4 Ways to Keep More of Your Funds' Returns

Following a disciplined investment strategy can help you keep more of what your fund holdings earn.

Our annual "Mind the Gap" study found that there’s a persistent gap between the returns investors actually experience and reported total returns. After adjusting for the impact of cash inflows and outflows, investors earned about 7.7% per year on the average dollar they invested in mutual funds and exchange-traded funds over the trailing 10 years ended Dec. 31, 2020, compared with reported total returns of 9.4% per year. This shortfall, or "gap," stems from inopportunely timed purchases and sales of fund shares, which cost investors nearly one sixth the return they would have earned if they had simply bought and held.

This return gap adds up over time. For example, an investor who started with a $300,000 portfolio at age 50 and consistently saved $10,000 per year over the next 15 years (not adjusted for inflation) would end up with about $1.6 million by age 65 if she earned the same return as the underlying funds in our study, but only about $1.3 million if she earned the average dollar-weighted return. That lower balance would also significantly reduce the amount of assets she could safely withdraw every year to support spending during retirement.

Investor return gaps mean there’s a lot of potential value being left on the table, but it doesn’t have to be that way. In this article, I’ll explain four strategies investors can use to improve their results.

Hold a Small Number of Widely Diversified Funds

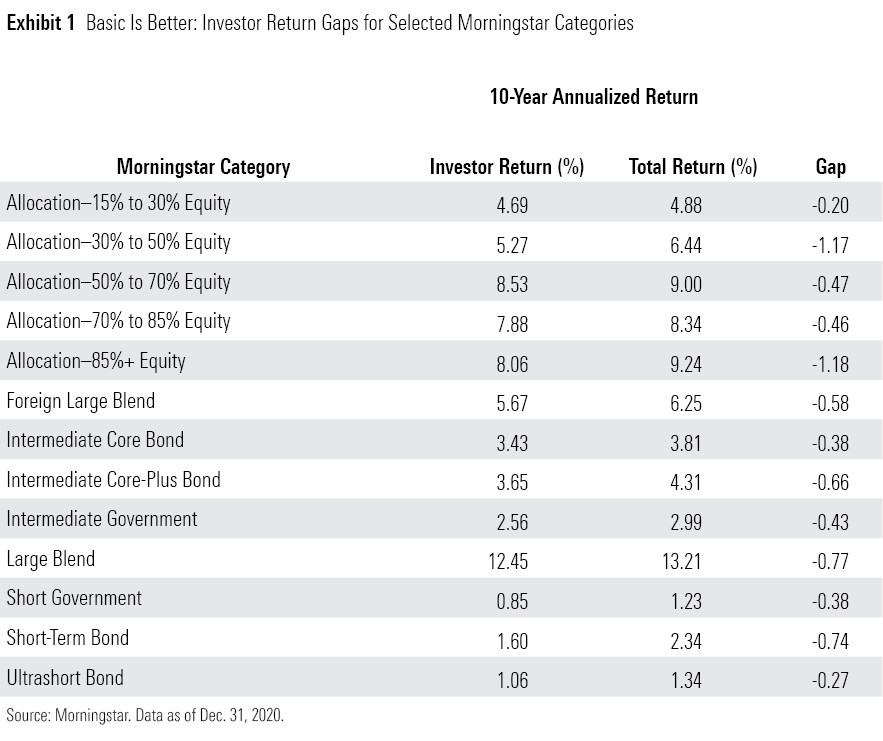

As the fund industry has grown, asset-management firms have rolled out more and more highly specialized funds. Theme-based sector funds, alternative funds of various stripes, leveraged factor portfolios, and single-country funds are just a few examples. But investors have fared far better by keeping things simple and sticking with plain-vanilla, broadly diversified funds. More broadly defined offerings, such as U.S. equity and taxable-bond funds, have fared significantly better than narrower offerings like sector funds and alternatives.

Under the surface, though, there's a more-nuanced story. More-specialized areas with the most-volatile cash flows--namely, alternative funds and sector equity funds--fared much worse than average and pulled down the aggregate results. The more-mainstream areas that are home to the majority of investor assets--such as U.S. equity funds and taxable-bond funds--fared much better, with return gaps of about 1 percentage point per year. Allocation funds also continued to excel, suggesting that their built-in asset-class diversification makes them easier for investors to buy and hold over time.

Simpler has also been better when it comes to specific Morningstar Categories. The broadest categories, such as large-blend, intermediate core bond, and foreign large-blend, have generally fared better than more narrowly defined categories. From a portfolio-construction perspective, that means investors should lean heavily on these areas as core holdings and avoid narrowly defined funds that tend to have the widest return gaps.

