Strategic Beta Is Active Management

The two approaches to portfolio construction are more similar than they are different.

A version of this article previously appeared in the August 2021 issue of Morningstar ETFInvestor. Click here to download a complimentary copy.

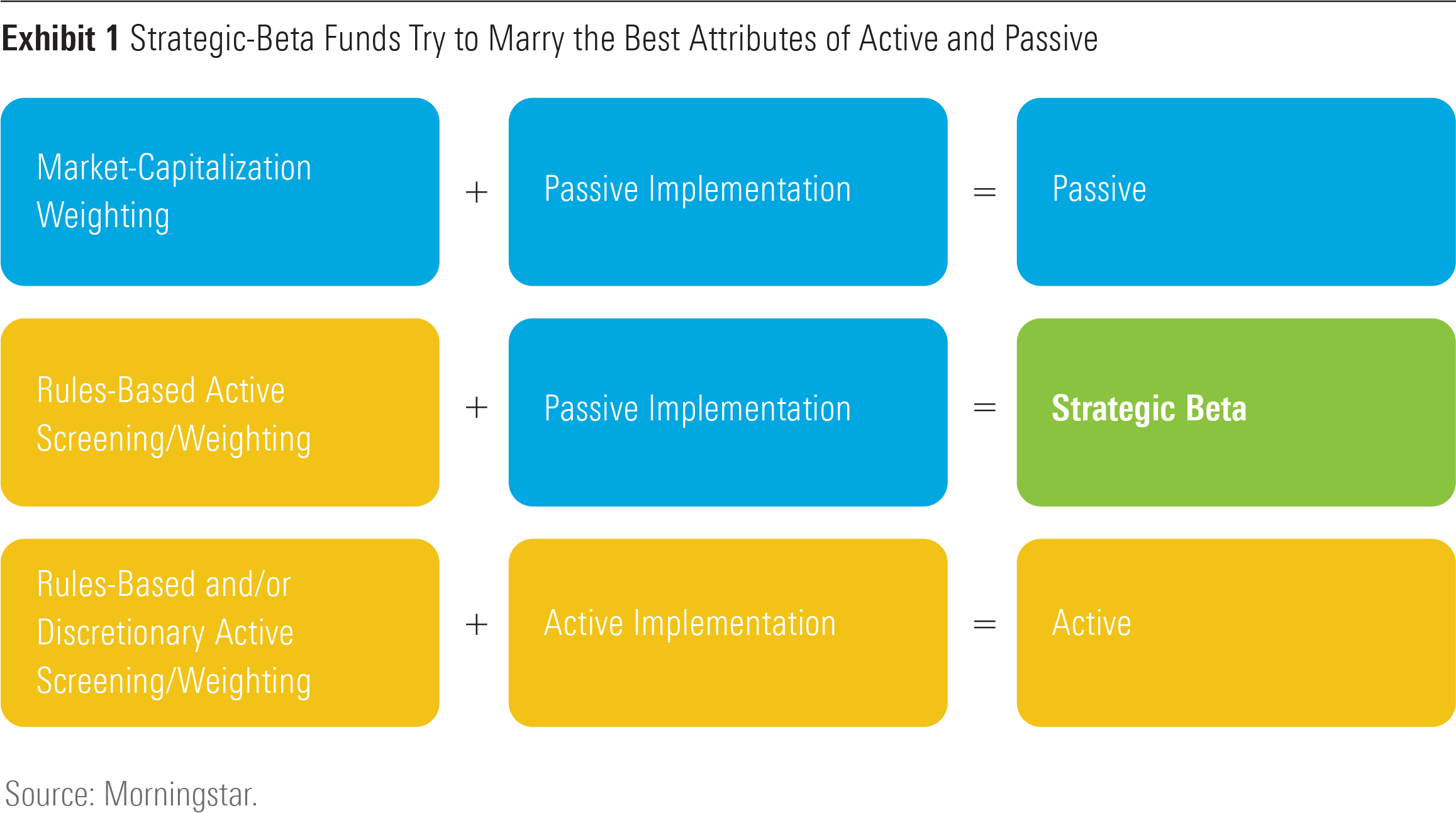

Strategic beta, also called smart beta, is a form of active management. Strategic-beta exchange-traded funds and mutual funds are linked to indexes that make active bets, of varying types and degrees of magnitude, against the broad market-cap-weighted benchmarks that are their starting point—more purely passive "market" exposures. These wagers are embedded in the funds' index methodologies, which are their active playbook. But unlike conventional active managers, strategic-beta funds cannot make adjustments. After the play has been called in the huddle, there is no option to call an audible. With respect to the ongoing implementation of the strategies built into their benchmarks, they are strictly passive.

