What Characteristics Are Linked to Consistent Dividend Payments?

We take a closer look at balancing dividend durability and yield.

A version of this article appeared in the July 2021 issue of Morningstar ETFInvestor. Download a complimentary copy of Morningstar ETFInvestor by visiting the website.

High-yielding dividend exchange-traded funds can be enticing for income-focused investors. But many of these funds are laden with risky stocks lacking the financial resources to support ongoing dividend payments. “Durable” is the last word to describe the regular cash payments from these firms.

Great dividend-income strategies take steps to control their exposure to firms whose dividends might be at risk. It’s a careful compromise between two competing forces, balancing yield with financial stability. Often the best portfolios land somewhere in the middle. They don’t have the highest yields, nor do they strictly focus on the highest-quality stocks.

Striking the right balance is foundational to consistently providing above-average dividend payments. But there is more to consider. Dividend-income strategies also need the freedom to pursue those characteristics. Adding constraints to the process, like forcing sector weights to match those of the market, can compromise future payouts in ways that aren’t always obvious.

Start With Quality

There is no one right way to emphasize quality in a dividend-income strategy, but it should be noticeable and consistent over time. The quality factor itself is somewhat squishy as it can be defined in a number of ways. Many strategies have converged on several metrics, typically some combination of profitability, earnings stability, and low dividend payout ratios, among others. Collectively, those traits are indicative of companies with the financial stability to weather adverse business conditions while continuing to make good on their dividend payments.

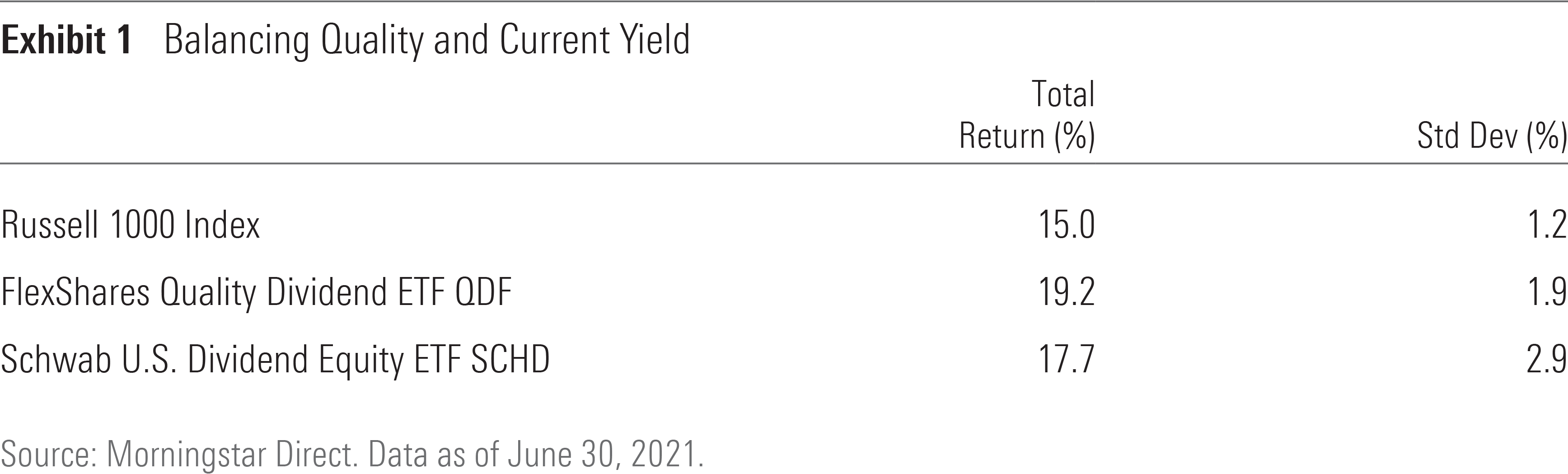

Well-constructed dividend-income portfolios should have above-average yields and above-average quality characteristics, like high profitability and low or reasonable dividend payout ratios. Two that strike a nice balance between yield and quality are FlexShares Quality Dividend ETF QDF, which has a Morningstar Analyst Rating of Silver, and Schwab U.S. Dividend Equity ETF SCHD, also rated Silver.