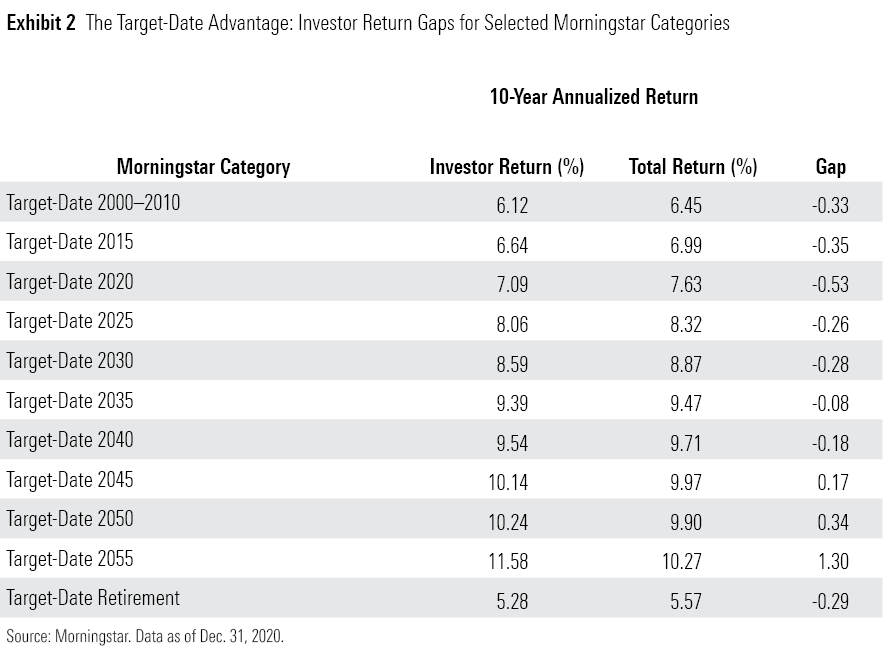

Funds that offer built-in asset-class diversification also excelled in our study. Morningstar has often sung the praises of target-date funds, which provide a preset blend of exposure to major asset classes that shifts over time. These funds and other asset-allocation offerings, such as balanced funds, have consistently shown some of the smallest investor return gaps. Not only are these funds easy to use, but they're also easy to live with. Investors tend to buy and hold them for long periods, or make investments on a regular schedule that enforces investment discipline and helps them avoid the temptations--and pitfalls--of trading at the wrong time. As shown in Exhibit 2, target-date funds of various categories generated investor returns that were relatively close to their reported total returns--and even pulled ahead in some cases.

Automate Routine Tasks, Such as Setting Asset-Allocation Targets and Rebalancing

Investors can easily get caught in a cycle of analysis paralysis by fretting over how much to buy or sell at various times. The constant stream of market and economic news can make it tempting--even for professional investors and financial advisors--to feel like they should be doing something to respond to shifting market conditions. But for the most part, the time and energy that investors spend on trading decisions is a wasted and often counterproductive effort. Tactical asset-allocation funds are a case in point. These funds make rapid-fire shifts between stocks, bonds, and other asset classes in an attempt to benefit from changing market and economic trends. But on average, tactical asset allocation funds have lagged portfolios with more static asset allocations by a fairly wide margin.

If professional fund managers aren’t able to add value by shifting between asset classes, that’s all the more reason for individual investors not to attempt anything similar. Instead, investors can improve their results by setting a rational asset allocation, buying low-cost funds, and just sticking with the plan. It also makes sense to set a strict schedule for rebalancing, such as rebalancing once per year or when your portfolio's allocations drift significantly away from target levels.

Avoid Narrow or Highly Volatile Funds

As a corollary to focusing on broadly diversified funds, it's also important to avoid highly specialized or volatile offerings. As mentioned above, dollar-weighted returns for the most specialized category groups and categories often fall behind those of more broadly diversified offerings. Within each category, investors also generally experienced narrower return gaps in less-volatile offerings. With only a few exceptions, funds that expose investors to less volatility are easier to own and less prone to erratic cash flows.

