The Model Portfolio Landscape in 7 Charts

What's driving their rapid growth and how we're helping make sense of it.

The model portfolio universe continues to expand at a rapid pace: The number of model portfolios reported to Morningstar now stands at approximately 2,100--more than double what it was in 2020.

In our recently published 2021 Model Portfolio Landscape, we take a deep dive into this universe. We touch on the assets following models, industry trends, the upcoming rollout of the Morningstar Rating (also known as the star rating) for model portfolios, and our highest-conviction model portfolios available to advisors and their clients.

Below, explore seven of our favorite charts and tables from the report.

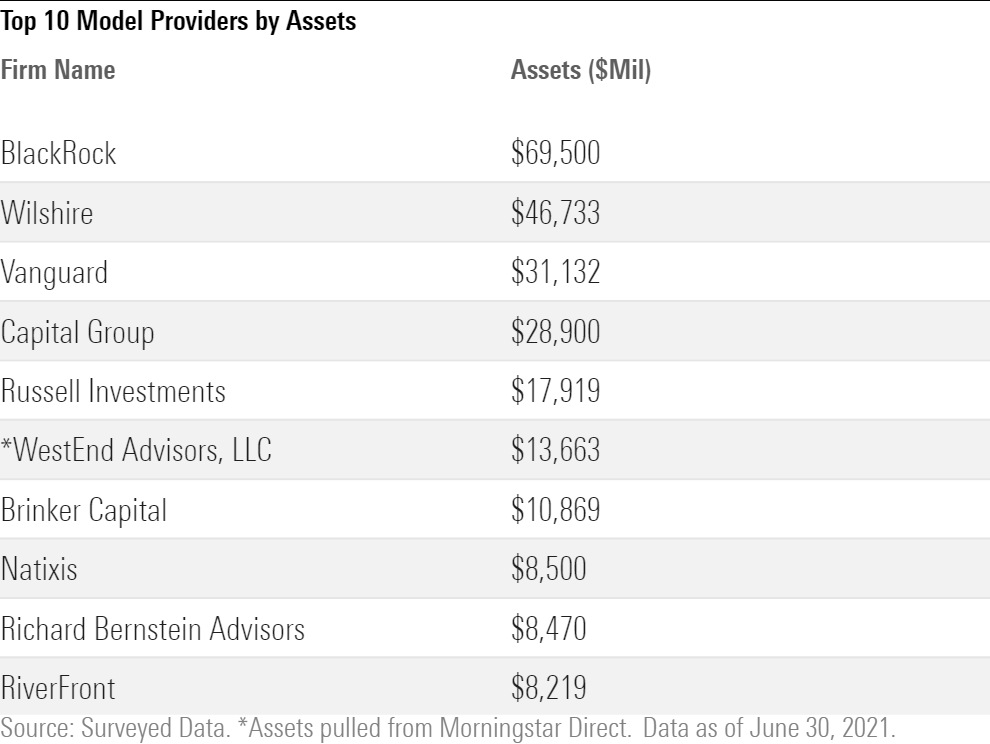

The Top 10 Providers of Model Portfolios

Tracking the size of the model portfolio landscape is difficult because asset managers and strategists often don't know the extent to which advisors are following paper models.

As of June 30, 2021, at least $315 billion was invested in third-party model portfolios, based on a survey of 28 of the leading model providers and data reported to Morningstar Direct. The table below lists the top 10 providers by reported assets.