Both share a common goal, but their approaches are very different. QDF uses an optimizer that simultaneously targets high-yielding stocks with above-average quality characteristics. On the other hand, SCHD looks for stocks with 10 years or more of dividend payments, then narrows that universe down to names with a combination of high yields, high profitability, and high dividend-growth rates. Exhibit 1 shows that both portfolios wind up at a very similar location, with average profitability and yields higher than the Russell 1000 Index.

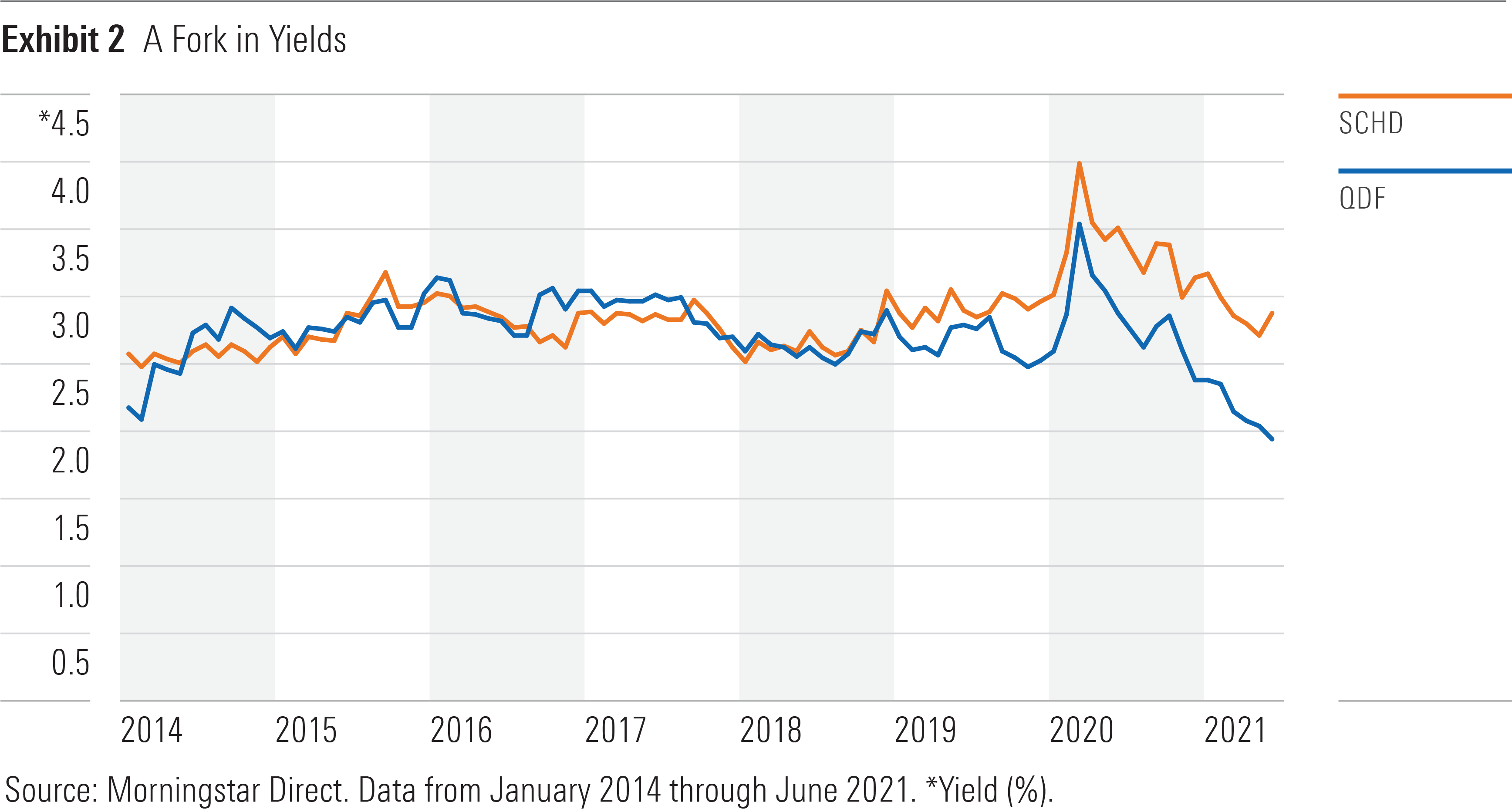

The numbers in Exhibit 1 generally represent each fund’s yield and profitability characteristics over time, with one important caveat. Exhibit 2 shows that QDF’s yield matched that of SCHD, until it started declining about three years ago. It still had a higher yield than the market at the end of June 2021, but it landed a full percentage point shy of SCHD.

