Our Ultimate Stock-Pickers' Top 10 Buys and Sells

Funds see value in a diverse range of sectors.

For the past decade, our primary goal with Ultimate Stock-Pickers has been to uncover investment ideas our equity analysts and top investment managers find attractive, in a manner timely enough for investors to gain some value. As part of this process, we scour the quarterly (in some cases, the monthly) holdings of 26 different investment managers: 22 managers oversee mutual funds covered by Morningstar’s manager research group and four Stock-Pickers run the investment portfolios of large insurance companies. As holdings data becomes available, we attempt to identify trends and outliers among their holdings as well as any meaningful purchases and sales that took place during the period under examination.

In our last article, we walked through our early read on our Ultimate Stock-Pickers' purchasing activity during the second quarter of 2021. The piece itself was an early read on individual purchases--focused on high-conviction and new-money buys--that were made during the period, based on the holdings of almost all our top managers. Now that all but two Ultimate Stock-Pickers have reported their holdings for the period, we think it is appropriate to examine our managers' high-conviction purchases and sales in aggregate. As stock prices have changed since our Ultimate Stock-Pickers made their buying and selling decisions, we urge investors to analyze securities at current valuation levels before making any investment decisions and provide our fair value estimates, moat ratings, stewardship ratings, and uncertainty ratings to help investors along the way.

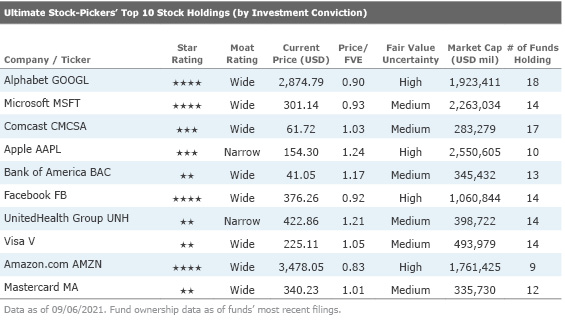

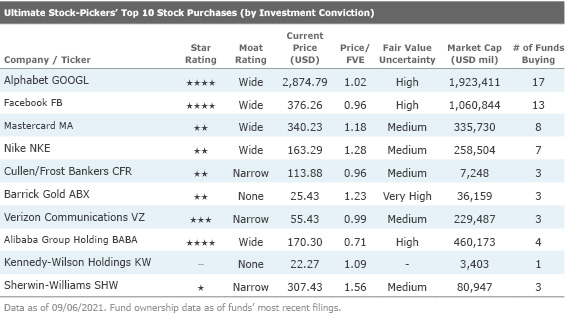

Our Ultimate Stock-Pickers continued their long-standing trend of buying and holding high-quality companies that Morningstar believes have developed sustainable competitive advantages. Morningstar's analysis shows that all the top 10 high-conviction holdings have either a narrow or wide economic moat and that seven of the top 10 conviction holdings have a wide economic moat. Additionally, eight of the 10 companies composing the top 10 high-conviction purchases list and five of the companies on the top 10 high-conviction sales list have been granted either a narrow or wide economic moat by Morningstar analysts.

From a sector allocation perspective, our Ultimate Stock-Pickers are taking about as active of a stance as they were last quarter. The Ultimate Stock-Pickers remain meaningfully underweight in technology and utilities sectors relative to the S&P 500. There has been a shift toward the industrials sector, with our managers overtaking the S&P 500 in this arena. The Ultimate Stock-Pickers also remain meaningfully overweight in the energy and basic materials sectors.

As many of the Ultimate Stock-Pickers are long-term investors, we were not surprised to see that the composition of our top 10 conviction holdings list was largely the same as the prior quarter. Google’s holding company, Alphabet GOOGL, maintained its number one spot on the list. Our Ultimate Stock-Pickers indicate a preference for communication services with three communications companies on our top 10 list. Managers also continue to hold companies from the financial services and technology sectors with these sectors also receiving attention from the Ultimate Stock-Pickers. Our current fair value estimates suggest that four of the names on the top 10 conviction holdings list--Alphabet, Microsoft MSFT, Facebook FB, and Amazon AMZN--are undervalued. Our research indicates that wide-moat rated Bank of America and Visa V along with narrow-moat rated UnitedHealth UNH are overvalued at the time of writing. As wide-moat Mastercard MA continues to maintain its presence on our top 10 convictions holdings list, we believe it is worthwhile to discuss the company's performance and take a closer look at Morningstar analyst Brett Horn’s outlook on the company.

