Two Perils for Investors: Big Governments and Bad Governments

The latter is worse, but neither are helpful.

Potential Concerns The business press constantly derides governments that spend heavily. The mindset requires little justification. Companies in the former state-controlled nations of the Soviet Union and East Germany, which featured nationalized industries, were abominably run. So are those that currently reside in Cuba and North Korea. Should a fool decide to invest in one of those countries' businesses, he would soon be parted with his money.

However, such criticism often not only addresses the tenets of communism, namely common ownership of production and (in reality, if not necessarily in theory) centralized planning, but also other government initiatives. By this argument, known as "crowding out," each additional penny spent by the government is a penny that would have been better spent by the private sector. When the government does more, the people ultimately receive less.

This column cannot hope to tackle the full implications of the crowding-out hypothesis. However, it can address one specific aspect: Does government spending harm stock market performance? If so, investors should favor countries that have relatively stingy governments. On the other hand, if there is no discernible relationship between government expenditures and stock market gains, then we can safely leave the crowding-out discussion for political forums.

In contrast with government spending, the optimal level of official corruption cannot be debated. It is zero. No doubt, companies that bribe the right officials, during the right circumstances, can succeed by stealing business from more deserving competitors. But when personal favors outweigh professional merit, the overall effect on a country’s economy, consumers, and corporate profitability is negative. With government corruption, less is certainly more.

Presumably, the damage caused by corruption will appear in equity returns. Companies from nations that don’t allocate their productive assets efficiently because of official corruption will struggle to compete with businesses that prosper on merit. Also, when high incomes can accrue from government positions, ambitious young workers are less likely to work in the private sector.

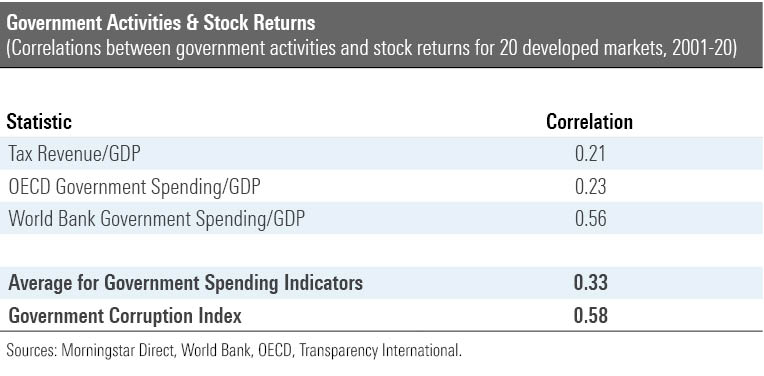

Testing the Data Let's see what the numbers indicate. This article evaluates only developed economies, as emerging countries march to a different drummer. It compares the 2001-20 total returns for the 20 largest developed markets against various measures of government spending, along with one of public-sector corruption. Those measures come from the year 2000, meaning that they represent the information available to investors at that time. (True, they would not have been released until sometime during 2001, but let's not be overly technical.)

Calculating total returns was straightforward, thanks to Morgan Stanley Capital International's single-country indexes. So, too, was obtaining an indicator of government corruption, from Transparency International's Corruption Perception Index. However, determining the levels of government spending was trickier. The World Bank and the Organization for Economic Co-operation and Development, or OECD, each offer various statistics, which vary in their details. However, as we shall see, their conclusions are broadly similar.

I started the inquiry into the effect of government spending indirectly, sorting countries by their tax rates. My source was the World Bank's "Tax Revenue (% of GDP)" ratio. The highest two countries by this statistic were Sweden and Denmark, while the lowest two were Australia and Switzerland. (The latter were surprises to me ... I confess to being not entirely convinced of the accuracy of government-spending data, which is why I took multiple bites of that apple.)

The correlation between the inverse of the countries’ tax-revenue ratios and their stock market returns was 0.21. In other words, nations that had relatively low tax rates entering 2001 tended to post stronger equity returns over the ensuing 20 years. The effect was not overwhelming, as Denmark notched the second-highest stock performance despite its steep taxes. Nonetheless, the pattern was evident even through a simple eye test. For example, the countries that possessed the five lowest tax ratios all posted above-average equity gains.

I then switched to evaluating spending directly, through the OECD's "General Government Spending" statistic, which attempts to capture a country's entire government costs, as a percentage of gross domestic product. Once again, Sweden and Denmark led the way, and again Switzerland landed near the bottom. The correlation was almost identical to the tax-rate exercise, at 0.23.

Finally, I returned to the World Bank's data, this time using its "Expense (% of GDP)" measure, which also purports to quantify overall government costs. Its figures, however, differ substantially from that of the OECD's spending statistic. As does the result: With the Expense % of GDP calculation, the correlation between lower amounts of government activity and stock market returns soars to 0.56. The two figures are strongly related.

Such was the story for big governments. Now comes the easier task, that of assessing the waste caused bad governments. Transparency International sorts countries by the honesty of their government officials. (Currently, the top-rated nations on the firm’s Corruption Perception Index are New Zealand and Denmark, with South Sudan and Somalia as bottom feeders.) Measuring the effect of public-sector corruption on stock market returns was as simple as comparing its rankings to those of the total returns.

This comparison had the steepest correlation of all, at 0.58. In the grand scheme of Transparency International’s index, none of these countries are deeply corrupt because they are relatively wealthy--corruption is strongly associated with national poverty. However, as evidenced by the outcome, even the difference between scrupulously clean, as with the Nordic countries, and partially unethical, as with Greece and Italy, looks to have a major effect on stock market results.

In Conclusion Corrupt governments are unambiguously bad, save for those who profit from the take. The same does not apply to large governments. Although such countries' stock markets have fared somewhat worse, one cannot conclude from that evidence alone that politicians should favor small-government policies. A country has many more stakeholders than its stock market's investors.

However, when viewed solely from the investor’s perspective, going small appears to be the correct prescription. Of even greater importance is ensuring that those who do hold public-sector jobs work honestly. There is no excuse for tolerating bad governments.

John Rekenthaler (john.rekenthaler@morningstar.com) has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q7DQFQYMEZD7HIR6KC5R42XEDI.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DJVWK4TWZBCJZJOMX425TEY2KQ.png)