Go Easy on the Constraints

It wouldn’t be unreasonable to assume that QDF’s process changed, given the dramatic decline in yield. But its approach to selecting and weighting stocks has remained the same. Instead, a constraint imposed on QDF’s optimizer bears the blame, requiring that sector weights land within 3% of their weight in the market. It’s an important detail meant to keep QDF’s performance from straying too far from its parent universe. And it has had an adverse effect on QDF’s ability to deliver a consistent yield.

Over the past three years, a number of big stocks in the information technology sector have come to dominate the U.S. market. Their yields declined as prices went up, and the weight of the sector expanded from about 20% in mid-2018 to around 30%by June 2021. That means QDF’s sector constraints force it to hold a number of tech stocks that pass its quality criteria but don’t quite fit the high-yield mold. As of June 2021, Apple AAPL and Microsoft MSFT collectively represented more than 12% of the fund’s assets and both had yields well under 1%.

SCHD has no such constraint on its portfolio. That gives it a little extra latitude to adapt to changes in the market, shifting toward segments that strike a better balance between quality and yield as they become more attractive on those characteristics. SCHD’s allocation to the technology sector was around 16% when markets closed on June 30, 2021. That stake was evenly spread across four names all yielding more than 2%.

Beyond the U.S.

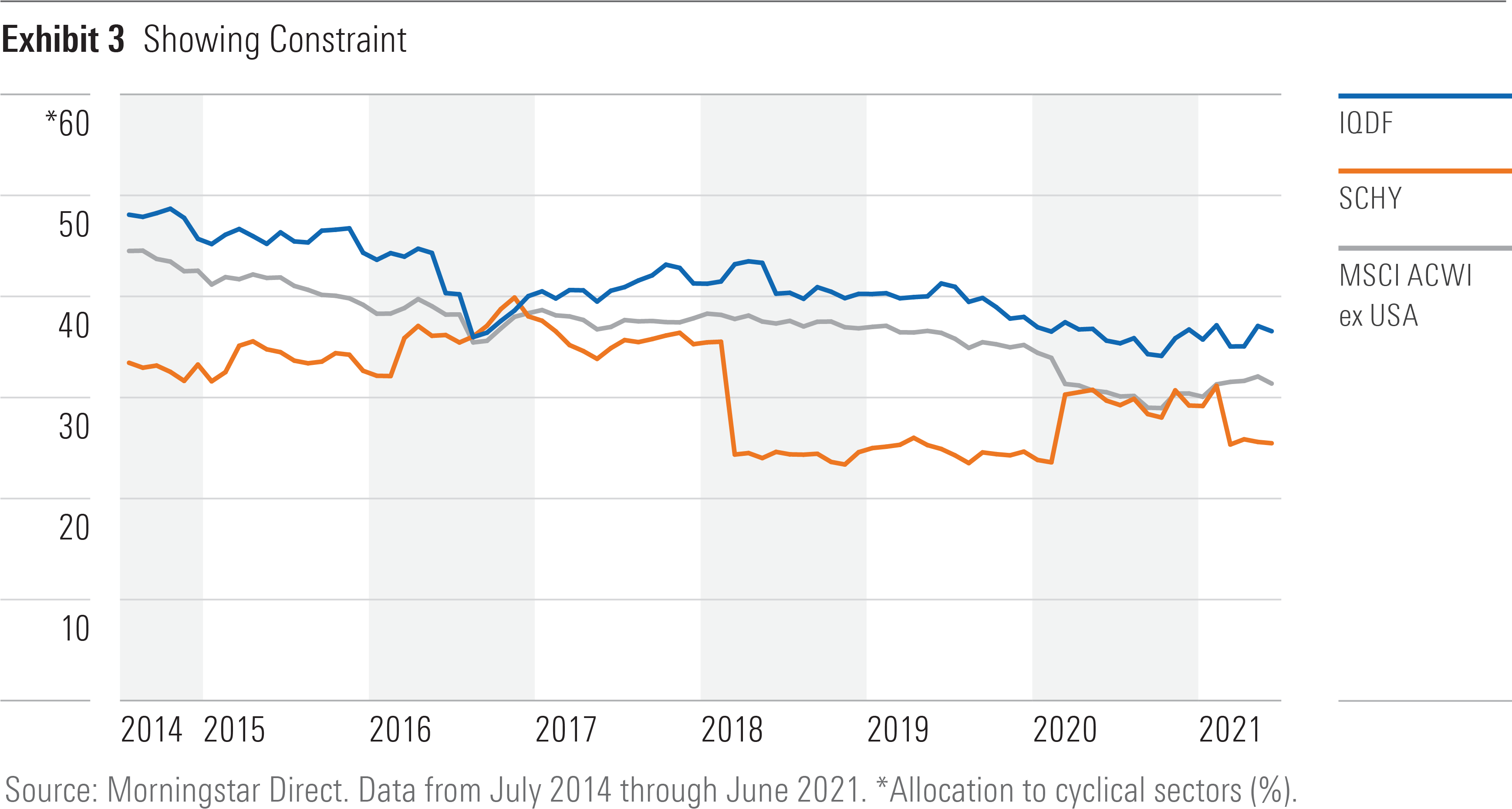

Dividend durability concerns caused by sector constraints aren’t limited to the U.S. market. FlexShares International Quality Dividend ETF IQDF applies the same approach as QDF to stocks listed on overseas exchanges. It has the same sector constraints as QDF, but the concerns regarding the fund’s yield manifest differently.

The core issue stems from the composition of foreign stock markets. Dividend sustainability is relatively shaky in overseas markets, partially because cyclical sectors represent a larger portion of the universe. Companies operating in the energy, materials, and financials sectors tend to be more sensitive to the business cycle, increasing the likelihood that they’ll cut dividends to preserve cash when the economy stumbles and profits shrink.