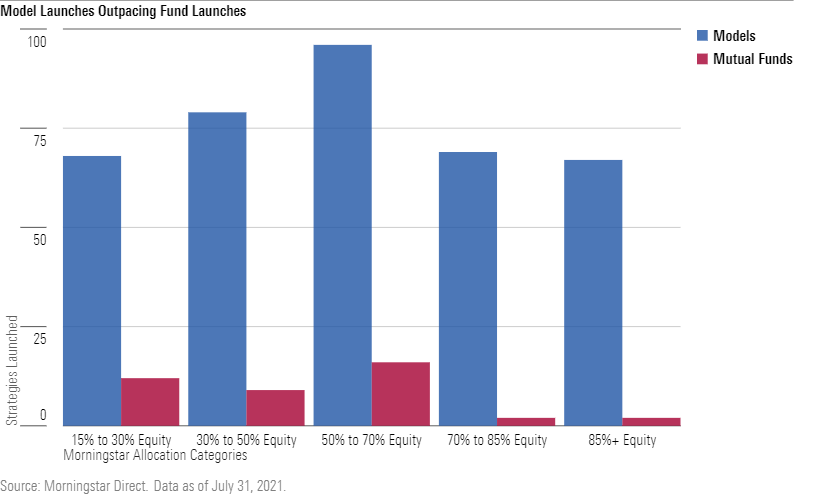

Model Portfolio Launches Everywhere

What's driving the flood of new model launches? One factor is that model portfolios have fewer barriers to entry and cost less to launch than mutual funds and other vehicles. For instance, since the providers don't hold the assets, they don't have to register with the SEC or pay a bank a fee to custody assets.

The chart below shows new model launches by the allocation Morningstar Categories compared with mutual funds since 2019, when Morningstar created a unique database for models.

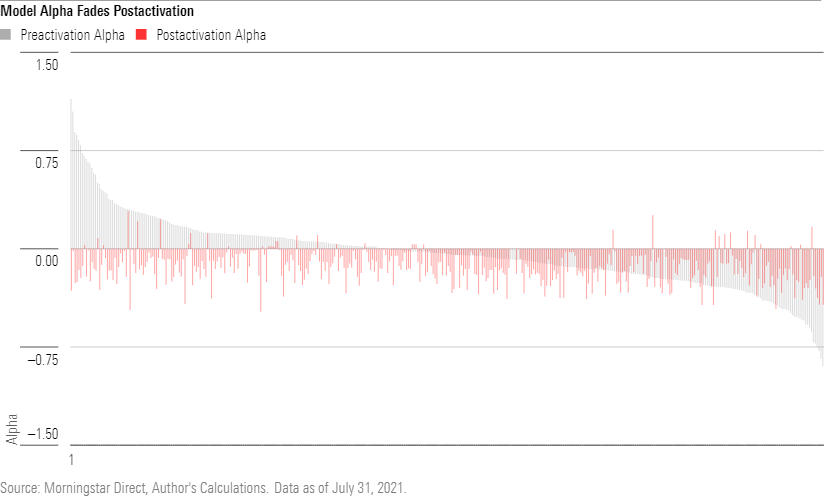

Model Portfolio Performance May Not Be as Strong as It Seems

Because of relaxed reporting standards, in some cases investors should view model portfolio performance with a dose of skepticism.

For example, models often submit historical performance records that predate their appearance in databases like Morningstar's when they start reporting. There also are cases where preactivation returns reflect hypothetical, back-tested returns. Even when reported returns reflect actual results, model providers have few incentives to voluntarily report poor performance. So, the possibility of managers only reporting flattering results rather than their entire record, warts and all, can inflate relative returns—a phenomenon known as backfill bias.

We see evidence of backfill bias when we look at backfilled model returns versus returns reported after a model enters Morningstar's database. There are approximately 400 models that report to Morningstar and have at least three-years of pre- and postactivation returns.

We used a multifactor regression with data from Fama-French to calculate each model's alpha before and after reporting to Morningstar. This analysis found that the alpha of about 70% of those models declined in the three years after they started reporting to Morningstar. Furthermore, the regression showed about half of the models demonstrated positive alpha based on preactivation returns, but only 10% did so in the three years following activation. These findings in three-year pre- and postactivation alphas are shown on the chart below.

This disparity is part of why Morningstar will extend its Morningstar Rating for funds, better known as the star rating, to models. The star rating's emphasis on longer time frames and risk-adjusted returns makes it useful for sorting through a large universe of options, like models.

Starting this fall, the star rating for models will follow the same approach that is used for mutual funds and separate accounts, with some additional criteria required to be eligible. (See the landscape report for additional details.)

