13 Stocks You Think You Should Sell But Shouldn't

These stocks carry sky-high price/earnings ratios, but we think they're actually undervalued.

Deciding when to sell a stock can be more difficult than getting your teenage sons to put away their laundry. (Or maybe that’s just my teenage sons...)

As we’ve discussed before, there are plenty of reasons that people hold on to stocks longer than they should. But most agree--at least in theory--that when a stock’s valuation reaches nosebleed levels, it’s time to sell.

One common metric for evaluating whether a stock is under- or overvalued is the price/earnings ratio. Mathematically, a P/E ratio is a stock's current price divided by the company's 12-month earnings per share. A forward P/E (which is what we're using in today's screen; more on that in a bit) uses a company's mean EPS estimate for the next fiscal year in the denominator.

A high P/E usually indicates that the market will pay more to obtain the company's earnings because it believes in the firm's ability to increase its earnings. In other words, investors in lofty P/E stocks are willing to pay more for what they expect to be high earnings down the road.

Owning high P/E stocks isn’t necessarily a bad thing: After all, high P/E names may in fact deliver on the heady growth expectations embedded in their prices. However, high P/E stocks can carry price risk, meaning that they can fall especially hard when the market hits a pothole, or if their earnings stories don’t pan out.

While P/E is certainly a widely accepted yardstick for measuring whether a stock is over- or undervalued, it's not always the best. For instance, it isn't terribly useful for valuing real estate investment trusts. REITs can produce net income near zero for an extended period of time owing to accounting treatments of real estate, which isn't a true reflection of earnings, explains analyst Kevin Brown. "P/E ratios just aren't something used for REITs for this exact reason," he concludes.

Morningstar's analysts take a different approach to valuing stocks: They focus on calculating a stock’s fair value estimate, which represents intrinsic value based on expectations of a company’s future cash flows. If a stock’s price is below that fair value estimate, it’s undervalued in our eyes.

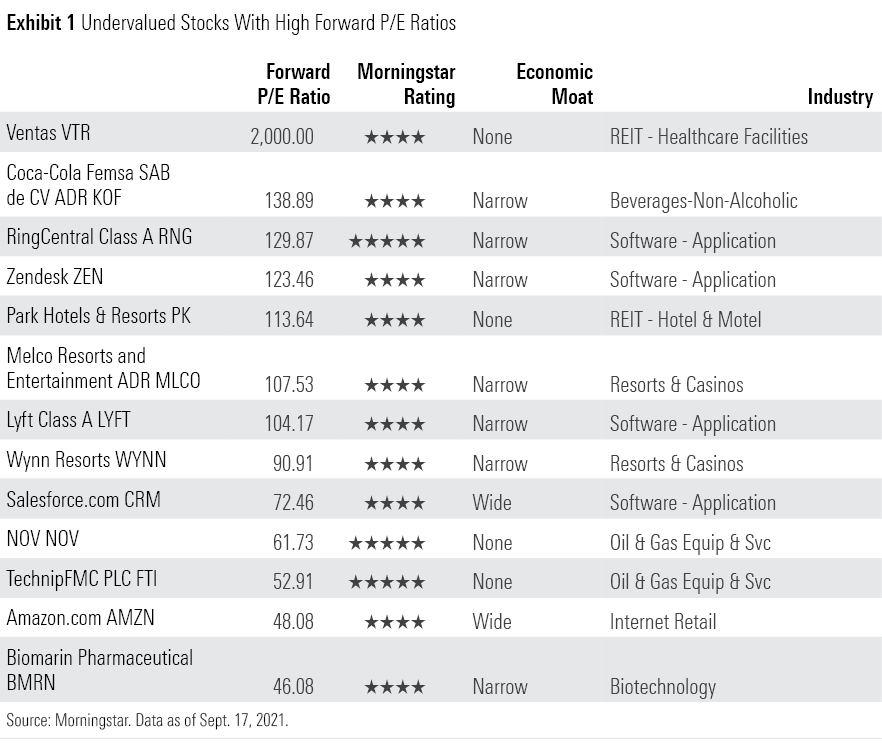

For today's screen, we wanted to find stocks that were overvalued according to their P/E ratios yet were undervalued according to our metrics. Specifically, we targeted stocks whose forward P/Es were more than twice that of the Morningstar U.S. Markets Index but whose star ratings were in the 4- and 5-star range. (We tossed out extreme uncertainty stocks from the mix, given the difficulty of accurately estimating the future cash flows of such companies.) Thirteen stocks made the cut. These stocks might look like sell candidates given their P/Es, but we'd argue otherwise.

Here's what our analysts have to say about three of the names from the list.

Ventas VTR

"The top healthcare real estate stands to disproportionately benefit from the Affordable Care Act. With an increased focus on higher-quality care being performed in lower-cost settings, the best owners and operators in the industry that can provide better outcomes while driving greater efficiencies should see demand funneled to them from the best healthcare systems. Additionally, the baby boomer generation is starting to enter its senior years and the 80-plus age population, an age range that spends more than 4 times on healthcare per capita than the national average, should almost double in size over the next 10 years. Long-term, the best healthcare companies are well-positioned to take advantage of these industry tailwinds.

