8 New Funds From Top Managers

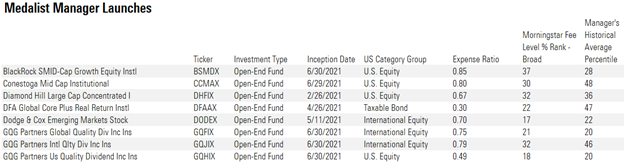

These Morningstar Medalist managers launched new funds during the first half of 2021.

When a top-rated fund manager or management team opens the doors on a new mutual fund, it’s worth it for investors to take notice.

There’s no guarantee lightning will strike twice, of course. But we decided to screen through the 348 new funds launched in 2021 for offerings run by managers of other top-rated strategies.

For this screen, we looked for open-end, actively managed funds that share a manager with a fund carrying a Morningstar Analyst Rating of Silver or Gold. We excluded funds that were additions to target-date or other strategy series or did not have share classes available for direct investment by individuals. (Morningstar Direct and Office clients also have access to our monthly report on new fund launches.)

Our screen found eight funds that met this criteria: four U.S. equity funds, three international stock funds, and one taxable-bond fund. The group included new offerings from DFA, Dodge & Cox, and BlackRock.

Here’s a closer look at each of the new funds offered by Morningstar Medalist managers:

BlackRock SMID-Cap Growth BSMDX In June, BlackRock launched a SMID-Cap Growth Equity fund with Phil Ruvinsky at the helm. Ruvinsky has been the lead manager on Silver-rated BlackRock Mid-Cap Growth Equity CMGIX since 2013. Ruvinsky's historical track record is strong; in his time managing other strategies, those funds have posted a tenure-length weighted average category percentile rank of 28--meaning they have better returns that nearly three fourths of comparable funds.

“BlackRock seems to be going with the hot hand here” says analyst Daniel Culloton. At BlackRock, “Most of its assets are in large- and mid-cap growth strategies, but smid-cap--which was a new area for the team with Lawrence Kemp and Phil Ruvinsky--has the best trailing performance of the strategies the team runs and the best inflows.”

Culloton adds that while “both the large-cap strategy and the mid-cap strategy have invested in small caps before, this is the first fund they have run at which small caps are an explicit menu item.”

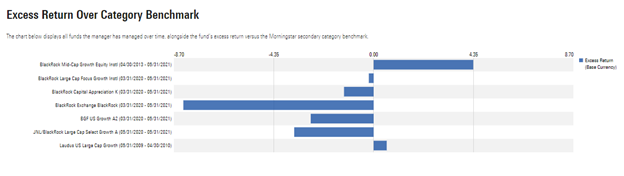

Here's a look at how Ruvinsky's track record on other funds stacks up using Morningstar's new Portfolio Manager Performance History notebook within the Analytics Labs module in Morningstar Direct. For this, we use the excess returns statistics, which measures performance over or below the Morningstar index for the fund's category. If a fund beats the benchmark, its return is positive and vice versa.

Phil Ruvinsky Fund Performance History

Dodge & Cox Emerging Markets Stock DODEX Dodge & Cox added a third international equity strategy to its lineup, Dodge & Cox Emerging Markets Stock. The management team has a variety of experience across Gold-rated strategies including Dodge & Cox International Stock DODFX and Dodge & Cox Global Stock DODWX. The firm's director of international research, Diana Strandberg, a 33-year veteran of Dodge & Cox, is a manager on all three international equity funds. Analyst Tony Thomas gives the funds a People rating of High for both strategies.

The High People rating is supported by fund performance, with managers averaging a percentile return rank of 22. Strandberg averages just above that, led by strong performance by Dodge & Cox International Stock and Dodge & Cox Global Stock. Of the fund launches in our screen, the fund also has the lowest fee percentile ranking, a rank comparing funds that invest in a similar asset class with similar distribution characteristics, of 17, with an expense ratio of 0.7%.

DFA Global Core Plus Real Return DFAAX At Dimensional Fund Advisors, portfolio managers are trained to run strategies across multiple asset classes, says analyst Daniel Sotiroff. David Plecha, head of fixed income at DFA, manages its new inflation-protected strategy but also runs Silver-rated DFA Global Equity DGEIX. "You may see some overlap from time to time" says Sotiroff, who gives the world large-blend stock fund a People rating of Above Average.

And like DFA’s offerings in general, the new fund has low fees. DFA Global Core Plus Real Return has the lowest expense ratio of those that made it through our screen at 0.3%, placing it at the 22nd percentile in its category.

Conestoga Mid Cap CCMAX Conestoga Mid Cap is led by Robert M. Mitchell, also the manager for the Silver-rated Conestoga Small Cap CCASX and Conestoga SMid Cap CCSGX funds. "A mid-cap fund would be a natural extension of Conestoga's offerings," says analyst Tony Thomas. However, "the firm struggled to gain traction with an earlier mid-cap fund." Conestoga's previous mid-cap offering lasted from 2021-14, but the strategy was liquidated after underperforming its Morningstar Category benchmark by 8 percentage points annually over its life.

However, Thomas points out the recently hired Ted Chang, who has prior experience with larger-cap companies, bolstering the fund's research team. “With Chang on board, and with the team’s patient investing style that has allowed them to watch some small- and smid-cap holdings grow into mid-cap companies, Conestoga probably saw that they could give a mid-cap fund a second chance.”

Mitchell has been slightly above average during his tenure, finishing in the 48th percentile. The fund is also competitive, with an expense ratio of 0.8%, placing the fund at a fee level percentile rank of 30 in its broad category.

GQG Partners Global Quality Dividend Income GQFIX GQG Partners International Quality Dividend Income GQJIX GQG Partners US Quality Dividend Income GQHIX GQG Partners launched three new strategies, each with chairman and chief investment officer Rajiv Jain at the helm. These dividend-focused strategies differ from Silver-rated GQG Partners Emerging Markets Equity GQGRX, also managed by Rajiv Jain, which invests in international growth strategies with less of an income focus.

While Jain has not previously managed a dividend strategy, Jain has experience to manage both domestically and international funds, says analyst Gregg Wolper. “Rajiv Jain has successfully run global funds with substantial U.S. stakes, so that is not new to him,” he says. Wolper gives GQG Partners Emerging Markets Equity Fund a People rating of High.

Jain has a strong performance history, finishing with an average percentile rank of 20. The three funds are also competitively priced with an average category rank of 24.

Diamond Hill Large Cap Concentrated DHFIX The managers of Silver-rated Diamond Hill Large Cap DHLAX are out with a concentrated version of the fund, Diamond Hill Large Cap Concentrated. The new fund will be holding roughly 20 stocks compared with 54 in the existing fund. The concentrated strategy has also been available through Nationwide Diamond Hill Large Cap Concentrated NWGHX. Our analysts give the managers of Diamond Hill Large Cap Concentrated a People rating of Above Average, noting the strength of Chuck Bath and Austin Hawley as a managerial duo.

With an average managerial percentile rank of 36, Bath and Hawley have provided above-average returns. Bath has led his funds to an average percentile return category rank of 28. With an expense ratio of 0.37, the fund finished in the 37th fee percentile.

/s3.amazonaws.com/arc-authors/morningstar/d8236d6f-dcec-4d1b-b5ba-e086adefd364.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/d8236d6f-dcec-4d1b-b5ba-e086adefd364.jpg)