What These Gold-Rated Equity Funds Are Doing Differently

A look at how these Morningstar Medalists have differentiated their portfolios from similar strategies.

Manager research analysts expect investment strategies with Morningstar Analyst Ratings of Gold to beat their peer norms and relevant indexes over full market cycles. The strategies can achieve this in a variety of ways, including owning something rivals don't or avoiding something peers hold.

It's especially revealing to look at how Gold-rated strategies' holdings differ from funds that are most comparable based on recent portfolios and performance patterns. Here, we use Morningstar's Similar Funds tool to look at three popular Gold-rated strategies through this lens. A word of caution, though: This exercise doesn't predict whether these differences will or will not drive these Gold medalists' future performance or if they are good or bad ideas. It does, however, shed some light on how some of the industry's leading lights were thinking and executing their processes as of their most recent portfolios.

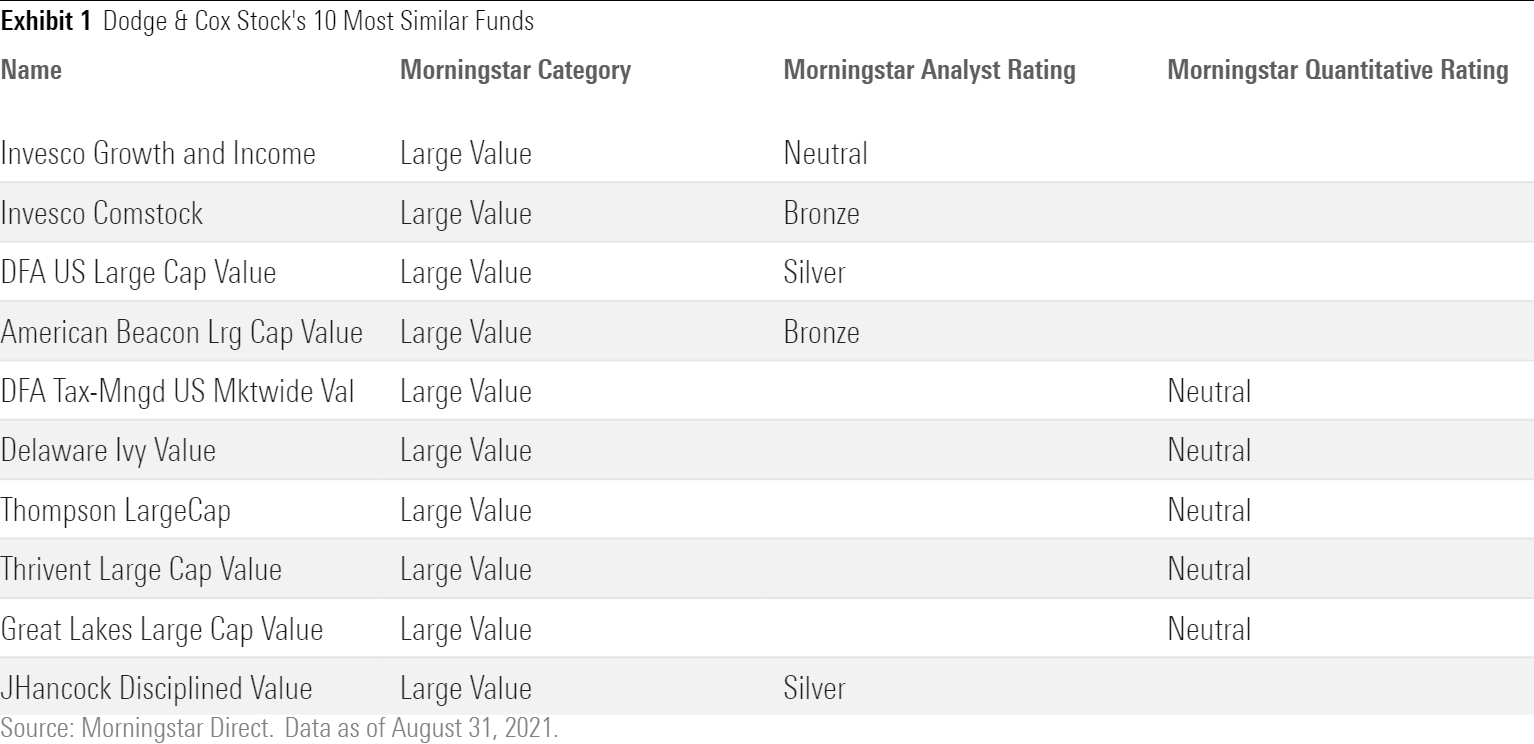

Dodge & Cox Stock DODGX

Dodge & Cox Stock is an old-school, contrarian, bottom-up value strategy that's been rated Gold since Morningstar first launched its Analyst Ratings. The Similar Funds tool turned up 10 other large-cap value funds that also tend to swim against the current. Yet, Dodge & Cox differs from them, too.

Below are Dodge & Cox Stock holdings of at least 1%, as of June 2021, that it didn't have in common with many of its most similar funds.