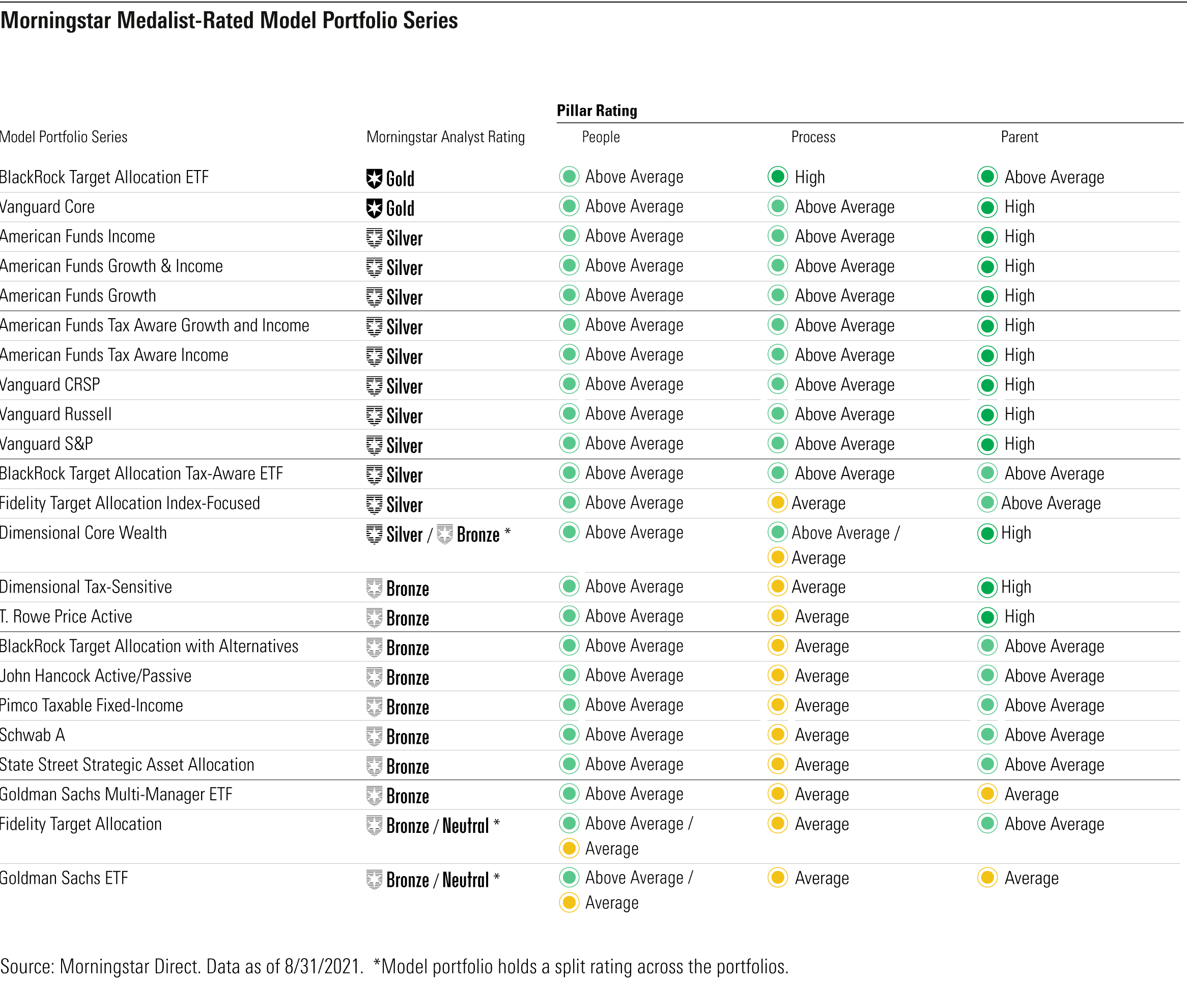

Morningstar's Top-Rated Model Portfolio Series

Advisors also can use the Morningstar Analyst Rating to assess models. We started assigning Analyst Ratings to separate accounts that are representative of models in March 2019, and the eligible coverage universe now includes hypothetical models to better reflect advisors' opportunity set. As of the end of August 2021, more than 40 series covering more than 250 individual models have Analyst Ratings, and the number of series should double by year-end.

The Analyst Rating is a forward-looking, qualitative assessment of a strategy's merits. Strategies expected to outperform their category index over a market cycle earn Gold, Silver, or Bronze ratings, while those expected to lag get Neutral or Negative ratings.

The chart below shows Morningstar's highest-rated model series as of August 2021. For a more detailed breakdown of each series' fees and underlying holdings, see the appendix.

