Which Bond Funds Are Most Exposed to Evergrande?

While the markets flash red, emerging-markets bond fund managers take a long-term view.

As troubled Chinese real estate developer Evergrande Group EVGPY teeters on the brink of what could become China’s largest-ever debt restructuring, its effects are being felt across global markets.

The ICE BofA Asian Dollar High Yield Index, which tracks external high-yield corporate bonds of Asian companies, saw its average yield spike to 12% this week from 7% at the start of the year as investors fled the debt of Chinese companies, particularly those involved in the real estate industry.

Behind the market volatility are fears that a default by the world’s most indebted company could send shock waves through China’s economy and beyond. However, as lenders waited for word from the company after it failed to make a $83.5 million coupon payment on Sept. 23, several emerging-markets debt fund managers expressed more-nuanced views of both Evergrande itself and the likely fallout of a potential Evergrande default.

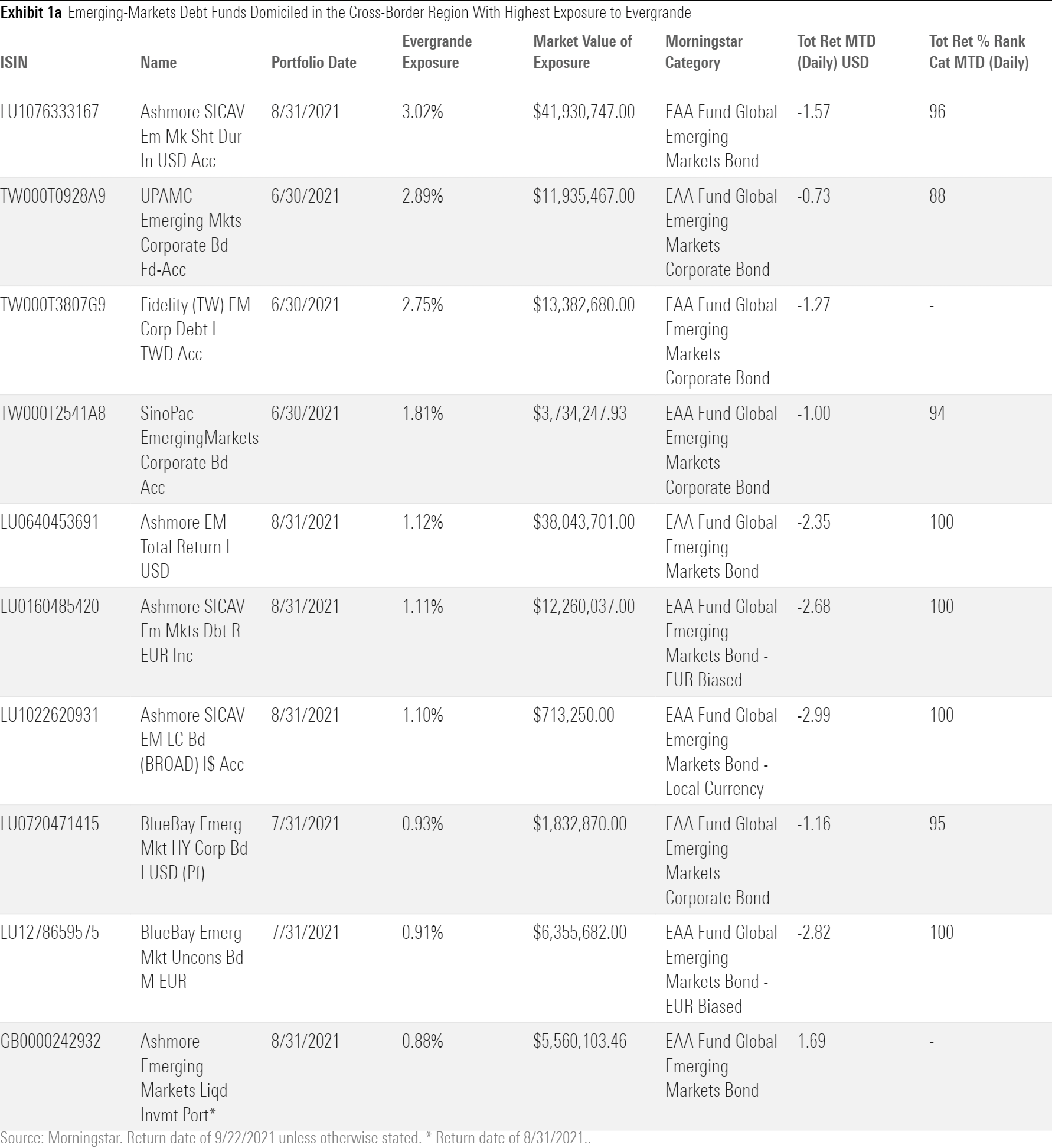

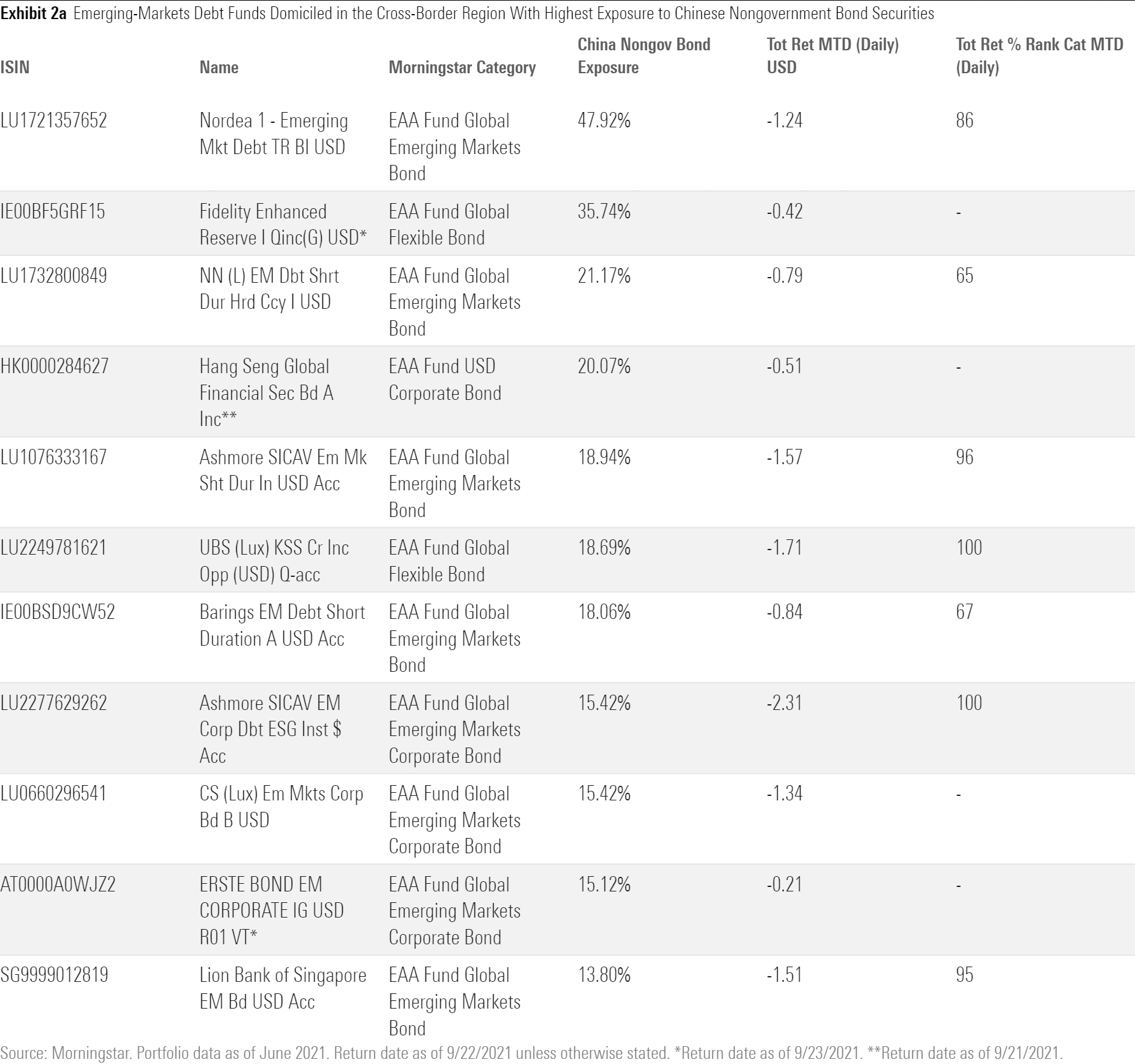

Exhibit 1 shows the emerging-markets bond funds in Morningstar’s U.S. fund database with the largest exposure to Evergrande’s bonds.

