4 Stocks to Watch Amid Housing Demand Boom

These companies stand to gain as the U.S. housing market takes off.

The U.S. housing market has been a bright spot during the pandemic as demand reaches levels not seen since the mid-2000s. This demand has outstripped housing supply, causing home prices to soar.

Brian Bernard, director of industrials equity research for Morningstar, says in a recent U.S. housing report that rising home prices aren't sustainable and that they'll moderate in the coming years.

While he agrees that more homes are needed to accommodate demand, he thinks the U.S. housing shortage isn’t as bad as some fear. For example, the National Association of Realtors and Rosen Consulting Group recently published a report that concludes that U.S. housing stock is undersupplied by at least 5.5 million units. But based on Bernard's own calculations, the shortage is closer to 3.8 million units.

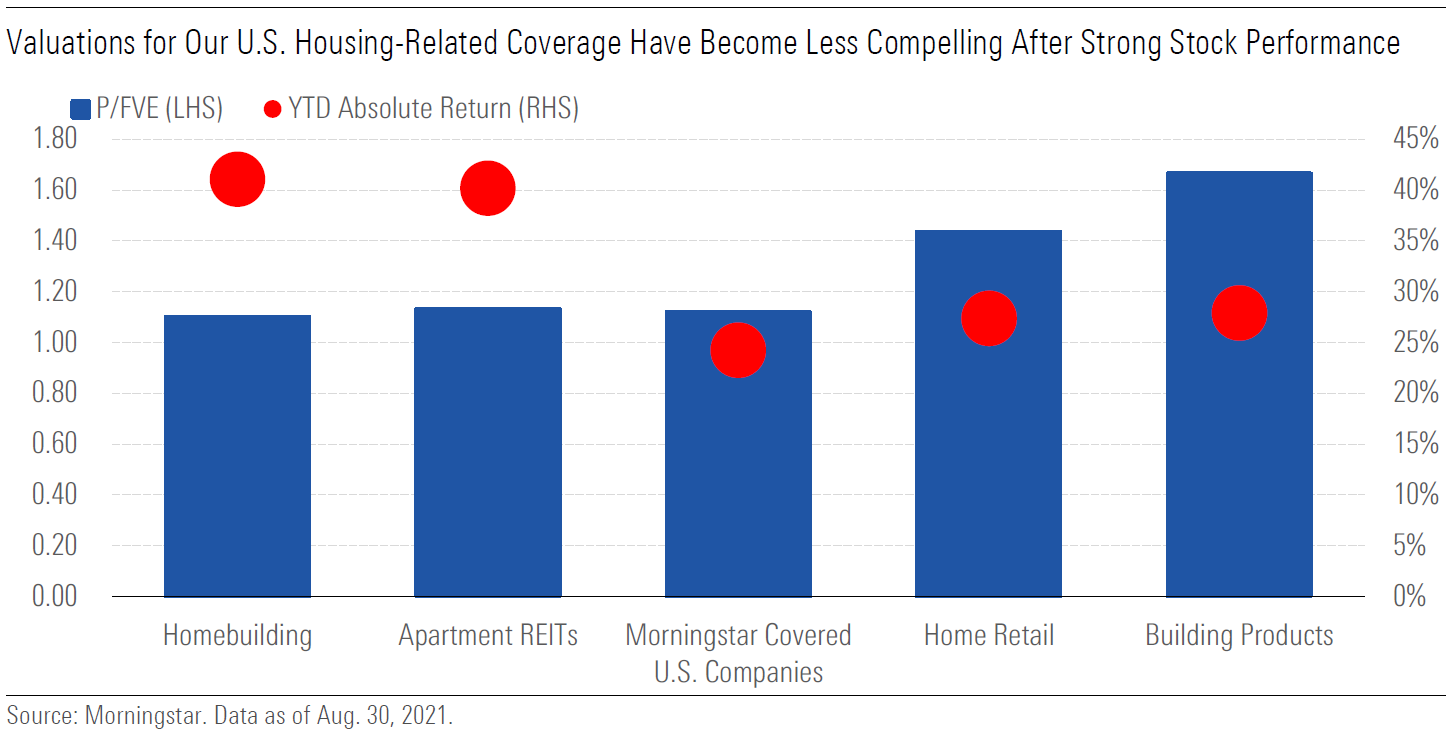

Less Compelling Valuations After Housing’s Strong Performance

As of late August, housing-related stocks have outperformed our broader U.S. stock coverage so far in 2021. Homebuilder-stock prices have increased 42%, and apartment REIT stock prices grew 38% for the year to date, compared with 24% for our U.S. stock coverage.

