More North American Firms Are Disclosing Diversity Data, New Study Shows

Despite a more than threefold increase, most companies still don't publicly release their diversity data.

More North American corporations are disclosing details about the racial and ethnic diversity of their workforces, though the majority aren't doing so publicly, according to new research from Sustainalytics, a Morningstar company.

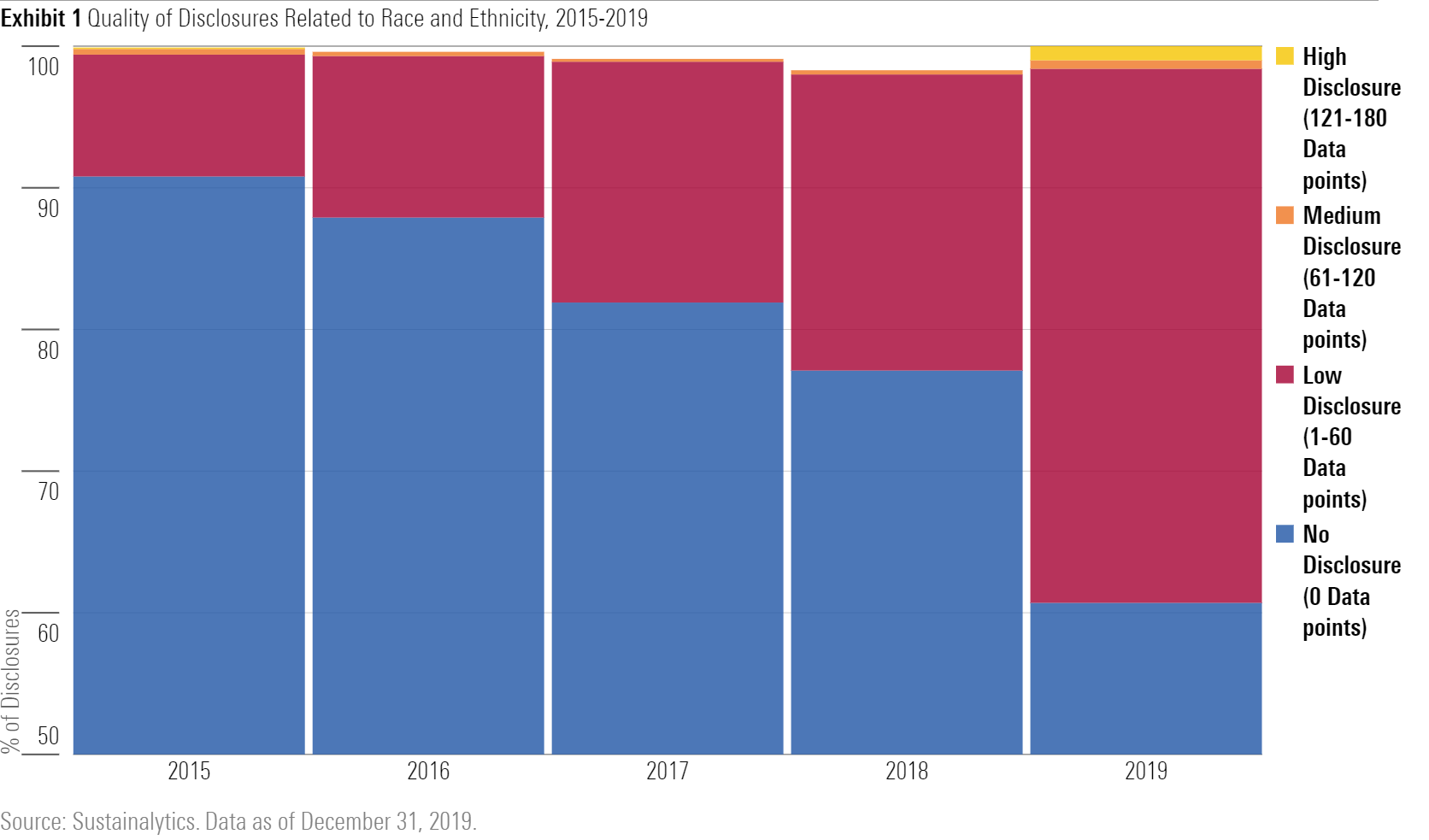

The study reviewed the disclosures of 685 mid- and large-cap firms in the United States and Canada. It found that while there was a more than a 335% increase in race and ethnicity disclosures from 2015 to 2019, 61% of the sample didn't publicly disclose any employee demographics data on race or ethnicity. Only 1% disclosed more than 120 of the 180 data points required by the Equal Employment Opportunity Commission, or EEOC, in its EE01 form.

Increasingly, investors are exploring how diverse hiring practices can help create wealth in underrepresented communities and how prosperity can lead to breaking cycles of poverty and violence, the study's authors say. The authors recently looked at racial and ethnic incidents at companies, too.

Quality of Racial and Ethnic Disclosures

The EEOC requires companies with at least 100 employees to file an EE01 form. This form asks companies to disclose their workers' racial demographics. Companies aren't required to publicly disclose the form results, however.

In 2019, the most recent year with data available, 61% of companies didn't publicly release any diversity data points from the EE01 form. This is a steady decrease from 2015, when 91% of companies didn't disclose any data.

There was a steady increase of companies disclosing one to 60 data points in the same period. In 2019, 38% of the study's sample released one to 60 data points--a significant improvement from the 9% of the sample in 2015.

Martin Vezér, one of the study's authors, says the gold standard for disclosing diversity data is to release the entire EE01 form. Though it's uncommon to do this, as a company's management might not agree on what data to disclose, and unfavorable data may hurt the company's public image.

For those that disclose only a few pieces of information that would be included in their EE01 forms, it's difficult to compare companies. "Companies are selective in whether and how they make employee demographics public," Vezér says. "While the statistics that some companies release aggregate workforce tiers and racial categories, others provide more granular information."

