The Best HSA Plans of 2021

Fidelity stands above the rest during our annual HSA checkup.

Editor’s note: We have published new research and enhanced our methodology. Read our evaluation of the best HSA providers of 2022.

As open-enrollment season approaches, you may be looking for a health savings account. HSAs come with high-deductible healthcare plans (a plan with a deductible of at least $1,400 for individuals or $2,800 for families) for people under 65.

Finding the right plan can be a daunting task given the numerous providers available and an overall lack of transparency in the space. To make things easier, we evaluated 11 of the top HSA providers in our 2021 Health Savings Account Landscape. Our report evaluates HSAs available to individuals looking to shop around. It does not consider employer-sponsored accounts, which can vary from the plans offered to individuals.

Why You Should Consider an HSA

HSAs offer tremendous tax benefits: Money enters tax-free, grows tax-free, and can be withdrawn tax-free if spent on qualified medical expenses. Individuals that use their HSA dollars on current healthcare expenses benefit because HSA contributions are excluded from income, Medicare, and Social Security taxes. Individuals that invest and grow their HSA dollars to pay for future medical costs further benefit from the tax-free growth of HSA dollars.

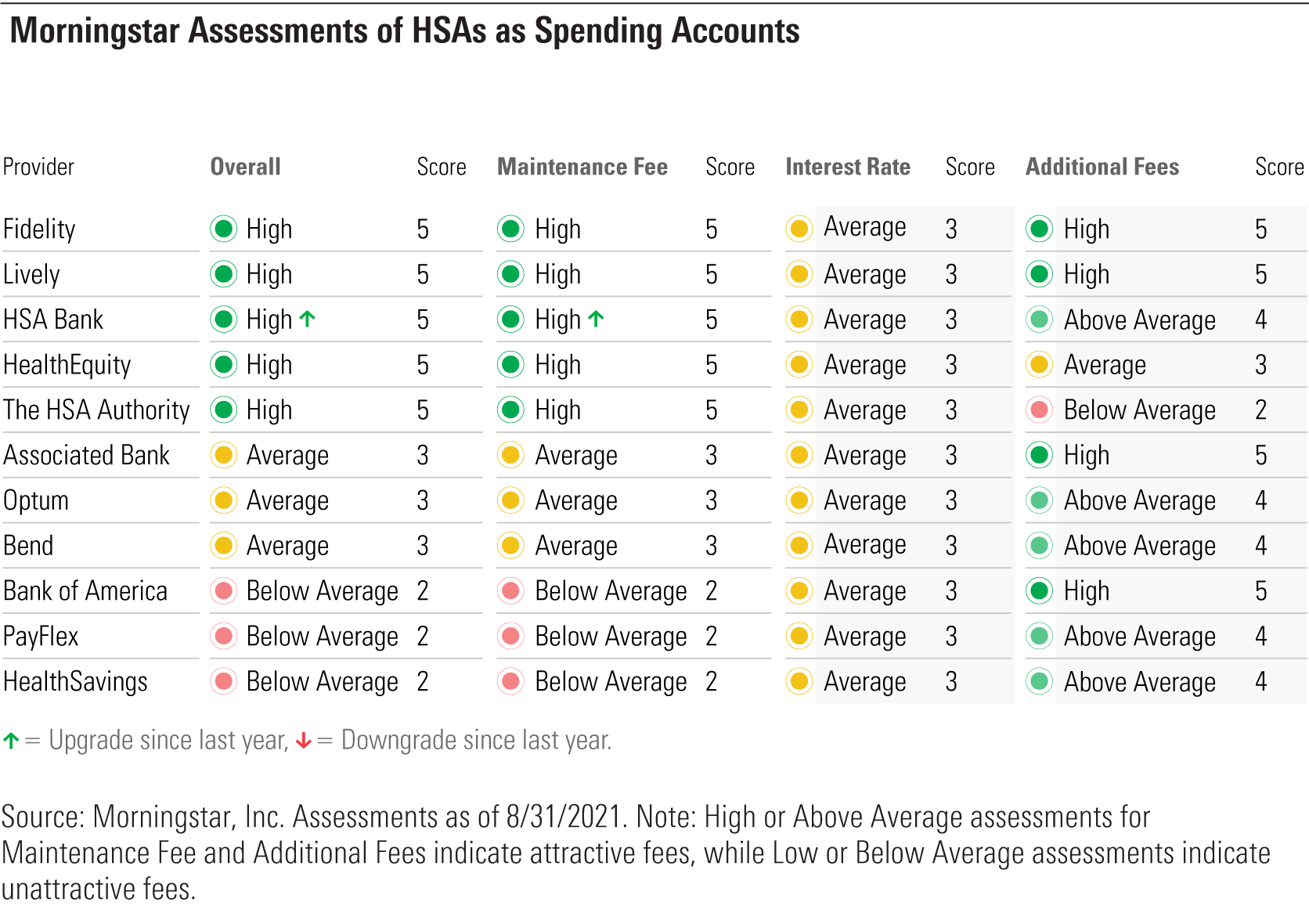

Whether you’re using an HSA as a spending account, an investment account, or both, our evaluations have you covered. We ranked 11 plans from both a spending and an investing perspective. You should prioritize the most relevant assessment for your circumstances.

This year, Fidelity remains the only HSA provider that earns a High assessment (the best assessment on our five-tier scale) for both its spending and investment accounts.

The Best HSAs for Spenders

HSAs as spending accounts should follow these best practices:

- Offer spending accounts without maintenance fees regardless of account size.

- Pay reasonable interest rates on deposits.

- Eliminate or limit additional fees.

- Offer FDIC insurance on the spending account.

This year’s assessments reaffirm that Fidelity and Lively offer the most compelling options for spenders. Both providers charge no fees for spenders (they avoid both maintenance fees as well as one-off additional fees).

Three other providers--HealthEquity, HSA Bank, and The HSA Authority--also don’t charge maintenance fees, but they still have a few additional fees such as paper statements, account closings, and excess contributions. Additional fees are typically infrequent or avoidable, so they don’t affect our assessments. Still, spenders should be aware of them. The table below shows the full list of rankings for HSAs as spending accounts.