The Bears

Among emerging-markets fund managers whose strategies are rated by Morningstar, several had voiced misgivings about Evergrande for some time.

Pimco’s global emerging-markets debt group, headed by Pramol Dhawan, grew increasingly wary over the past two years. Pimco Emerging Markets Bond PEBIX, which has a Morningstar Analyst Rating of Bronze, held a small stake (20 basis points) in Evergrande’s bonds at the start of 2020, but the managers eliminated exposure to the company over the course of the year as regulatory pressures mounted. Still, the team is optimistic about the Chinese real estate sector’s long-term prospects, noting that housing demand remains robust. As other sellers rush to offload the bonds of Chinese developers, Pimco’s managers say they are now looking for opportunities to invest in those that have manageable debt loads and that are active in China’s more-stable coastal and urban housing markets.

T. Rowe Price’s emerging-markets debt team, meanwhile, only dabbled in the debt when valuations turned enticing. Lead portfolio manager Samy Muaddi runs Neutral-rated T. Rowe Price Emerging Markets Bond PRXIX, which held no Evergrande debt at the start of 2020 but bought a modest amount at cheap valuations after the coronavirus-driven sell-off late in the first quarter of 2020. Roughly six months later, the team sold its remaining position, as the analysts grew cautious on Evergrande’s ability to maintain onshore financing.

TCW’s emerging-markets fixed-income team started 2020 with a constructive view of Evergrande but trimmed its positions throughout 2020 and the first half of 2021. Gold-rated TCW Emerging Markets Income TGEIX, which is comanaged by Penny Foley, David Robbins, Javier Segovia, and Alex Stanojevic, held more than 1.0% of the portfolio in Evergrande as of April 2020, but the team trimmed that position to 0.48% by the end of 2020 and fully exited it by August 2021. By then, the team was convinced Evergrande would likely need a comprehensive debt restructuring, noting that there isn’t a clear precedent for a massive $304 billion restructuring that would involve hundreds of projects. TCW is waiting for the Evergrande situation to stabilize before moving into select higher-quality Chinese property developers that sold off in contagion.

The Bulls

Other bond fund managers have viewed Evergrande in a more positive light in recent months.

When prices for Evergrande’s bonds plummeted in August and September, BlackRock’s emerging-markets debt team, led by Sergio Trigo Paz, saw an opportunity. The group manages a number of global emerging-markets bond strategies, including BlackRock Emerging Markets Flexible Dynamic Bond BEDIX. As Evergrande’s bonds reached distressed levels in mid-September, the group added the company’s debt to five of its strategies. The team argues that, with Evergrande’s chances of a distressed exchange or takeover by a state-owned company considerable, the recovery value of the bonds is likely to exceed their current price of roughly 30 cents on the dollar.

London-based emerging-markets giant Ashmore Group remains one of the largest holders of Evergrande bonds, with $146 million held across several portfolios (based on portfolio data collected by Morningstar from June to August 2021). Ashmore Emerging Markets Short Duration Institutional ESFIX had the largest individual stake in Evergrande (5.2% of assets as of end-June 2021). Country exposures in the team’s funds tend to deviate significantly from the index, and the team has historically dabbled in distressed debts such as Argentina and Venezuela, with mixed success. Ashmore Emerging Markets Corporate EMCIX has also been one of the most volatile funds in its peer group, with a standard deviation almost double its index’s over the team’s tenure.

A Rocky Road for Chinese Corporate Bonds

With Evergrande’s stumbles reverberating loudly across the Chinese U.S. dollar bond market, investors in bond funds that had bet big on Chinese corporates are likely to feel some pain in the near term.

