Can These Bond ETFs Deliver?

Strategic-beta corporate-bond ETFs may outperform, but investors should proceed with caution.

A version of this article previously appeared in the August 2021 issue of Morningstar ETFInvestor. Click here to download a complimentary copy.

The low rates and tight spreads that characterize the current corporate-bond market seem to present investors with an ultimatum: accept a lower risk-adjusted return from cheap index-trackers or bet on more-expensive active funds seeking to beat their benchmarks.

There is a third alternative. Strategic-beta corporate-bond exchange-traded funds try to provide superior risk-adjusted performance by leveraging the same factors driving active funds' returns, while charging much lower fees. Although bond performance is driven primarily by interest-rate and credit risk, the best actively managed corporate-bond funds seek superior risk-adjusted performance by identifying bonds with favorable attributes. The two most common are quality and value.

Here, I review the landscape of strategic-beta corporate-bond ETFs within the investment-grade and high-yield corporate-bond markets, presenting sensible options for each.

Quality and Value in Bonds

Quality refers to the tendency for securities issued by companies with solid businesses to outperform securities issued by companies with less-solid businesses, on a risk-adjusted basis.

For bonds, quality is defined by a company's ability to repay its debt, and it is closely linked to firms' credit ratings. As a result, quality in bonds is also closely linked to yield. But credit ratings tend to be lagging indicators, and bond prices tend to drop precipitously prior to downgrades. Still, an aggressive pursuit of quality risks limiting potential return.

Funds use the quality factor to mitigate volatility. They use accounting data to assess areas like profitability and leverage, metrics that gauge companies' ability to service their debt. A quality bond is one from a company that generates excess cash relative to debt-servicing costs.

Value refers to buying securities that are cheaper than they should be. For bonds this means buying bonds offering higher yields than they should because the market perceives them to be riskier than they are.

For bonds, value is closely linked to credit risk because it centers on the perceived risk of default being greater than the actual probability. As a result, an aggressive pursuit of value results in more exposure to credit risk.

Bond funds use the value factor to try to enhance return. Many create value scores by comparing a model-based yield spread (the difference in yield between a Treasury and a corporate bond with the same maturity) with the market spread. On this measure, attractive bonds have market spreads higher than their model-based spread. This indicates that the bond offers a higher yield than necessary. Approaches vary to the creation of model-based spreads, but they invariably incorporate quality as a safeguard.

There are lots of trade-offs and complicating nuances: The bonds of high-quality issuers, for example, rarely trade at bargain valuations, while higher-yielding bonds often come from businesses facing operational challenges. The best strategic-beta corporate-bond ETFs incorporate these factor exposures sensibly. Here are a few that ply these strategies in the investment-grade and high-yield markets.

Investment Grade

The investment-grade corporate-bond market is generally efficient at transforming opinions into prices, but it's not infallible. Bonds representing more than half of the market carry a BBB credit rating, the lowest possible investment-grade rating, and three decades of falling yields have increased demand for yield, providing incentives for risk-taking. Consequently, there is an opportunity for quality-oriented strategies to boost risk-adjusted performance relative to traditional market-value-weighted index funds.

Goldman Sachs Access Investment Grade Corporate Bond ETF GIGB carries a Morningstar Analyst Rating of Neutral. The fund maintains a light quality tilt. GIGB excludes the 10% of issuers from each sector with the lowest operating margins and highest leverage. Bonds that make the cut are weighted by their market value.

GIGB's quality screen is effective because it trims the fat without affecting the quality of the meat. While it won't catch all soon-to-be fallen angels (bonds initially receiving an investment-grade rating that subsequently were downgraded to high-yield status), it will catch some. That said, on the balance, eliminating the riskiest of the lot diminished the fund's return potential, which is the basis for our Neutral rating.

A value orientation can be valuable in the investment-grade bond market. Two interesting funds that look to leverage the value factor are WisdomTree U.S. Corporate Bond WFIG and iShares Edge Investment Grade Enhanced Bond ETF IGEB. Neither is currently rated by our analysts. Both employ a quality screen and value tilt, but WFIG balances an aggressive quality screen with a sensible value tilt. IGEB aggressively pursues value and courts a lot more credit risk--which gives it larger upside potential relative to WFIG.