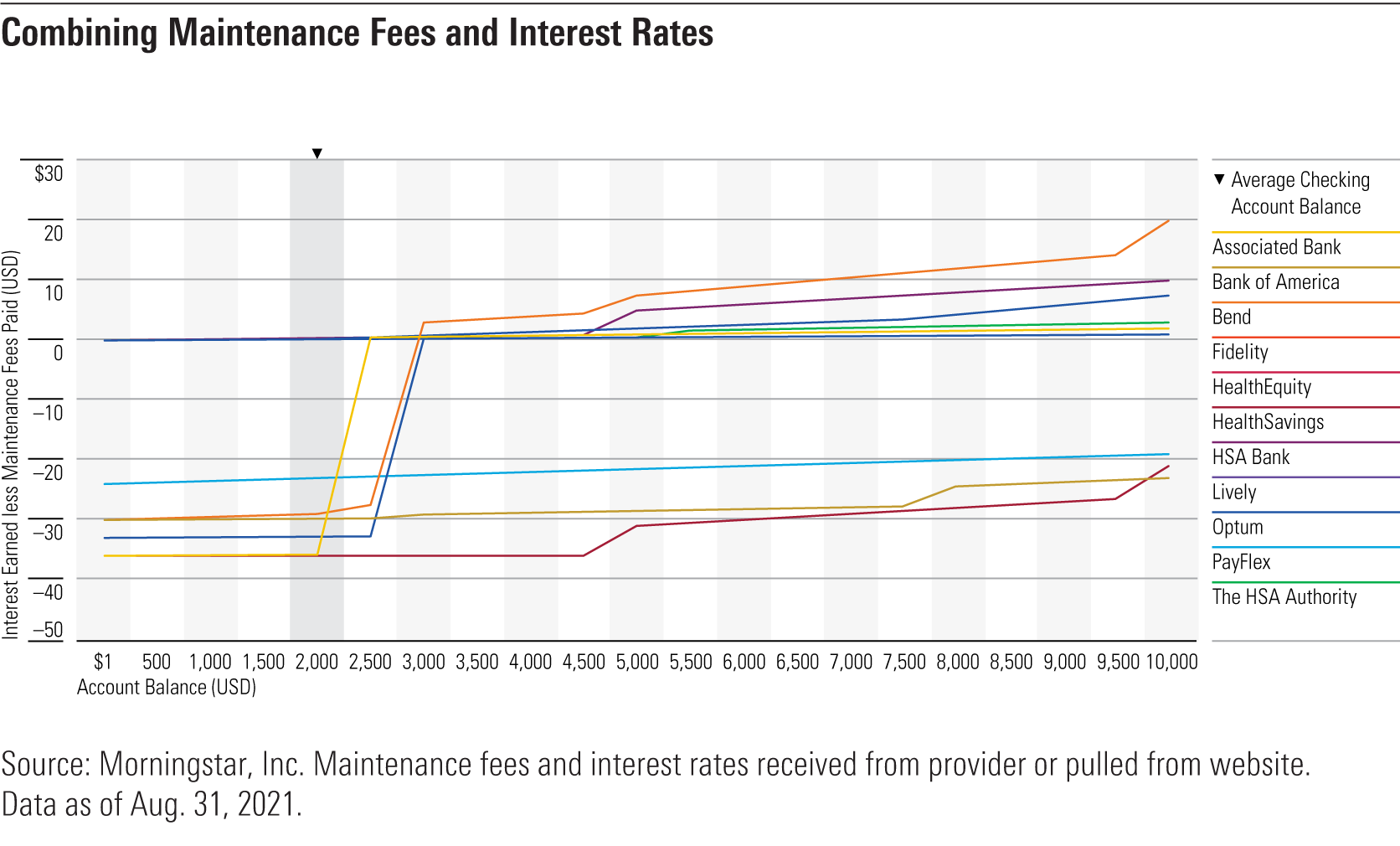

Most HSA providers offer interest on HSA dollars that remain in their spending account. But with the interest rates near zero, they no longer serve as a differentiating factor. The chart below illustrates the advantage that Fidelity, Lively, HealthEquity, The HSA Authority, and HSA Bank have relative to other providers; it shows how providers stack up when considering both maintenance fees paid and interest dollars earned at account balances ranging from $0 to $10,000.

The Best HSAs for Investors

HSAs as investment accounts should follow these best practices:

- Offer investment strategies in all core asset classes while limiting overlap.

- Provide strong investment strategies that earn Morningstar Medals.

- Charge low fees for active and passive strategies.

- Don't require investors to keep money in spending accounts before investing.