Reframing strategic beta as active management is a useful thought exercise. It allows us to better understand the nature of these funds, their potential pitfalls, and the features that differentiate them from traditional active strategies. I'd argue that much of what investors need to know about strategic-beta funds they have already learned from decades of examining active strategies, vetting them, and putting them to use.

Caveat Emptor

You are probably familiar with the concept of survivorship bias. It describes our tendency to focus only on winners, forget losers, and make some poor statistical inferences as a result. The tendency to strike failed funds from the historical record results in an upward bias to measures of fund managers' success. What you might not realize is that survivorship bias presents itself in many forms. Not only does it stem from a failure to account for those funds that crash and burn, it also reflects issues with accounting for those that never make it out of the hangar. In "Mutual Fund Incubation," [1] University of Virginia finance professor Richard Evans examined the practice of incubation among mutual fund managers. Incubation involves registering and seeding a number of public funds. At first, the funds aren't given a ticker symbol and as such are effectively private. The sponsoring fund company will ultimately select the better-performing funds, slap a ticker on them, and begin marketing them to the investing public. The underperformers are left to die on the vine. Evans found that this process led to an upward bias in fund returns. He also discovered that, while incubated funds outperformed nonincubated funds during their incubation period, on average they subsequently underperformed their nonincubated counterparts following their incubation periods.

What has mutual fund incubation got to do with strategic beta? From a product-development perspective, the resemblance between Evans' findings and trends in the introduction of new strategic-beta ETFs is uncanny. Vanguard research [2] has shown that a very similar performance pattern has emerged among the strategic-beta ETFs that have been launched to track newly minted indexes:

"… [W]e find that ETFs are most likely to be created with indexes that have performed well relative to the broad U.S. stock market before the inception date, but that such performance, on average, does not persist. Even so, new ETFs that use indexes with backfilled data appear to have more success in attracting assets, suggesting that the availability of hypothetical performance data may contribute to the viability of a new ETF. Overall, our research suggests that investors need to be cautious in considering historical index performance, especially for indexes constructed for use in new ETFs."

Underperforming funds never leave the incubator. Bad back-tests never see the light of day. Investors know that past performance is not indicative of future results, but they sure hope it will be. In vetting strategic-beta ETFs, keep in mind that survivorship bias comes into play immediately--don't let it cloud your judgment.