"In our view, Ventas will benefit from these industry tailwinds due to its portfolio of high-quality assets connected to top operators in the senior housing, medical office buildings, life science, and hospital segments. Ventas has made a bet on the potential future of healthcare delivery by partnering with Ardent Health Services, an acute-care hospital owner and operator, and partnering with Wexford, a life science operator and developer. While the ultimate scope, scale, and success of these strategies remain to be seen, Ardent and Wexford give Ventas added platforms for consolidation as owners and operators potentially seek an efficient capital partner that can help provide an integrated healthcare infrastructure.

"The coronavirus was a major challenge for the senior housing industry as the senior population was one of the worst hit from the virus. Even a few cases led to quarantines of entire facilities, which caused dramatic declines in occupancy over the past few several quarters. However, we remain optimistic about the sector’s longer-term prospects given that the industry has started to recover from the impact of the virus, supply will likely fall below the historical average in the coming years, and the demographic boon will create a massive spike in demand for senior housing. We also like Ventas' acquisition of New Senior Investment Group to expand its exposure to the sector ahead of what we believe will be a decade of strong growth."

Kevin Brown, analyst

RingCentral RNG

"RingCentral provides a leading Unified Communications-as-a-Service platform that facilitates cloud-based business communication and collaboration via one application and enables a single user experience. As the firm’s offerings become increasingly critical to flexible communication and collaboration at work, we believe narrow-moat RingCentral will exhibit healthy long-term growth.

"RingCentral earns more than 90% of its subscription revenue from its flagship product, RingCentral Office, which offers an integrated communications platform that allows users to engage with each other using a variety of mediums such as messaging, voice-calling, video chats, conferencing, and more. RingCentral’s cloud-based offering is aimed at replacing traditional PBX phones, which offer limited flexibility and remote-use capabilities, thus ushering in a new era of business communications.

"RingCentral’s moat is supported by strong user metrics, with net monthly subscription dollar retention rates above 99%, and most of its revenue is recurring in nature. RingCentral’s early focus was on small and medium businesses, but we’re optimistic about the company’s expansion into larger enterprises, as dollar retention exceeds 120% for midsize and enterprise customers. We believe that increased enterprise adoption will lower churn and lead to higher seat penetration, further cementing RingCentral’s position as a leader in the UCaaS space.

"Channel partners are a key part of RingCentral’s go-to-market strategy. With thousands of partners, including Avaya and AT&T, among others, the firm has been able to expand within the enterprise and international markets over time. RingCentral currently has 2.5 million-3 million UCaaS seats, and these partners provide access to 150 million-200 million of the on-premises user base. This direct access should benefit the company in its go-to-market efforts as RingCentral strives to displace landline phones. We foresee healthy long-term growth as the firm increases seat penetration, expands enterprise adoption, and develops its international presence."

Dan Romanoff, analyst

Lyft LYFT

"In the U.S. market, Lyft has quickly emerged as the number-two ride-sharing player, a position we think the firm will keep for years to come. It has successfully gained share going head to head against the market leader, Uber, in pursuing riders in an addressable market (including taxis, ride-sharing, bikes, and scooters) that we value at over $550 billion (based on gross revenue) by 2024, from our estimate of $224 billion in 2019. In our view, Lyft warrants a narrow economic moat and a stable moat trend rating, thanks to the network effect around its ride-sharing platform and intangible assets associated with riders, rides, and mapping data, which we think can drive Lyft to profitability and excess returns on invested capital.

From a strategic standpoint, Lyft is well on its way to becoming a one-stop shop for on-demand transportation. It has tapped into the bike- and scooter-sharing markets, which we think will be worth over $12 billion by 2029, growing 7% annually. Lyft also appears to be aggressively pursuing the autonomous vehicle route as it understands that self-driving cars may help the firm to expand its margins; without drivers, it could recognize a bigger chunk of the fare as net revenue. In contrast to Uber, Lyft is not focused on food transportation or logistics. We like Lyft's relatively narrower focus on consumer transportation but note that Uber has an edge on Lyft in terms of an earlier start, higher market share, and a stronger network effect around its services. In addition, unlike Uber, Lyft’s lack of revenue diversification won’t soften the impact of exogenous shocks like COVID-19.

We believe Lyft may need to more aggressively acquire riders via lower pricing. However, we don't think this is a death knell for future profitability. Compared with Uber, Lyft has fewer riders on its platform and fewer rides taken because it is focusing mainly on the U.S. market; however, it may be able to avoid some bumps on the road toward profitability, including the international regulatory-related ones that may require additional costs. We foresee the firm becoming profitable in 2024."

Ali Mogharabi, senior analyst

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RYIQ2SKRKNCENPDOV5MK5TH5NY.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PPB6K765QVEN5C6ZRHVEXM3CIQ.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/4TYZEEXD3RGWNKTVNUJBWDUFAM.jpg)