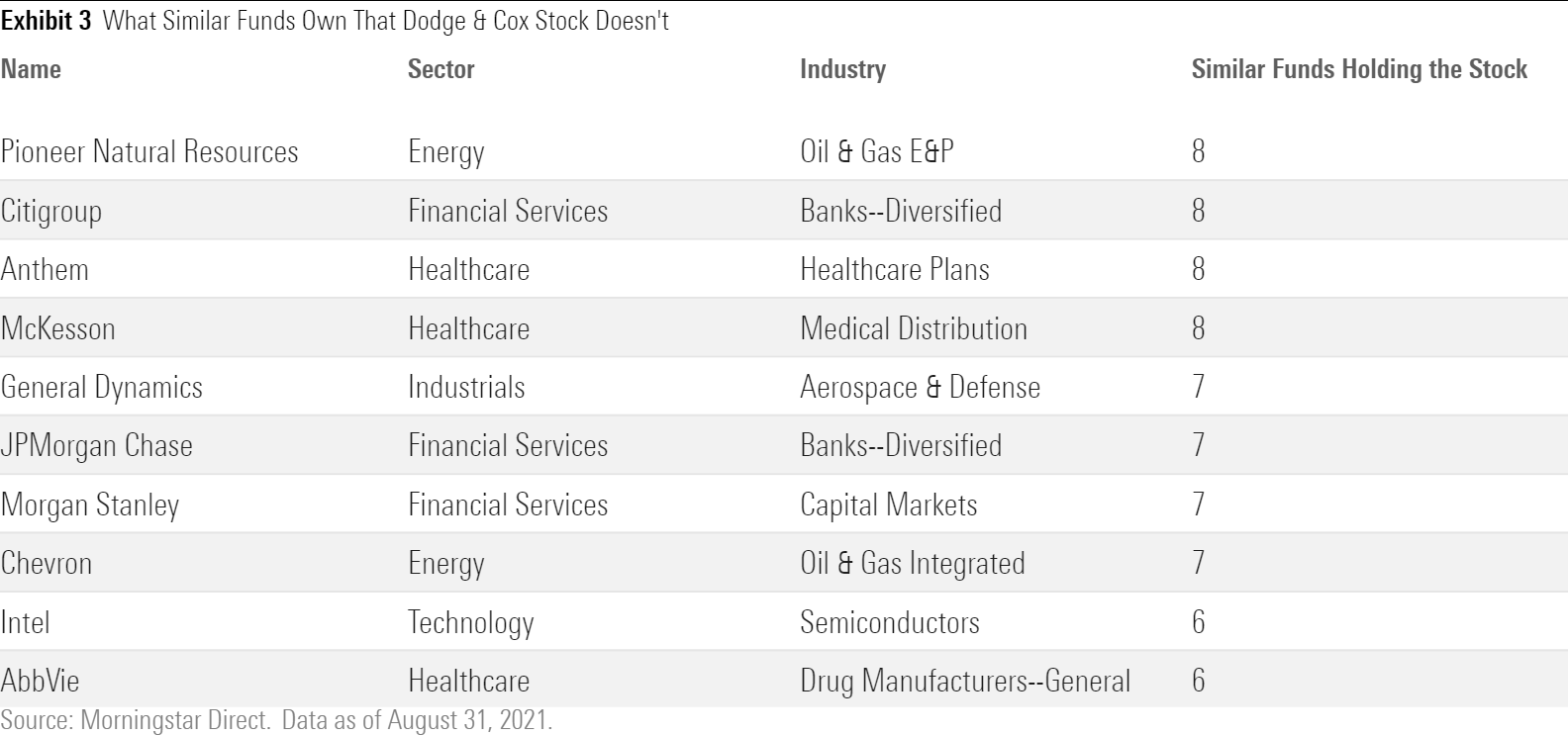

Healthcare and technology picks set Dodge & Cox Stock apart from its closest rivals. It owns several stocks from those sectors that two or fewer of its most similar competitors own. The fund has long been overweight drugmakers versus the S&P 500, and it has demonstrated a research edge in the industry. The firm recently promoted healthcare analyst Karim Fakhry to its nine-person equity investment committee and the strategy's drugmaker picks have significantly outperformed those in the benchmark. Dodge & Cox Stock also has long held computer hardware makers HP HPQ and Dell Technologies DELL, which rarely showed up in its 10 most similar rivals' portfolios. Former HP analyst David Hoeft has served on the firm's U.S. equity investment committee since 2002 and is in line to become Dodge & Cox's chief investment officer in early 2022.

Dodge & Cox Stock doesn't own several stocks that have been popular with its most similar peers, including some oil and gas companies and giant banks, such as JPMorgan Chase JPM, Morgan Stanley MS, and Citigroup C. However, these omissions don't indicate hesitation with energy and financials--the fund's heightened emphasis on valuation and fundamentals has led it to overweight those sectors compared with the S&P 500 over the past decade, investing in companies that have faced challenges recently, such as Occidental Petroleum OXY and Wells Fargo WFC.