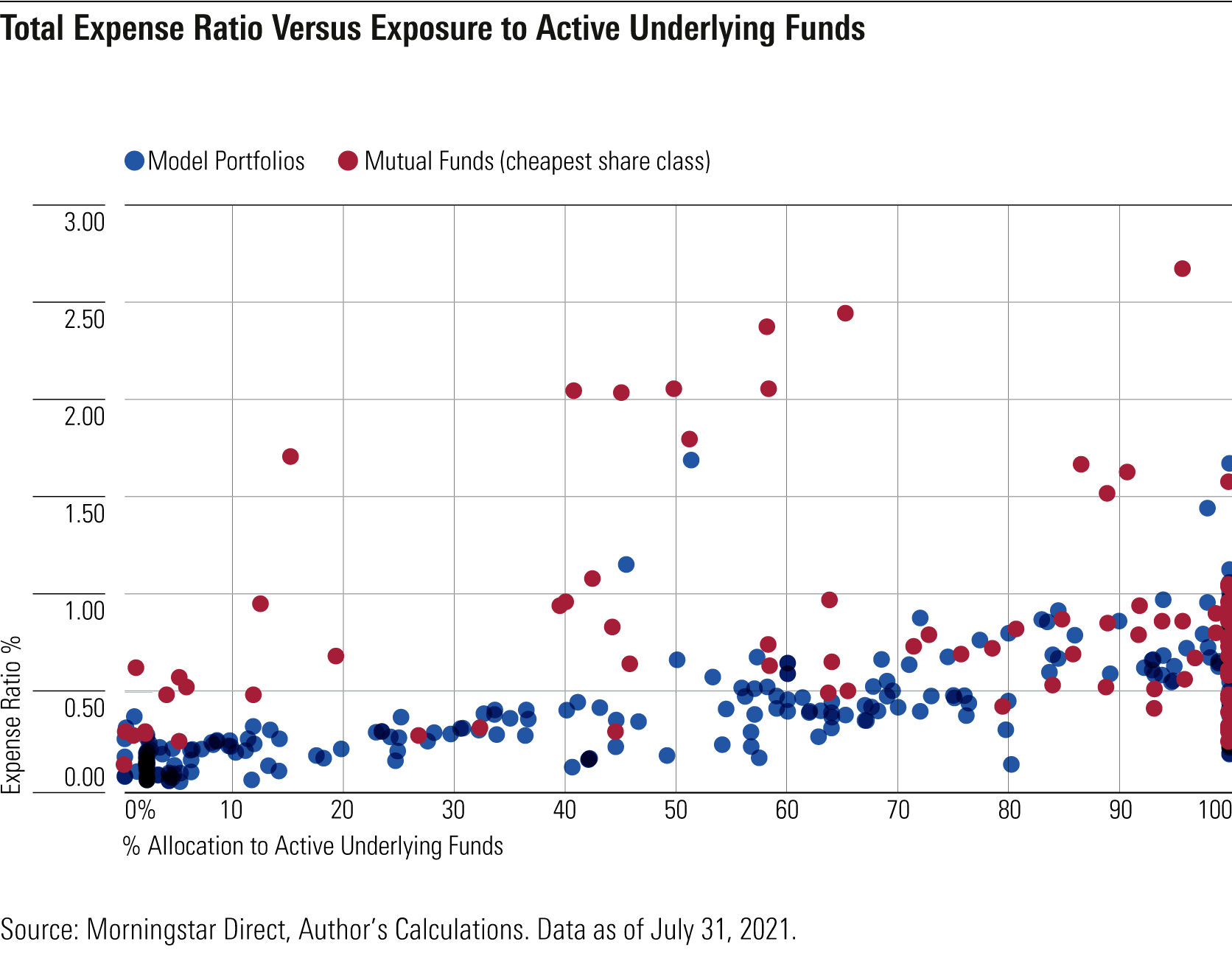

Model Portfolios Are Cheaper Than Mutual Funds

The chart below illustrates the cost for each model portfolio and the cheapest share class of mutual funds in the allocation--50% to 70% equity category relative to their exposure to active underlying funds.

It shows that, even after adjusting for model portfolios' generally heavy use of passive options, they remain cheap versus mutual fund peers. Whereas expenses for model portfolios fall within a relatively narrow band, mutual funds have a handful of high-priced outliers; seven charge more than 200 basis points.