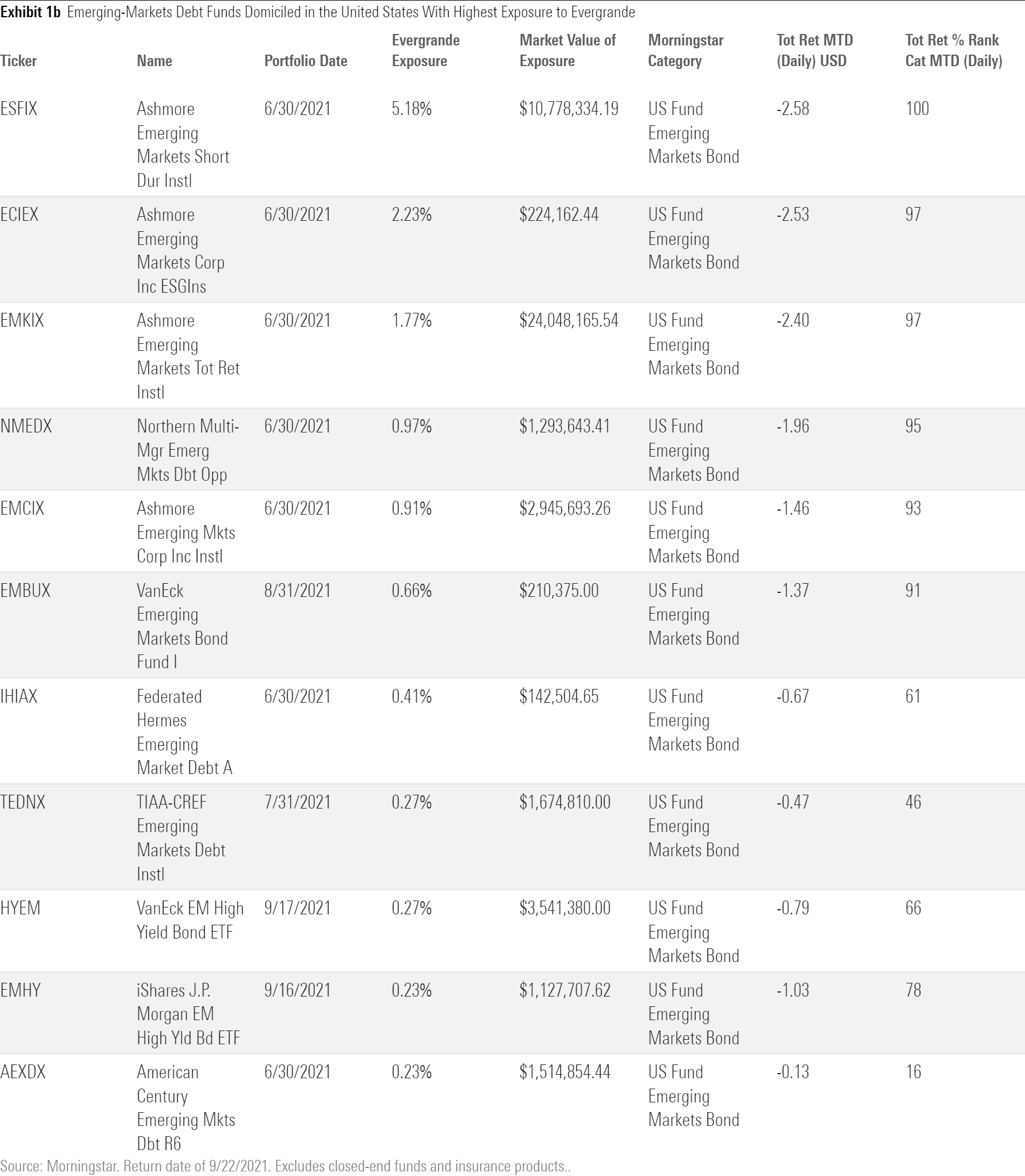

Exhibit 2 shows the global emerging-markets, corporate, or multisector bond funds in our database with the largest nongovernment Chinese bond exposures.

While some of the week's headlines may make investors want to reach for the panic button, it's important to remember that periods of market volatility are a normal part of investing. However, emerging-markets corporate bonds are particularly prone to idiosyncratic and geopolitical risks.

Investors should therefore favor funds that boast experienced, capable management teams following repeatable investment processes, including sensible concentration limits for individual issuers and a robust risk control framework.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BHGJBKNFZRB7NHXO3ZLRNAHOIY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RENAPI2NVVDIDCNNAGV6XAUCM4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ROHC7ZXJXZU7LIKGTTYJTD667I.png)