WFIG excludes the 20% of issuers from each sector least likely to service their debt and weights the remaining bonds by a value-score-adjusted market value. The value score is equal to the spread multiplied by a probability of default. The bonds with the best value scores in their sector receive double representation in the portfolio, while those with the worst value scores are excluded.

IGEB excludes bonds from up to 20% of issuers from each credit rating group that are most likely to default. The remaining bonds receive a value score equal to the difference between the spread and a probability-of-default percentage. An optimizer designed to maximize exposure to the value score constructs the portfolio.

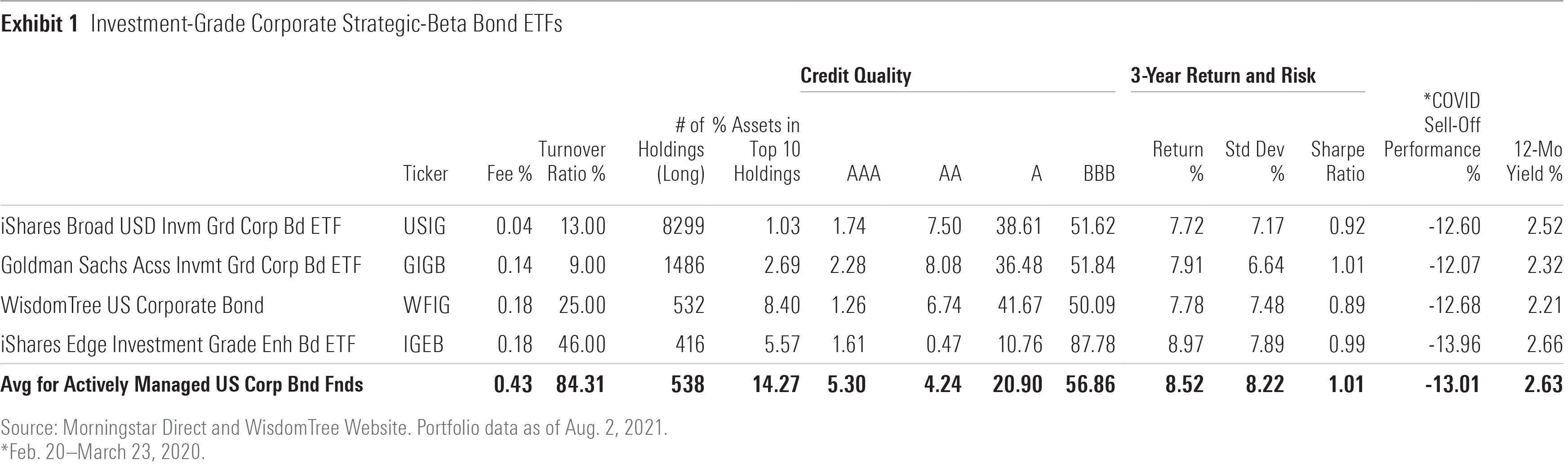

Exhibit 1 contains key risk and performance metrics for GIGB, WFIG, IGEB, and iShares Broad USD Investment Grade Corporate Bond ETF USIG, a market-value-weighted fund representative of the investment-grade corporate-bond market, over the trailing three years through July 2021. While IGEB generated the highest return, it also exhibited the most volatility. Unsurprisingly, GIGB exhibited much less volatility without sacrificing return, resulting in the best risk-adjusted performance.

High Yield

High-yield corporate bonds are much riskier than their investment-grade counterparts. They are also more likely to be mispriced because there is less trading, resulting in less price discovery. So, the market is less likely to price these bonds as efficiently as they may investment-grade credits.

WisdomTree U.S. High Yield Corporate Bond WFHY employs a sensible quality screen and value tilt. Its quality screen excludes all companies with negative five-year average free cash flow. It also has a much stricter quality screen than its investment-grade sibling. And its value score takes additional steps to mitigate risk when evaluating the attractiveness of credit spreads. For instance, bond seniority is factored into the spread before the spread is multiplied by a probability-of-default percentage.

WFHY weights eligible bonds by a value-score-adjusted market value. The bonds with the best value scores in each sector receive twice the weight, while those with the worst value scores are excluded. This strikes a sensible balance between the risk and return potential inherent in the high-yield corporate-bond market.

FlexShares High Yield Value-Scored Bond Index HYGV is a solid pick for the risk-tolerant. HYGV employs a quality screen to remove the 10% of bonds least likely to be repaid, irrespective of their sector or credit rating. It also excludes the least-liquid 5% of bonds per sector. It then aggressively leverages value through its optimized portfolio-construction process, which aims to maximize exposure to bonds trading at favorable risk-adjusted spreads.

