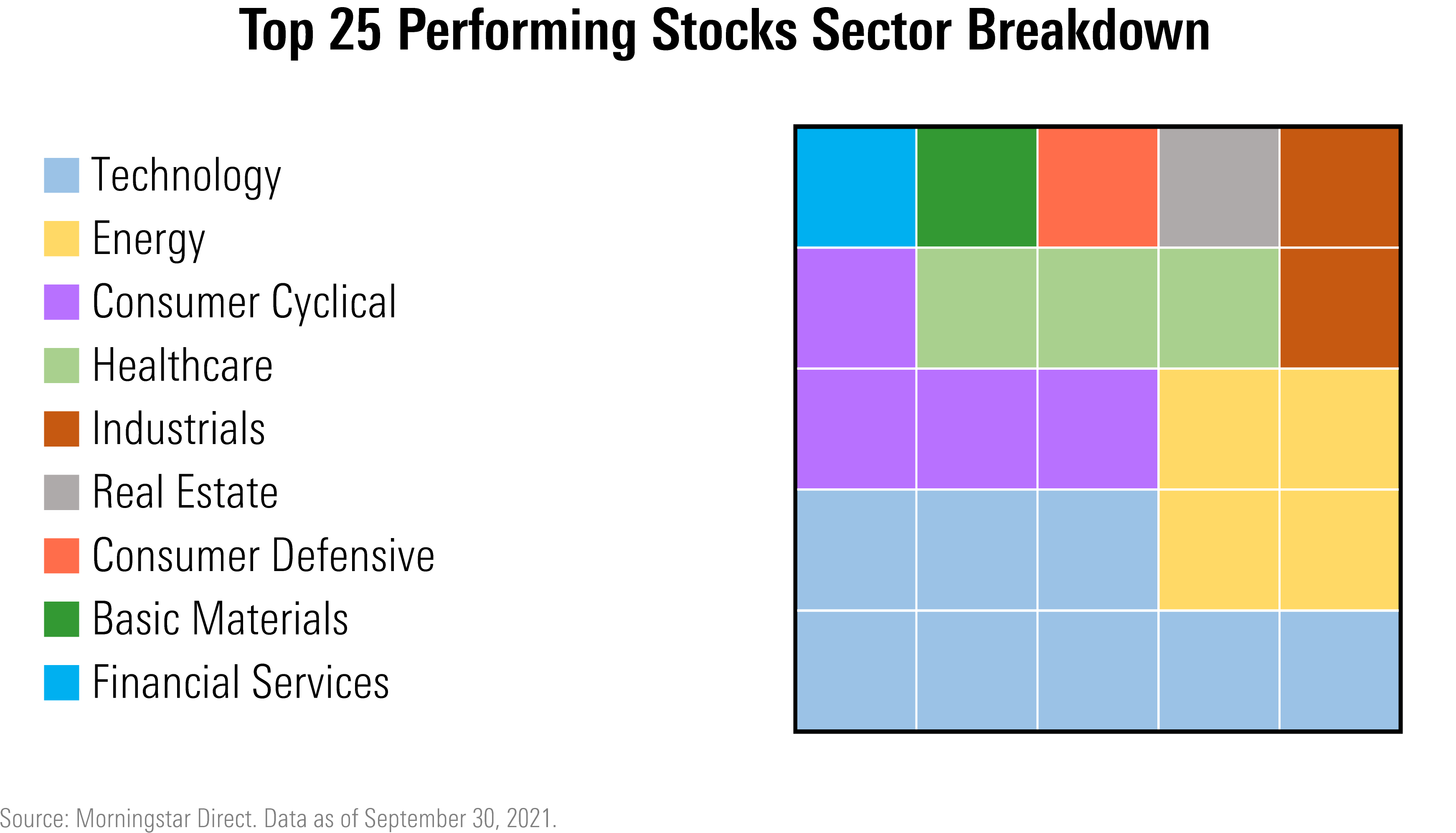

Of the top 25 performing stocks in our coverage list this quarter, tech, energy, and consumer cyclical stocks make up more than half. (A full list of the top performers can be found at the end of this article.)

Tech stocks that provide offerings in workforce management have done exceptionally well in the past three months.

Atlassian leads the group with a 52.4% quarterly return. Following the project management company is Paylocity, up 47.0%, and Paycom PAYC, up 36.4%. Both firms provide cloud-based payroll and human capital management services.

Database management companies saw strong gains in the third quarter. MongoDB MDB rose 30.4%, and Snowflake SNOW was up 25.1%. However, equity analyst Julie Sharma pegs them as overvalued at current prices. MongoDB is 64% ahead of its fair value, while Snowflake trades at a 29% premium.