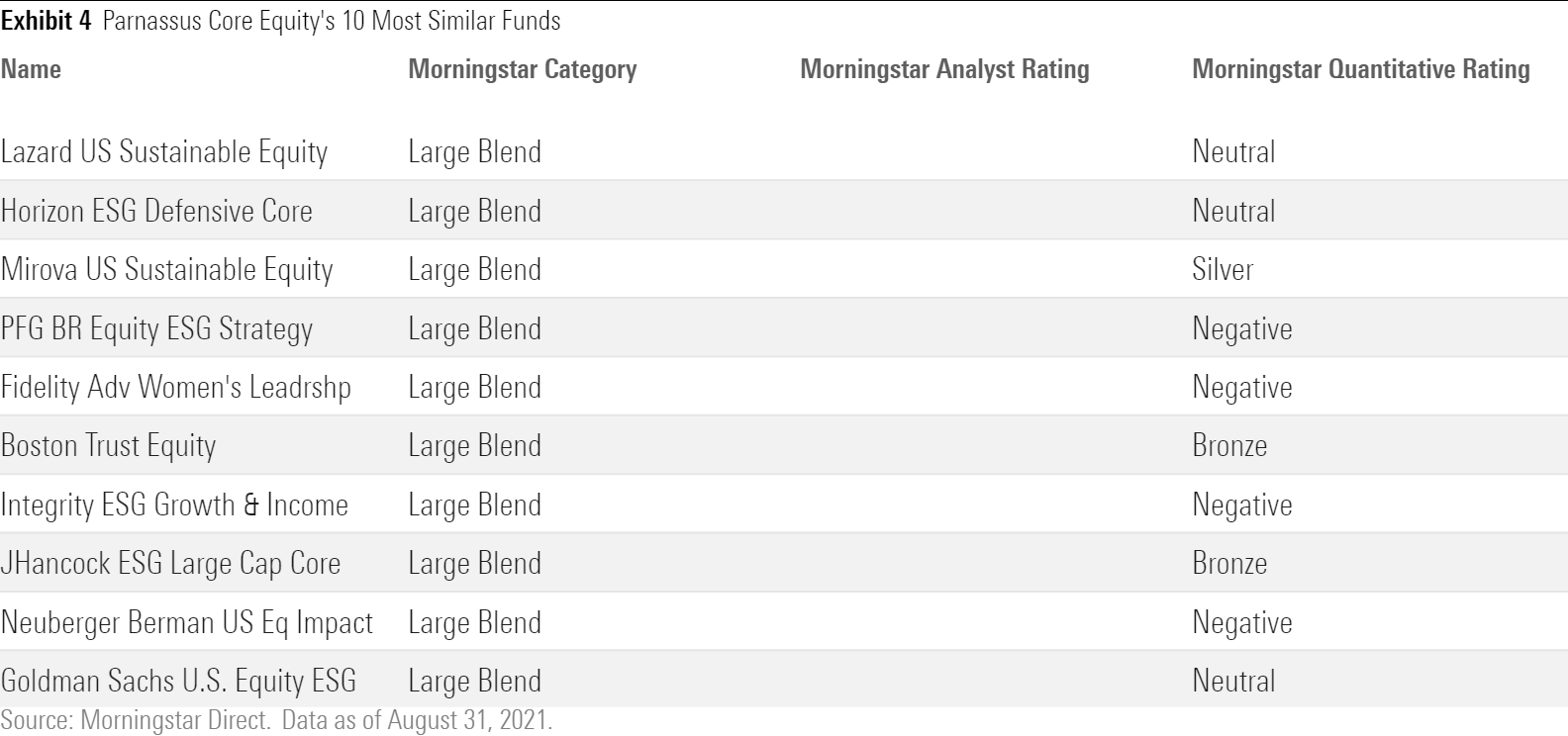

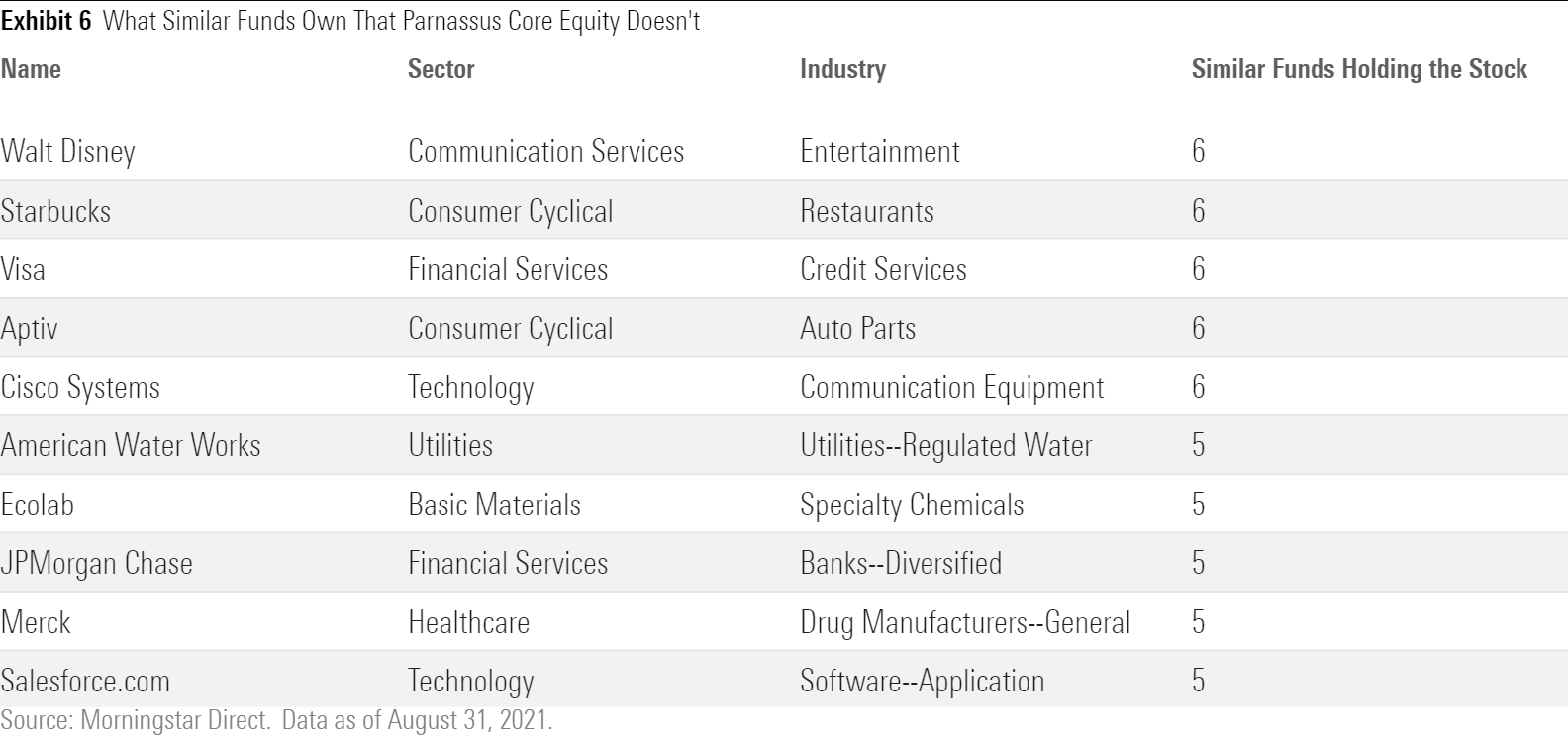

Parnassus Core Equity PRILX

Parnassus Core Equity is one of the oldest active environmental, social, and governance-focused funds in the industry. It's also one of the few U.S. active ESG funds that get both an Analyst Rating of Gold and a Morningstar ESG Commitment Level of Leader. Here's what sets it apart from the 10 funds with the most similar portfolios and performance patterns, none of which Morningstar analysts currently rate.

Parnassus thinks highly of multiple financial data firms, with 7% of assets split between CME Group CME and S&P Global SPGI, which almost no similar fund owned. Five of Parnassus' 40 holdings--an eighth of both the portfolio's holdings and assets--were unique relative its 10 most similar strategies.

Unlike many similar strategies, Parnassus doesn't hold some of the S&P 500's most popular stocks. Some omissions are likely due to the firm's bottom-up approach, as the fund owned popular stocks like Walt Disney DIS and Starbucks SBUX as recently as 2020. On the other hand, the strategy hasn't held American Water Works AWK and Ecolab ECL over the past decade, perhaps indicating that the firm thinks less of these stocks' ESG merits than many of its competitors do.

