The Best Funds for Built-In Diversification

Balanced funds can play a useful role, but target-date funds look more compelling overall.

Target-date funds, which offer a preset mix of major asset classes that automatically shifts over time for investors with a specific retirement date, are the Rodney Dangerfield of the investment world: They get no respect. Somewhat inexplicably, these funds have attracted more than their fair share of criticism. Financial advisors often dismiss them as cookie-cutter solutions: Because they offer the same portfolio for everyone with a given retirement date, the argument goes, they're not sufficiently customized to meet an investor's unique level of risk tolerance or other portfolio needs. Similarly, author and financial expert Michael Falk has criticized target-date funds for failing to customize their asset allocations for investors with different levels of wealth and taking on too much equity-market risk, which could hurt retirees in a bear market.

While some of these criticisms have merit, target-date funds still rank as one of the best options available for investors seeking a diversified portfolio in a single fund. Balanced funds, which traditionally offer a relatively static mix of about 60% stocks and 40% bonds, are target-date funds' primary competitor and often the only other option available for investors seeking built-in diversification in a mutual fund or exchange-traded fund format. Here, I’ll compare how target-date funds stack up against plain-vanilla balanced funds on various dimensions to see which type has the edge. Bottom line: Target-date funds may not be a perfect solution in every case, but they still qualify as more compelling than balanced funds based on several key factors.

First, Some History

Balanced funds have long been fixtures of the mutual fund world. Some of the oldest balanced funds, such as Dodge & Cox Balanced DODBX, Eaton Vance Balanced EVIFX, and George Putnam Balanced PGEOX, date back to the 1930s, while Vanguard’s venerable Wellington Fund VWELX originally launched in 1929. Up until the 1990s, balanced funds were the main option available for investors seeking a diversified mix of both stocks and bonds in a single fund. As companies increasingly abandoned traditional pension plans in favor of self-directed 401(k) plans, target-date funds began emerging as more-sophisticated competitors. Instead of keeping a static asset blend, target-date funds generally shift their portfolio allocations over time to meet the needs of investors planning to retire at a certain date.

The 2006 Pension Protection Act, which introduced the concept of Qualified Deferred Investment Alternatives, made target-date funds a more popular option for employers to include as core investment options for their retirement-plan lineups. As a result, assets in target-date funds (not including collective investment trusts) totaled $1.7 trillion as of Aug. 31, 2021, compared with only $500 billion for funds that self-identify as balanced funds.

Risk and Returns

Performance for target-date funds spans a wide range because their asset mixes vary depending on the specific retirement date. Analyzing the results is also challenging because only a handful of funds have been around more than 15 years.