Wide-moat Mastercard was held by 12 funds at the time of this article’s writing. This medium uncertainty stock currently trades at par with Morningstar analyst Brett Horn’s fair value estimate of $337. Horn asserts that the company possesses a wide moat, a result of the network effect stemming from its status as the second-largest payment processor in the world.

Horn believes that Mastercard has multiple characteristics that should draw investors’ attention. First, despite the evolution in the payment space, he thinks a wide moat surrounds the business and views Mastercard’s position in the current global electronic payment infrastructure as essentially unassailable. Second, Mastercard benefits from the ongoing shift toward electronic payments, which provides plenty of opportunities to utilize its wide moat to create value. Digital payments, on a global basis, surpassed cash payments just a couple of years ago, suggesting that this trend still has a lot of room to run, and Horn contends that emerging markets could offer a further leg of growth even if growth in developed markets slows. Finally, Mastercard is something of a tollbooth business, and the company is relatively agnostic to smaller shifts in the electronic payment space, as it earns fees regardless of whether payment is credit, debit, or mobile.

At the same time, Horn does provide a caution about Mastercard’s business. He notes that cross-border transactions, which are particularly lucrative for the networks, came under heavy pressure due to the fallout from the pandemic and a reduction in global travel. He expects a full recovery, but this could take a few years. From a longer-term point of view, Horn thinks it is likely that smaller and more regional networks are building out additional capacity for cross-border transactions, which could eat into growth a bit in the coming years, but he has yet to see a material effect.

Dissecting the company’s competitive advantage, Horn notes that payment networks such as Mastercard benefit, unsurprisingly, from a network effect. The more consumers that are plugged into a payment network, the more attractive that payment network becomes for merchants, which, in turn, makes the network more convenient for consumers and so on. In our view, this dynamic explains why a handful of networks have come to dominate electronic payments over time, and at this point, Mastercard has reached essentially universal acceptance in most developed markets.

Horn believes Mastercard has a stable moat trend. Despite the ongoing evolution in the payment space, Horn does not see any major disruptive threats and believes the company enjoys a strong secular tailwind that should persist for the foreseeable future.

As we previously mentioned, our Ultimate Stock-Pickers' top 10 conviction stock purchases list is primarily composed of names that have been given moats by Morningstar equity analysts. We found that our Ultimate Stock-Pickers made two purchases in the consumer cyclical sector—Nike NKE and Alibaba Group Holding BABA. Since Alibaba has recently made news for its troubles with the Chinese government, we think it is pertinent to take a deeper dive into the company that was purchased by four of our fund managers.

Wide-moat rated Alibaba currently trades at a 29% discount to Morningstar analyst Chelsey Tam’s fair value estimate of $302. Alibaba is a big data-centric conglomerate, with transaction data from its marketplaces, financial services, and logistics businesses allowing it to move into cloud computing, media/entertainment, and online-to-offline services.

According to Tam, Alibaba’s Internet services affect the vast majority of Chinese Internet users, including a 91% penetration rate for the Taobao/Tmall e-commerce marketplaces as of December 2020, based on 989 million Chinese Internet users as of December 2020 as per CNNIC. This provides Alibaba with an unparalleled source of data that it can use to help merchants and consumer brands develop personalized mobile marketing and content strategies to expand their target audiences, increase click-through rates and physical store transactions, and bolster return on investment. Alibaba's marketplace monetization rates have generally been on an upward trend despite recent macro uncertainty, indicating that sellers are increasingly engaging with Alibaba's marketplaces and payment solutions, although increased compliance of antitrust laws and more competition will put pressure on monetization in the near to medium term.

Tam believes Alibaba merits a wide moat due to its strong network effect, where the value of the platform to consumers increases with a greater number of sellers, and vice versa. When discussing Alibaba’s network effect, it is important to look at the company’s “ecosystem” of products. Alibaba's ecosystem is made up of several leading Chinese online retailing platforms, including Taobao Marketplace, China's largest online consumer-to-consumer shopping site, and Tmall, China's largest third-party business-to-consumer platform for branded goods. Alibaba’s core China retail marketplaces (Taobao and Tmall) generated gross merchandise volume of more than USD 1 trillion in the year ended March 2020, more than Amazon and eBay combined in 2020.

Further, Tam expects globalization will be a key growth driver for Alibaba in the years to come. In particular, Tam views Alibaba's controlling stake in Southeast Asia e-commerce platform Lazada as a positive for its international expansion aspirations. First, Tam thinks that Lazada is additive to Alibaba's network effect—the primary source behind our wide moat rating—and will give Alibaba's third-party merchants access to potentially 200 million active Internet users across Indonesia, Malaysia, the Philippines, Singapore, Thailand, and Vietnam (based on Internet Live Stats). Second, while Alibaba has had limited success with its previous e-commerce endeavors outside China, Lazada has a higher probability of success given the lack of existing players in Southeast Asia with established network effects and an underpenetrated e-commerce market (collectively representing an estimated 3%-5% of total retail goods sales versus an estimated 21% in China in 2019).