HYGV is an aggressive fund that will take it on the chin when credit spreads widen but stands to generate outsize returns when they tighten. It also boasts a broadly diversified portfolio with minimal concentration risk, mitigating downside risk.

Goldman Sachs Access High Yield Corporate Bond ETF GHYB is a good pick for the risk-averse, but it is also the least likely to beat traditional market-value-weighted index funds. GHYB excludes the 15% of issuers in each sector least likely to service their debt and weights the remaining bonds by market value. Reducing exposure to the lowest-quality companies is a sensible approach, but GHYB relies exclusively on the market's collective wisdom in sizing its bets. Still, its broadly diversified portfolio mitigates concentration risk, which should provide downside protection along with its quality screen.

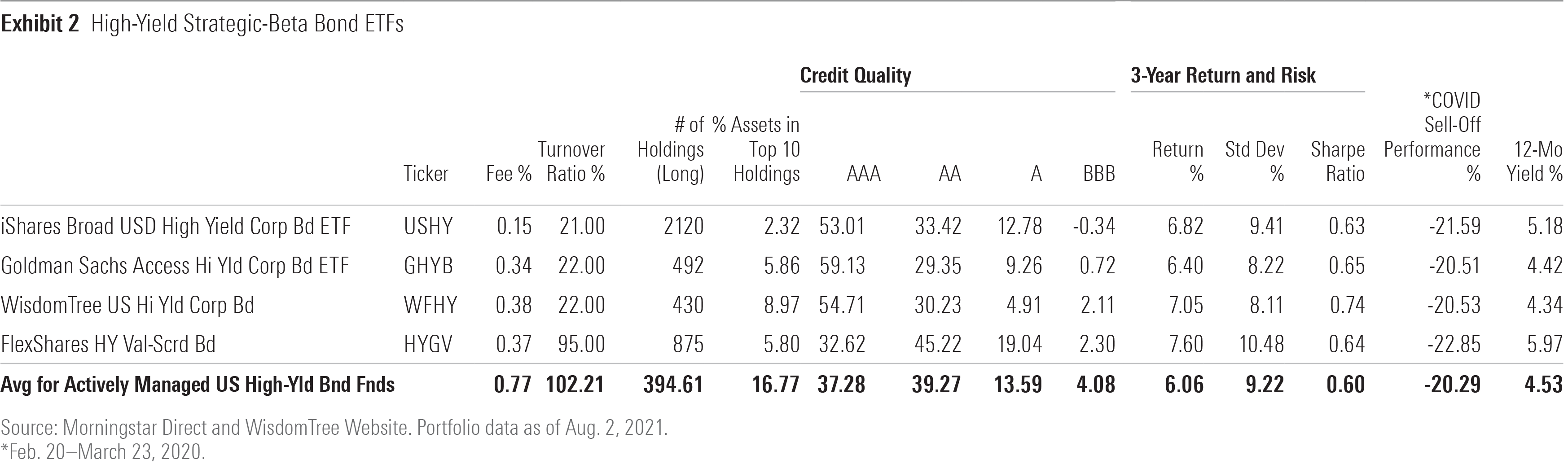

Exhibit 2 contains the key risk and performance metrics for WFHY, HYGV, GHYB, and iShares Broad USD High Yield Corporate Bond ETF USHY, a market-value-weighted fund whose portfolio is representative of the high-yield bond market, over the trailing three years through July 2021. Clearly, WFHY struck the best balance between risk and return, while HYGV provided the most tantalizing yield over this span.

Wrapping It Up

Market-value-weighted index funds are tough to beat. It is hard to outsmart the market, especially over the long run. Leveraging the market's collective wisdom is usually a safe bet; boasting a low fee always is.

But the best strategic-beta corporate-bond ETFs take a shot at beating traditional market-value-weighted index funds by offering low-cost exposure to the common factors that drive bond returns: quality and value. Still, careful consideration of a fund's investment universe and portfolio-construction process is required, because a quality bent can limit return potential, while tilting to value can increase volatility. Nonetheless, these factors can limit volatility and increase return potential when combined sensibly.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Morningstar, Inc. does not market, sell, or make any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/30aa6d58-cc92-46c5-8789-50161dc392a9.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)