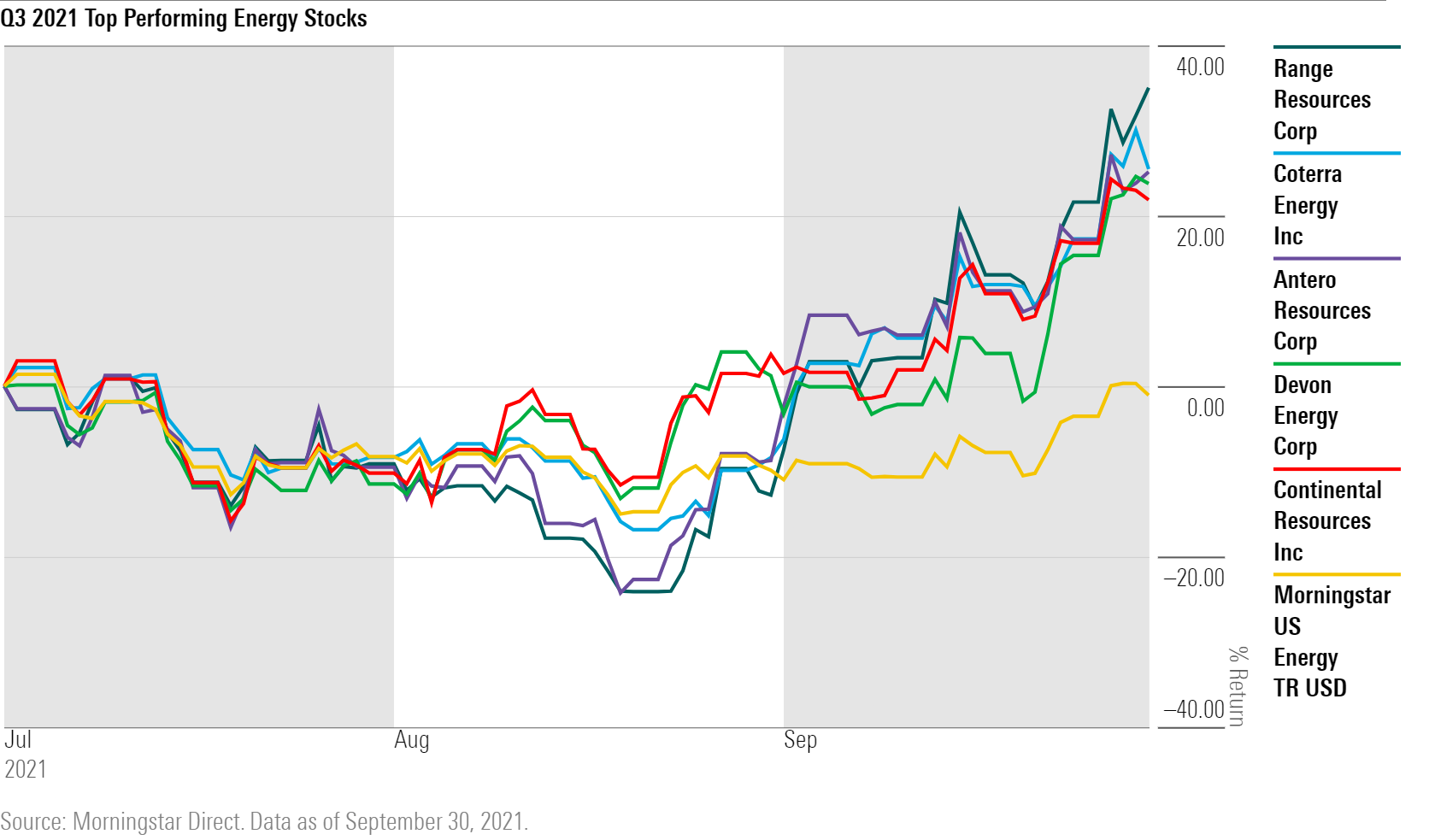

Energy stocks dominated our coverage list in performance last quarter in large part because of rallying oil prices. This quarter, some of our top-performing energy stocks have swung from losing up to 25% in August to gaining more than 20% in September. Leading the pack is Range Resources RRC, which closed the quarter with a 35.0% rally. Cabot Oil & Gas (now Coterra Energy CTRA) and Antero Resources AR are right behind, both returning 25% throughout the quarter.

Energy stocks have benefited from oil prices, which have rallied to a new three-year high amid a supply crunch; production has failed to keep up with demand as the global economy recovers from the pandemic downturn. Morningstar analyst Stephen Ellis says it's unclear whether OPEC production increases will be extended into 2022. Furthermore, U.S. shale companies have been utilizing their extra cash flow to reduce their debt rather than expanding their rigs and production capacities, he says.