This outperformance has left valuations less compelling. For our U.S.-housing stocks coverage, 42% of stocks receive a 3-star Morningstar Rating for stocks, 25% have a 2-star rating, and 33% have a 1-star rating. The chart below illustrates these valuations and year-to-date absolute returns as of late August for four housing subindustries: homebuilders, apartment REITs, home retail, and building products.

Homebuilders and apartment REITs are two subindustries that are in line with the average valuation of Morningstar’s U.S. stock coverage. Building products and home retail look overvalued, Bernard says.

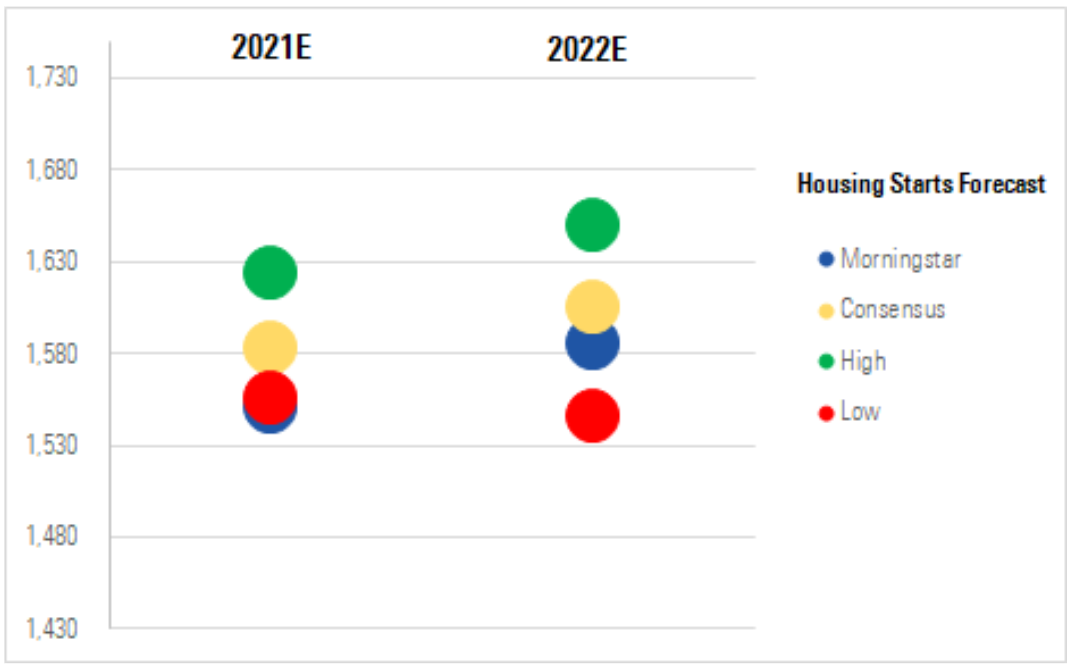

Housing Starts Forecast

Bernard expects annual housing starts to average 1.6 million over the next decade, which equates to 15.6 million total housing starts. The chart below shows how his near-term forecast compared with other estimates.

These near-term projections are on the low end of the consensus estimates, Bernard explains.

There are two reasons behind his cautious near-term outlook. The first is that there are some signs of moderating, yet still strong, demand. Weekly mortgage applications and mortgage applications for new homes have slightly declined compared with last year.

The second reason is that disruptions in the housing supply chain still exist in the near term. For example, there are shortages of inputs, like windows and appliances, rising costs for building materials, like lumber, and shortages in construction labor.