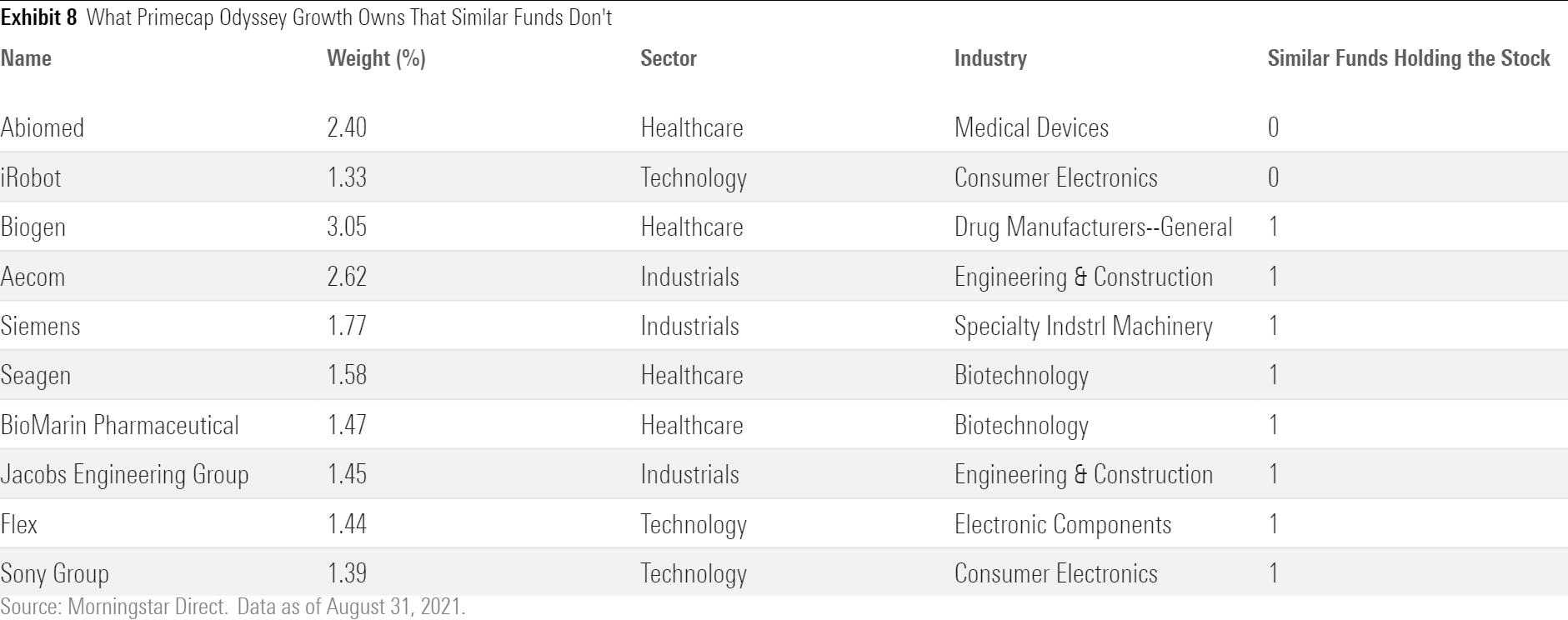

Primecap Odyssey Growth POGRX

Primecap Odyssey Growth's five managers pick a mix of off-beat growth and some high-octane stocks in concentrated independent portfolio sleeves. The aggregate portfolio of 140- to 160-stocks has more holdings than the typical large-growth peer but still includes several unusual ones relative to its 10 most similar funds.

Primecap has different views on several healthcare, technology, and industrials companies. The fund has consistently invested more than half its assets in healthcare and tech combined while overweighting industrials, but its stock selection in these sectors has been mixed: Healthcare, including biotech, has been outstanding, while tech and industrials picks were weaker than those in the S&P 500 as the fund avoided some heavyweights like Apple AAPL.

The companies Primecap doesn't own reveals its contrarian streak, selling out of Akamai Technologies AKAM in 2012, Mastercard MA in 2014, and not owning the other eight most common holdings in similar funds over the past decade despite the breadth of the portfolio. Most of the companies that the similar funds owned and Primecap didn't as of June 2021 had dramatically outperformed the Russell 1000 Growth Index in the decade prior to mid-2021.

/s3.amazonaws.com/arc-authors/morningstar/a9934929-bc1b-4947-9568-208bd9d6ba90.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a9934929-bc1b-4947-9568-208bd9d6ba90.png)