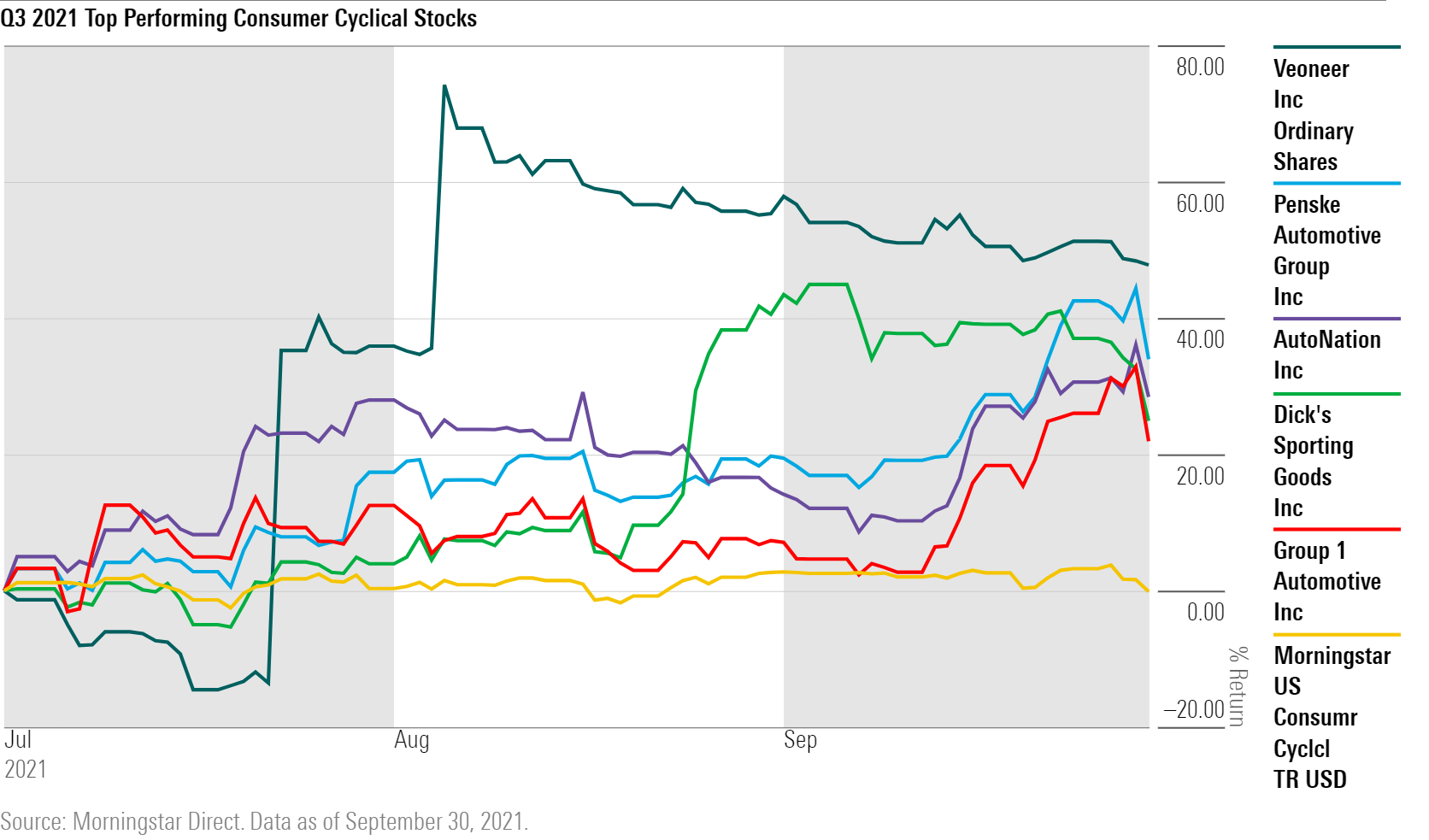

With U.S. retail sales recovering nicely from the pandemic, consumer cyclical stocks in the retail industry have done well in recent months. Retailers that intersect with the automobile industry have done better still. Companies that sell new or used cars, or car parts, have enjoyed immense pricing power as the strained global supply chain and semiconductor shortage create a massive demand-supply gap in the automobile industry.

Veoneer VNE is the top performer of auto stocks under Morningstar’s coverage, rising 47.8% this quarter. Dealerships AutoNation AN (up 34.0%) and Penske Automotive PAG (up 28.4%) followed. Morningstar currently pegs Veoneer as fairly valued. However, AutoNation and Penske Automotive both trade 20% above their fair values.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZU2N7Y2TDFFL3EAFRGYANDSBJY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FNDLNORUIBFD5KKEXASUD67L6Q.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BHGJBKNFZRB7NHXO3ZLRNAHOIY.png)