IQDF’s sector constraints keep its portfolio parked in stocks from these sectors, even after their profitability takes a hit or they cut dividend payments. Exhibit 3 shows its allocation to cyclical sectors is usually higher than Schwab International Dividend Equity ETF SCHY, which follows the same process as SCHD. So, SCHY isn’t hobbled by sector constraints that may force IQDF into riskier segments of the market. SCHY was launched in April 2021, so the historical sector composition data shown here represents that of its target index, the Dow Jones International Dividend 100 Index.

A closer examination of IQDF and SCHY’s holdings shows how IQDF’s sector constraints inject some uncertainty into future dividend payments. In mid-2020, major energy firms, including Royal Dutch Shell RDS.A and BP BP, cut their dividends in half (or more) when the demand for oil declined as travel and transportation ground to a halt during the coronavirus pandemic shutdown. Both were components of IQDF at the time and were still in its portfolio as of June 2021. SCHY had a tiny position in one stock from the energy sector: China Shenhua Energy Company.

Not every energy company cut its dividend, and the overall impact on IQDF’s yield and dividend payments was relatively small. But many companies in these sectors have historically gone through gut-wrenching periods of stress. Forcing IQDF to hold some of these stocks is less of an immediate concern but still something to consider and keep an eye on.

The Lesson

Finding the right balance between yield and quality is tricky but doable, and it can be accomplished in more than one way. But imposing additional constraints on the process can compromise the dividend-income intention of an otherwise well-constructed portfolio, forcing a fund to hold stocks that don’t quite deliver on that expectation.

Dividend yields aside, QDF and SCHD are both solid value-oriented strategies. Their quality screens are effective at controlling risk, which should lead to better risk-adjusted performance than the Russell 1000 Value Index over the long haul. That expectation, combined with relatively low fees, are big reasons for their Silver ratings. IQDF and SCHY are not rated at the moment, though both follow similar processes as their U.S.-focused counterparts to select and weight stocks.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Morningstar, Inc. does not market, sell, or make any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/78665e5a-2da4-4dff-bdfd-3d8248d5ae4d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LUIUEVKYO2PKAIBSSAUSBVZXHI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/78665e5a-2da4-4dff-bdfd-3d8248d5ae4d.jpg)