With regard to regulation risk, Tam notes that in July the Ministry of Industry and Information Technology announced a half-year rectification on Internet companies, which signals further regulatory tightening. However, Tam does not see material concrete impact from it at this stage, and Morningstar has kept the China Internet coverage’s fair value estimates intact.

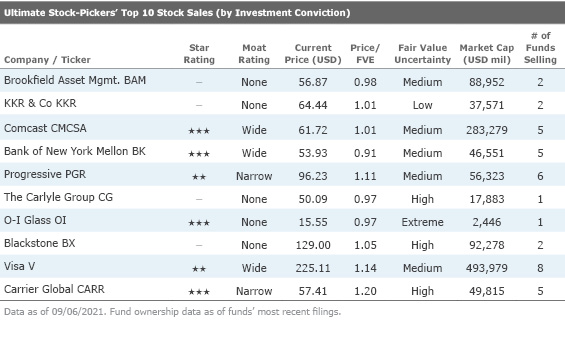

The Ultimate Stock-Pickers’ top 10 conviction sales list contains some new names compared with the previous quarter. These names include Blackstone BX and The Carlyle Group CG. Two of the conviction sales are also conviction holdings--wide-moat Visa and Comcast CMCSA appear on both lists. Much of the selling activity came from the financial services sector, which contributed seven names to the conviction sales list, while communication services, consumer cyclical, and industrials each contributed one name. Seven of the 10 names on this list are overvalued according to Morningstar estimates. We’d like to discuss the lone industrials stock on this list. Narrow-moat Carrier Global CARR was sold by five managers and currently trades at a 20% premium to Morningstar analyst Brian Bernard’s fair value estimate of $40.

Carrier, a leading supplier of climate control and fire and security solutions, was spun off from United Technologies in April 2020. The company paid a price for its freedom; the separation left it saddled with a significant amount of debt. Despite its debt burden, which Carrier has diligently worked down, the firm now has a narrowed strategic focus and no longer must fight for capital from an increasingly aerospace-focused parent company.

In Bernard’s view, Carrier is a quality franchise with leading brands across most of its product portfolio. While Carrier's profit margins have historically outperformed its peer group, its top-line growth has been less impressive. Over the near term, elevated spending on research and development, sales, and capital projects will be needed to support product development and growth initiatives, but Bernard thinks increased reinvestment will help management accomplish its goal of mid-single-digit top-line growth over the midterm.

Two of Carrier's higher-profile growth initiatives include increasing its service attachment rate and becoming the leader in the applied HVAC market within five years. Bernard believes that Carrier will successfully increase its service revenue, and while he thinks Carrier can gain market share in the applied HVAC segment, he remains skeptical that the firm will be able to surpass Johnson Controls and Trane.

On the economic moat front, Bernard believes that Carrier merits a narrow economic moat rating supported by intangible assets and customer switching costs. In complex industries, a good record in offering customers durable, well-engineered, and reliable equipment cannot be achieved without technological know-how. Bernard believes that Carrier's proven engineering and technological expertise and service capabilities are key differentiators that have allowed the firm to build a large installed base of its commercial building systems and transportation refrigeration products that translated into leading market positions.

Bernard assigns Carrier a stable moat trend. He asserts that Carrier had to forgo some investment opportunities under United Technologies' ownership (for example, applied commercial HVAC and variable refrigerant flow, VRF, technology); however, the firm was able to maintain leading market positions across most of its product lineup. As a standalone company, Bernard expects the firm will increase its reinvestment to address areas of the business that need attention (for example, its applied HVAC market share and service attachment rates). That said, even if Carrier is successful gaining market share and increasing its service revenue mix, Bernard does not think incremental gains will be large enough to materially strengthen Carrier's intangible assets and/or switching costs moat source.

Disclosure: Malik Ahmed Khan, Justin Pan, and Eric Compton have no ownership interests in any of the securities mentioned above. It should also be noted that Morningstar's Institutional Equity Research Service offers research and analyst access to institutional asset managers. Through this service, Morningstar may have a business relationship with fund companies discussed in this report. Our business relationships in no way influence the funds or stocks discussed here.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HHSXAQ5U2RBI5FNOQTRU44ENHM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/737HCNGRFLOAN3I7RKGB7VPEKQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)