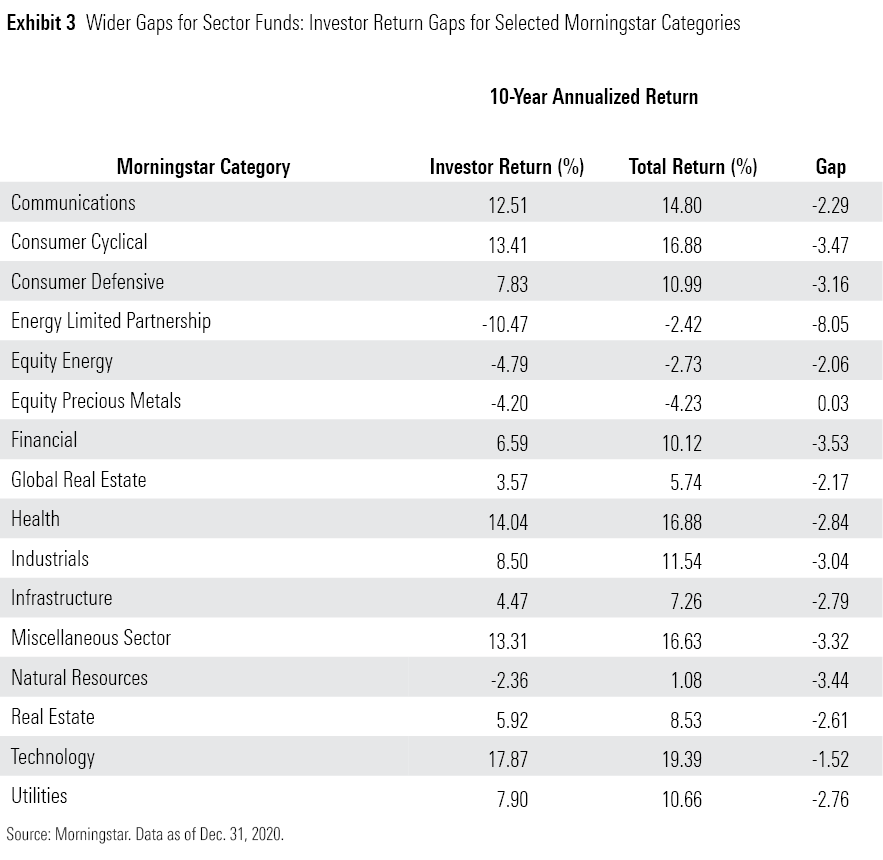

Sector funds are a prime example of the perils of narrowly defined funds. As shown in Exhibit 3, dollar-weighted returns have lagged investor returns for almost every sector-fund category, with only a couple of exceptions. On average, sector-fund investors gave up close to 4 percentage points per year because of poorly timed fund flows. Sector funds are particularly prone to performance-chasing, with investors often piling into popular sectors after a strong showing and then bailing when they fall out of favor. The specialty-financial category, for example, attracted large inflows in 2007 and 2008, followed by billions in outflows in the wake of damage from the global financial crisis. Healthcare funds experienced significant asset growth from 2013 through 2015, but many of those assets fled after the medical sector lagged in 2016.

Investors in country- and region-specific funds, as well as most alternative funds, have also suffered wider-than-average investor return gaps. Ironically, investors often seek out these areas in hopes of outperformance, but poorly timed purchases and sales mean they often end up giving up any extra returns they might have hoped to capture. Alternative funds, for example, have been a twofold disappointment. Total returns have been relatively low to begin with, and these funds have also proved difficult for investors to use effectively. As a result, alternative funds have actually experienced negative returns in dollar-weighted terms, falling more than 4 percentage points behind reported total returns.

Embrace Techniques That Put Investing on Auto-Pilot, Such as Dollar-Cost Averaging

Dollar-cost averaging doesn’t usually lead to better results compared with a buy-and-hold approach. In fact, because market returns are positive more often than not, dollar-cost averaging often leads to lower returns. This simply reflects the underlying math of total returns: If returns are generally positive, investors are typically better off making a lump-sum investment and holding it for the entire period. As mentioned earlier, investors who buy and hold can take full advantage of performance trends when total returns are positive, but investors who contribute smaller amounts over time often have fewer dollars invested during periods with strong returns.

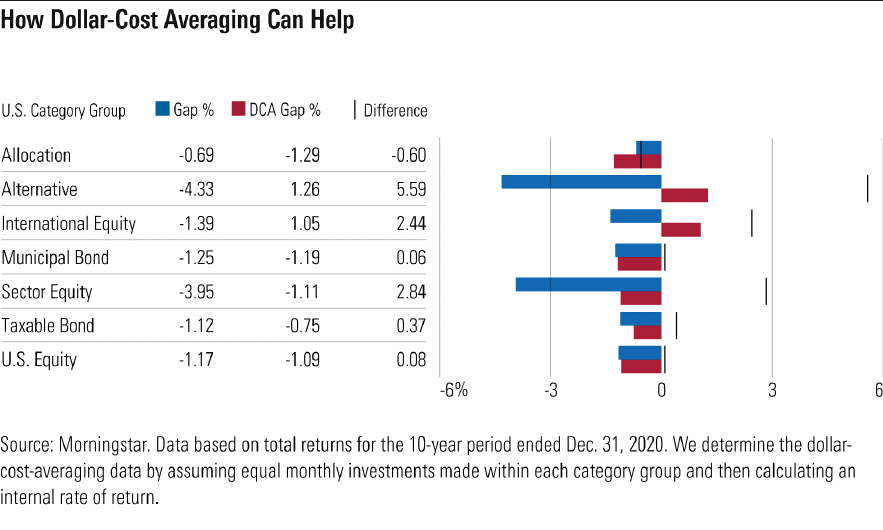

But dollar-cost averaging can help investors avoid some of the ill effects of poorly timed cash flows by enforcing a more-disciplined approach. In fact, following a systematic investment approach would have improved investors' results in six of the seven major category groups. With international equity and sector equity funds, for example, investor returns based on dollar-cost averaging came out more than 2 percentage points per year ahead of investors’ actual returns. Dollar-cost averaging pulled even further ahead for the alternatives category group. Investors in these funds tend to make frequent purchases and sales, but all of that trading activity hasn't led to better results. Following a more-disciplined approach would have improved returns by more than 5 percentage points per year.

Conclusion

The four strategies discussed above have a common underlying theme: the simpler, the better. By minimizing complexity, trading activity, and the need to make decisions, investors can significantly improve their results and keep a greater portion of their funds’ total returns.

/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LUIUEVKYO2PKAIBSSAUSBVZXHI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)