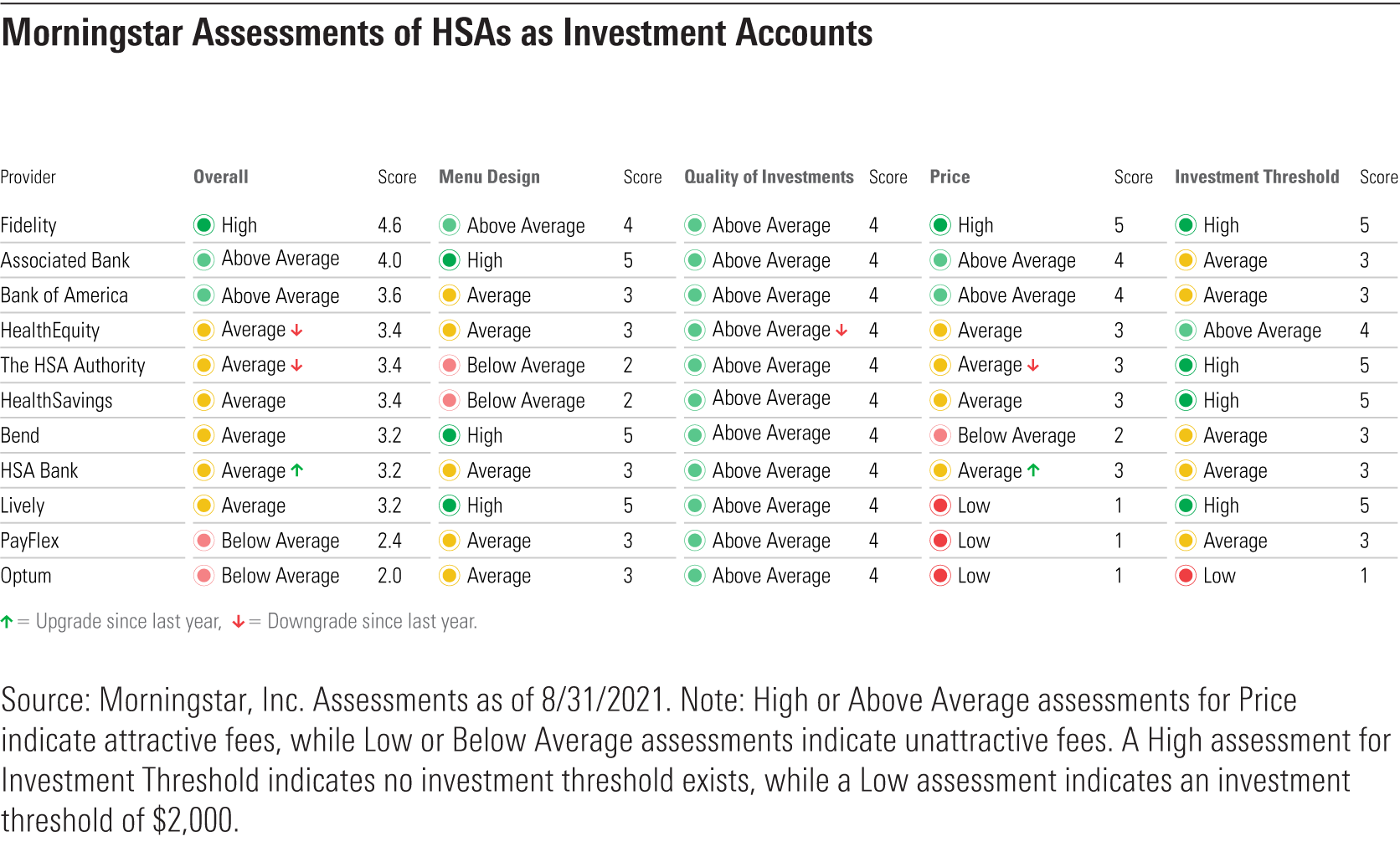

Fidelity is a clear-cut winner for the third year in a row. It does not impose a maintenance or investment fee and includes cheap passive funds within its well-constructed investment menu. At Fidelity, investors can buy a passive 60% stock/40% bond portfolio for an all-in cost of 0.02% regardless of account balance, an option other providers can’t compete with. Investors are also not blocked by an investment threshold, which allows for first-dollar investing.

Associated Bank and Bank of America also have compelling offers with competitive price tags. Their investment menus include strong underlying funds, but they both have an investment threshold of $1,000, which creates an opportunity cost for HSA investors. The table below outlines our assessments across the 11 providers.