Overall Workforce Demographics

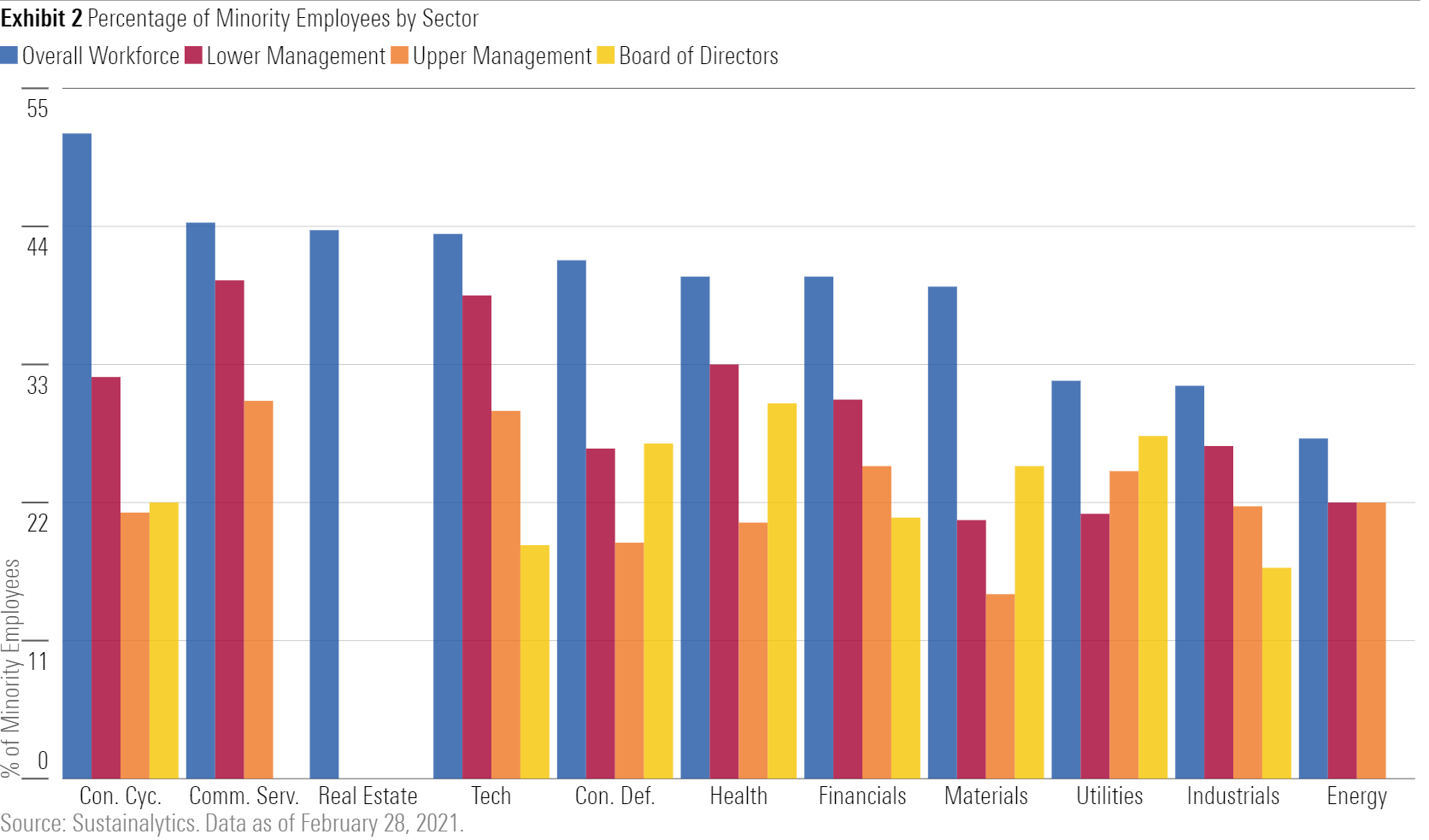

Some investors may be curious to see what positions that employees from underrepresented communities have within an organization. The study looked at the percentage of diverse employees in the overall workforce, lower management, upper management, and corporate board levels.

The largest gaps in diversity levels exist in the basic-materials, consumer cyclical, and consumer defensive sectors. This means the percentage of employees from underrepresented communities is higher in the overall workforce compared with upper management. (Only overall workforce data was available for the real estate sector.)

To develop a more holistic assessment of a company's hiring practices, other factors like region and company operations should be considered, the study's authors say.