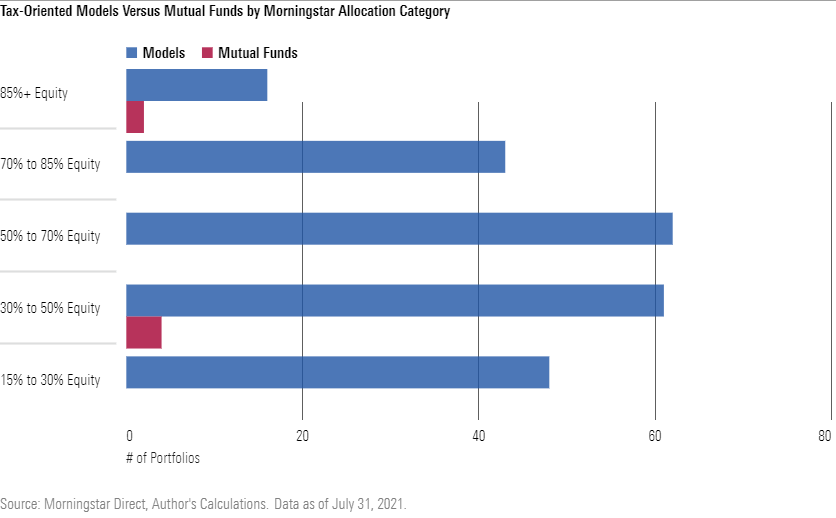

Model Portfolios Offer an Expansive Lineup of Tax-Oriented Strategies

Model portfolios make up for the lack of tax-oriented allocation strategies in the mutual fund space by offering a plethora of options for tax-conscious investors.

Mutual funds must hold at least 50% of their assets in municipal bonds to pass the income from that sleeve to investors tax-free. However, model portfolios don't face such limitations, as each fund in the portfolio is owned directly and passes any associated tax benefits on to its investors--making their construct more conducive to tax-oriented strategies. The chart below shows the number of tax-oriented model portfolios and mutual funds across allocation categories.

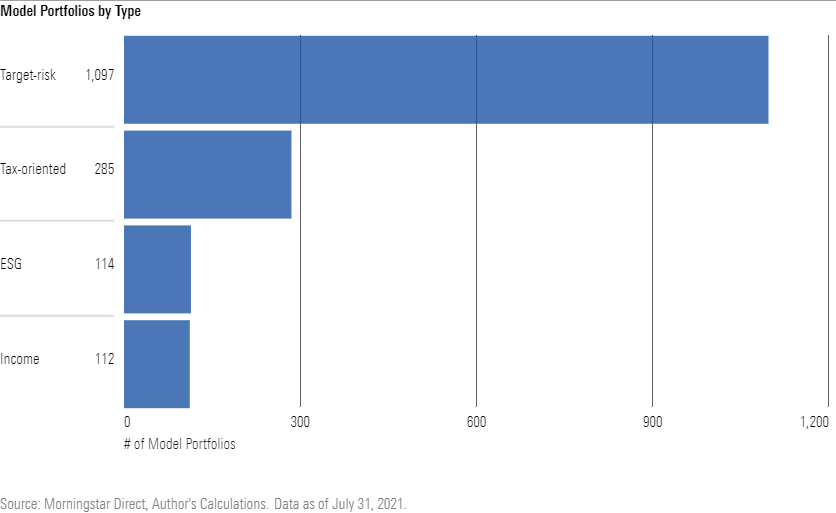

Among model portfolios, tax-orientation ranks among the most common objectives. The chart below buckets model portfolios in Morningstar's database into four types: target-risk, tax-oriented, ESG, and income.

Tax-oriented models total 285, accounting for nearly 20% of the models within these four groupings. (This table excludes nearly 500 models that don't fit nicely into common groupings, such as stand-alone equity, fixed-income, allocation, or alternative models.)

/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)

/s3.amazonaws.com/arc-authors/morningstar/41940ba6-d0f1-493c-af96-52ad9419064e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LUIUEVKYO2PKAIBSSAUSBVZXHI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/41940ba6-d0f1-493c-af96-52ad9419064e.jpg)