U.S. Equity Managers Not Overreacting to Restive Retail Investors

They have taken notice of recent investor behavior but aren't altering their processes.

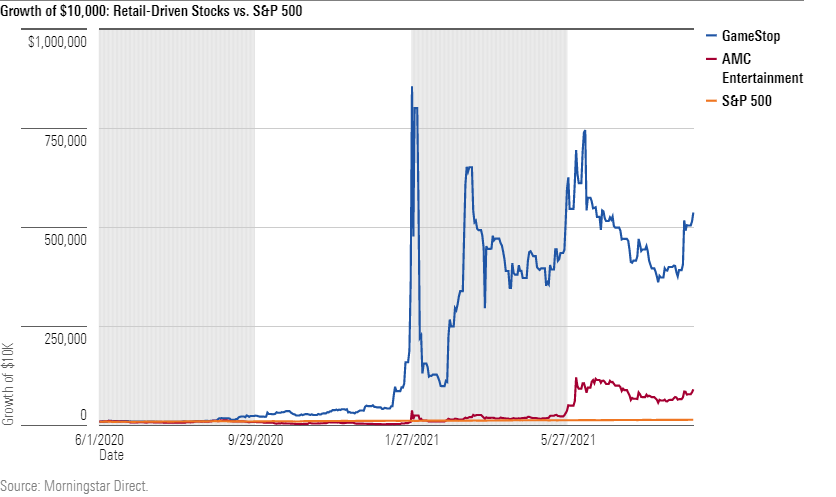

Retail investors have powered astonishing price moves in stocks such as GameStop GME, AMC Entertainment AMC, and BlackBerry BB. Trading volume in U.S. equities from retail investors surged by a third in 2020 versus 2019, according to The Wall Street Journal. Observers, including Morningstar's John Rekenthaler, have compared the behavior of today's retail investors to that of investors in the late 1990s, before the dot-com bubble burst. Fund managers have taken notice, but they are responding differently.

Phil Nordhus, manager of Principal SmallCap PSLIX, said that for the first time in his 15-year tenure, his largest performance detractor relative to the Russell 2000 Index in 2021's first half was a stock he didn't own: AMC Entertainment. The theater chain that took up 0.02% of the Russell 2000 Index at the end of August 2020 was the benchmark's largest constituent at 0.65% of the index one year later after rising more than 700% during that period. Nordhus didn't own so-called "meme stocks" like AMC and GameStop because he didn't like their fundamentals, but he owned Bed Bath & Beyond BBBY, which also rose during the retail-driven rally. Nordhus trimmed the stock as it rose to keep it at roughly the benchmark's weighting.

Boston Partners All-Cap Value BPAIX manager Duilio Ramallo says that retail investor activity has increased some stocks' volatility, but it hasn't changed the way he and his team evaluate companies because those price moves have little to do with the companies' fundamentals. Boston Partners managers wouldn't buy AMC or GameStop as long-term holdings, in any case. They don't meet Boston Partners' firmwide investment criteria, which include attractive valuations, sound business fundamentals, and positive business momentum.

Not all managers sat out the meme-stock rally, though. Phil Hart, who manages a quantitatively driven sleeve of VY JPMorgan Small Cap Core Equity VPRSX, said if one stock determined his success or failure of his highly diversified portfolio in a given quarter or year, he would feel like a failure as a risk manager. He and his team bought AMC in 2021's first quarter to reduce the risk of lagging too far behind the benchmark in the Reddit-fueled rally. The position ended up boosting the fund's returns, but Hart doesn't see the retail investor resurgence as a net positive, because it creates an additional layer of risk for his purposes.

Retail investors also left their mark in the commodities markets as the prices of lumber and silver skyrocketed early in the year. Steve Land, manager of Franklin Templeton Gold and Precious Metals FKRCX, said that among precious-metals equities, it is not uncommon for retail investors to pile in and out, exacerbating short-term price swings. Silver, for example, often acts as a higher-risk, higher-return version of gold, and it jumped quicker in the summer of 2020 as investors worried about inflation poured into the metal. IShares Silver Trust SLV rose 53.2% between July 1 and Aug. 31, 2020 compared with the SPDR Gold Shares' GLD 10.6% gain during that time. Land owned some silver-related stocks, but the rally didn't change the way he invests in them; he continues to look for companies with attractive valuations.

It's not clear if recent frenzied retail investor behavior will persist, but it has professional asset managers' attention. Few, though, have changed their processes because of it.

/s3.amazonaws.com/arc-authors/morningstar/ac242d77-42e4-4165-951a-b300b089a834.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ac242d77-42e4-4165-951a-b300b089a834.jpg)