Starstruck

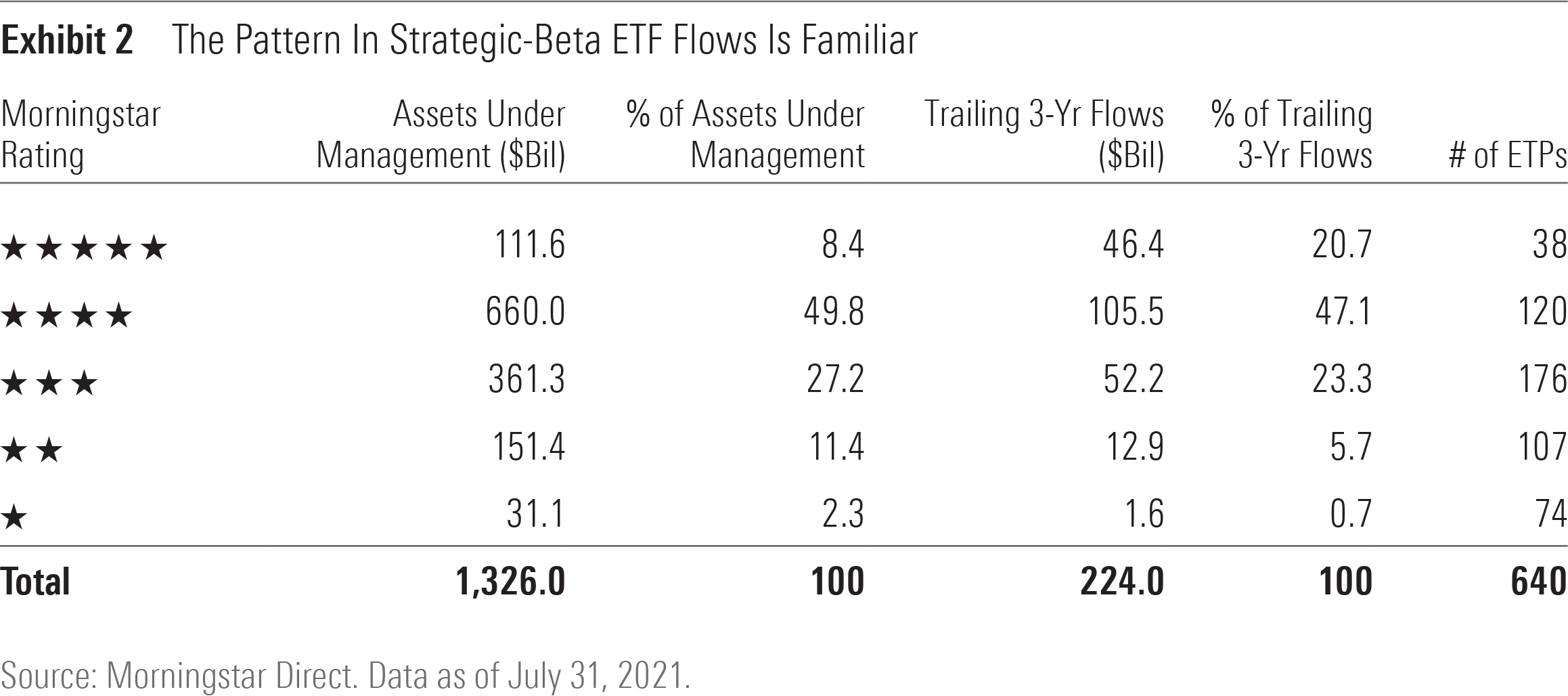

Despite all we know about the peril of extrapolating past performance into the future, we just can't help ourselves. This habit is evident in the manner in which investors select funds. It is widely known that investors have relied heavily on the Morningstar Rating for funds (aka the star rating) to inform their fund-selection process for years. The rating is a strictly quantitative, backward-looking measure of a fund's risk-adjusted performance relative to its Morningstar Category peers. Historically, the funds earning the highest ratings have tended to receive the lion's share of investors' money. In my opinion, this pattern is driven by a number of factors. One of them is classic performance-chasing behavior. Another is aggressive marketing of highly rated funds: We've all seen the ads touting that XX% of XYZ Fund Company's mutual funds have 4- or 5-star Morningstar Ratings. Career risk is also at play. For example, it is hard for an advisor to make the case for an otherwise solid 2-star fund that might simply be going through a rough patch. Whatever the case might be, investors are starstruck.

As it is for active, so it is for strategic beta. When it comes to selecting strategic-beta ETFs, investors' purchasing decisions appear to be following a familiar pattern. As you can see in Exhibit 2, 58% of the total assets invested in strategic-beta ETFs reside in those funds with a 4- or 5-star rating. Additionally, during the past three years, 68% of net new inflows went into these same funds.

Performance

The similarities between strategic beta and active management don't end with how these funds are brought to market and how investors choose them. There are also important commonalities with respect to how investors might improve their odds of long-run success, the ups and downs that strategies of each ilk will experience across a market cycle, and how investors might respond to this cyclicality.