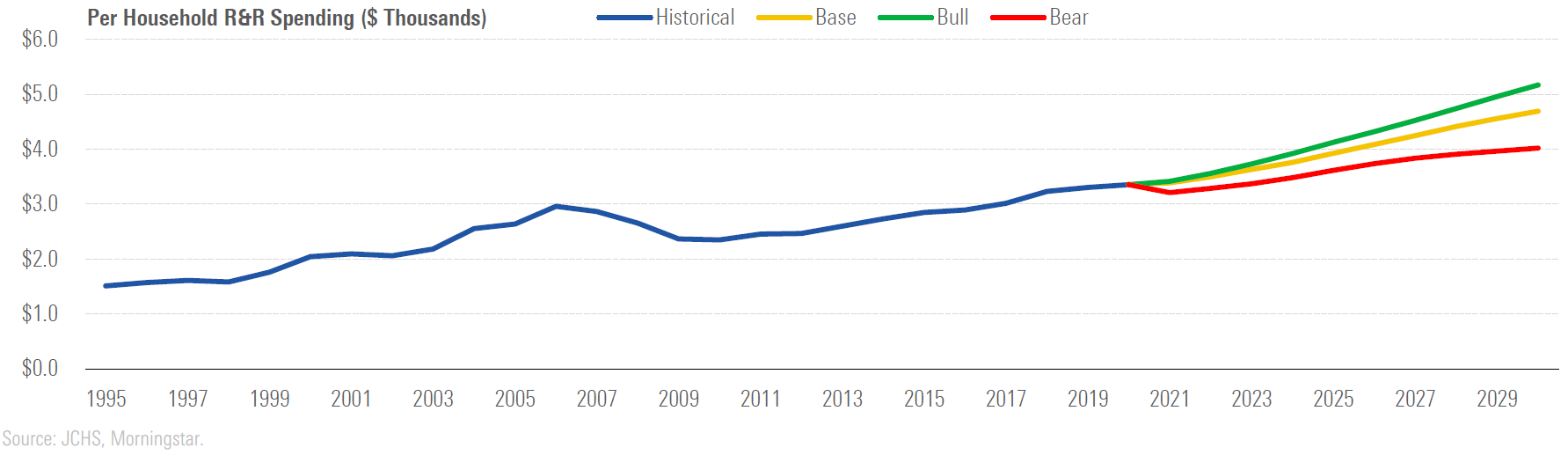

Repair and Remodel Spending

More time at home and increased personal savings have caused repair and remodel spending to surge during the pandemic. These DIY projects benefited home improvement retailers like Home Depot HD and Lowe’s LOW.

Another reason for elevated repair and remodel spending is consumers’ reluctance to bring contractors into their home during the pandemic. This hurt do-it-for-me projects that are largely served by professional home improvement companies.

The chart below looks at historical repair and remodel spending and forecasts for the next decade.

So far in 2021, Bernard is seeing repair and remodel spending shift back to its prepandemic mix. In 2018-19, do-it-for-me projects accounted for 63% of total projects and 87% of project spending.

2021 financial performance supports this view. For example, Fortune Brands Home & Security FBHS, which has more exposure to professional, do-it-for-me projects, expects to have 16%-18% organic revenue growth in 2021. Meanwhile, Home Depot and Lowe’s, which serve mostly DIY consumers, are expected to have negative low- to mid-single-digit organic revenue growth.

Housing Stocks to Watch

Despite strong performance in 2021, there are a few picks that are the least overvalued. Bernard highlights one from each housing subindustry and explains why investors may consider them. Price/fair value estimate data is through Aug. 30, 2021.

Lennar LEN Subindustry: Homebuilding Price / Fair Value Estimate: 1.10 Economic Moat: None

Lennar is well-positioned to benefit from increased demand from first-time buyers, and its returns on invested capital should improve as the firm continues to shift toward a lighter land strategy. We also think the spin-off of Lennar's ancillary businesses will dampen its earnings volatility. Improved financial disclosure for the spun-off company could help the market better understand this once opaque, yet in our view valuable, portfolio of businesses.

Masco MAS Subindustry: Building Materials and Products Price / Fair Value Estimate: 0.98 Economic Moat: Wide

Masco's 2021 revenue growth may be more subdued than some other building products firms as DIY spending normalizes. However, we still see solid growth and profitability for Masco over our 10-year forecast. Masco’s key organic growth initiatives include increasing Behr’s professional painter market share and extending the plumbing segment’s product portfolio.

Williams-Sonoma WSM Subindustry: Home Improvement and Home Goods Retail Price/Fair Value Estimate: 0.96 Economic Moat: Narrow

Williams-Sonoma is pivoting to capitalize on higher-margin white-space opportunities, supporting both top- and bottom-line growth ahead. We expect stronger sales growth driven by faster adoption of offerings across business to business, marketplace, franchise, and direct to consumer. More importantly, our 2030 operating margin outlook is now above 15%, as we surmise that the proportion of sales subject to higher profitability will account for a larger part of the total sales mix over time.

AvalonBay Communities AVB Subindustry: Apartment REITs Price/Fair Value Estimate: 1.12 Economic Moat: None

AvalonBay Communities owns and operates high-quality multifamily buildings in urban and suburban coastal markets with demographics that allow the company to maintain high occupancies and drive strong rent growth. The company regularly recycles capital by selling noncore assets or exiting markets and using the proceeds to develop its pipeline or for acquisitions with promising growth prospects, a sound strategy that continues to produce strong returns.

/s3.amazonaws.com/arc-authors/morningstar/8b2c64db-28cb-4cb4-8b53-a0d4bc03a925.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ROHC7ZXJXZU7LIKGTTYJTD667I.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TP6GAISC4JE65KVOI3YEE34HGU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2c64db-28cb-4cb4-8b53-a0d4bc03a925.jpg)