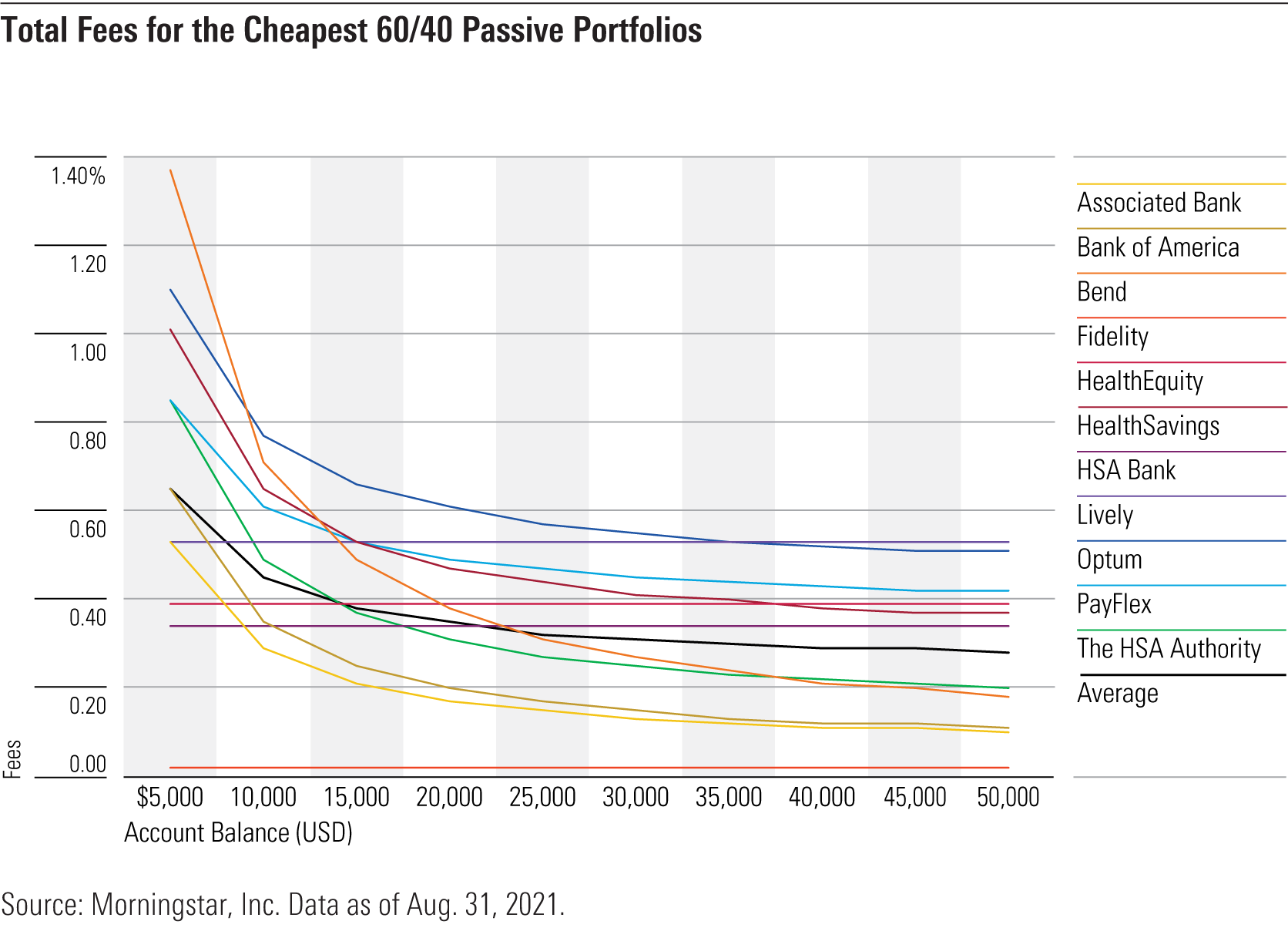

Providers charge varying maintenance fees that may be waived at different asset levels. Investment fees can be dollar-based or percentage-based, which creates different experiences for those with different account balances. The chart below illustrates the fees an investor incurs from balances between $5,000 and $50,000 if investors were to build a 60% stock/40% bond portfolio with the cheapest passive funds.

At Fidelity, investors pay the lowest fee across the board. Fees decline as account balances grow at Associated Bank, Bank of America, The HSA Authority, and Bend. These four providers charge dollar-based fees that become less pronounced when expressed in percentage terms as assets grow.

Currently, six providers--HealthEquity, HealthSavings, HSA Bank, Lively, PayFlex, and Optum--charge percentage-based investment fees ranging from 0.24% to 0.50%, keeping costs high regardless of account balances.

/s3.amazonaws.com/arc-authors/morningstar/532c09c7-c679-4cfa-bfb6-578ca1149ef7.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GQNJPRNPINBIJGIQBSKECS3VNQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EC7LK4HAG4BRKAYRRDWZ2NF3TY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/532c09c7-c679-4cfa-bfb6-578ca1149ef7.jpg)