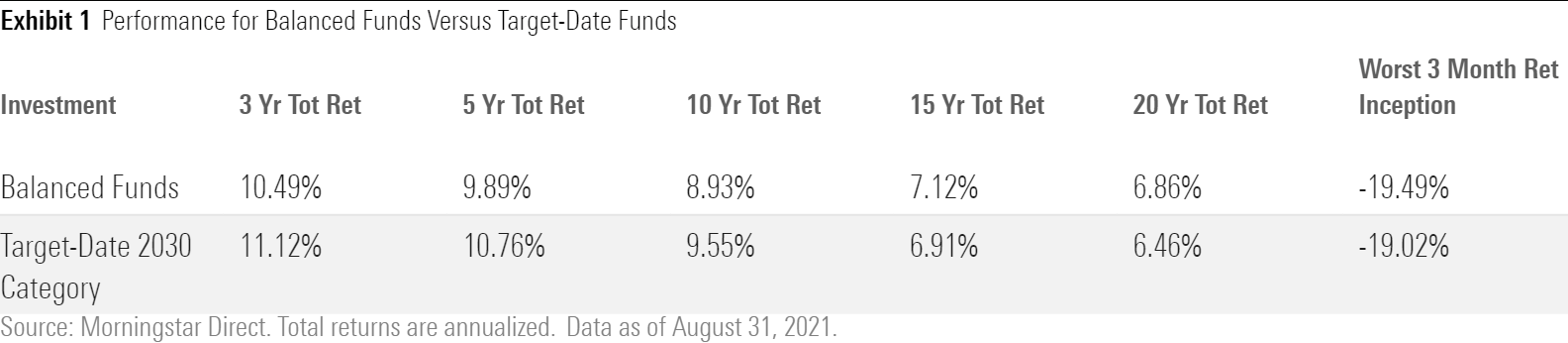

For the closest comparison to balanced funds, I looked at the target date 2030 Morningstar Category, which has slightly more equity exposure than the typical balanced fund (62% of assets, on average, compared with 59% for balanced funds). As shown in the table below, the performance edge varies depending on the time period: Target-date funds have taken the lead over the trailing three-, five-, and 10-year periods ended Aug. 31, 2021, but balanced funds pulled ahead for the trailing 15- and 20-year periods. This probably reflects the fact that target-date funds had a higher percentage of their portfolios allocated to stocks during the 2000s, when equity-market returns for stocks were flat to negative overall. Risk, as measured by standard deviation, has been slightly higher for target-date funds, but downside performance hasn't been dramatically different. On balance, neither fund type has a clear advantage for risk-adjusted returns. Advantage: draw

Fees and Expenses

Target-date funds may be pricier than they need to be in absolute terms, but still offer an expense advantage compared with balanced funds. Because target-date funds came of age more recently, they’re more likely to favor low-cost index funds as their underlying holdings, whereas many balanced funds are actively managed offerings that carry higher costs. In addition, target-date funds are primarily used in 401(k) plans, where plan sponsors closely scrutinize costs to avoid the type of lawsuits that are often filed against 401(k) plans for excessive fees.

Target-date funds are often criticized for layering management fees on top of the expense ratios for the underlying funds, but funds that do that are now in the minority. Even after considering both underlying fund fees and any additional advisory fees, total fees (found in the data point labeled "prospectus net expense ratio" under the Expense tab on Morningstar.com) for target-date funds average 0.55% of assets. For comparison, balanced funds have an average expense ratio of 1.08%. Advantage: target-date funds

Asset-Class Diversification

Target-date funds are the clear winners here. Most balanced funds have a pronounced home-country bias, allocating less than 16% of their equity assets to international stocks, on average. (Global balanced funds are obviously the exception). Target-date funds, on the other hand, generally allocate more than a third of their equity assets to international stocks, making them a better match for global market diversification.

In addition, target-date funds often include small allocations to asset classes such as real estate and commodities, which can improve portfolio diversification because of their lower correlation with the broader equity market. Target-date funds geared toward investors in retirement also routinely allocate a portion of their assets to Treasury Inflation-Protected Securities, which can help retirees mitigate the corrosive effects of inflation. By contrast, balanced funds generally stick to the broadest types of stocks and bonds. To get exposure to other asset classes, balanced-fund investors would need to supplement their core holdings with additional funds, but target-date funds provide built-in diversification in one package. Advantage: target-date funds

Ease of Use

Target-date funds’ built-in diversification also makes them easier to use because it investors don't have to worry about crafting an asset mix to meet their needs and then choosing the best funds within each asset class. In addition, the fact that target-date funds gradually shift their portfolios toward safer asset classes means investors don’t have to worry about adjusting their allocations over time. Investors could theoretically hold a balanced fund throughout retirement, but that may leave them with more exposure to equity-market risk than they’re comfortable with as they get older.

While target-date funds are generally the best option for a "set it and forget it" approach to asset allocation, they do require some additional research up front. Even within the same target-date category, target asset allocations can vary significantly. For investors targeting retirement in 2050, for example, target equity allocations for the period 30 years prior to retirement range from about 98% of assets (for T. Rowe Price and BlackRock's offerings) to just 77% of assets (for Putnam). Similarly, allocations to other asset classes, such as foreign stocks and bonds, commodities, real estate, and TIPS, can vary even for funds with the same target date. Investors should therefore ask about a fund's target asset allocation for different ages (also known as a glide path) to make sure it fits their needs. Advantage: target-date funds (with a caveat for up-front research needed)

Conclusion

As mentioned above, target-date funds aren’t perfect. While they are low-maintenance overall, they still require investors to do some research and make sure they’re comfortable with a given fund’s target asset allocations. Target-date funds geared toward investors already in retirement also have room for improvement in helping plan participants transition from accumulating assets to creating sustainable cash flows that can support retirement spending.

But overall, target-date funds have significant benefits. Like balanced funds, they’ve excelled at helping investors narrow the gap between reported returns and the actual returns they earn in dollar terms. Compared with balanced funds, target-date funds’ lower costs and greater level of portfolio diversification also give them an edge. But target-date funds' ease of use is what really sets them apart. Despite the supposed benefits of customization, most investors can improve their results by minimizing the number of decisions they need to make and take action on. Target-date funds' built-in diversification and automation are compelling advantages that make them worthy of more respect.

/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)