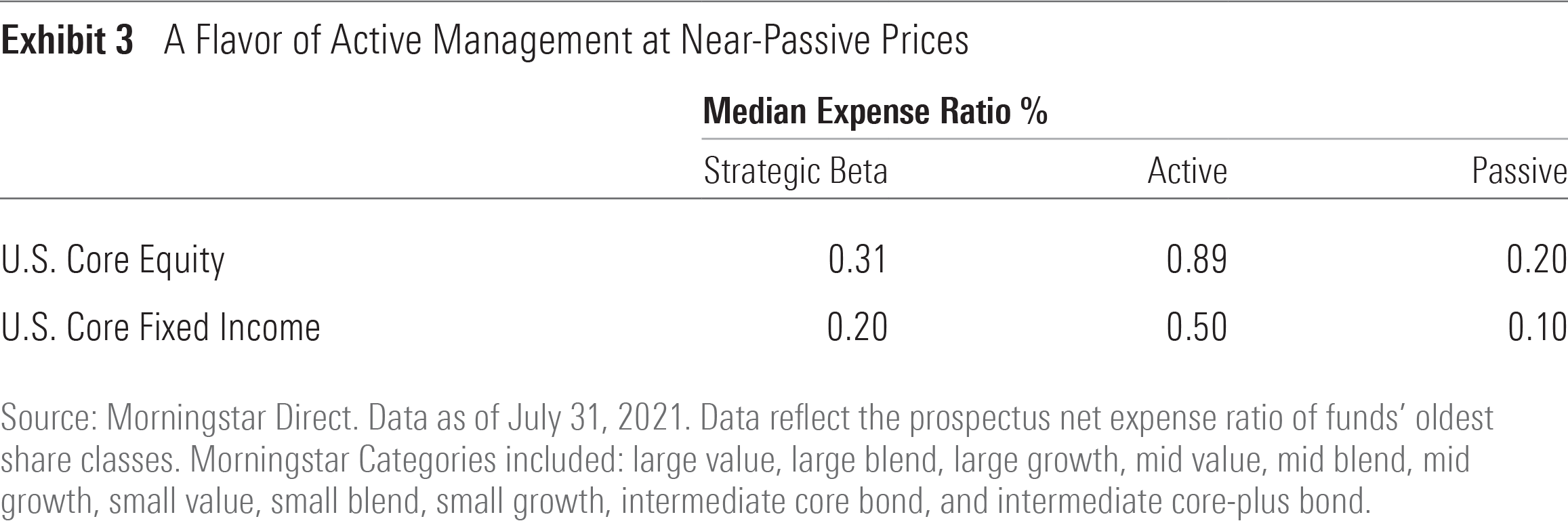

This isn't the first time I've used this Jack Bogle quote, and I promise it won't be the last: "In investing, you get what you don’t pay for." Every study I've ever seen on the relationship between fees and performance corroborates this bit of wisdom. Be it an active manager or a strategic-beta ETF, lower fees represent a lower hurdle and, thus, greater odds of market-beating returns. Focusing on fees is the most reliable way to improve your odds of picking a winner.

Disciplined active managers and strategic-beta ETFs will also share the common experience of prolonged droughts: periods during which their investors will be subjected to excruciating pain as their style falls and remains out of favor. We previously detailed value's current dry spell, so I won't belabor the point here. Suffice it to say that, in order to beat the market, you must be different from the market. Being different won't always be pleasurable. You will be paid in proportion to your discomfort--assuming there's any payout at all.

For some investors, this pain will be too much to bear. Regular cycles of performance-chasing, disappointment, and retreat have led many investors to miss out on the moments when funds deliver the goods. Investors generally select good funds, but they tend to use them poorly--buying after a strong run and selling just before a rebound. We have seen this exact pattern emerge within strategic-beta ETFs as well.

This Time Is Different

Reframing strategic beta as a new form of active management reveals some striking similarities between the two. That said, there are very important differences worth noting:

1) Lower fees. As you can see in Exhibit 3, the fees charged by strategic-beta ETFs are typically substantially lower than those levied by actively managed mutual funds. That said, they often charge a multiple of the fees levied by their more traditional, purely passive peers.

2) Tax efficiency. ETFs tend to be more tax-efficient than mutual funds, largely because they distribute fewer (if any) and smaller capital gains. ETFs' structure is the primary driver of their tax efficiency. The ability to regularly purge low-cost-basis securities in-kind is a key advantage over traditional open-end mutual funds and has allowed even high-turnover strategies to avoid distributing gains. For example, there are 68 strategic-beta ETFs that had average annual turnover in excess of 100% over the trailing five years through 2020. There were just 12 capital gains distributions among those 68 funds over that span--representing just 3.5% of the fund years in the sample.

3) Relative predictability. I'm borrowing from Bogle again here. This takes a number of forms in the context of strategic-beta ETFs. The fact that these funds are making active bets based on a set of (usually) transparent rules makes them somewhat more predictable relative to active strategies. Also, they aren't susceptible to key-person risk. Few could likely name the managers of Vanguard Dividend Appreciation ETF VIG off the top of their head. Should these managers up and leave their post, you wouldn't know the difference.

Strategic-beta ETFs are arguably a new and more efficient way of making the same bets that investors hired active managers to make on their behalf for decades. Most of what investors need to know about these funds they have already learned from years of investing in active strategies. Though the ante might be lower, the odds may be a bit better, and it is less likely there will be any wild cards, investors are still making an active bet against the market. There's no guarantee it will be a winning bet, and their ability to collect will require them to stay at the table even when they don't feel they have a hot hand.

[1] Evans, R.B. 2010. "Mutual Fund Incubation." The Journal of Finance, Vol. 65, No. 4, P. 1581.

[2] Dickson, J., Padmawar, S., & Hammer, S. 2012. "Joined at the Hip: ETF and Index Development." https://www.vanguardcanada.ca/documents/joined-at-the-hip.pdf

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Morningstar, Inc. does not market, sell, or make any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)