Higher Returns for More Diverse Upper Management

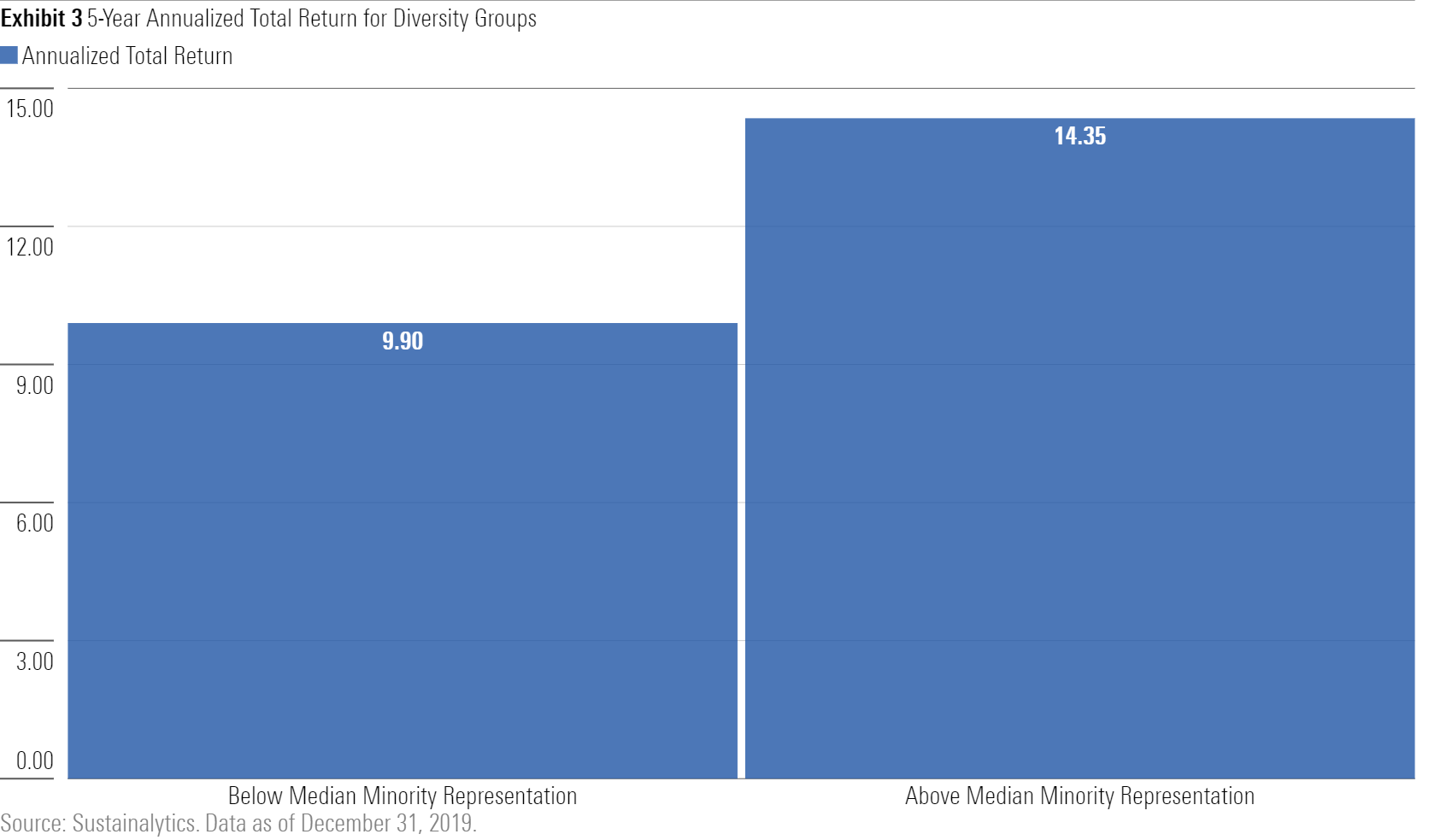

Sixty-five companies of the 685 in the sample disclosed racial and ethnicity data on their upper management. The study's authors divided the companies into two groups, those above the median representation and those below, and looked at their trailing five-year annualized returns.

Companies above the median diversity level had a trailing five-year annualized return of 14.35% compared with 9.90% for those below the median.

Of these 65 companies, the study's authors also found that more diverse upper management teams had higher one- to five-year returns, compared with less diverse teams, in 84% of cases.

The Road Ahead for Diversity Disclosures

Investors using strategies around racial diversity still have barriers, according to the report. The first is that the number of companies publicly disclosing their diversity is still low: Only 269 of the 685 companies in the sample disclosed any data.

Another barrier is the outdated classification template on the EE01 form. For example, distinguishable ethnicities like Middle Eastern, Chinese, or Thai would be simply classified as "Asian." This template was first created during the civil rights era, when concepts around race weren't as developed.

Investors looking to enact change can encourage companies to release their entire EE01 forms; create quantitative targets to increase racial diversity; implement programs that retain employees from underrepresented communities; and support shareholder resolutions that hold companies accountable on racial diversity.

/s3.amazonaws.com/arc-authors/morningstar/8b2c64db-28cb-4cb4-8b53-a0d4bc03a925.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CQP5OBZT3NBS7M76RDJCKLIFVM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2c64db-28cb-4cb4-8b53-a0d4bc03a925.jpg)